Introduction: Cracking the Code of Real Estate Capital Growth

Investing in real estate can feel like navigating through a maze, especially when it comes to understanding capital growth. It's not rocket science, but just like NASA meticulously calculates trajectories, we need to be precise with our metrics. This article breaks down the intricacies of capital growth, distinguishing it from asset-value growth, and highlighting why understanding this difference is crucial for making savvy investment decisions. Think of this as your guide to decoding real estate jargon and maximizing your returns.

Capital Growth vs. Asset Value Growth: Two Sides of the Same Coin?

Often used interchangeably, 'capital growth' and 'asset-value growth' are actually distinct concepts. While both relate to an increase in value, the devil lies in the details.

Capital Growth: A True Measure of Investment Performance

Imagine capital growth as your report card for real estate investments. It reflects how much your investment has grown after factoring in all the expenses and income. The CFA Institute's Global Investment Performance Standards (GIPS) defines capital growth as the percentage change in the value of your real estate investments, including:

- Cash and cash equivalents: Think of this as your readily available funds.

- Capital Expenditures: These are the ongoing costs of maintaining and improving your property, such as renovations or repairs.

- Net Proceeds from Sales: This is the profit you make when you sell a property.

Asset-Value Growth: A Snapshot in Time

Unlike capital growth, asset-value growth is like a snapshot – it captures the increase in the market value of your property at a particular moment. It's a useful metric for:

- Comparing your property's value: You can see how your property stacks up against similar properties in the market.

- Tracking market trends: It provides insights into how property values are changing in a specific location.

Why the Distinction Matters: Avoiding Cosmic Investment Errors

Remember NASA's Mars Climate Orbiter mishap? Confusing metric units led to a costly failure. Similarly, misunderstanding capital growth can lead to investment missteps.

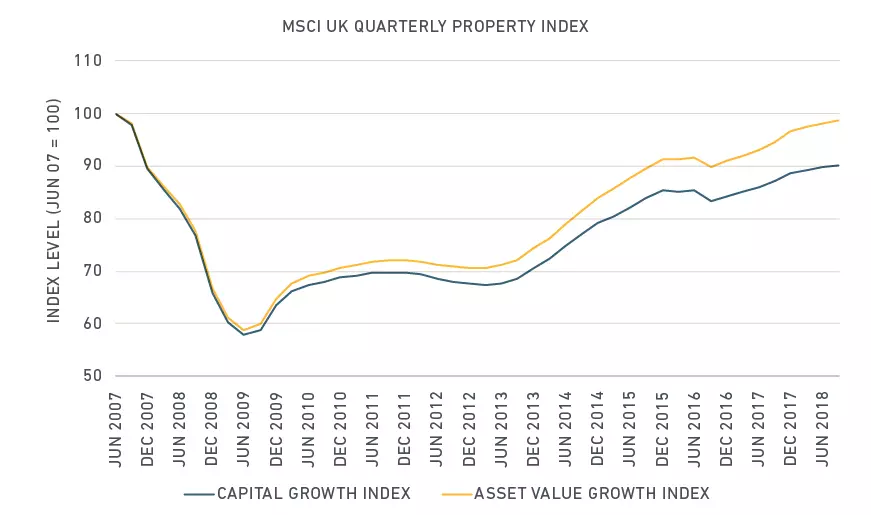

The MSCI UK Quarterly Property Index illustrates this:

- Asset values: Recovered significantly since the financial crisis, almost reaching their pre-crisis peak.

- Capital growth: Significantly lagged behind asset-value growth.

Using asset-value growth alone to assess your returns would paint an overly rosy picture, potentially leading to poor investment decisions.

The Takeaway: Navigating Your Real Estate Journey

To recap, consider these key points:

- Capital growth is a comprehensive measure of your investment's performance, factoring in income, expenses, and sales proceeds.

- Asset-value growth offers a snapshot of your property's market value at a given time.

- Understanding the difference is crucial for making informed investment choices and achieving your financial goals.

Think of it like this: capital growth is like charting your course through the cosmos, ensuring you reach your destination, while asset-value growth is like checking your current location on the map. Both are important, but for different reasons. So, equip yourself with the right knowledge and navigate your real estate journey with confidence!