If you're interested in the biggest U.S. real estate property portals and want to dive into their key facts, revenue figures, and recent controversies, you've come to the right place.

Zillow: One of the Most Powerful Real Estate Portals

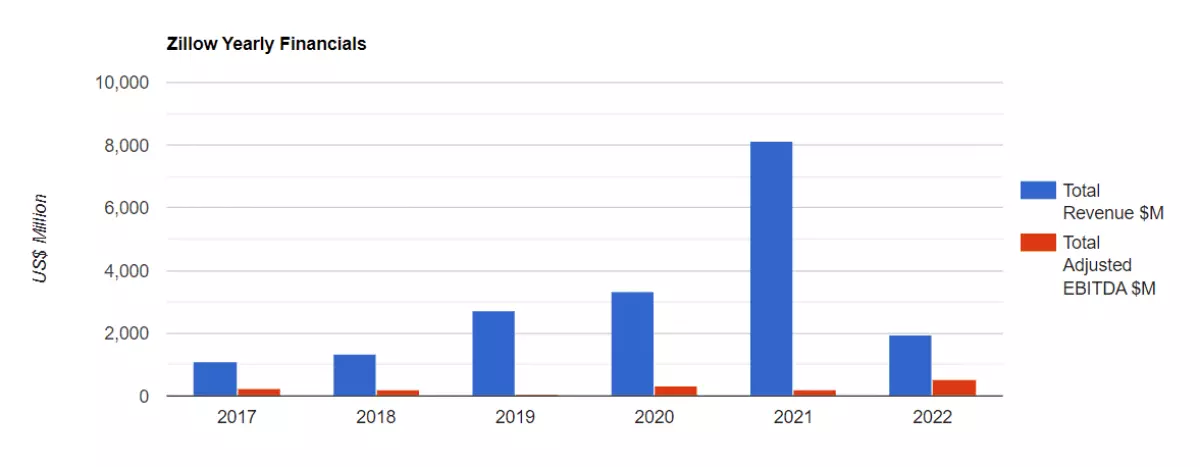

Zillow is undeniably one of the most influential portals, not only in North America but also worldwide. Founded in 2006, Zillow generates billions of dollars in revenue each year, despite the collapse of its iBuying home renovations business in November 2021.

Zillow Financial

Zillow Financial

Realtor.com: Zillow's Runner-Up

Realtor.com, founded in 1995, historically occupied the second position behind Zillow. Initially backed by the National Association of Realtors, the portal's relationship with the industry association has weakened over time.

Move Inc Financial

Move Inc Financial

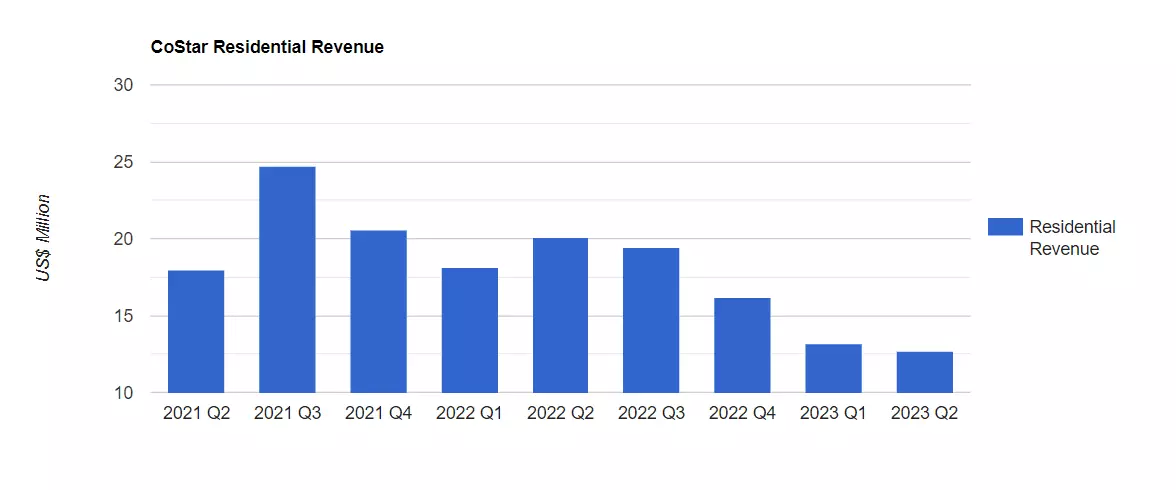

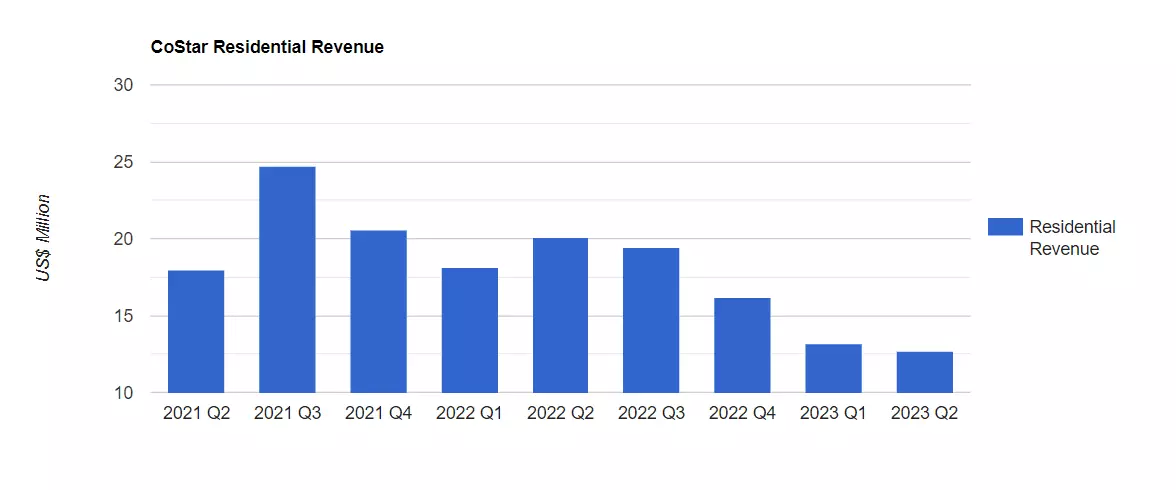

Homes.com: The Rising Star

Homes.com, acquired by commercial real estate giant CoStar Group in 2021, has been steadily gaining momentum. Though not yet a direct challenger to Zillow, Homes.com, as part of CoStar's 'Residential' business segment, generates between $10-$20 million in revenue per quarter.

Costar Financial

Costar Financial

Traffic Comparison: Zillow Takes the Lead

According to Similarweb, Zillow boasts the highest traffic among U.S. real estate portals. Realtor.com, although in the second position, experienced a 20% drop in traffic between March and July 2023. Both Zillow and Realtor.com faced challenges due to high mortgage rates and low inventory.

CoStar Group aims to boost traffic to Homes.com by implementing various strategies. The company intends to divert traffic from Homesnap.com, another portal it owns. Additionally, a national media campaign to raise awareness and drive traffic to Homes.com is in the works.

US Portal Traffic

US Portal Traffic

Ownership: Zillow, Realtor.com, and Homes.com

Zillow Group, a publicly traded company, owns and operates Zillow. Realtor.com is owned by Move, Inc., with 80% ownership held by media corporation Newscorp and 20% owned by REA Group, an Australian specialist portal company. CoStar Group owns Homes.com, along with Apartments.com and Homesnap.com.

CoStar's Failed Acquisition

CoStar Group's relationship with Move, Inc. raised eyebrows when CoStar considered acquiring Realtor.com in 2022. However, the deal worth $3 billion was ultimately withdrawn. CoStar opted to invest in improving Homes.com using its cash reserves.

In the most recent financial results, CoStar proudly announced overtaking Redfin and Realtor.com, making them the operator of the U.S.'s number two portal network in terms of traffic for the first time.

The Business of Zillow: Revenue Generation

Zillow primarily generates its revenue from its Premier Agent product. This product involves selling buyer leads to agents, even if the agent receiving the lead is not the agent listing the property. While agents don't pay to list on Zillow or any other real estate portal, Zillow accesses the MLS system through its membership with the National Association of Realtors.

In addition to Premier Agent, Zillow has expanded its revenue streams in recent years:

- Commission sharing: Zillow now splits the commission with agents in select local markets, receiving a percentage of the agent's commission on the sale in exchange for generating and qualifying leads.

- Paid enhanced listings: Zillow charges agents for special 'AI-enhanced listings' on its site.

- Mortgage: Zillow generates revenue as a mortgage originator, though the service's profitability has been inconsistent. Zillow is working on better integrating the service within its user flow.

- Title and Escrow: Zillow initially closed its own Title and Escrow service but later acquired digital specialist Spruce.

- Agent software solutions: These solutions include client management and analytics, showing management software, and professional training through ShowingTime+.

Zillow's iBuying Endeavor

Until November 2021, Zillow was involved in the iBuying business, which entailed buying and renovating houses before selling them. Despite its famous Zestimate algorithm, which aimed to accurately estimate house prices, and efforts to promote its mortgage service, Zillow faced significant financial losses and ultimately shut down its iBuying program.

In August 2022, Zillow announced a partnership with iBuyer Opendoor, allowing certain Zillow users to receive offers on their houses through the partnership.

Realtor.com's Revenue Model

Realtor.com follows a more traditional revenue model. The portal generates revenue by selling leads to real estate agents and offering advertising space to agents, brokers, and other parties in the real estate industry. Since acquiring the lead qualification service OpCity in 2018, Realtor.com has pioneered the next-gen-lead-gen model. In this model, agents pay a percentage of their commission to the portal company to generate and refine leads.

Zillow Vs Realtor.com Next Gen Lead Gen Revenue

Zillow Vs Realtor.com Next Gen Lead Gen Revenue

Homes.com's Unique Approach

Homes.com differentiates itself by promising not to sell leads to agents. CoStar Group, the parent company, adheres to the "your listing, your lead" mantra. Homes.com charges agents for extra visibility packages, allowing agents to receive leads from their listings for free. However, agents who want to maximize their lead generation on the portal can pay Homes.com to prioritize their listings in search results. This business model aligns with practices commonly seen in portals outside the U.S. and has proven successful in commercial and rental real estate.

Listing Controversies: Pocket Listings and Fair Housing

While real estate portals in the U.S. include all home listings available on the MLS (Multiple Listing Service), not all home listings are on the MLS. The National Association of Realtors' Clear Cooperation Policy requires agent members to upload all home listings to the MLS within one business day of starting their marketing efforts. However, big brokerages like Compass can create "pocket listings" by internally marketing listings exclusively to other Compass agents. These pocket listings do not appear on Zillow or other third-party real estate websites.

The debate surrounding pocket listings centers on fair housing concerns, as some argue that they hinder equal access to housing. On the other hand, big brokerages view pocket listings as a competitive advantage and an integral part of their business model.

User-Friendly Features: What Property Portals Offer

We examined 650 real estate portals worldwide in 2021 to identify industry-standard features and innovations. In August 2023, we conducted a feature review of major U.S. real estate portals to assess their offerings.

Stock Performance: Zillow and CoStar Shares

Zillow's share prices experienced a decline after shutting down its iBuying business but have since shown some recovery. However, reaching the heights of $161 per share, achieved in 2021, remains a distant goal.

CoStar's share prices have gradually risen over the past three years. Despite sustained double-digit year-on-year revenue growth and inclusion in the S&P 500 index, CoStar has yet to reach its record $94 per share achieved in August 2020.

Zillow Vs Costar Share Price E1692800527784

Zillow Vs Costar Share Price E1692800527784

2023 News Highlights

Zillow never fails to make headlines, and 2023 is no different. The company has faced several lawsuits, including one initiated by its own shareholders in 2017. Despite the challenges, Zillow continues to innovate, particularly in the field of artificial intelligence. The portal reported over half a billion dollars in revenue for Q2 FY23.

Realtor.com, on the other hand, faced a decline in traffic and revenue, each dropping over 20% year-on-year. The company underwent a leadership change in June, appointing Damian Eales as the new CEO. Eales expressed strong determination to reclaim the top spot from Zillow, guided by his Newscorp superiors' directive.

Homes.com received a boost when CoStar abandoned the Realtor.com deal. This decision implies that Homes.com will likely receive increased investment in the coming years. CoStar Group also decided to discontinue Homesnap in favor of Homes.com, just three years after acquiring it for $250 million. CoStar CEO Andy Florance celebrated the company's consecutive quarters of overtaking Redfin and Realtor.com, securing its position as the U.S.'s second-largest portal in terms of traffic.

Read all you need to know about property portals worldwide for free on Online Marketplaces!