Photo by airdone

Photo by airdone

Are you on the lookout for the best closed-end funds in the real estate market? Look no further! The Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) is your ultimate choice. With a portfolio combining REIT equity and preferred stock, RNP has consistently outperformed its benchmark and broader REIT indices. Let's dive in and explore why RNP stands out among its competitors.

The Exceptional Manager

Image source: Annual Report

Image source: Annual Report

Cohen & Steers (CNS), a New York-based asset management firm, is renowned for its expertise in publicly traded real estate and infrastructure investments. With over $75 billion in assets under management, CNS has gained a stellar reputation by delivering strong and consistent performance. The company's expansion into private real estate showcases their commitment to remaining at the forefront of the industry. When it comes to managing closed-end funds, CNS has proven itself as a leader.

The Impressive Portfolio

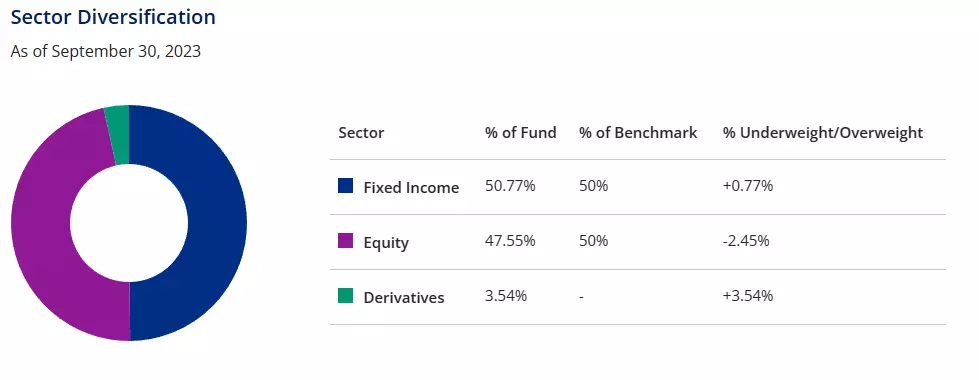

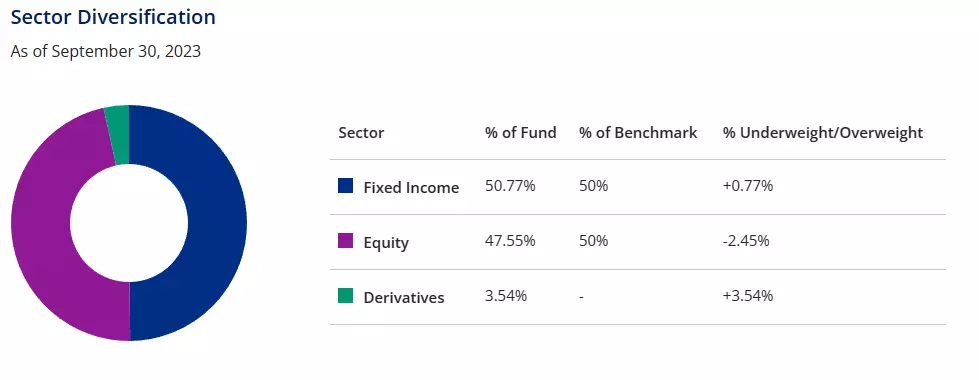

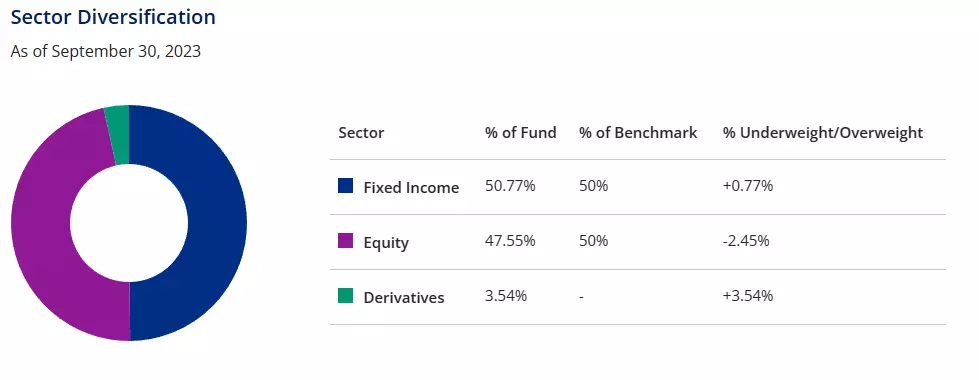

Image source: CNS

Image source: CNS

RNP's portfolio boasts a combination of REIT equity and preferred stock, with minimal allocations elsewhere. The fund also utilizes derivatives such as covered call and cash-secured put options, providing additional opportunities for growth. The portfolio comprises industry giants like American Tower Corporation, Prologis, Welltower, Invitation Homes, and Simon Property Group. These industry leaders represent 19.2% of RNP's portfolio, offering investors a diversified and stable mix of real assets.

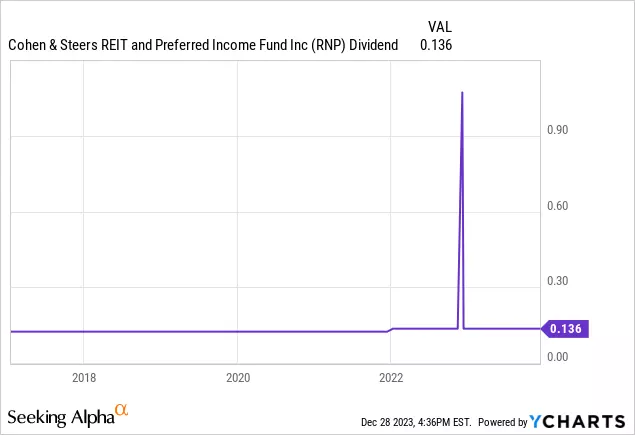

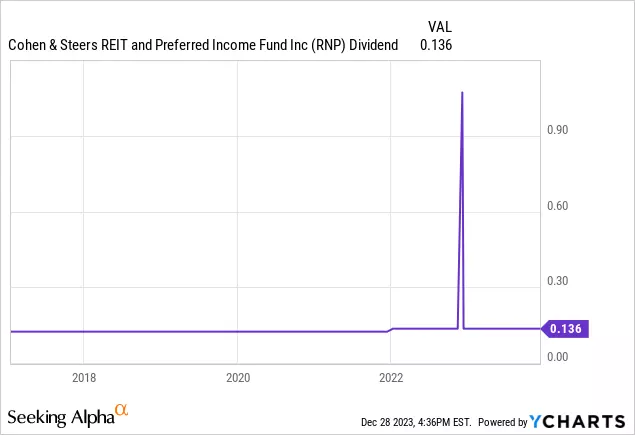

The Reliable Monthly Dividend

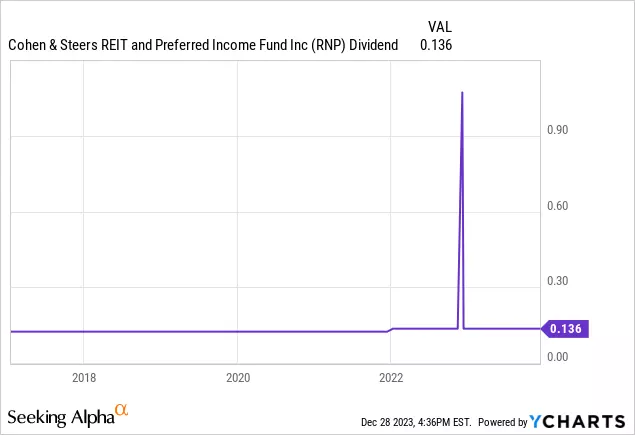

Image source: Data by YCharts

Image source: Data by YCharts

One of the biggest attractions of closed-end funds is the yield they provide. RNP excels in this area by offering investors an equal monthly dividend, supplemented by an annual distribution. For over a decade, RNP has consistently maintained or increased its monthly distribution, making it an excellent source of predictable income. Compared to traditional real estate investments, RNP eliminates management responsibilities and capital expense liabilities, providing investors with hassle-free returns.

The Bright Outlook

Image source: NAREIT

Image source: NAREIT

While the best opportunity for RNP may have passed, there is still room for growth. The recent shift in interest rate expectations presents a positive economic outlook for RNP's portfolio. Current interest rates offer attractive investment opportunities in REIT equity and preferreds. Additionally, the strong rental market and increasing cash flows to REITs indicate a promising future for RNP investors.

In Conclusion

Image source: Data by YCharts

Image source: Data by YCharts

RNP has gained significant traction in the market, with its share price rising by nearly 30% in the past three months. While the ideal time to purchase might have passed, RNP remains an exceptional choice for investors seeking monthly income. With conservative valuations and a bright outlook, RNP offers a compelling option for those looking to capitalize on the real estate market. Remember, the best time to buy was always yesterday, and the best time to sell is never. Stay invested in RNP and continue accumulating shares for a bright financial future.