Introduction

Investing in commercial real estate has always been an attractive option for those looking for stable income streams. Starwood Real Estate Income Trust, Inc. is now offering a unique opportunity for income-focused investors with its $18 billion follow-on offering. In this article, we will explore the key details of this offering and how it can benefit investors.

A Premier Real Estate Investment Option

Starwood Real Estate Income Trust, Inc. is a nontraded REIT that specializes in investing in stabilized, income-oriented commercial real estate. Managed by Starwood REIT Advisors, a subsidiary of Starwood Capital Group Holdings, a global investment manager, the REIT aims to bring institutional-quality real estate investments to income-focused investors.

The REIT's investment strategy primarily focuses on commercial real estate properties in the United States and Europe. With a track record of success and a commitment to delivering stable income, Starwood Real Estate Income Trust provides a compelling opportunity for investors seeking reliable returns.

The Follow-On Offering

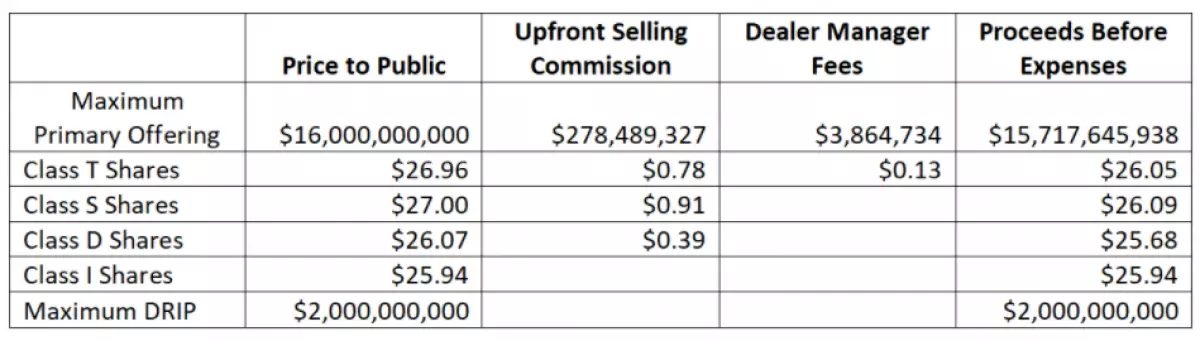

Starwood Real Estate Income Trust's follow-on offering aims to raise up to $18 billion in shares of common stock. This offering consists of up to $16 billion in shares as part of its primary offering and up to $2 billion in shares through its distribution reinvestment program. The REIT is offering four classes of shares, each with different upfront selling commissions, dealer manager fees, and ongoing stockholder servicing fees.

With its experienced management and well-defined investment strategy, Starwood REIT has already established a strong track record. The initial $5 billion offering in 2017 raised approximately $3.9 billion, and the follow-on offering of $10 billion raised around $5.8 billion as of December 31, 2021. These numbers reflect the trust and confidence investors have in the REIT's ability to deliver results.

Potential Returns and Liquidity

Investing in Starwood Real Estate Income Trust offers the potential for attractive returns. The REIT's Class I shares, for example, saw a 19.76% increase in net asset value (NAV) per share from $21.66 as of December 31, 2020, to $25.94 as of December 31, 2021. This increase, combined with a total return of 26.33% for the year, positions Starwood REIT among the top performers in its category.

While the REIT's shares do not trade publicly, investors can take advantage of the share repurchase plan offered by the REIT. This plan allows shareholders to request the repurchase of their shares on a monthly basis, providing a potential avenue for liquidity. However, it's important to note that the REIT is not obligated to repurchase shares and may choose to repurchase only a portion or none of the requested shares based on available liquidity and other restrictions.

Conclusion

If you're an income-focused investor looking for a promising opportunity in the commercial real estate market, the $18 billion follow-on offering by Starwood Real Estate Income Trust is worth considering. With its strong management, focus on stable income-generating properties, and impressive track record, this offering provides a path to potentially attractive returns. Take advantage of this opportunity to invest in a trusted and experienced real estate investment option.

Image: Starwood Real Estate Income Trust's $18 Billion Follow-On Offering

Image: Starwood Real Estate Income Trust's $18 Billion Follow-On Offering