Image: imaginima/iStock via Getty Images

Image: imaginima/iStock via Getty Images

This article presents an abridged version of the comprehensive report published on Hoya Capital Income Builder Marketplace on April 5th.

REIT Rankings: Self-Storage

Image: Hoya Capital

Image: Hoya Capital

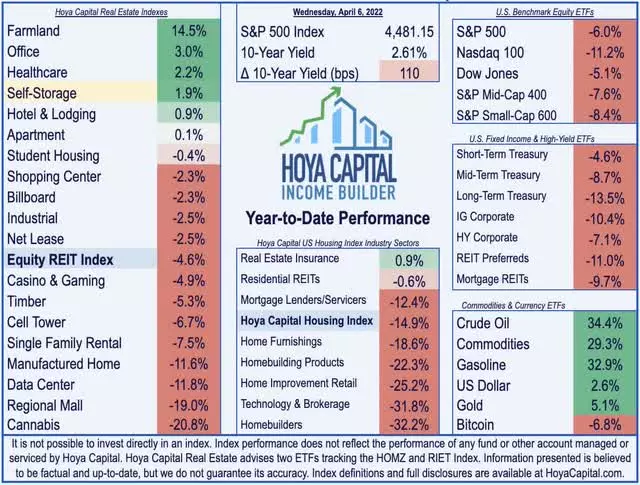

Self-storage REITs have recently experienced a remarkable rebound, outperforming other property sectors during the pandemic and continuing their upward trajectory in early 2022. The Hoya Capital Self-Storage REIT Index tracks the five major players in the self-storage industry, comprising Public Storage (PSA), Extra Space Storage (EXR), CubeSmart (CUBE), Life Storage (LSI), National Storage (NSA), along with micro-cap Global Self Storage (SELF). Together, these REITs hold a staggering $130 billion in market value.

Image: Hoya Capital

Image: Hoya Capital

Surpassing Expectations

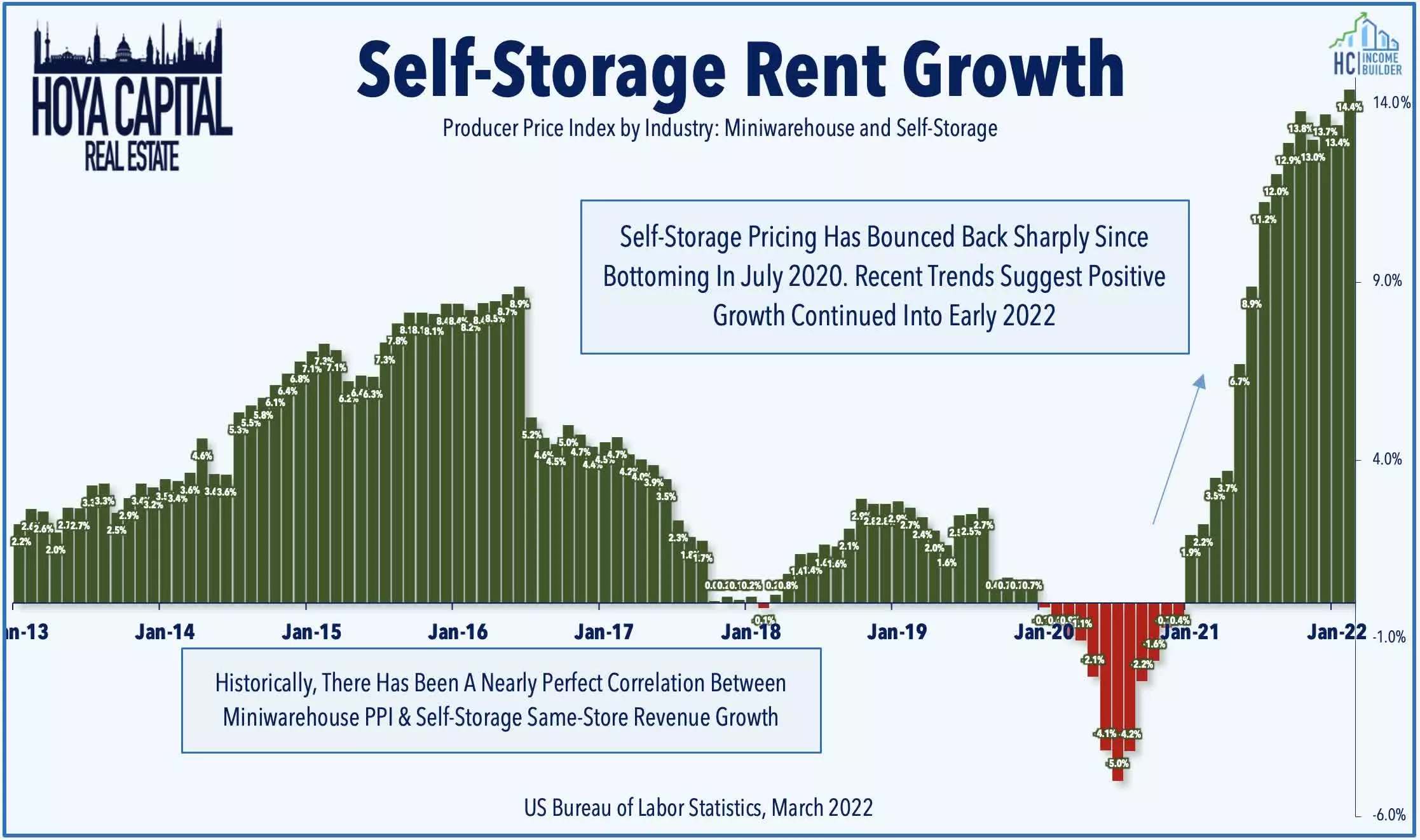

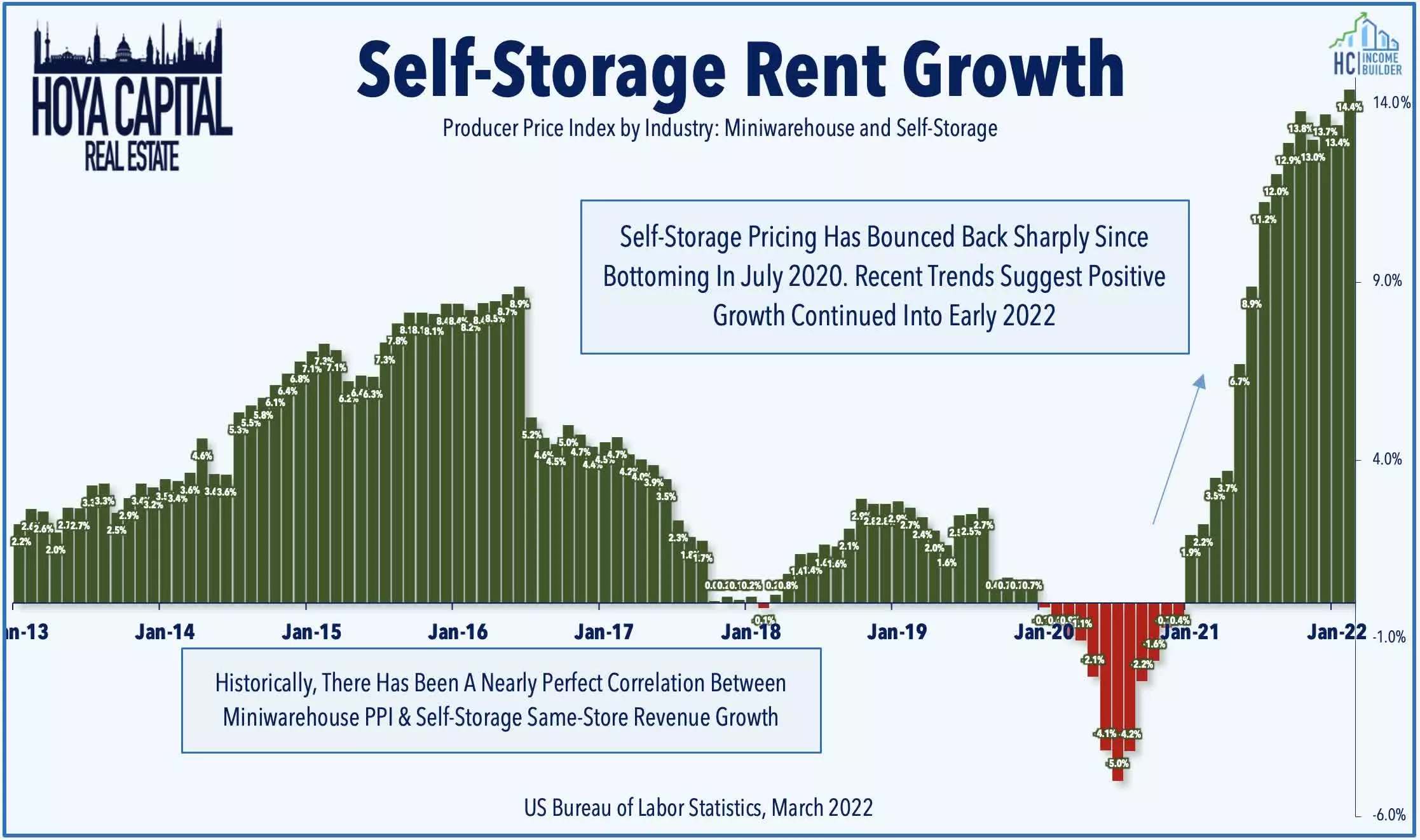

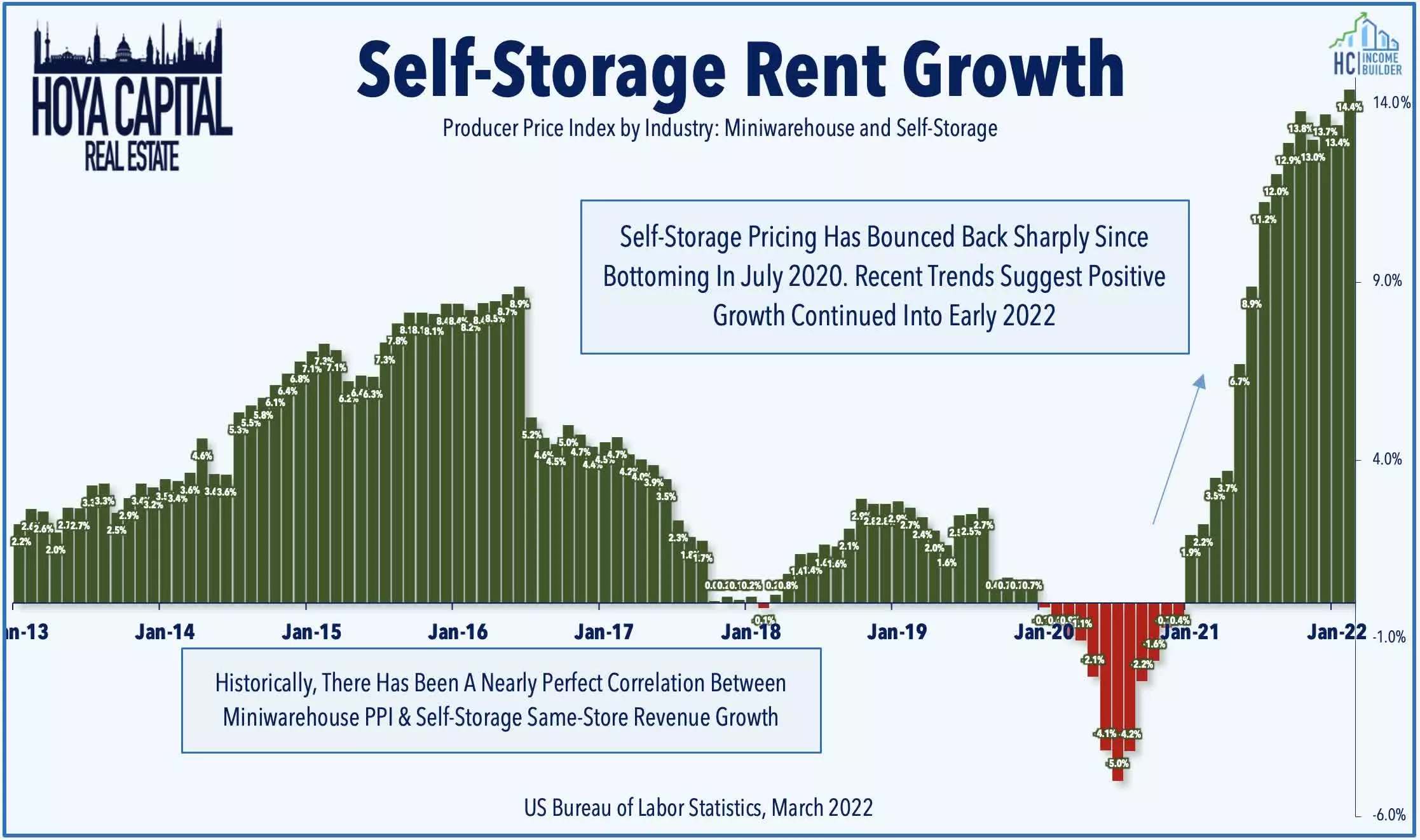

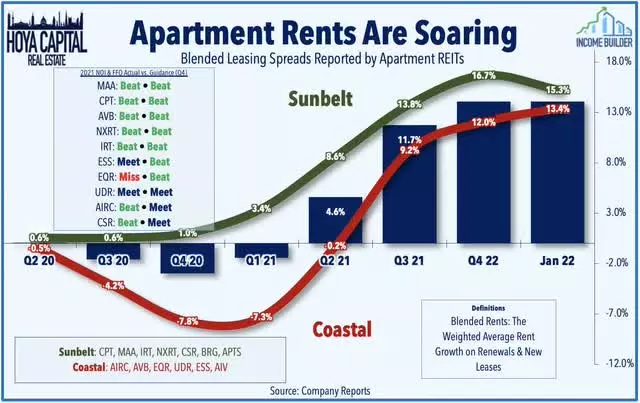

Overcoming initial challenges, self-storage demand skyrocketed during the pandemic, resulting in record occupancy rates and rent hikes. The Producer Price Index for self-storage facilities, which closely correlates with rent growth, demonstrated exceptional growth. The most recent report showed a staggering 14.4% year-over-year increase in self-storage rents in February alone, compared to less than 1% growth before the pandemic.

Image: Hoya Capital

Image: Hoya Capital

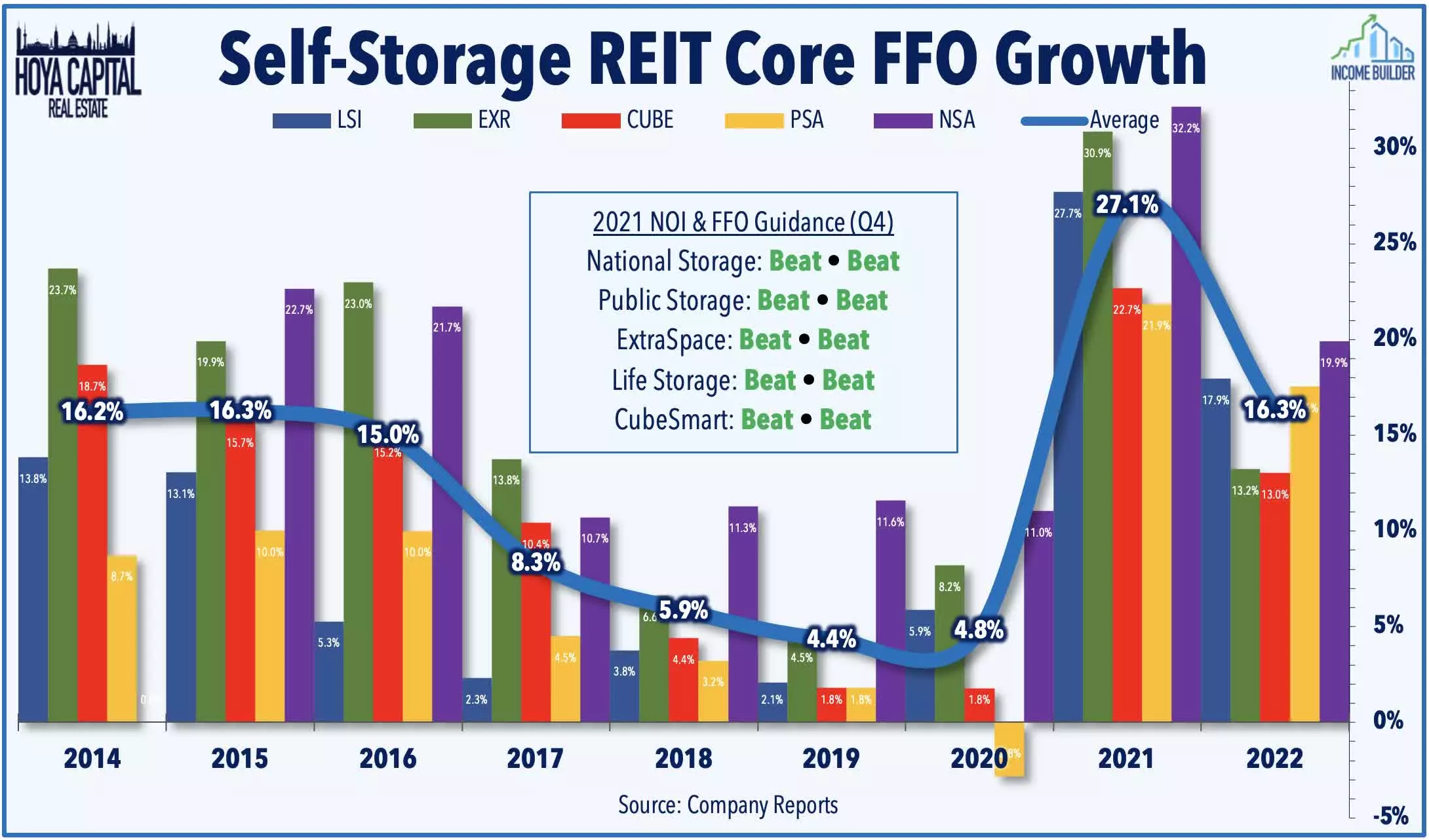

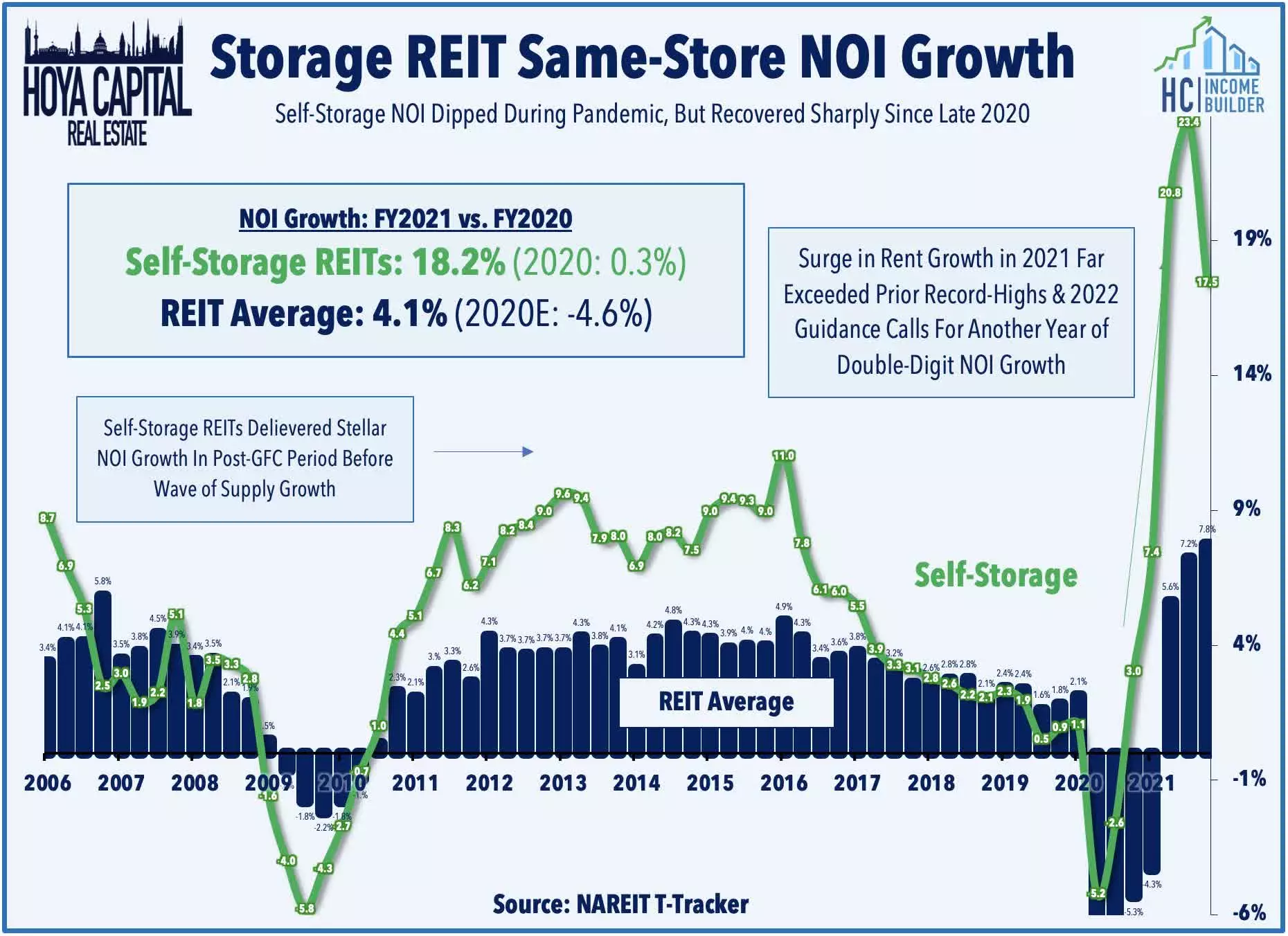

Driven by high occupancy rates, double-digit rent growth, and strategic acquisitions and development projects, storage REITs posted remarkable FFO/share growth of 27.1% in 2021. This far surpassed the previous record of 16.3% in 2015. Furthermore, the outlook for 2022 is equally promising, with storage REITs expecting FFO growth to match the pre-pandemic record of 16.3%.

Image: Hoya Capital

Image: Hoya Capital

A Resilient Rebound

Storage REITs experienced a significant downturn during the early stages of the pandemic, leading many investors and analysts to doubt their future prospects. However, they have defied expectations, sustained their rebound, and consistently outperformed in subsequent quarters. With move-in rental rates surging by approximately 14% year-over-year in Q4, and ending occupancy rates and Net Operating Income Margins at record highs, the outlook remains strong.

Image: Hoya Capital

Image: Hoya Capital

Market Factors and Prospects

Storage demand is closely tied to housing market turnover, including home sales and rental turnover. While the surge in mortgage rates may slow turnover and temper storage demand in the coming months, rising residential rental rates and strong performance in the broader rental markets may offset some of the effects. Additionally, it is worth noting that Google Search traffic for "storage unit" remains higher than last year and significantly higher than in March 2019, indicating sustained interest.

Image: Hoya Capital

Image: Hoya Capital

Stellar Performance

Self-storage REITs have proven to be some of the most resilient players in the real estate sector. In 2021, they were one of just five property sectors in positive territory, achieving returns of 78%, which far outperformed the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the S&P 500 ETF (SPY). Public Storage, CubeSmart, and Extra Space have consistently led the way in terms of performance.

Image: Hoya Capital

Image: Hoya Capital

Strong Fundamentals and Growth

After experiencing soft fundamentals prior to the pandemic, self-storage REITs have emerged as top performers, recording the strongest two-year NOI growth of any property sector. The surge in same-store NOI growth was driven by rising rents, improved occupancy rates, and increased NOI margins. With plenty of acquisition and consolidation opportunities on the horizon, these REITs are set for continued growth and success in the coming years.

Image: Hoya Capital

Image: Hoya Capital

The Self-Storage Advantage

The self-storage business boasts remarkable operating efficiency, commanding some of the highest NOI margins in the real estate sector. These REITs require minimal ongoing capital expenditures while delivering consistently high returns. With strong revenue and expense management technology, brand value, and low costs of capital, they enjoy a competitive advantage over smaller brands and private market competitors.

Image: Hoya Capital

Image: Hoya Capital

Diverse Market Presence and Dividend Yield

Self-storage REITs are well-positioned in both suburban and Sunbelt markets, benefiting from a combination of high rental rates and rising demand. While the average dividend yield for these REITs stands at 2.4%, slightly below the sector average, they consistently pay out around 60% of their available cash flow. CubeSmart, National Storage, and Extra Space have shown impressive dividend growth rates over the past five years.

Image: Hoya Capital

Image: Hoya Capital

The Road Ahead

Although valuations may not be as compelling as in the previous year, storage REITs demonstrate strong balance sheets, low capital expenditure requirements, and significant growth potential. With expectations of a leveling-off in mortgage rates, these REITs remain an attractive long-term investment option.

Image: Hoya Capital

Image: Hoya Capital

For detailed analysis of all real estate sectors, refer to our quarterly reports covering a wide range of topics.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. Long positions listed below are held by Hoya Capital in the Hoya Capital Housing 100 Index and the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.