Image by designer491/iStock via Getty Images

Image by designer491/iStock via Getty Images

Introduction

Welcome to the world of Modiv Inc. (NYSE:MDV), a dynamic net lease real estate investment trust that is making waves in the market. With its unique approach, Modiv offers investors the opportunity to enjoy monthly dividends and diversification across various property types and industries. In this article, we will explore the intriguing potential of Modiv and the factors that set it apart from the competition.

Thesis: Unlocking Potential Despite a Capital Disadvantage

Modiv's journey began in 2006 as a commercial real estate crowdfunding platform called Rich Uncles. Over the years, it evolved into a non-traded REIT focused on net lease properties. Under the leadership of CEO Aaron Halfacre, Modiv transformed its management team, upgraded its portfolio, and positioned itself as an institutionally-grade REIT. The company went public in February 2022 and embarked on a new chapter.

Data by YCharts

Data by YCharts

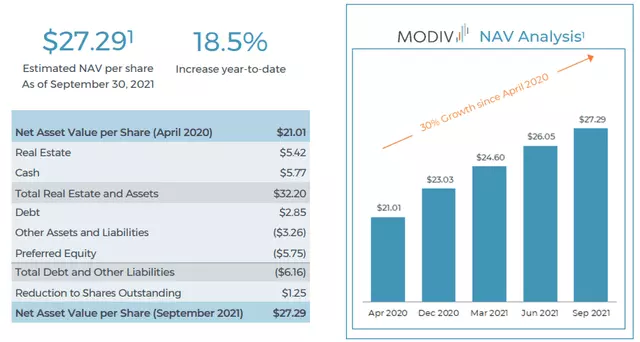

Despite its impressive potential, Modiv's stock has experienced a significant decline compared to the broader net lease REIT index (NETL). However, this presents an opportunity for value investors, as Modiv is currently trading at a substantial discount to its net asset value (NAV). With a high dividend yield of 7.5%, Modiv stands out among its peers. However, it is worth noting that the REIT carries an above-average debt load, which limits its capacity to raise additional capital. As a result, Modiv relies on capital recycling for growth.

Overview of a Net Lease REIT Newcomer

As of March 31st, 2022, Modiv owned 36 net lease properties across the United States. However, the company has been actively expanding its portfolio, and it now boasts 44 properties leased to 29 different tenants. Around 55% of the portfolio consists of investment grade credit rated tenants.

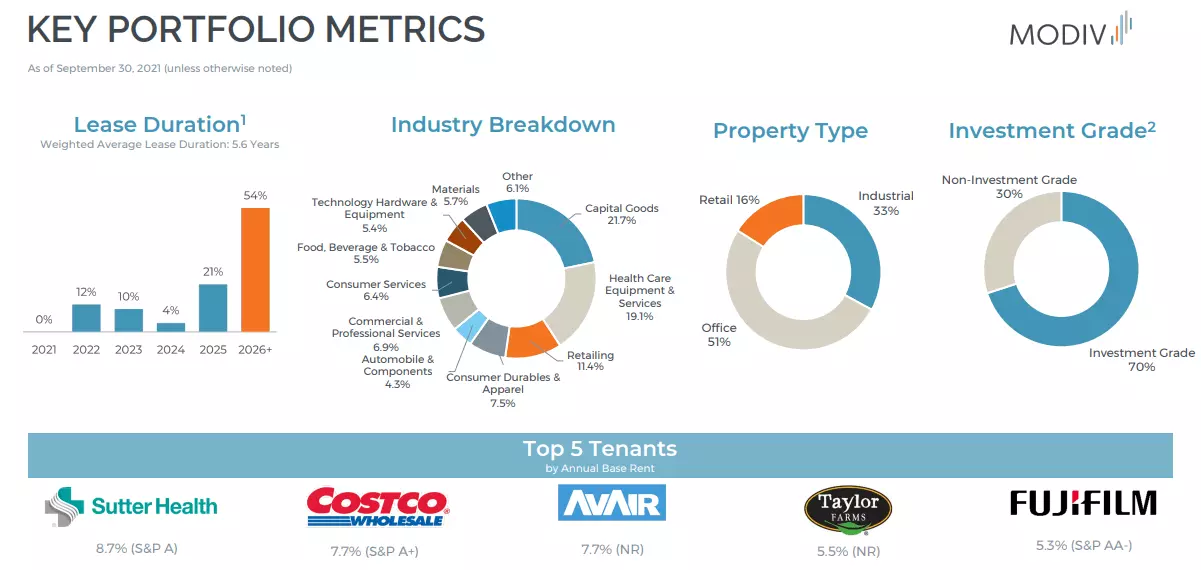

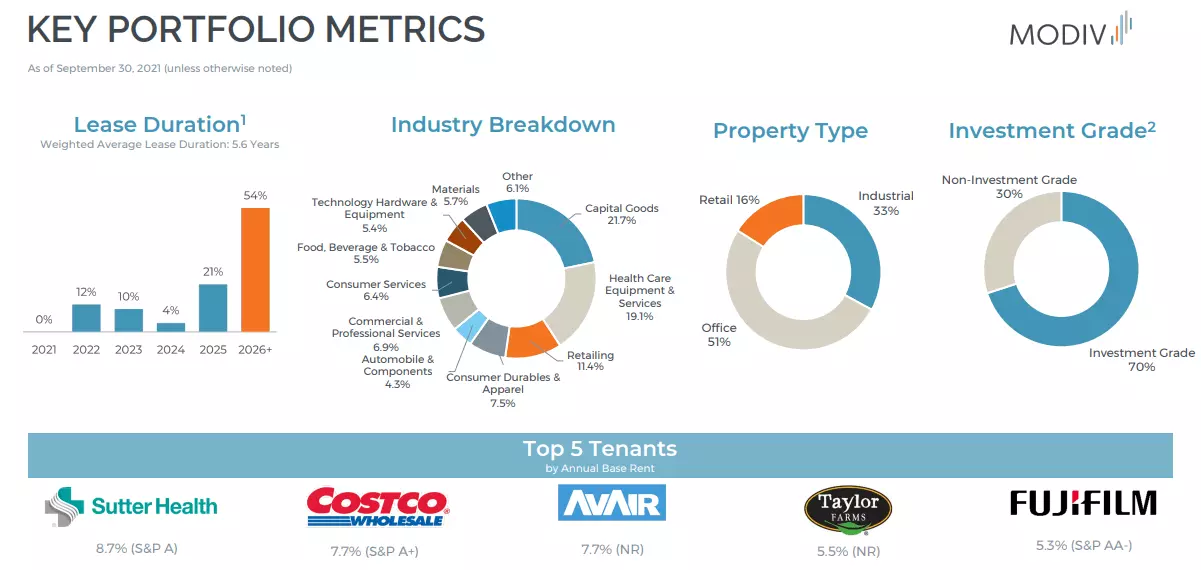

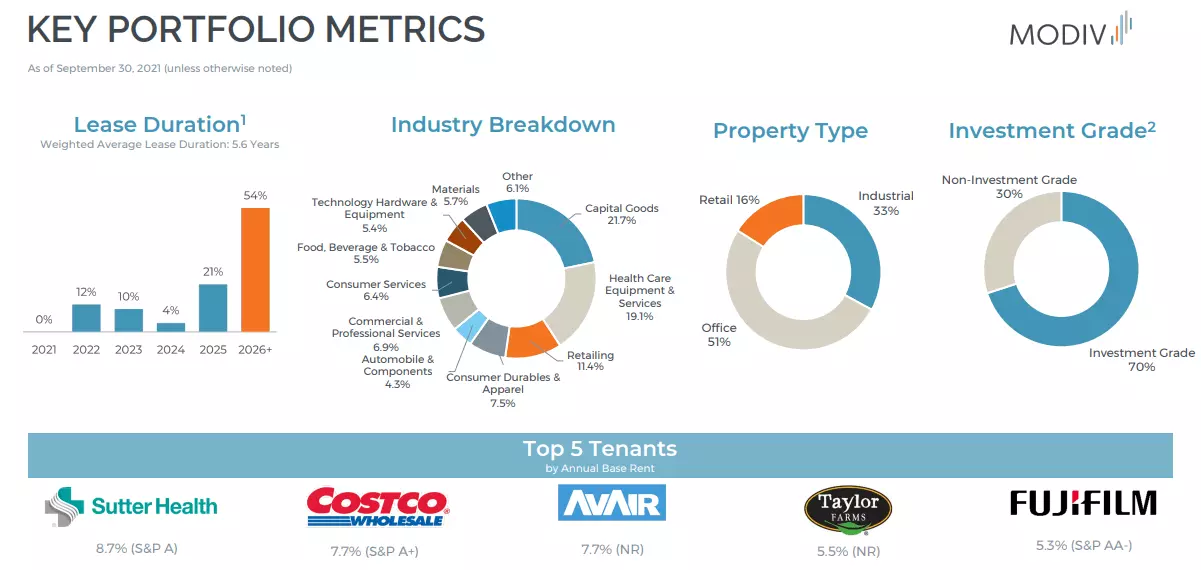

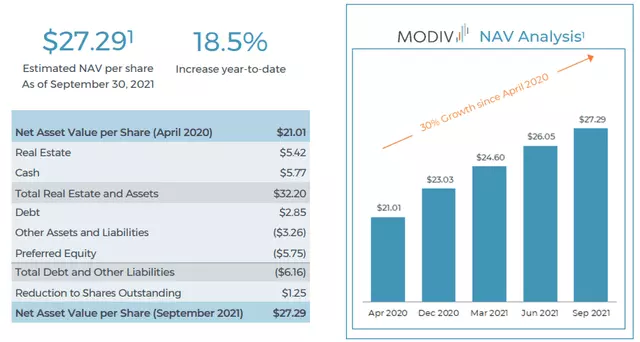

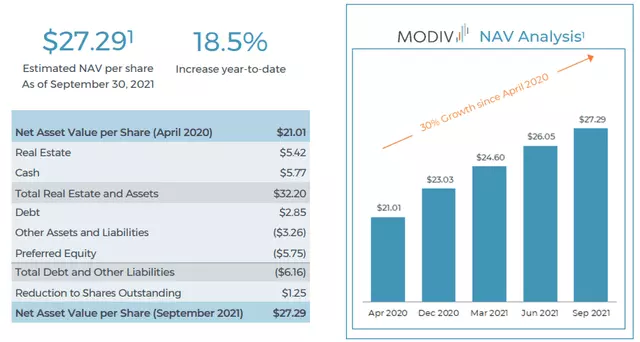

Image by MDV Q3 2021 Presentation

Image by MDV Q3 2021 Presentation

Modiv has made strategic acquisitions to enhance its portfolio and reduce exposure to office and non-essential retail properties. The company prioritizes long-let properties with lease terms of 20-25 years. Consequently, the weighted average remaining lease term (WALT) has increased to 10.6 years as of Q1 2022.

Image by MDV Q3 2021 Presentation

Image by MDV Q3 2021 Presentation

Modiv's property breakdown by annual base rent as of mid-May 2022 is as follows:

- Industrial: 46%

- Office: 35%

- Retail: 19%

Furthermore, Modiv's top three tenant industries include Automobile & Components (19% of ABR), Pharmacies (14%), and General Retail (11%).

Balance Sheet and Financials

Modiv's balance sheet has undergone significant changes over the past year. Equity represents approximately 53% of its total capitalization, with the remaining portion being debt.

Image by MDV Q1 2022 Supplemental

Image by MDV Q1 2022 Supplemental

The majority of Modiv's debt consists of fixed-rate obligations, providing stability amidst rising interest rates. The company has been reducing its debt through strategic property dispositions, allowing it to strengthen its financial position.

Image by MDV Q1 2022 Supplemental

Image by MDV Q1 2022 Supplemental

Modiv's net debt to EBITDA ratio has fluctuated due to the timing gap between property dispositions and acquisitions. However, it is expected to stabilize at a reasonable level of around 5.75x.

Bottom Line and the Preferred Equity Opportunity

In 2021, Modiv achieved an impressive AFFO per share of $1.30 and paid out dividends of $1.05 per share, resulting in a payout ratio of approximately 81%. For 2022, management projects an AFFO per share of $1.31 and dividends of $1.15, translating to a payout ratio of 88%. These figures indicate Modiv's commitment to providing steady income to its investors.

For those seeking higher income potential, Modiv offers an attractive alternative in the form of its Series A preferred equity (MDV.PA). With a yield of 7.375% and a call date set for September 2026, MDV.PA is currently trading slightly above its common stock's effective yield. However, due to its limited trading volume, it is advisable to use limit orders when buying or selling MDV.PA.

In conclusion, Modiv presents an intriguing investment opportunity, combining high-yielding potential, diversification, and a solid portfolio. While the company faces a capital disadvantage, its strategic approach and commitment to value creation make it a compelling option for investors. So, whether you choose Modiv's common stock or its preferred equity, it's a hold for now with promising prospects.

Note: This article reflects the author's opinion and should not be taken as financial advice. Always conduct thorough research before making any investment decisions.