When tech stocks crash, investors perk up and look for reasons why. In this case, one cause sticks out above the rest — rising interest rates. But why do tech stocks go down when interest rates rise? Let's dive deeper into this phenomenon.

When tech stocks crash, investors perk up and look for reasons why. In this case, one cause sticks out above the rest — rising interest rates. But why do tech stocks go down when interest rates rise? Let's dive deeper into this phenomenon.

Overview of Rising Rates

In March 2023, the Federal Reserve raised the federal funds rate by 25 basis points, bringing the benchmark interest rate to 4.5%. Rising interest rates can harm any stock, but tech companies tend to feel the burn more than others.

Why does the Federal Reserve raise (and lower) interest rates? The Fed's primary goals are to keep prices stable and encourage maximum sustainable employment. Inflation is their greatest concern, and interest rates are their tool to control it. Since the end of the Great Recession into the beginning of the COVID-19 pandemic, inflation has been at or below the target of 2%. However, the pandemic created a massive supply and demand imbalance, leading to skyrocketing prices. In response, the Federal Reserve began raising rates to cool demand and bring inflation back to a moderate level. Unfortunately, this action has hit tech stocks the hardest.

Overview of Tech Stocks

Tech stocks are known for their innovative nature, but innovation comes at a cost. Most tech companies, especially those covered in financial media, are growth stocks. These companies spend significant amounts of money to bring their products and services into the mainstream. Tech stocks range from small-cap startups to some of the world's largest and most successful companies like Apple Inc., Microsoft Corp., and Alphabet Inc. (formerly Google).

Tech stocks often reinvest excess profits back into the firm for research and development, and they don't keep a lot of cash on hand. Even large-cap companies launching new products or services must borrow money to finance their ventures. When interest rates rise, the cost of borrowing capital also increases. This is felt more by tech stocks compared to banks or utility providers who don't need frequent capital infusions.

Rising Rates and Tech Stocks

While tech stocks and high interest rates don't usually go hand in hand, it's not a simple equation of buying tech when rates fall or selling tech when rates rise. The relationship between interest rates and tech stocks is complex and depends on several factors.

Looking back at historical data, it's clear that tech stocks' performance during rate hikes is not straightforward. For example, during the dot-com bust in 2000, rates plummeted, but the tech sector still suffered. During the Great Recession, rates stayed near zero, yet tech outperformed the S&P 500. The lesson here is that the relationship between rates and tech stocks is not always linear, and other factors come into play.

Prospects for Tech Stocks in 2024

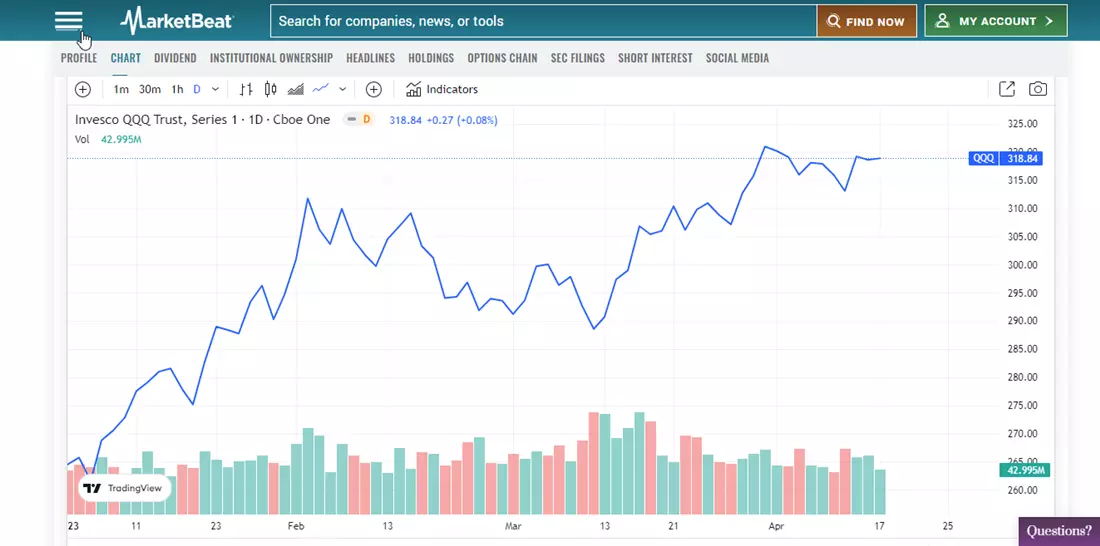

Despite the challenges posed by rising interest rates, the tech sector has shown resilience and potential. Market indices hit all-time highs in 2023, and tech stocks surged in the second half of the year. With inflation numbers dropping and the prospect of interest rate cuts on the horizon, there are reasons to be optimistic.

However, it's important to note that the tech sector is vulnerable to economic uncertainty, inflation, and corporate earnings. Tech firms that heavily rely on growth and market share without meaningful profits are particularly at risk. Valuation metrics and investor sentiment also play significant roles in tech stock performance.

Strategies for Investors

To navigate the volatility of the tech sector, investors should consider the following strategies:

- Build a diverse portfolio to avoid heavy concentration and minimize risk.

- Monitor interest rates and adjust your investment allocation accordingly.

- Take advantage of opportunities when tech stocks go on sale, focusing on strong companies like Amazon and NVIDIA.

The Future of Tech Stock Investing

Investing in the tech sector has always been an exciting proposition. Tech companies have produced game-changing innovations, but they also come with volatility and risks. It's essential to research companies and align with their mission before investing.

While high interest rates have historically affected the tech sector, the performance of tech stocks is not always predictable. The relationship between rates and tech stocks is intricate, and market dynamics play a significant role.

In conclusion, rising interest rates can have a negative impact on tech stocks, but the effects are not uniform. Investors should remain cautious and evaluate other factors influencing the tech sector to make informed investment decisions.