Image: benedek/iStock via Getty Images

Canadian Apartment Properties REIT (TSX:CAR.UN:CA) is Canada's largest residential REIT, and it presents an intriguing investment opportunity. With a diverse portfolio of over 57,000 residential suites and manufactured housing community sites across Canada, as well as a stake in European Residential REIT (ERE.UN:CA), CAPREIT offers significant potential for investors.

A Brief Overview

Founded in 1997, CAPREIT has experienced impressive growth to become a leader in the Canadian REIT market. Its portfolio includes a range of residential suites and manufactured housing communities. Additionally, CAPREIT has a stake in Irish Residential Properties (OTCPK: RSHPF) and has been actively involved in various strategic initiatives, including a capital recycling program.

Understanding the Portfolio

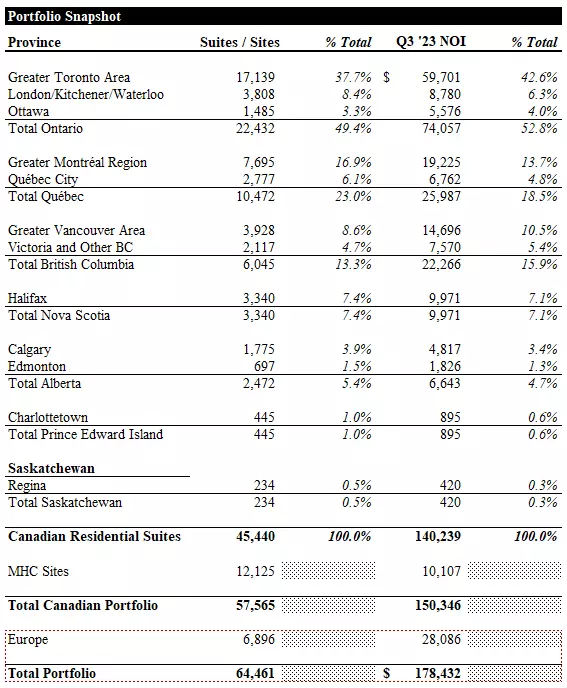

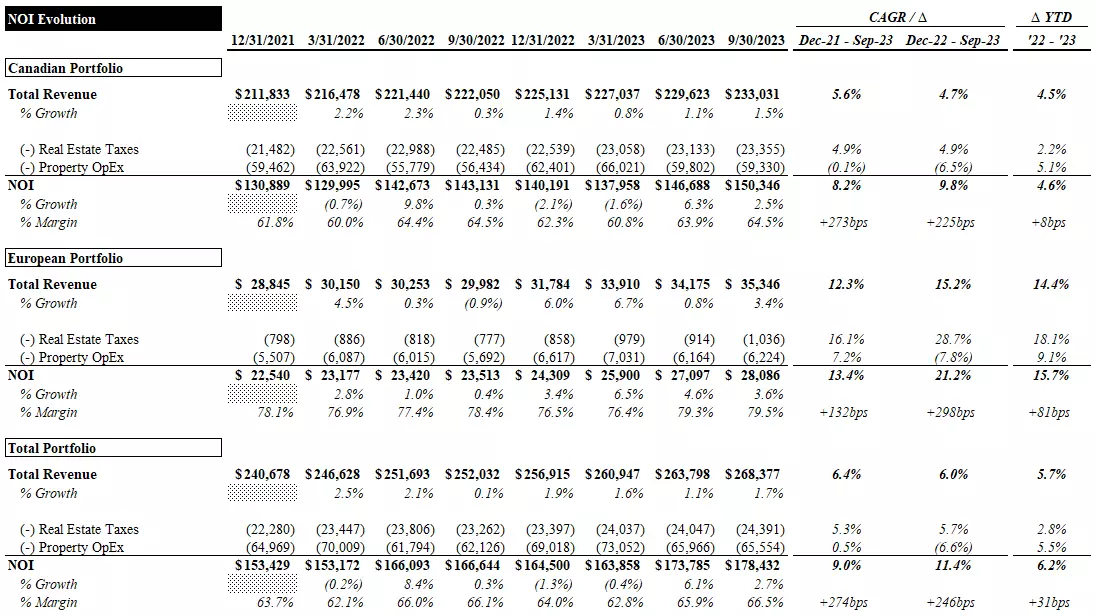

CAPREIT's Canadian residential portfolio consists of approximately 45,400 suites, primarily located in Ontario. Quebec and British Columbia are the REIT's second and third-largest markets, respectively. The portfolio also includes 12,125 manufactured housing community sites across Canada. CAPREIT also consolidates ERE's 6,896 residential suites and commercial GLA.

Image: Portfolio Snapshot (Empyrean; CAPREIT)

The portfolio has shown resilience, with stable occupancy rates averaging around 99% across the Canadian residential, manufactured housing, and ERE portfolios. CAPREIT's Canadian residential assets have also experienced consistent growth, with an average monthly rent increase of 6.3% CAGR.

Recent Performance

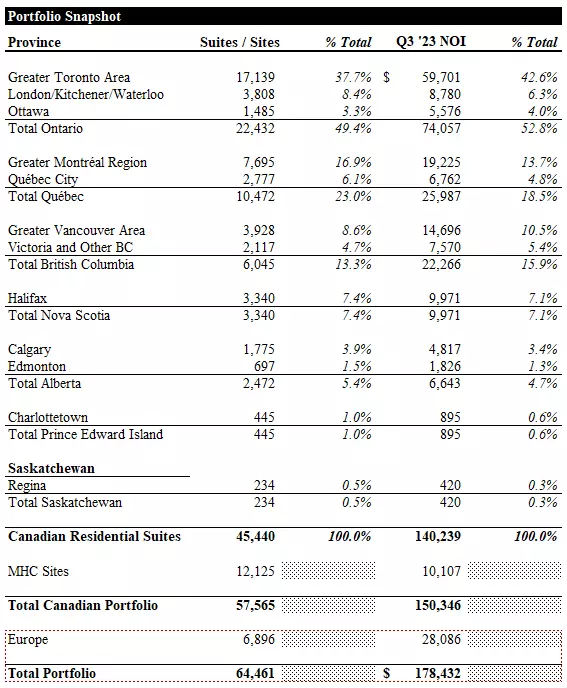

CAPREIT's financial performance has been notable. Over the past few years, the REIT has achieved positive growth in revenue, net operating income (NOI), and adjusted cash flow from operations (ACFO). While there have been some challenges, such as rising interest costs, CAPREIT's ability to adapt and manage its portfolio has allowed it to navigate these obstacles.

Image: Revenue Evolution (Empyrean; CAPREIT)

CAPREIT's reported revenue figures have been positively influenced by the consolidation of ERE. However, even when excluding ERE, CAPREIT's Canadian portfolio has demonstrated strong performance.

Valuation and Investment Opportunity

CAPREIT's current valuation presents an interesting opportunity for investors. With a price-to-FFO multiple of 19.4x and a price-to-ACFO multiple of 20.1x, CAPREIT offers a potential upside. The market is currently pricing CAPREIT at a discount to its net asset value (NAV) and implies a cap rate of approximately 4.2%.

Considering CAPREIT's portfolio, management team, and potential for growth, it is an attractive proposition for investors. While there are risks associated with rent control regulations and the ongoing strategic review of ERE, the overall outlook for CAPREIT remains positive.

Conclusion

CAPREIT's position as Canada's largest residential REIT, combined with its strong portfolio and capable management team, make it an appealing investment choice. Despite the challenges posed by rent control regulations and the ongoing strategic review of ERE, CAPREIT has demonstrated resilience and potential for growth. While it is essential to carefully consider the risks, investing in CAPREIT could prove to be a rewarding opportunity.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.