Investing in Real Estate Investment Trusts (REITs) in the UK can be a smart move to diversify your investment portfolio. With a market capitalization of £5.8 billion in June 2023, REITs offer individuals the opportunity to gain exposure to income-generating real estate properties without the hassle of property management.

If you're wondering how to get started, look no further. In this step-by-step guide, we'll walk you through the process of investing in REITs in the UK, from selecting suitable options to opening a brokerage account and monitoring your investments effectively.

Research and Select REITs

The first step in investing in REITs is to research and select the right ones for your investment goals. Analyze their investment strategies, property portfolios, financial performance, and dividend history. Consider factors such as property type, geographic location, and management expertise.

Open a Brokerage Account

Once you have identified the REITs you want to invest in, the next step is to open a brokerage account. Choose a reputable brokerage firm that offers access to the UK stock market. For beginners, we recommend eToro, a platform that provides access to REITs listed on the London Stock Exchange and other international exchanges.

Conduct Due Diligence

Before investing, it's crucial to conduct due diligence on the selected REITs. Review their financial statements, annual reports, prospectuses, and any available market research. Assess the risks, growth potential, and overall stability of the REITs. This step is essential to make informed investment decisions.

Place Buy Orders

Once you have completed your due diligence, it's time to place buy orders for the desired REITs. Through your brokerage account, specify the number of shares you wish to purchase and the price at which you are willing to buy. Take into consideration the current market conditions and your investment objectives.

Monitor Your Investments

Investing in REITs requires regular monitoring. Stay updated on news and announcements related to the REITs and the real estate market. Monitor the performance of the REITs and evaluate whether they align with your investment objectives. By staying informed, you can make informed decisions regarding your portfolio.

Consider Dividend Reinvestment

Some REITs offer dividend reinvestment plans (DRIPs) that allow you to automatically reinvest dividends to acquire additional shares. Evaluate the benefits of DRIPs based on your investment strategy. Dividend reinvestment can help you take advantage of compounding returns and potentially grow your investment over time.

Review and Adjust

Periodically review your REIT investments and make adjustments as needed. Consider rebalancing your portfolio based on changes in market conditions, investment goals, and risk tolerance. Regularly assessing and adjusting your investments can help you optimize your returns and align your portfolio with your evolving financial objectives.

Best Investment Platforms to Buy REITs

Now that you know how to invest in REITs in the UK, let's explore some of the best investment platforms where you can buy REITs:

1. eToro - Best Place to Invest in REITs UK

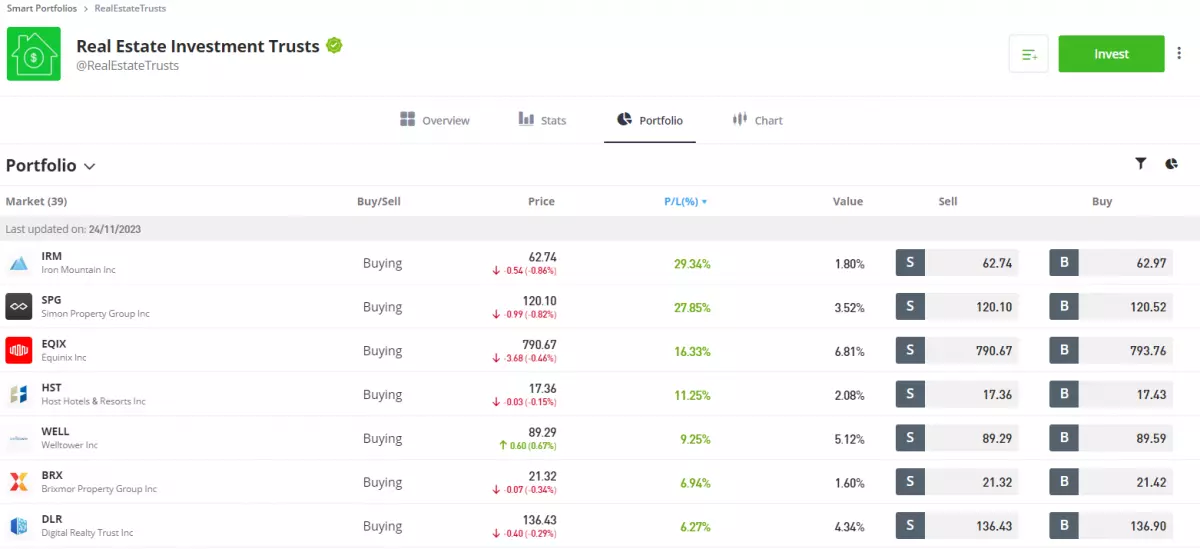

Diversify your investment portfolio with popular REIT ETFs through eToro. Explore options such as iShares Global REIT ETF and iShares Core U.S. REIT ETF. Get started with a minimum deposit of just $10. Along with ETFs, eToro also offers a Real Estate Investment Trusts Smart Portfolio curated by their analysts.

Diversify your investment portfolio with popular REIT ETFs through eToro. Explore options such as iShares Global REIT ETF and iShares Core U.S. REIT ETF. Get started with a minimum deposit of just $10. Along with ETFs, eToro also offers a Real Estate Investment Trusts Smart Portfolio curated by their analysts.

2. Hargreaves Lansdown

Unlock a wide range of REITs for investment through your ISA or SIPP with Hargreaves Lansdown. Explore their diverse selection and take advantage of the tax advantages offered by these investment accounts. Expand your investment opportunities and access REITs with Hargreaves Lansdown.

3. interactive investor

Take advantage of Interactive Investor's offerings by opening a SIPP or ISA account. Access a wide range of REITs and enhance your investment portfolio. Explore the diverse selection available and make informed decisions with interactive investor.

Investing in REITs through these platforms provides you with convenient and reliable access to the real estate market, allowing you to capitalize on potential income and capital appreciation opportunities.

What is a Real Estate Investment Trust?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate properties. REITs provide individuals with the opportunity to invest in real estate without the need for direct property ownership or management. These companies pool investors' capital to invest in a diversified portfolio of properties, including residential, commercial, or industrial real estate assets. REITs are required to distribute a significant portion of their taxable income as dividends to shareholders, providing investors with a regular income stream. They offer a convenient way to access real estate investments, providing liquidity and potential capital appreciation.

How Does a REIT Work?

A Real Estate Investment Trust (REIT) operates by pooling investors' capital to invest in a portfolio of income-generating real estate properties. Here's a breakdown of how it works:

- Structure: REITs are established as companies that own, operate, or finance real estate assets. They must meet specific requirements to qualify as REITs.

- Property Acquisition: REITs acquire properties such as residential, commercial, or industrial real estate assets. These properties generate rental income or other forms of revenue.

- Income Distribution: REITs are required to distribute a significant portion of their taxable income as dividends to shareholders. This distribution is often made in the form of regular cash dividends.

- Professional Management: REITs employ professional managers who handle property management, leasing, maintenance, and other operational aspects of the real estate portfolio.

- Diversification: REITs aim to diversify their holdings by investing in a variety of properties across different locations and sectors. This diversification helps reduce risk and enhances the potential for stable returns.

- Publicly Traded or Non-Traded: REITs can be publicly traded on stock exchanges, allowing investors to buy and sell shares. Some REITs are non-traded and have limited liquidity.

- Regulatory Requirements: REITs must comply with specific regulations, including distribution requirements, asset diversification rules, and restrictions on non-real estate activities.

By investing in a REIT, individuals can benefit from real estate ownership without the need for direct property management. It provides access to potential income, diversification, and participation in the real estate market.

UK Specifics to REITs

In the UK, REITs have specific considerations to keep in mind. Dividend yields from UK REITs are considered rental income from properties, exempting the company from paying Corporation Tax. However, individual investors may still be liable to pay Income Tax and/or Capital Gains Tax (CGT) on their profits.

UK REITs are subject to a 0.5% stamp duty on all share purchases, which can impact the overall return on investment and increase transaction costs. Nevertheless, a significant advantage of UK REITs is that property income profits are not subject to the standard corporate tax rate of 25%. Instead, these profits are distributed, with 90% being counted as property income distribution (PID), taxed based on the individual's tax bracket.

Understanding these UK-specific aspects is essential when investing in REITs, as they can have implications for your overall investment strategy and tax planning.

Types of REITs

There are several types of REITs based on the nature of their underlying properties:

- Equity REITs: These REITs primarily own and operate income-generating properties such as residential buildings, office spaces, retail centers, and industrial properties.

- Mortgage REITs: Also known as mREITs, these REITs invest in mortgages or mortgage-backed securities and earn income from the interest on these investments.

- Hybrid REITs: These REITs combine characteristics of both equity and mortgage REITs, owning and operating properties while also investing in mortgages.

- Publicly traded REITs: These REITs are listed on stock exchanges and can be bought and sold by individual investors like stocks.

- Non-traded REITs: These REITs are not listed on stock exchanges and are sold through broker-dealers or private placements. They typically have limited liquidity.

- Specialty REITs: These REITs focus on specific property types such as healthcare facilities, data centers, hotels, self-storage units, or timberlands. They specialize in a particular sector of the real estate market.

By understanding the different types of REITs, you can align your investments with specific sectors or investment strategies that best suit your needs.

REIT ETFs

REIT ETFs (Real Estate Investment Trust Exchange-Traded Funds) provide a convenient way to gain exposure to a diversified portfolio of REITs. These ETFs invest in a basket of REITs, allowing investors to access the real estate sector without directly owning individual REIT stocks.

REIT ETFs typically track an index or a specific REIT market segment, offering investors the opportunity to invest in a diversified portfolio of real estate assets across different property types, regions, or countries. By holding shares in a REIT ETF, investors can benefit from potential income and capital appreciation generated by the underlying REIT holdings.

Investing in REIT ETFs provides diversification, liquidity, and cost efficiency. With a single investment, you can gain exposure to a broad range of REITs, reducing individual stock risks. Additionally, REIT ETFs are traded on stock exchanges, allowing for easy buying and selling throughout the trading day. They often have lower expense ratios compared to actively managed mutual funds, making them a cost-effective option for accessing the real estate market.

Investing in REITs through an ISA

Investing in REITs through an Individual Savings Account (ISA) offers a tax-efficient way to participate in the real estate market. An ISA allows individuals to save or invest money without paying tax on the returns generated within the account.

By utilizing an ISA for your REIT investments, you can potentially benefit from tax advantages such as tax-free dividends and tax-free capital gains. This can maximize your returns and help you achieve your financial goals. Investing in REITs through an ISA also offers the flexibility to choose from a range of REIT options and manage your investments within a tax-efficient wrapper.

It's important to note that ISAs have annual contribution limits. As of the 2023/2024 tax year, the overall annual ISA allowance is £20,000, including cash and stocks & shares ISAs. Before investing in REITs through an ISA, consider these limits and any specific terms and conditions associated with the ISA provider.

Disadvantages of UK REITs

While UK REITs offer attractive investment opportunities, there are some potential disadvantages to consider:

- Stamp Duty: UK REITs are subject to a 0.5% stamp duty on all UK share purchases, increasing transaction costs.

- Tax Considerations: Individual investors may still be subject to taxes on their investment returns, such as Income Tax and/or Capital Gains Tax (CGT).

- Market Volatility: REITs are exposed to market volatility, including economic conditions, real estate market trends, and investor sentiment.

- Interest Rate Sensitivity: REITs can be sensitive to changes in interest rates, impacting borrowing costs and profitability.

- Sector-Specific Risks: Different real estate sectors may carry specific risks, such as economic conditions and regulatory changes.

- Lack of Control: As a passive investor in a REIT, individuals have limited control over management and decision-making processes.

It's important to assess these disadvantages and consider them within the context of your overall investment strategy and risk tolerance.

Final Thoughts

Investing in UK REITs can be an attractive option for individuals seeking exposure to the real estate market. By investing in REITs, you can access a diversified portfolio of income-generating properties without the need for direct ownership. This investment avenue offers the potential for regular dividends and the opportunity to benefit from long-term capital appreciation.

However, it's crucial to consider the potential risks and disadvantages associated with investing in REITs. Market volatility, tax considerations, and sector-specific risks should be thoroughly evaluated. By conducting thorough research, staying informed, and seeking professional advice when needed, you can make well-informed investment decisions.

Remember, each investor's financial situation and goals are unique. It's essential to align your investment strategy with your personal circumstances and consult with a financial advisor before making any investment decisions.

FAQs

Q: How can I invest in REITs in the UK? A: To invest in REITs in the UK, you can start by opening a brokerage account with a platform that offers access to REITs listed on the London Stock Exchange or other international exchanges, such as eToro.

Q: Are there any tax advantages to investing in REITs through an ISA? A: Yes, investing in REITs through an Individual Savings Account (ISA) provides tax advantages such as tax-free dividends and tax-free capital gains.

Q: What are some good investment platforms to buy REITs in the UK? A: Some popular investment platforms to consider for buying REITs in the UK are eToro, Hargreaves Lansdown, and interactive investor.

Q: What types of REITs are available? A: There are several types of REITs, including equity REITs, mortgage REITs, hybrid REITs, publicly traded REITs, non-traded REITs, and specialty REITs. Each type focuses on different aspects of the real estate market.

Q: What are REIT ETFs? A: REIT ETFs (Real Estate Investment Trust Exchange-Traded Funds) are investment funds that provide exposure to a diversified portfolio of REITs. Investing in REIT ETFs offers diversification, liquidity, and cost efficiency.

Q: What are the disadvantages of UK REITs? A: Some disadvantages of UK REITs include stamp duty costs, potential tax liabilities, market volatility, interest rate sensitivity, sector-specific risks, and limited control over management decisions.

Remember to always conduct thorough research and consider your financial goals and risk tolerance before investing in REITs or any other financial securities. Happy investing!