A property title search is a crucial step before buying or selling a real estate property. It helps determine the ownership of the property and uncover any restrictions. By conducting a title search, you can verify the current owner, rule out potential legal risks, and ensure a smooth transaction. In this article, we will explore what a property title search is and the best ways to check it.

What is a Property Title Search?

A property title search is the process of identifying the ownership of a property and uncovering any restrictions on its use. For buyers, this search helps verify the current owner and avoid any legal issues. Sellers also need to check the title to ensure there are no claims or liens of which they are unaware.

If the property title search reveals significant defects, it could challenge your ownership and lead to various issues. Some common defects to watch out for include:

- A broken chain of title, indicating improper transfer due to fraud or inheritance issues.

- Liens on the property caused by unpaid taxes, debts, or judgments.

- Bankruptcy by the current owner.

- Pending divorce proceedings, where property ownership is undetermined.

3 Ways to Run a Property Title Search

You can choose to conduct a property title search independently or seek professional services to save time and effort. To initiate a search, you will need either the property's full address, the property owner's name, or the parcel number.

Method 1 - Search for Public Records Manually

Image Source: Unsplash

Image Source: Unsplash

A manual title search involves examining legal documents and property records, such as deeds of ownership, transfers, mortgages, and tax records. Depending on the required documents, you may need to visit different government sources, including the local county recorder, county clerk's office, tax assessor, and registry of deeds. You can find links to property-related departments in the Public Record Online Directory.

Some states have digitized their databases, allowing online searches, while others require in-person visits to the relevant offices. Public viewing of property records is usually free, but there may be a nominal fee for copies.

Method 2 - Use a Dedicated People Search Engine (Recommended)

People search engines offer a fast and efficient way to check a property's history and conduct a title search. These engines collect and sort millions of public records from verified resources, providing up-to-date data in one easy-to-read report.

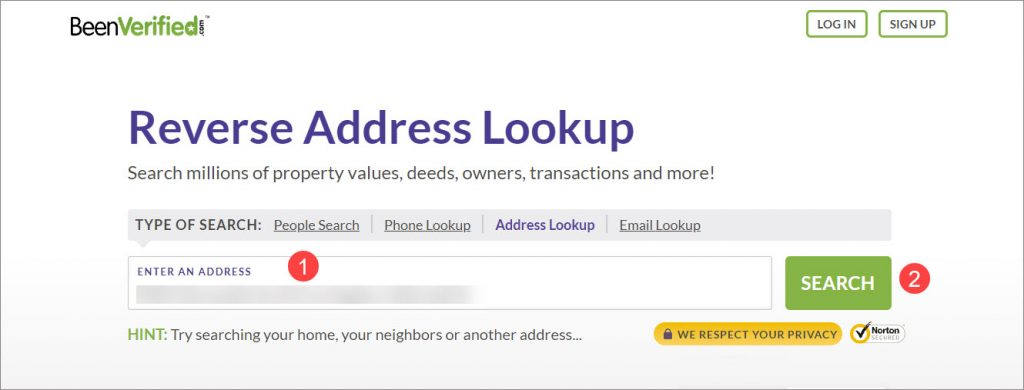

Option 1 - Reverse Look Up the Address

One recommended people search engine is BeenVerified. It allows you to look up public records for individuals, properties, and vehicles. By using their reverse address lookup tool, you can access information such as property owners, home value, sales history, and get a clear view of the neighborhood.

To conduct a reverse address lookup:

- Visit the BeenVerified address lookup page.

- Enter the address you wish to investigate and click Search.

- Wait a few minutes for the results to load. The report may contain sales data, mortgage history, tax assessments, deed data, and more.

Image Source: BeenVerified

Image Source: BeenVerified

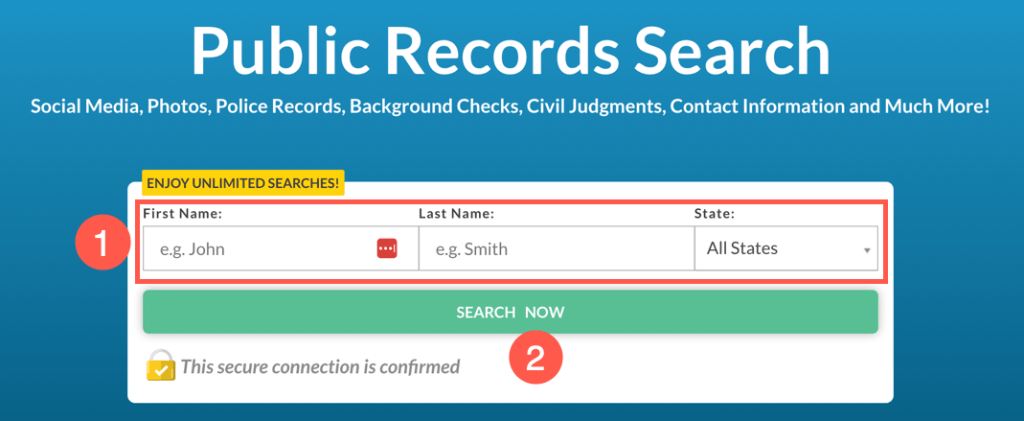

Option 2 - Search by the Owner's Name

Another reputable online service is TruthFinder, which offers comprehensive background reports. In addition to contact details, TruthFinder provides criminal history records, marriage licenses, divorces, child support orders, and more.

To search by the property owner's name:

- Visit the TruthFinder official website.

- Enter the property owner's name and click Search.

- Once the search completes, unlock the report, and explore the various elements. Pay attention to assets, bankruptcy, liens, and other judgments that may affect the property.

Image Source: TruthFinder

Image Source: TruthFinder

Method 3 - Hire a Title Company

Image Source: Unsplash

Image Source: Unsplash

If you're applying for a mortgage loan, your lender will require a title company for the title search. A title company acts as a third party on behalf of both lenders and buyers, ensuring a smooth home transaction. They conduct thorough title searches, property surveys, handle the closing, and provide insurance policies against title defects. While not mandatory in some jurisdictions or for cash payments, hiring a title company can offer peace of mind.

To choose a reliable title company, ask your lender or real estate agent for recommendations. You can also seek referrals from friends or family. The cost of a title search varies by location, typically ranging from $75 to $250.

Conclusion

Conducting a property title search is essential to ensure a smooth real estate transaction. Government agencies are reliable sources of property records, which include property deeds, tax records, mortgage reports, and survey maps. These records are available to the public upon request. If you prefer a quicker option, you can use a third-party public record search engine or hire a title company. By following these methods, you can confidently check property ownership and avoid potential complications.