As an experienced investor in private real estate deals and funds, I've gained valuable insights over the past seven years. With the recent arrival of distributions, I'd like to share my thoughts and experiences with you. Join me as we explore the seven key takeaways from my journey in private real estate investing.

Investing is a Temporary Expense

When it comes to building wealth, consider treating your investments as expenses. These expenses will provide for you in the future when you no longer wish to work or are unable to. Investing in real estate has allowed me to feel more secure in raising my family, especially during uncertain times.

Take Action on Your Investment Thesis

When I first ventured into private real estate investing, I didn't have all the answers. However, I had developed an investment thesis after evaluating the market in 2016. Taking action based on your beliefs is crucial. Real estate crowdfunding platforms like Fundrise have made it easier for us to invest in properties that align with our investment philosophy.

Image: Private real estate passive income

Image: Private real estate passive income

Give Your Investments Time to Compound

One of the standout benefits of private investments is the potential for compounding over time. Unlike investments that promise immediate rewards, private funds often pay out over a 5-10 year period. The longer you can let your investments compound, the greater your overall returns are likely to be. It's important to remember that real estate investments can have recurring tenant and maintenance issues, so patience is key.

Investing Long-Term Provides Mental Relief

Once you commit capital to a private investment, you can often forget about it for years. Sure, you'll receive periodic statements, but for the most part, it's great to have your capital out of sight and out of mind. This allows you to focus your time and energy on other ventures. Knowing that a team of professionals is looking after your investments also relieves mental burden and helps secure your family's financial future.

To Invest Easier, Think of Your Capital in Separate Buckets

Investing can be intimidating, especially when you have a significant amount of money to reinvest. To make the process smoother, consider mentally allocating your capital into separate buckets. By compartmentalizing your funds based on purpose or investment type, you can make more confident decisions and reduce the perceived burden of reinvestment.

Diversify to Manage Risks

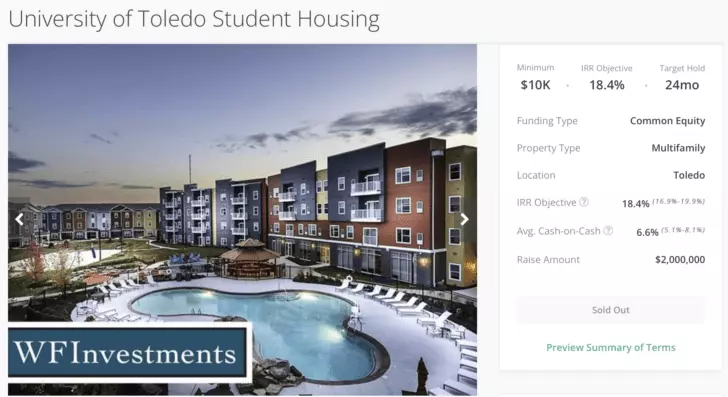

Diversification is a fundamental principle of investing, and private real estate is no exception. While my overall returns have been positive, I have also experienced losses. One of my investments in a student housing complex turned out to be a complete write-off due to unforeseen circumstances. It's essential to thoroughly evaluate sponsors and deals before investing, and diversify your portfolio to mitigate risks.

Image: Failed real estate crowdfunding deal

Image: Failed real estate crowdfunding deal

Live Where You Want, Invest Where the Returns Are Highest

Investing in private real estate syndication deals allows you to invest in locations with the highest potential returns, regardless of where you live. The ability to allocate your money to more profitable areas can be a game-changer. With the rise of remote work and the flexibility of investing online, take advantage of the opportunities and invest strategically based on your financial goals.

Conclusion

Private real estate investing has been a gift that keeps on giving. The surprise of receiving distributions and watching my investments grow has brought financial stability to my life. With real estate playing a significant role in my passive income portfolio, it has allowed me to embark on new and exciting ventures, such as investing for my children's future and exploring other physical assets.

Remember, investing is a long-term journey. Hold on to your investments, diversify wisely, and enjoy the rewards they bring. If you're considering private real estate investing, platforms like Fundrise offer exciting opportunities to explore. Take action, be patient, and let your investments work for you.

Image: Fundrise

Image: Fundrise

To learn more about personal finance and gain valuable insights, join the Financial Samurai newsletter with over 65,000 subscribers. Financial Samurai is one of the leading independent personal finance sites, providing valuable content since 2009.