Introduction

Have you ever wondered about the value of owning an undeveloped lot in a residential subdivision? Just like a tree that doesn't reach the clouds, the value of vacant lots doesn't rise indefinitely. As a property owner, you face the challenge of deciding how long to hold onto this type of investment. In this article, we will explore the factors that can impact the value of undeveloped lots in subdivisions and provide insights for owners to consider.

Image source: Saigonintela.vn

Image source: Saigonintela.vn

The Risk of Being Priced Out of the Market

Real estate professionals understand that vacant subdivision lots can eventually be "priced out of the market." The main factor that contributes to this situation is time. The longer it takes for a subdivision to be fully built, the higher the chance that vacant lots will reach a limit on their value or even decline. Lenders who finance developers also evaluate how long it will take to complete a subdivision because they are aware of this risk.

This is a significant question in the Lakes Region of New Hampshire, where some subdivisions started 20-35 years ago. These subdivisions offer amenities for second home owners, such as beach rights or scenic views, combined with basic sites suitable for seasonal and year-round homes. Despite increasing interest in buildable land, these subdivisions have vacant lots that may soon reach their value limits.

The Example: Understanding the Pricing Out of Vacant Lots

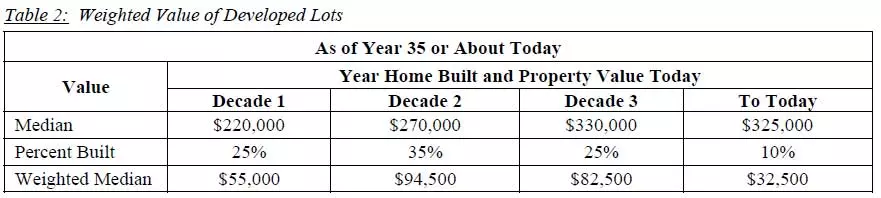

To illustrate how vacant lots can be priced out of the market, let's consider a hypothetical case of a subdivision began in the late 1960s that has experienced slow growth. The table below shows the median prices of lots in each decade, the extent of building in each period, and the median cost of homes built in each decade.

Image source: Saigonintela.vn

Image source: Saigonintela.vn

As we can see, property values did not consistently increase over this 35-year period. The example includes periods of high demand for real estate, followed by periods of soft demand. During the high-demand periods, land was assumed to appreciate, while homes were assumed to retain their value. In the other periods, vacant land was assumed to appreciate at 10% per year, and homes at 7%.

Considering the current decade, the price of vacant land is now over $80,000, and the median land price is expected to be $65,000. Additionally, the median value of developed property in the subdivision, taking into account appreciation and the proportion of development in each decade, is $264,500.

The Risk of Overpricing and Home Value Mismatch

At some point, potential buyers may answer "No!" to the question of whether they would put a $400,000 home in a neighborhood with a weighted value of $264,500. This is when vacant lots have been priced out of the market. It is uncommon for buyers to purchase lots to build homes of lesser value in proportion to the land cost. However, in a soft real estate market, lower-priced homes may emerge if lot owners are forced to sell at distressed prices due to financial factors.

Consider Your Alternatives

If you find yourself priced out of the market, building a lesser home may seem like an alternative. However, it's crucial to recognize that regardless of what you originally paid for the lot, when you build on it, you are essentially buying the lot at today's value. Building a lesser home may satisfy your immediate needs, but it can impact overall property values and limit appreciation potential.

If you have held the lot for some time and have experienced a significant capital gain, you may want to explore a tax-deferred exchange under Section 1031 of the Internal Revenue Code. This allows you to roll the gain over tax-free into another property with better appreciation potential rather than trying to build on your current lot. Consult with a tax professional or visit www.apiexchange.com for more information on tax-deferred exchanges.

Risks of Holding Vacant Land

As the value of vacant lots becomes limited, it's essential to consider the risks associated with holding onto them. These risks include higher property taxes, more stringent development rules that can increase building costs, and possible changes in real estate market conditions. It is important to evaluate your specific situation and consider a Comparative Market Analysis tailored to your subdivision to better understand your investment potential.

Exceptional Cases and Conclusion

While the example provided above is a general illustration, there are exceptions to this trend. In cases where vacant land is appreciating rapidly, such as waterfront parcels, redevelopment of existing properties may be justified. However, this is not common in other types of property.

In conclusion, owning an undeveloped lot in a subdivision can present both opportunities and challenges. It's crucial to carefully assess the market conditions, the potential for appreciation, and your long-term plans before deciding to hold onto or sell the property. Consulting with a qualified real estate professional can provide valuable insights and guidance in making informed decisions.

About the Author: Chuck Braxton is a REALTOR® with the Meredith office of Roche Realty Group, Inc. With over 25 years of experience, he applies his business expertise to help owners and buyers navigate real estate in the Lakes Region. For more information and analysis, you can visit his website here.