Introduction: Unpacking Mortgage REITs

Imagine this: investments that offer impressive dividends, often exceeding 10%. That's the allure of Mortgage Real Estate Investment Trusts (mREITs). But before you jump in, it's crucial to understand the mechanics behind these lucrative, yet volatile, investment vehicles.

This guide demystifies mREITs, delving into their workings, their potential for high yields, and the risks that come with the territory. We'll explore how mREITs generate returns, the factors that influence their performance, and essential considerations for investors seeking to add them to their portfolios.

Understanding the Basics: How mREITs Operate

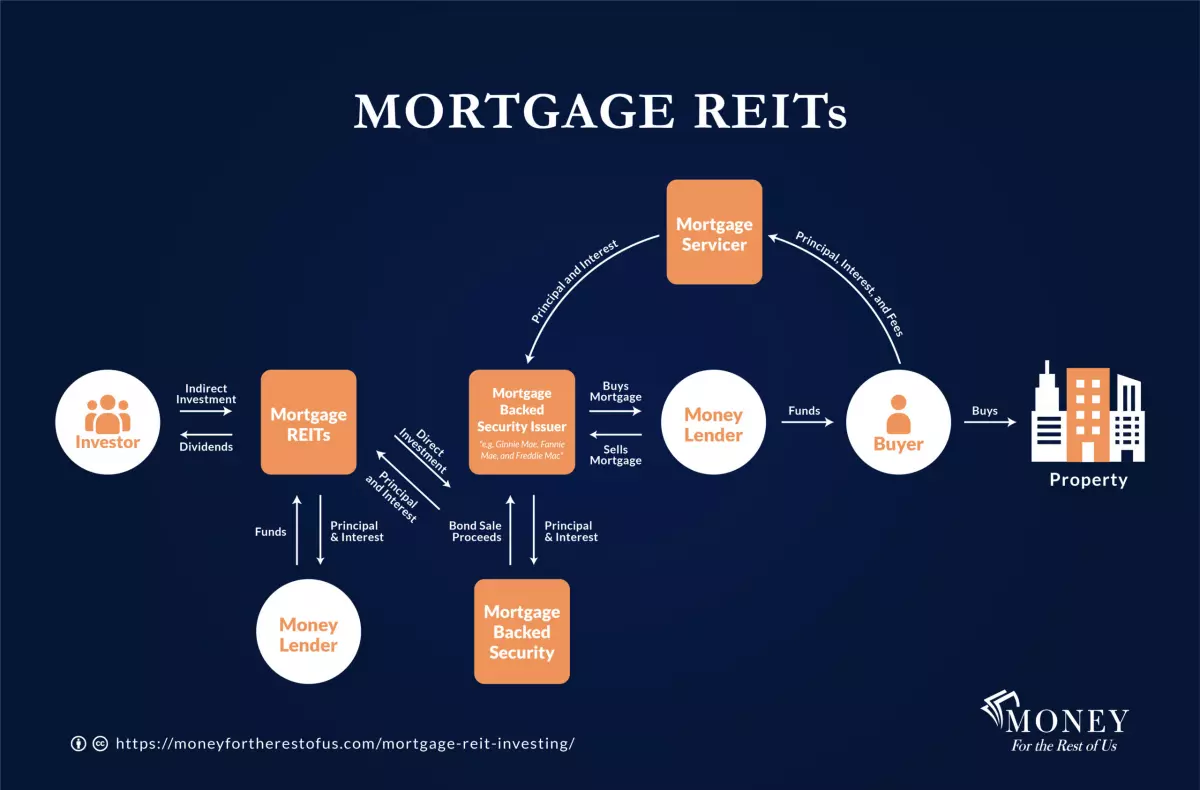

Instead of investing directly in properties, mREITs hold mortgages or mortgage-backed securities (MBS). Think of MBS as bonds backed by a pool of mortgages. Here’s how they work:

- Investing in Mortgages: mREITs primarily invest in agency MBS issued by government-sponsored enterprises like Fannie Mae and Freddie Mac. These MBS carry lower risk due to government backing.

- The Leverage Game: To amplify returns, mREITs borrow money at lower, short-term rates and invest in higher-yielding, long-term MBS. This strategy is called a carry trade.

- Generating Income: The difference between the interest earned on MBS and the cost of borrowing (the net interest margin) forms the income stream for mREITs.

- Sharing the Profits: mREITs, bound by regulations, distribute a significant portion of their taxable income as dividends to shareholders, often leading to attractive yields.

Unraveling the Risks: What Makes mREITs Volatile

While high dividends sound enticing, remember that mREITs come with their share of risks:

1. Net Interest Margin Risks

- Yield Curve Dynamics: When long-term interest rates (affecting mortgage rates) exceed short-term rates (affecting borrowing costs for mREITs), the yield curve slopes upward, favoring mREIT profitability. However, a flat or inverted yield curve squeezes profit margins.

- Repo Market Disruptions: mREITs rely heavily on short-term loans called repurchase agreements (repos) to finance their operations. Volatility in repo rates, like the spike in 2019, can directly impact mREIT profitability.

2. MBS Pricing Risks

- Interest Rate Sensitivity: Like any bond, MBS prices fall when interest rates rise. This dynamic, evident in 2022, can significantly impact mREIT book values and share prices.

- Prepayment Risk: Falling interest rates may trigger mortgage refinancings. While this can benefit mREITs by providing early principal repayments, it also creates uncertainty in projected cash flows.

3. Risks Specific to mREIT Shareholders

- Price Volatility: High leverage magnifies both profits and losses. Any threat to mREIT profitability, like rising interest rates or widening credit spreads, can trigger sharp declines in share prices.

- Dividend Cuts: When income falls short of dividend obligations, mREITs may be forced to reduce or suspend dividends, impacting investor returns and potentially triggering further share price declines.

mREITs vs. Equity REITs: A Tale of Two REITs

While both mREITs and equity REITs fall under the REIT umbrella, they operate quite differently. Equity REITs invest directly in income-generating properties, while mREITs focus on mortgages.

| Feature | Mortgage REITs | Equity REITs |

|---|---|---|

| Investment | Mortgages, MBS | Physical properties |

| Income Source | Interest income on mortgages | Rent payments, property appreciation |

| Risk Profile | More sensitive to interest rate changes | More exposed to real estate market fluctuations |

A Look at Returns: Balancing Yield and Volatility

Historically, mREITs have offered attractive double-digit dividend yields. However, periodic drawdowns due to interest rate sensitivity and other risks have often offset those gains, leading to lower overall returns compared to the broader market.

Investing in mREITs: Strategies and Considerations

Investors have several options for accessing mREITs:

- Individual mREIT Stocks: This approach allows for targeted exposure but requires thorough due diligence and risk assessment.

- mREIT ETFs: ETFs offer diversified exposure to a basket of mREITs, potentially mitigating some of the risks associated with individual stocks.

- mREIT Preferred Stock: Preferred shares of mREITs typically offer lower but more stable dividends compared to common shares and may provide some downside protection in turbulent markets.

Conclusion: Proceed with Caution, Reap Potential Rewards

Investing in mREITs is like navigating a ship through potentially choppy waters. While the promise of high dividends is alluring, understanding the underlying mechanics, risks, and potential volatility is crucial for successfully adding mREITs to your investment portfolio.