Published on May 15th, 2023 by Felix Martinez

Real Estate Investment Trusts (REITs) are a popular choice among income investors looking to generate higher income levels from their investment portfolios. These companies own real estate properties and generate a steady income stream by leasing them to tenants or investing in real estate-backed loans.

Unlike traditional corporations, REITs are required by law to distribute 90% of their taxable income to shareholders in the form of dividends. This unique tax advantage allows REITs to avoid paying corporate taxes and pass on a significant portion of their income to investors. With over 200 REITs to choose from, many offer high dividend yields.

However, not all high-yielding stocks are worth investing in. It's crucial for investors to thoroughly assess the fundamentals and ensure that the high yields are sustainable. Some high-yield securities carry a significant risk of a dividend reduction or deteriorating business results.

To help income investors make informed decisions, we have created a list of REITs and companies that own data centers with strong business models and property portfolios. These companies have more sustainable dividends than most REITs and should be considered as a safer option for income investors.

Data Center REIT No. 8: Keppel REIT (KREVF)

- Dividend Yield: 6.8%

Keppel REIT is a real estate investment trust listed on the Singapore Stock Exchange. Managed by Keppel REIT Management Limited, a subsidiary of Keppel Capital Holdings, the company's portfolio comprises a diversified mix of commercial properties, including office spaces, retail spaces, and data centers primarily located in Singapore's central business district. With total assets under management valued at approximately $9.2 billion, Keppel REIT aims to provide stable and growing distributions to its unitholders.

Source: Investor Presentation

Data Center REIT No. 7: DigitalBridge Group, Inc. (DBRG)

- Dividend Yield: 0.3%

DigitalBridge Group, Inc., formerly known as Colony Capital Inc., is a leading global digital infrastructure investment firm headquartered in Boca Raton, Florida. The company has a diverse portfolio of investments that includes digital towers, fiber networks, data centers, small cells, and edge data centers. With the increasing demand for digital services and technologies, DigitalBridge Group is well-positioned to capitalize on the exponential growth of modern communication networks.

Source: Investor Presentation

On May 3rd, 2023, DigitalBridge Group reported its first-quarter results, showcasing a 7.4% increase in total revenue year over year. However, expenses were up by 12.3%, resulting in a net income loss of $(1.34) per share compared to $(1.84) in the previous year.

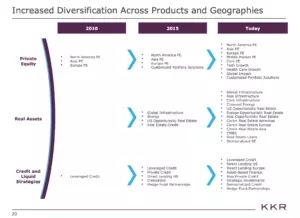

Data Center REIT No. 6: KKR & Co Inc (KKR)

- Dividend Yield: 1.4%

Established in 1976, KKR & Co is a prominent global investment firm operating in four business lines: Private Markets, Public Markets, Capital Markets, and Principal Activities. The company's diverse portfolio spans multiple sectors and geographies, managing assets worth $496 billion. With a workforce of more than 1500 employees across 16 countries, KKR aims to deliver long-term appreciation and generate substantial returns for its investors.

Source: Investor Presentation

On May 8th, 2023, KKR & Co released its first-quarter results, reporting lower-than-expected fee-related earnings due to lower fees generated in the Capital Market segment. However, the company's assets under management increased by 6% year over year to $510 billion, and it raised $12 billion of organic new capital in the quarter.

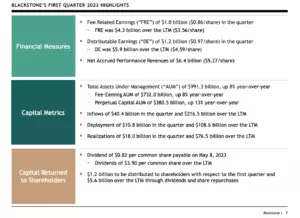

Data Center REIT No. 5: Blackstone Group Inc. (BX)

- Dividend Yield: 4.7%

Blackstone is a major investment firm founded in 1985 and currently led by CEO Stephen Schwarzman. With $991.3 billion in assets under management, the company operates in four main areas: Private Equity, Real Estate, Credit, and Hedge Fund Solutions. Despite the ongoing turmoil in capital markets, Blackstone raised a remarkable $40.4 billion in inflows during the first quarter of 2023.

Source: Investor Presentation

Blackstone reported its Q1-2023 results on April 20th, 2023, revealing lower total net realizations and fee-related earnings compared to the previous year. However, the company's assets under management increased by 8% year over year to $991.3 billion.

Data Center REIT No. 4: Iron Mountain (IRM)

- Dividend Yield: 4.5%

Iron Mountain is a Real Estate Investment Trust (REIT) that provides storage and information management services globally. With a focus on record management, destruction, data protection and recovery, and computer backup services, Iron Mountain operates in North America, Latin America, Europe, and the Asia Pacific area. In its first-quarter earnings report, the company generated revenues of $1.31 billion, a 5% increase from the previous year.

Source: Investor Presentation

Iron Mountain's first-quarter results showcased an increase in normalized funds-from-operations per share and improved margins. The company provided guidance for adjusted FFO-per-share for the current year, projecting solid growth of around 4% relative to 2022.

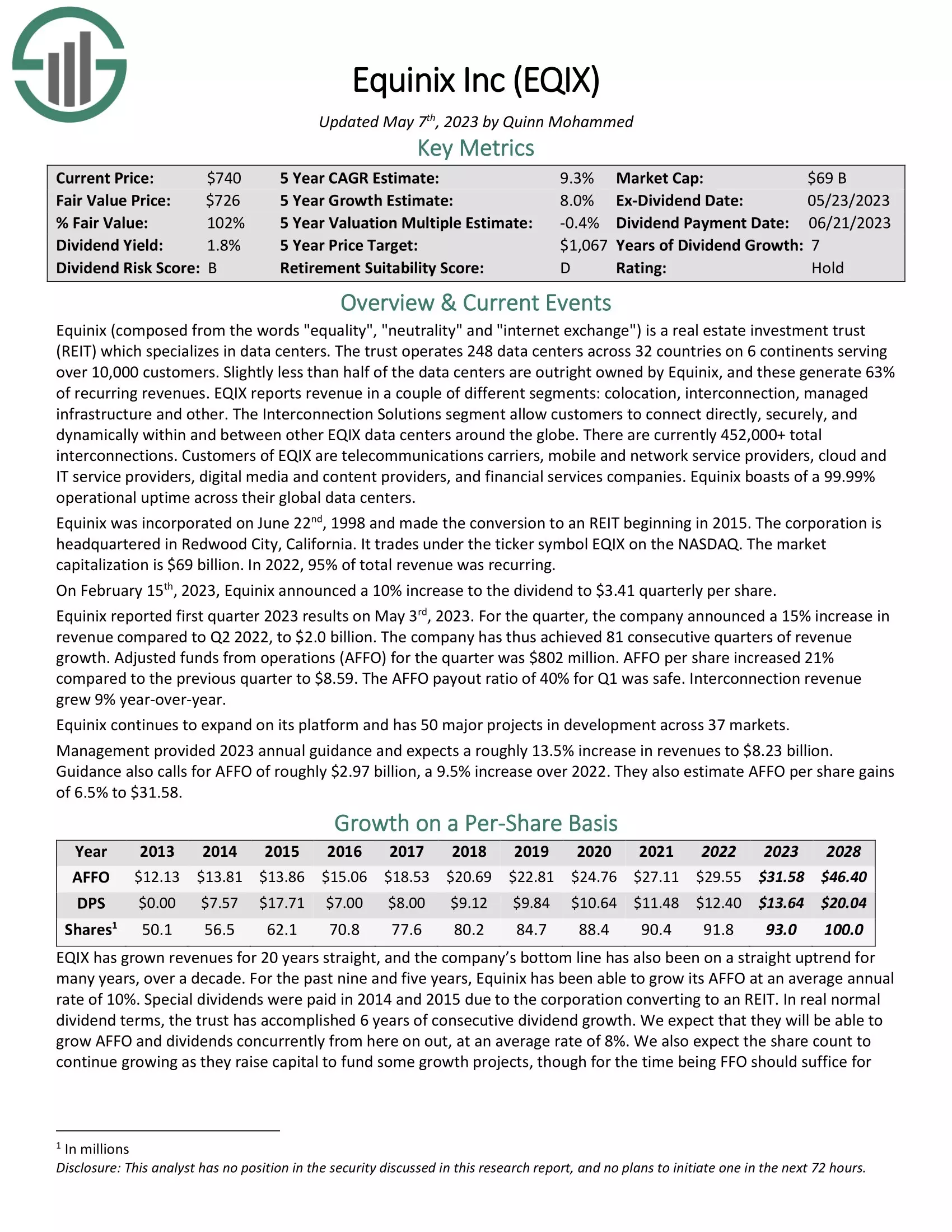

Data Center REIT No. 3: Equinix (EQIX)

- Dividend Yield: 1.9%

Equinix is a global leader in data centers and internet exchange services. The company reported a 15% increase in revenue and a 21% increase in adjusted funds from operations (AFFO) per share compared to the same quarter of the previous year. With over 80 consecutive quarters of revenue growth, Equinix is committed to rewarding its investors and expects a roughly 13.5% increase in revenues for the current year.

Source: Investor Presentation

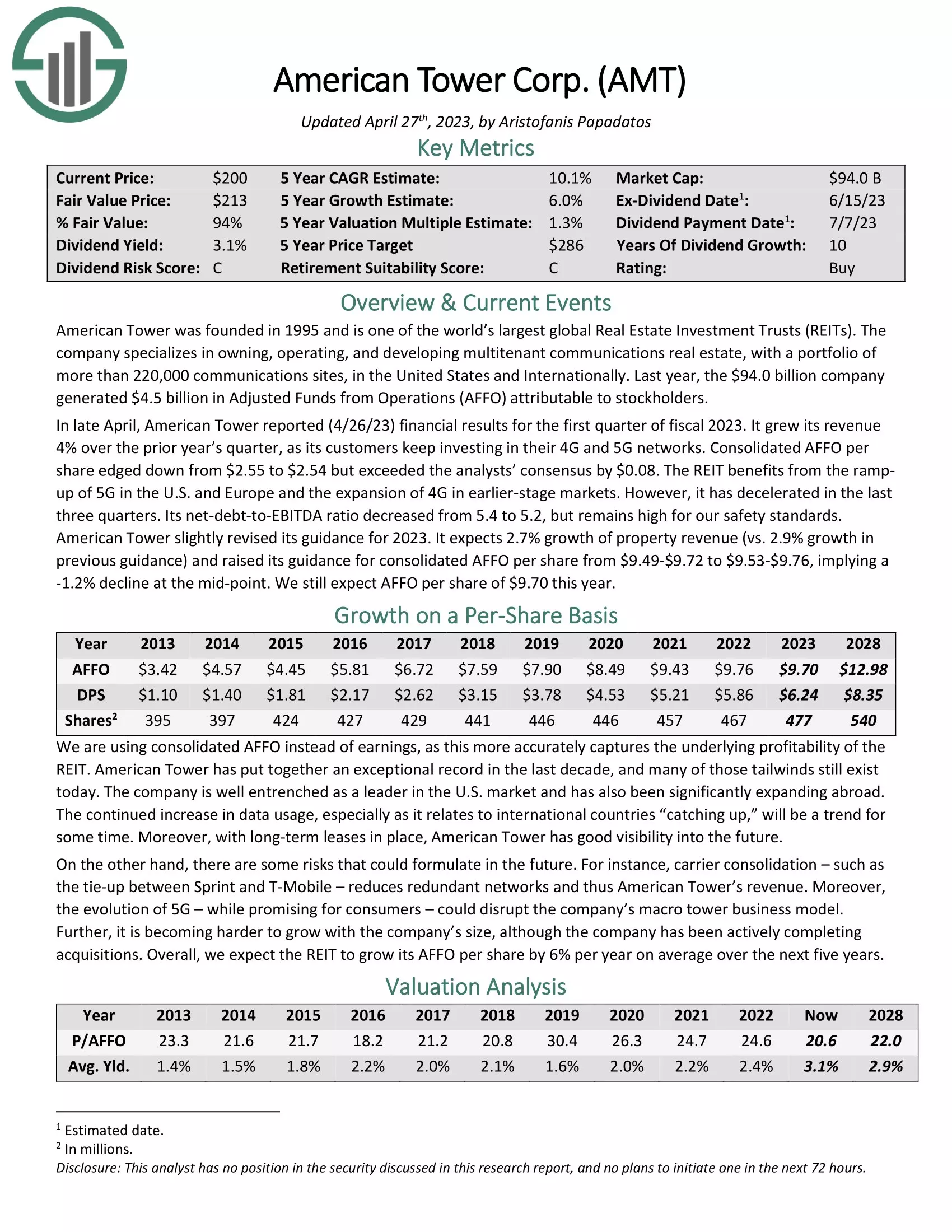

Data Center REIT No. 2: American Tower Corp (AMT)

- Dividend Yield: 3.1%

American Tower is a large Real Estate Investment Trust (REIT) focused on the ownership, operation, and development of communication real estate. With over 220,000 communication sites worldwide, the company generated $4.5 billion in Adjusted Funds from Operations (AFFO) for stockholders in 2022. American Tower reported a 4% increase in revenue for the first quarter, driven by its customers' continued investments in 4G and 5G networks.

Source: Investor Presentation

Data Center REIT No. 1: Digital Realty Trust (DLR)

- Dividend Yield: 5.0%

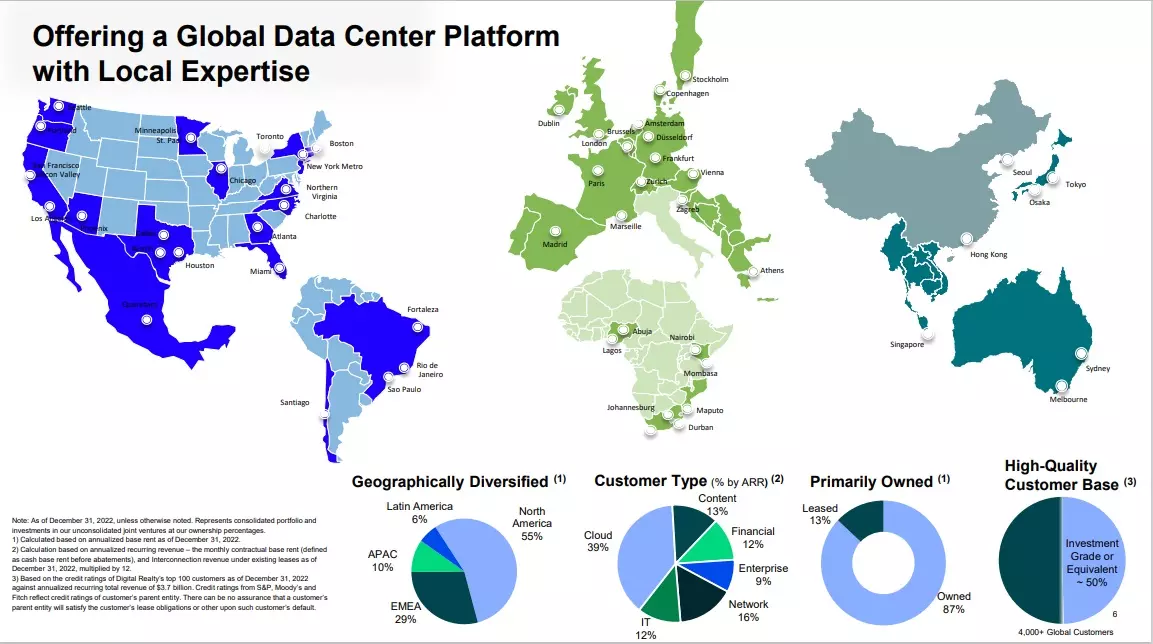

Digital Realty Trust is a REIT that specializes in buying and developing properties for technological uses. Operating over 300 facilities in 28 countries, the company offers exposure to the technology sector. With a consistent track record of increasing its dividend for 17 consecutive years, Digital Realty Trust reported a 3% increase in revenue for the fourth quarter of 2022 and provided optimistic guidance for 2023.

Source: Investor Presentation

Final Thoughts

While REITs offer attractive dividend yields, it's important for income investors to choose safe options that can sustain their dividend payments even during economic downturns. The eight REITs listed above have reasonable debt levels, ample cash flow, and high yields, making them appealing choices for income investors.

If you're interested in finding high-quality dividend growth stocks and other high-yield securities, Sure Dividend offers various resources that can assist you in your investment journey. From high-yield individual security research to comprehensive lists of dividend kings, aristocrats, and achievers, Sure Dividend provides valuable insights for income-seeking investors.

Remember, thorough research and due diligence are essential when making investment decisions. Choose wisely and enjoy the benefits of steady income from your investment portfolio.