Image source: Saigonintela.vn

Image source: Saigonintela.vn

What is a REIT?

Real Estate Investment Trusts (REITs) are corporations that own and manage real estate properties. They issue units, similar to stock shares, which give investors access to the income generated by the REIT's property portfolio. One key advantage of REITs is that they don't pay taxes. Instead, investors pay taxes on the distributions they receive from the REIT.

REIT in a Nutshell

- REITs allow average investors to participate in the real estate market passively, without the need to buy and manage properties.

- REITs provide developers with an alternative source of funding for real estate projects.

- Institutional investors and mutual funds use REITs as an easy and liquid way to invest in real estate.

- The REIT market is extensive, with over $3 trillion worth of real estate assets.

- There are multiple types of REITs, classified by how they are traded, the type of assets they hold, and the sectors they operate in.

How REITs Work

REITs function similarly to mutual funds but are backed by real estate properties and/or mortgages. These entities assemble portfolios of assets and issue units to long-term investors through public offerings or private placements. They can raise additional capital through secondary offerings and other means. Traders can trade publicly traded REIT units directly on exchanges, while non-traded REIT units are traded through brokers. Private REITs do not trade publicly.

As an example, Innovative Industrial Properties, Inc. (NYSE: IIPR) is a REIT that manages a portfolio of industrial properties leased to medical-use cannabis facilities. It went public on November 28, 2016, and its units trade on the New York Stock Exchange.

REITs vs Real Estate Investing

There are two main strategies for making money from real estate investments. The first is fix-and-flip, where investors purchase distressed properties, renovate them, and sell them for a profit. The second strategy involves long-term income generation through rental properties. REITs offer an alternative way to execute the second strategy, with occasional gains from property sales.

Here's a comparison between publicly-traded REITs and direct real estate investments:

| ATTRIBUTE | PUBLICALLY TRADED REITs | REAL ESTATE |

|---|---|---|

| Liquidity | Highly Liquid. You can sell your units when you want to cash out. | Illiquid. It can take months or years to sell a property. |

| Diversification | REITs provide instant diversification within a real estate sector. | Overexposed to risk from a single property vacancy. |

| Investor Commitment | Relatively small time commitment to select a REIT and monitor its performance. | Large time commitment to lease out and manage properties and collect rents. |

| Minimum Investment | As low as one unit. | Sizeable capital investment, typically 20% to 40% of purchase price. |

| Short-term Gain | Only from REIT unit appreciation. | Available through fix-and-flip projects. |

| Asset Allocation | Easily adjust asset allocation to REITs by trading units. | Limited ability to change asset allocation to real estate in the short run. |

| Shorting | You can short REIT units to take advantage of a downturn in the real estate market. | Not possible with direct real estate investments. |

| Pledging | You can pledge all of your REIT units as collateral for another purchase or a loan. | You can only pledge the equity in your properties, subject to loan agreement terms. |

| IRA | Easy to hold REITs in an IRA. | Requires a self-directed IRA and a property manager as custodian. |

| Control | Your only control is deciding when to buy and sell units. | Complete control over your properties. |

Read more about the differences between REITs and Real Estate Investing here.

Qualifying As a REIT

For a REIT to qualify as a tax-free, pass-through entity, it must meet several criteria, including being structured as a corporation or trust, having a board of trustees or directors, and issuing fully transferable units. Additionally, a REIT must distribute at least 90% of its taxable income to unitholders and invest at least 75% of its assets in real estate. There are specific guidelines regarding income sources, asset allocation, and ownership limits as well.

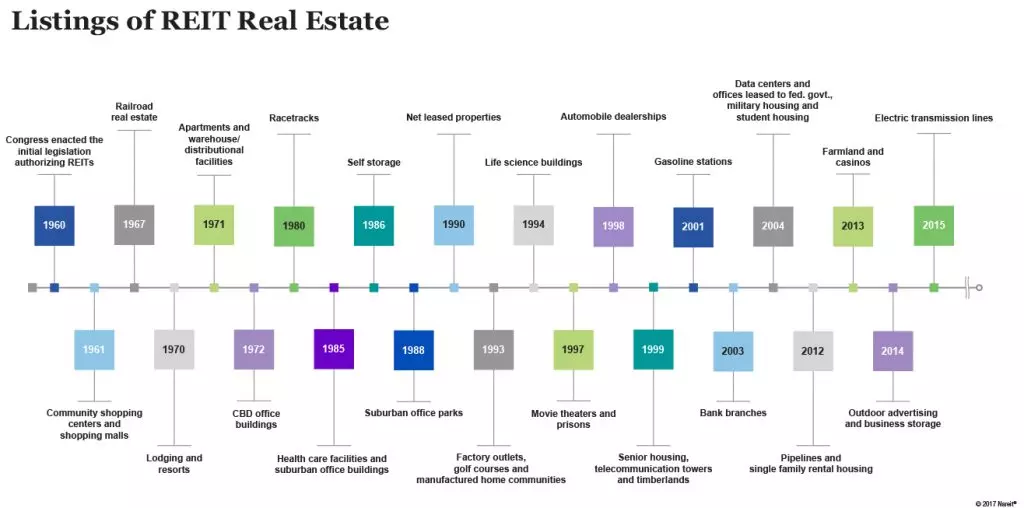

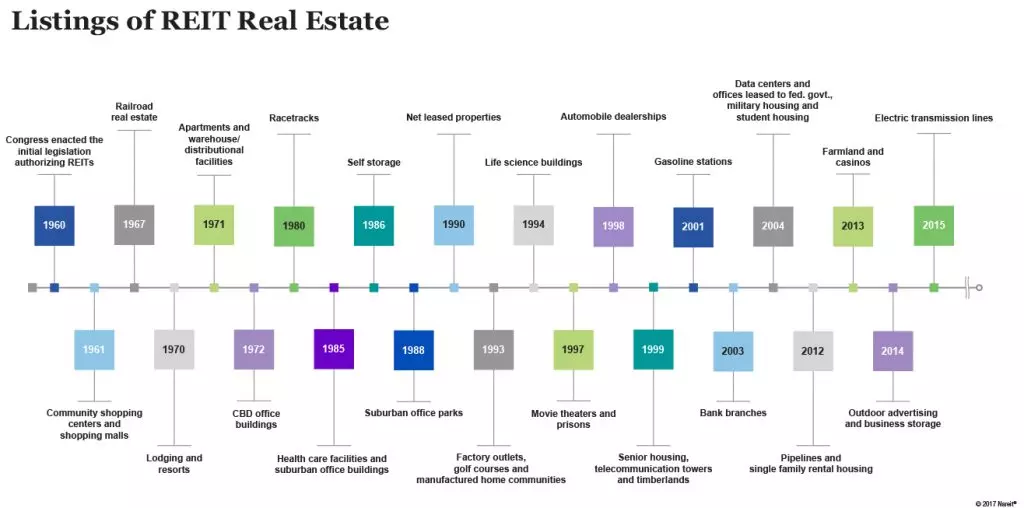

History of REITs

The concept of REITs emerged from the desire of investors to passively invest in diversified income-producing real estate portfolios while avoiding double taxation. The Real Estate Investment Trust Act, signed by President Eisenhower in 1960, allowed investors to trade public units and invest in large portfolios of real estate. Since then, REITs have gained popularity worldwide, with the Nareit FTSE Global Real Estate Index Series encompassing nearly 500 exchange-traded REITs across 35 countries.

Image source: Saigonintela.vn

Image source: Saigonintela.vn

Sources: