Image: MaslovMax/iStock via Getty Images

Image: MaslovMax/iStock via Getty Images

The Vanguard Real Estate ETF (NYSEARCA:VNQ) has stood the test of time as the go-to REIT ETF for investors seeking diversified exposure to United States REITs. While traditional real estate investment can be risky and time-consuming, VNQ offers a safer alternative, allowing investors to access institutional-quality real estate without the hassle.

A Robust Investment Opportunity

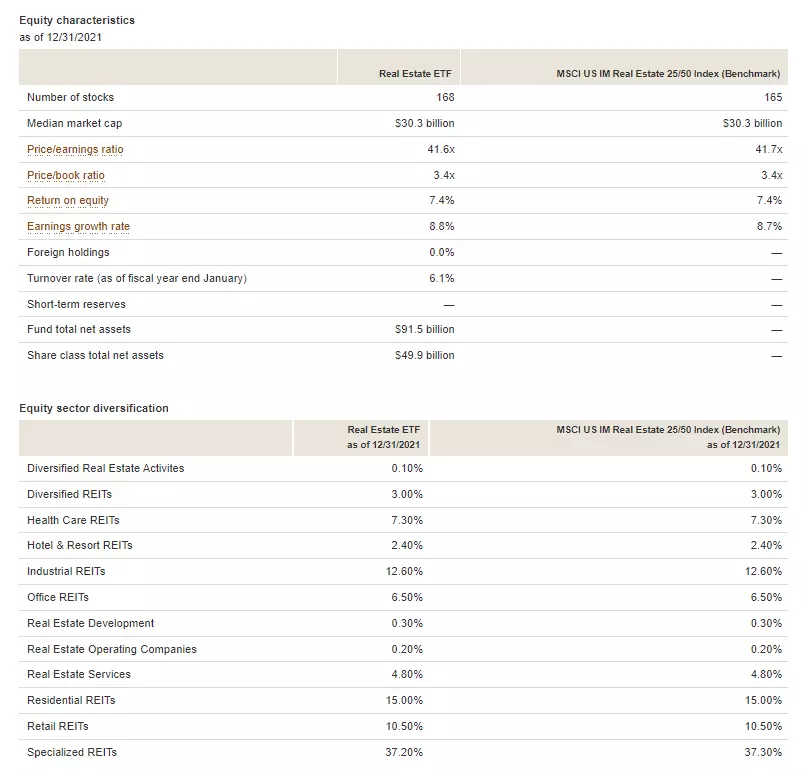

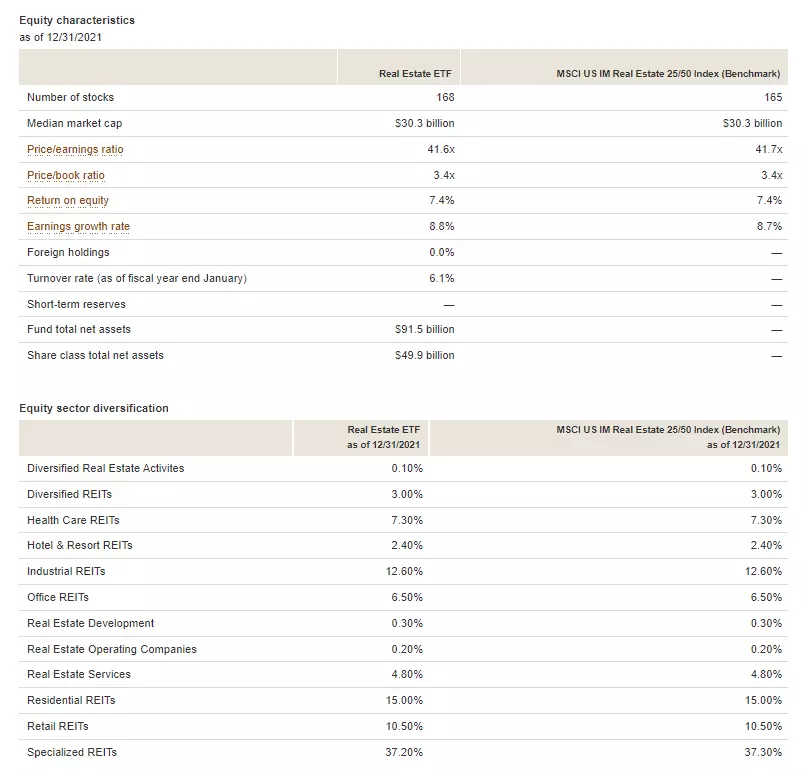

VNQ tracks the MSCI US Investable Market Real Estate 20/50 Index, which covers a wide range of real estate assets beyond just REITs. With 165 constituents, this REIT ETF provides investors with exposure to not only residential and commercial properties but also specialized REITs, industrial REITs, and more.

Image: MSCI

Image: MSCI

By investing in VNQ, investors can tap into a diverse portfolio of high-quality real estate assets across the United States.

Three Reasons to Choose VNQ

Reason #1: Liquidity

As the largest REIT ETF by assets, VNQ boasts impressive trading volumes and provides ample liquidity for investors. This ensures that investors can easily buy and sell shares without facing significant bid-ask spreads or deviations from net asset value.

Furthermore, VNQ's focus on larger REITs means that liquidity of underlying holdings is not an issue, providing stability and confidence to investors.

Image: Data by YCharts

Image: Data by YCharts

Reason #2: Options

VNQ has established itself as a popular choice among REIT investors, which has resulted in a deep and expansive options chain. This means that investors willing to take on more risk can find a range of options for trading calls or puts, giving them more flexibility and opportunities for speculation.

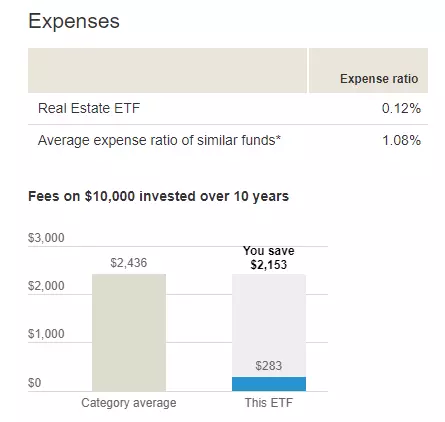

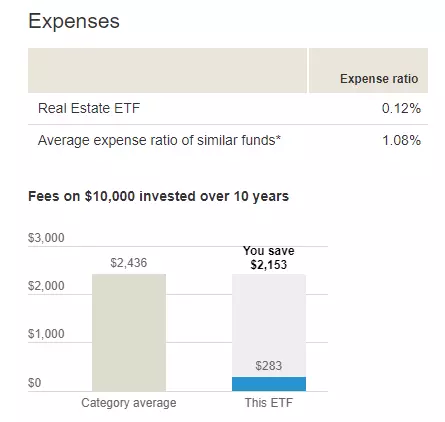

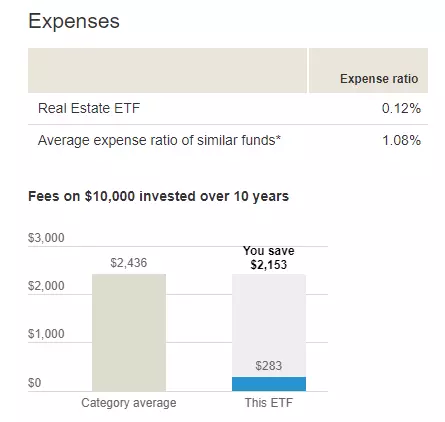

Reason #3: Expense Ratio

Managed by Vanguard, one of the world's largest fund managers, VNQ boasts a highly competitive expense ratio of only 0.12%. This means that investors can access broad exposure to the U.S. real estate market at a low cost, making it an attractive option for long-term investors.

Image: Vanguard

Image: Vanguard

A Compelling Investment Opportunity

With its broad exposure to the U.S. real estate market, VNQ offers investors a well-diversified portfolio of over a hundred different holdings. Additionally, VNQ's yield of 2.91% provides income investors with an attractive option that outpaces the broader equity market.

Image: Data by YCharts

Image: Data by YCharts

Investing in VNQ allows investors to tap into the advantages of professional management, scalability, and legal benefits that traditional real estate investments do not offer. With its strong track record and competitive expense ratio, VNQ stands out as the ultimate choice for REIT ETF investors.

So if you're looking to access the diverse and lucrative world of real estate investing, VNQ is the king of REIT ETFs that you need to consider.