Image source: Thomas De Wever

Image source: Thomas De Wever

Are you looking for an investment opportunity that offers a strong yield? Look no further than the Hoya Capital High Dividend Yield ETF (NYSEARCA:RIET). This high-yield REIT index ETF provides investors with a fully covered 9.9% yield, with the potential for dividend growth. While it may be a relatively risky investment, it's an excellent choice for those seeking higher returns.

RIET - Basics

- Investment Manager: Hoya Capital

- Underlying Index: Hoya Capital High Dividend Yield Index

- Expense Ratio: 0.50%

- Dividend Yield: 9.92%

- Total Returns 1Y: -23.7%

RIET - Overview

RIET is a REIT index ETF that tracks the Hoya Capital High Dividend Yield Index. This index invests in 100 high-yield REITs, including common and preferred stocks, as well as mREITs. With sub-asset class, sector, and size caps/floors, it ensures diversification. Preferred stocks have weights of 0.33%, while other asset class weights range from 1.2% to 1.5%.

Image source: RIET

Image source: RIET

While RIET's investment methodology may seem complex, it remains a well-diversified portfolio. With 100 securities from various property sectors, concentration is relatively low. The top ten holdings account for only 17.0% of the fund's portfolio.

RIET also includes mREITs in its investment strategy. Although mREITs are considered risky due to their leverage ratios and potential losses, RIET does not seem to overweight them. The fund's industry caps and floors ensure a balanced approach, minimizing the risk associated with specific REIT segments.

RIET - Dividend Analysis

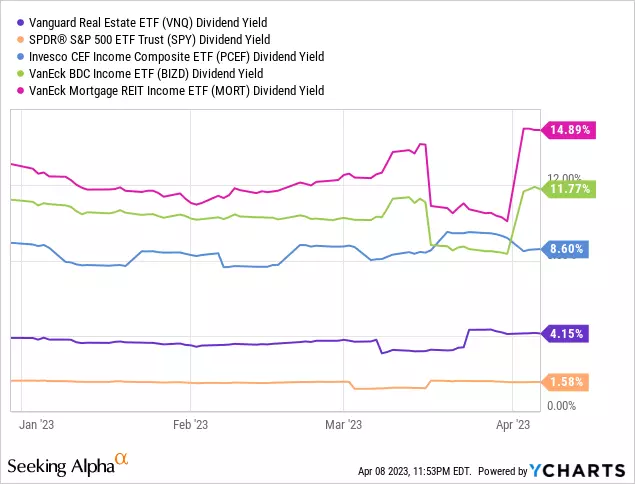

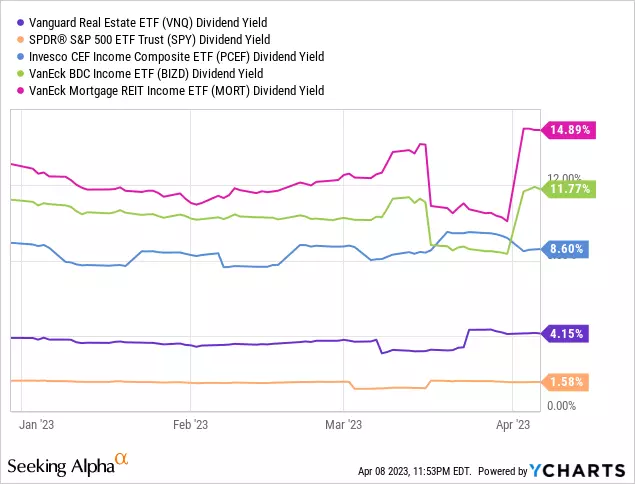

One of RIET's most attractive features is its 9.9% dividend yield, which is higher than that of the average REIT or equity fund. This strong yield is comparable to other high-yielding asset classes such as BDCs, CEFs, and mREITs.

Data by YCharts

Data by YCharts

The dividends RIET provides are fully covered by the underlying generation of income. This is evident from its 10.0% SEC yield, which indicates a fund's actual income, excluding capital gains and other factors. While the track record for dividend growth is relatively short, RIET has shown promising results, with dividends growing by 2.4% this past January.

Overall, RIET's strong, fully covered, and growing 9.9% dividend yield is a compelling reason to consider this fund as part of your investment strategy.

RIET - Quick Cap Rates Analysis

Compared to the Vanguard Real Estate ETF (VNQ), RIET offers a much higher yield. With current real estate yields being low, investors expect lower real estate prices in the coming months. However, RIET's higher yield helps sustain asset prices and minimizes the impact of fluctuating t-bill rates.

Considering RIET's strong 9.9% yield, it remains an attractive investment option, especially in an environment of increasing interest rates.

RIET - Performance Analysis

While RIET's overall performance track-record is below-average, it has shown improvement in recent months. It may have moderately underperformed broader REIT indexes and U.S. equities since its inception, but these short-term results should be interpreted with caution.

Seeking Alpha - Chart by Author

Seeking Alpha - Chart by Author

RIET's underlying holdings, particularly its mREITs, are riskier than average. Therefore, investors should expect above-average losses during downturns, recessions, and bear markets. However, as long as the fundamentals remain strong, such as growing dividends that are fully covered, long-term performance should follow suit.

Although risk and underperformance are concerns, RIET's short-term track record doesn't overshadow its potential for returns. With its focus on income generation, long-term results primarily depend on dividends, which remain strong and continue to grow.

Conclusion

In conclusion, the Hoya Capital High Dividend Yield ETF (RIET) is an appealing high-yield REIT index ETF. With a robust 9.9% dividend yield, RIET presents an attractive investment opportunity for those seeking higher returns.

Investing in RIET allows you to tap into the potential of the real estate market with a diverse portfolio of high-yield REITs. While there are risks involved, the fund's strong dividend coverage and growing track record provide confidence in its potential for long-term performance.

So, if you're looking for an investment that combines a strong yield with growth potential, consider adding RIET to your portfolio.