Hey there, fellow housing enthusiasts!

Buckle up, because the rental market just took an interesting turn. February 2024 data shows a nationwide median rent of $1,377, marking a slight 0.2% increase – the first uptick after six months of decline. Could this be the start of the typical spring and summer rental surge, or are we witnessing a temporary blip?

This report dives into the latest trends shaping the rental landscape, exploring everything from month-over-month and year-over-year changes to regional variations and the impact of new construction. We'll even take a peek at how these fluctuations are reflected in inflation numbers.

Whether you're a seasoned renter or a curious observer, this deep dive has something for you. Let's get to it!

Rent Trends: A Balancing Act Between Seasonal Shifts and Long-Term Cooldown

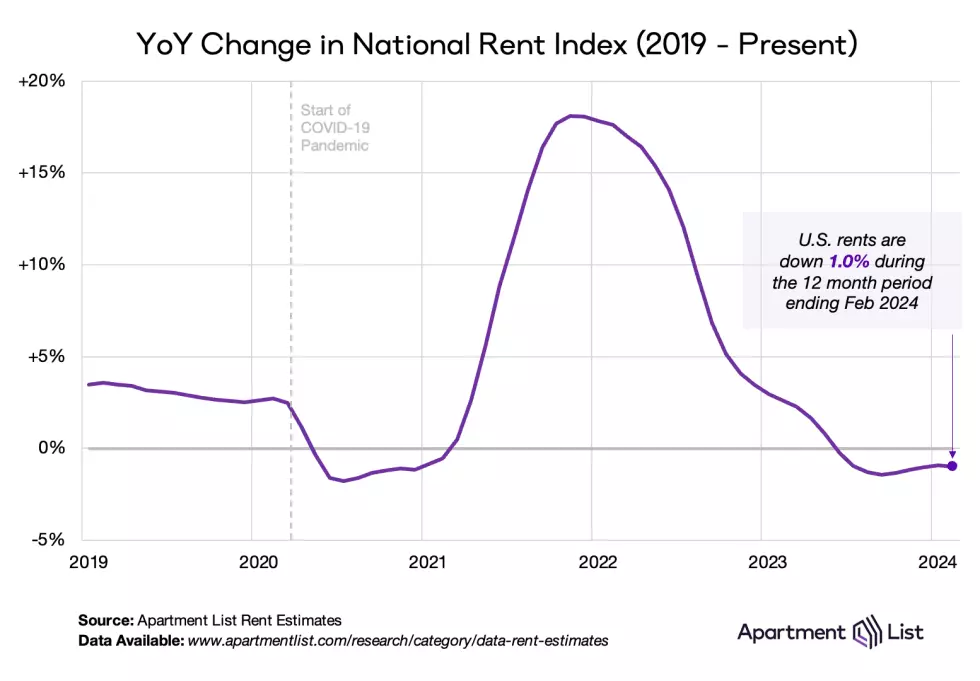

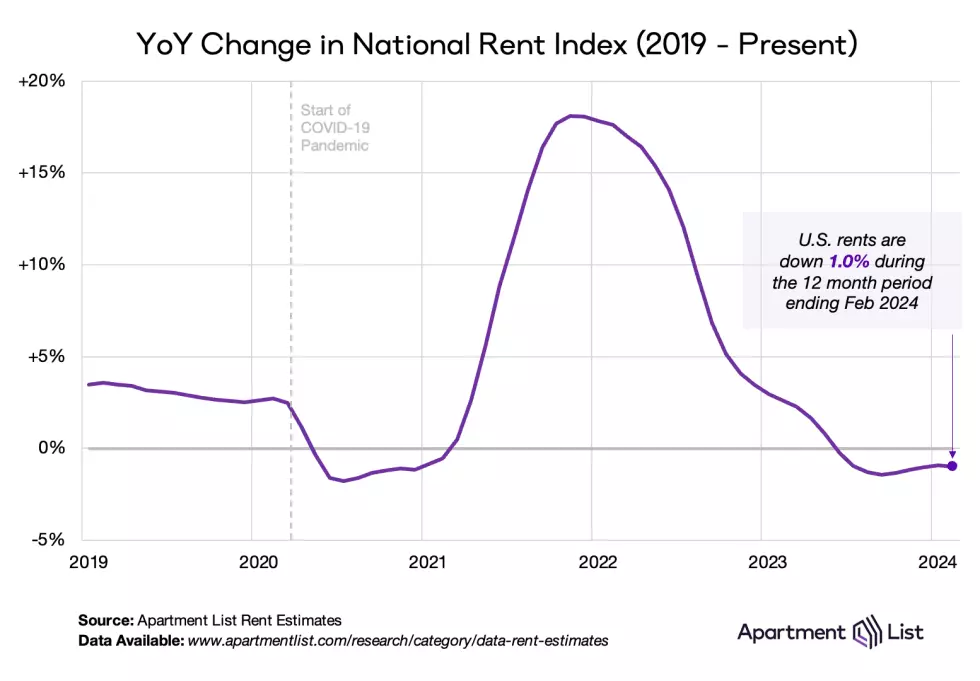

Remember the rental frenzy of 2021 and 2022? While those days are behind us, understanding the current market requires looking at both recent and long-term changes.

Month-to-Month: A Glimmer of Growth

February’s 0.2% rent increase, while small, signals a potential shift after a prolonged period of decline. This aligns with the typical seasonal pattern of rent increases during the spring and summer months as moving activity picks up. However, the past two years have shown us that seasonal trends aren't always predictable.

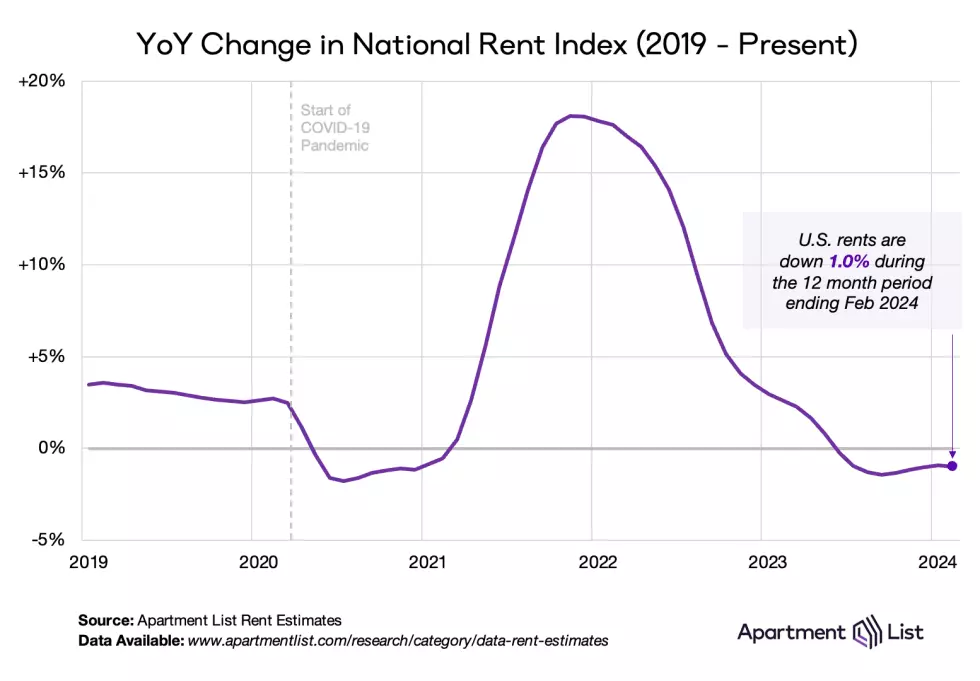

Year-over-Year: The Cooldown Continues

Despite the recent uptick, year-over-year rent growth remains in negative territory at -1%. This means you're likely to find slightly cheaper apartments today compared to last year. However, let's not forget the substantial rent hikes of 2021 and 2022. The national median rent is still a considerable 20% higher than it was three years ago.

Inflation and Vacancies: Unpacking the Bigger Picture

The rental market doesn't exist in a vacuum. Let's look at how these rent trends connect with broader economic indicators.

Inflation: A Slow and Steady Decline

The rental market slowdown is gradually being reflected in inflation numbers, particularly the Consumer Price Index (CPI). The CPI's shelter component, heavily influenced by housing costs, is showing signs of cooling down. This trend, if sustained, could bring some relief from overall inflation.

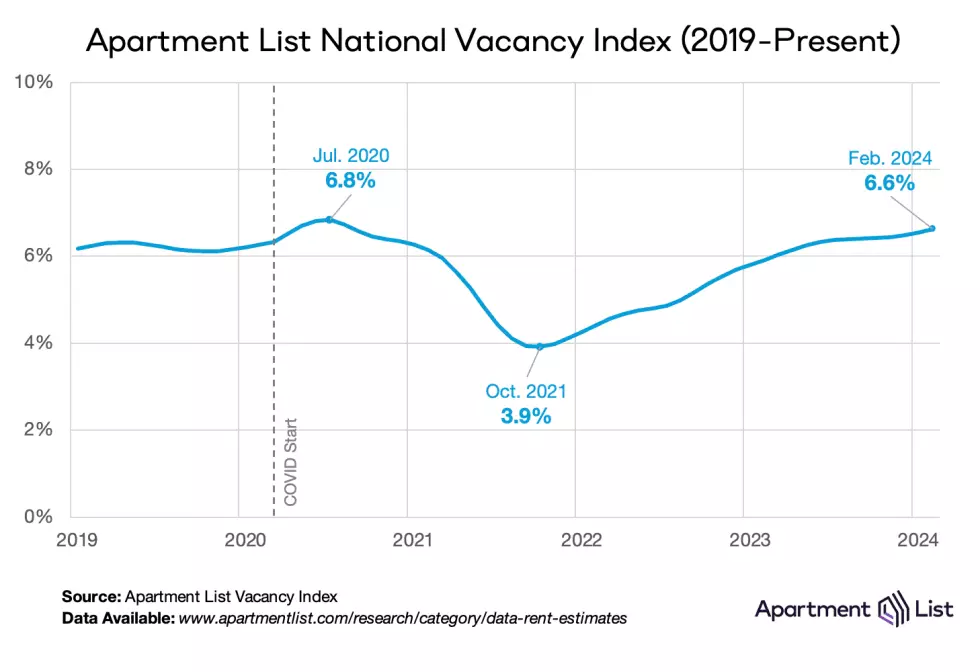

Vacancies: A Return to Pre-Pandemic Levels

Remember the days of scarce apartments? Those days seem to be fading. The national vacancy index now sits at 6.6%, surpassing pre-pandemic levels. This increase in available units can be attributed to a steady rise in new apartment construction, particularly in Sun Belt markets.

Regional Roundup: From Sun Belt Declines to Midwest Growth

The national rental market is anything but uniform. Let's break down the regional variations and what's driving them.

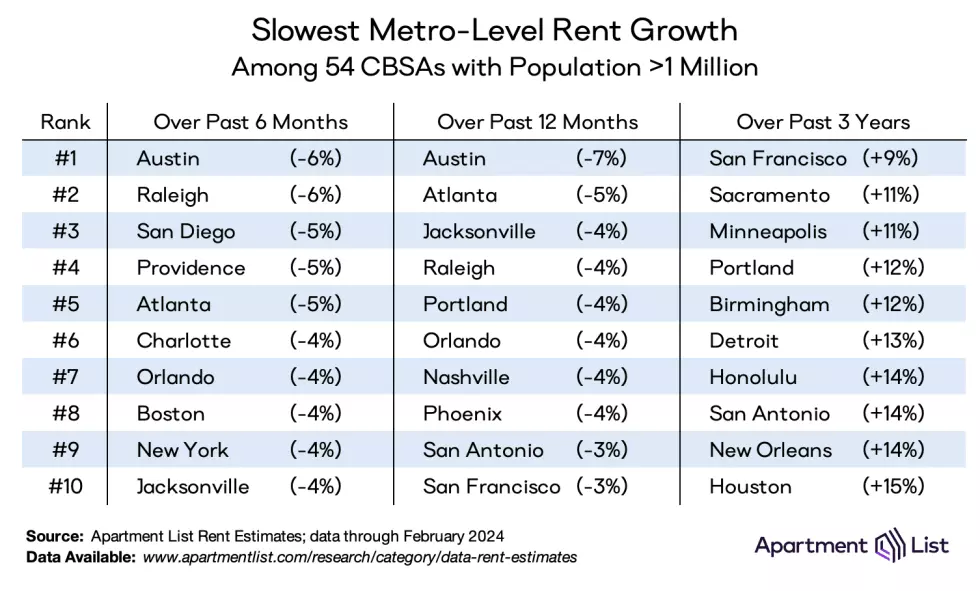

Sun Belt: New Construction Fuels Rent Declines

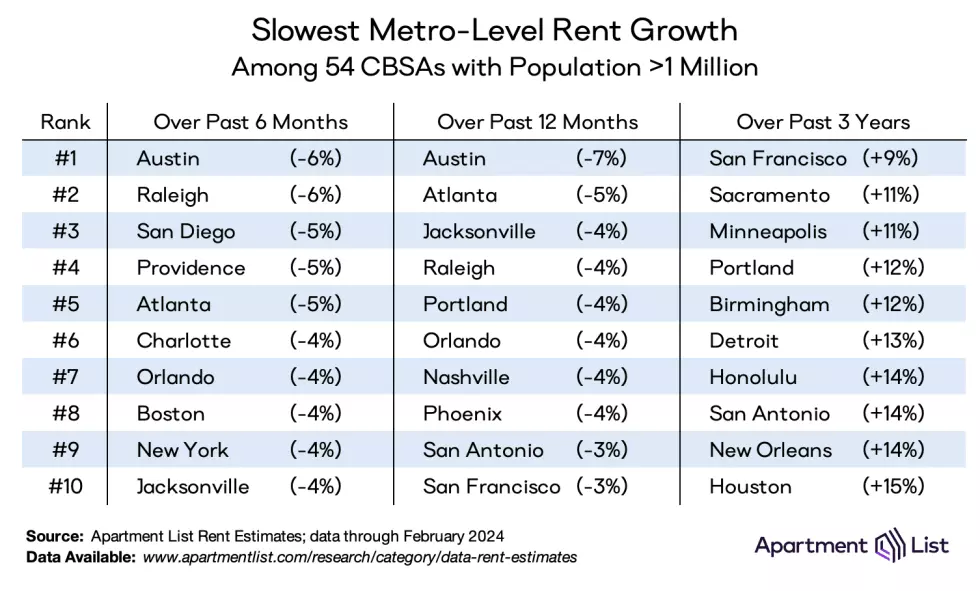

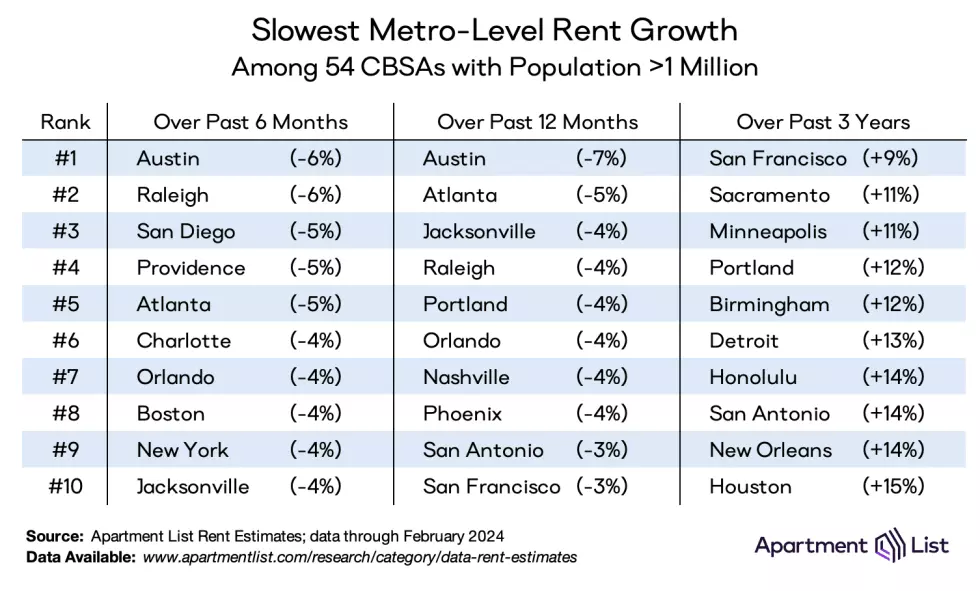

Sun Belt metros, known for their recent population surges, are now experiencing some of the steepest year-over-year rent declines. Take Austin, for example, where rents have dropped by 7% in the past year. This trend can be attributed to a boom in new housing construction in these areas, increasing the supply of available units.

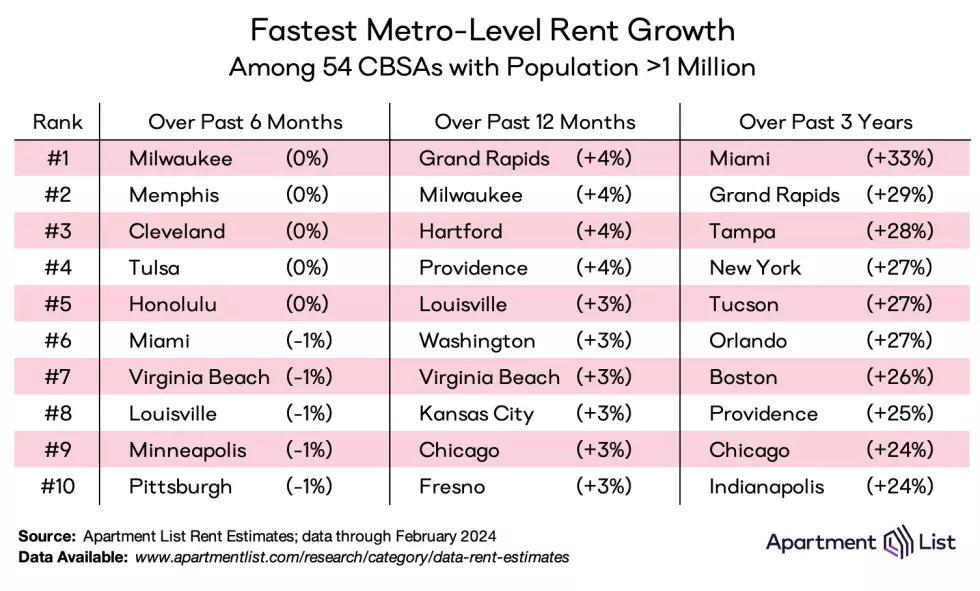

Midwest and Northeast: Steady, But Modest, Growth

On the flip side, metros in the Midwest and Northeast are witnessing positive rent growth, albeit at a more modest pace. Factors like limited new construction and steady demand contribute to this trend. However, even in these regions, rent growth remains relatively subdued compared to the national average.

Looking Ahead: What's Next for the Rental Market?

Predicting the future of any market is tricky, but here's what we can glean from current trends and expert insights.

Continued Moderation:

The rental market is expected to remain relatively balanced in the coming months, with new construction playing a key role in tempering potential rent increases.

Regional Variations:

Keep an eye on regional trends. Sun Belt markets might continue to see more rent adjustments due to new construction, while other areas may experience steadier, albeit modest, growth.

Economic Factors:

Broader economic conditions, such as inflation and employment rates, will undoubtedly influence rental market dynamics.

In a nutshell, the rental market is at a fascinating crossroads. While recent data suggests a potential shift, long-term trends indicate continued moderation. Keep an eye out for regional variations and how broader economic factors might shape the future of renting.