Real estate data holds the key to informed decisions and successful investments in the property market. Whether you're buying, selling, or seeking opportunities, having access to reliable and comprehensive data is essential. In this article, we will explore the different categories of real estate data, examine its attributes, delve into the various use cases, and discuss the pricing options available.

Real Estate Data Explained

Real estate data can be classified into four main categories:

Residential real estate data

This category encompasses data related to areas designated for residential purposes such as family homes, apartments, flats, and lofts. Understanding the trends and dynamics of residential real estate is crucial for both buyers and sellers.

Commercial real estate data

Commercial real estate data focuses on properties intended to generate income for the owners. This includes shopping centers, hotels, offices, and other income-generating venues. Accurate and up-to-date commercial real estate data is vital for making informed investment decisions.

Industrial real estate data

Industrial real estate data covers areas and buildings exclusively used by companies for research, design, production, and distribution of physical goods. This includes warehouses, production facilities, logistical centers, and laboratories. Having access to this data is essential for businesses operating in the industrial sector.

Land data

Land data includes information about ranches, farms, and vacant land. Real estate investors often acquire vacant land with the expectation of future residential development, which significantly enhances its value. Comprehensive land data is crucial for identifying investment opportunities and assessing their potential.

Now that we've explored the different categories of real estate data, let's delve into the essential attributes that data providers consider when compiling datasets.

Attributes of Real Estate Data

Real estate data providers consider several factors when compiling land and ownership databases. These factors include:

-

Geolocation data: This provides information on the property's location, which can be presented as an address or through coordinates.

-

Site or building coverage: This indicates the percentage of the lot area covered by the building. Understanding this factor helps assess the potential usage and value of the property.

-

Plot density: Plot density expresses the number of dwelling units per acre, taking into account thoroughfares, public parks, and other public areas. City authorities often refer to plot density regulations when determining land usage for residential purposes.

-

Site area: Site area refers to the floor area ratio of a specific site. It is calculated by dividing the total gross building floor area by the land area of the lot. Understanding this ratio helps evaluate the potential usage and limitations of the property.

-

Local authority: The local authority refers to the city or county in which the property is situated. It's important to assess the jurisdiction and regulations in order to comply with local laws and policies.

-

Tenure: Tenure refers to the legal ownership of the land. It determines who can use the land, for how long, and under what conditions. Understanding the tenure is crucial for making informed decisions regarding land acquisition.

-

Flood risk: Assessing flood risk is essential, as it can have a significant impact on the cost of property ownership. Properties located in floodplains may require additional insurance and come with potential risks and limitations.

-

Property type: Identifying the property type (residential, commercial, or industrial) helps determine its specific characteristics, potential usage, and market value.

-

Financing: Understanding the financing options and history of a property provides valuable insights into its market value and potential risks.

-

Taxes: Property taxes are an important consideration for property owners. Understanding the tax obligations associated with a property is crucial for financial planning and investment decision-making.

Now that we have a better understanding of the essential attributes of real estate data, let's explore the diverse use cases where this data can prove invaluable.

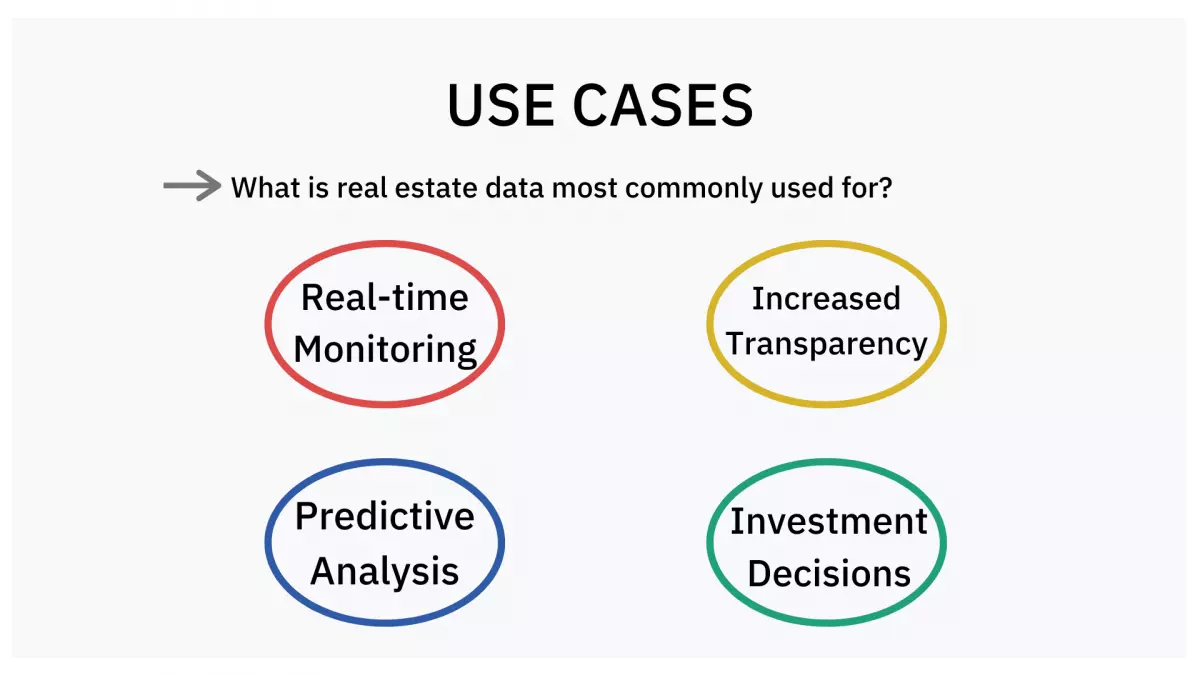

Use Cases for Real Estate Data

Real estate data offers a range of use cases that can inform decisions and optimize spending. Here are a few examples:

1. Predictive analytics

Companies can leverage real estate data to analyze building conditions, age, past reconstructions, and ownership details to estimate property value accurately. Machine learning algorithms can forecast rent per square foot with remarkable accuracy, enabling better investment decisions.

2. Increased industry transparency

Real estate data provides transparency in business processes, allowing companies to make informed decisions quickly. Accurate and objective data empowers real estate companies to navigate the market with confidence.

3. Real-time monitoring and communication

Real estate agents can leverage real estate data to identify potential buyers and sellers at the right time. By monitoring trends and actual prices, agents can offer clients more profitable opportunities and optimize their services.

4. Customized strategization

Real estate data enables insurance companies to assess regional needs and create tailored insurance plans. This ensures that individuals receive appropriate coverage based on their specific requirements.

While real estate data offers tremendous value, it's essential to consider a few factors when investing in third-party datasets.

-

Provider reviews: Prioritize providers with positive reviews, ensuring they have a proven track record of delivering reliable and accurate data.

-

Data coverage: Confirm that the dataset covers the locations and property types you're interested in. The data should align with your specific requirements.

-

Data integration: Evaluate whether the data can be easily integrated into your existing systems and software. Seamless integration will streamline your operations and maximize the value of the data.

-

Pricing feasibility: Consider the pricing options available and ensure they align with your budget and intended use case. Evaluate the cost-effectiveness and quality of the data to make an informed decision.

Real Estate Data Pricing

Real estate data providers offer various pricing options, including software packages, bulk downloads, subscriptions, and pay-as-you-go plans. The cost of the data depends on the breadth and depth of the dataset requested. Data marketplaces like Datarade offer a wide selection of real estate datasets, but premium data products may come with a higher price tag. Choosing the right data for your needs requires careful consideration of your data budget and intended use case.

In conclusion, real estate data is a valuable asset for anyone involved in the property market. By accessing comprehensive and reliable data, you can make informed decisions and optimize your investments. Whether you're a buyer, seller, or investor, leveraging real estate data will provide you with a competitive edge in the ever-evolving real estate landscape.

Image credit: Courtesy of Saigon Intela

Image credit: Courtesy of Saigon Intela

Remember, choosing the right data provider, considering the data attributes, and exploring the various use cases will enable you to unlock the full potential of real estate data. Stay informed, make data-driven decisions, and seize the opportunities that lie within the vast real estate market.