REIT Rankings: Office

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

Office REIT Sector Overview

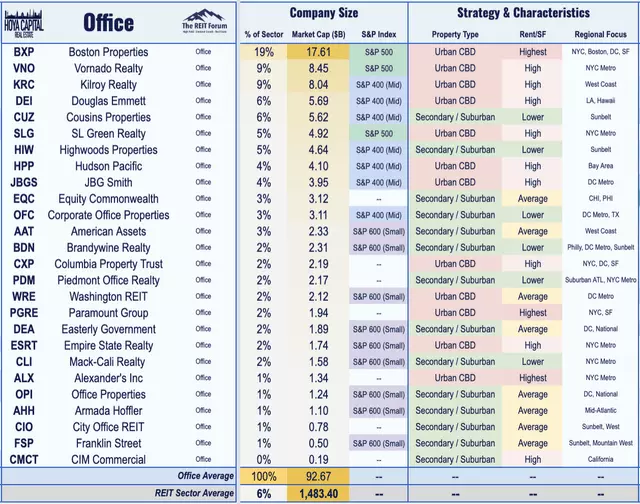

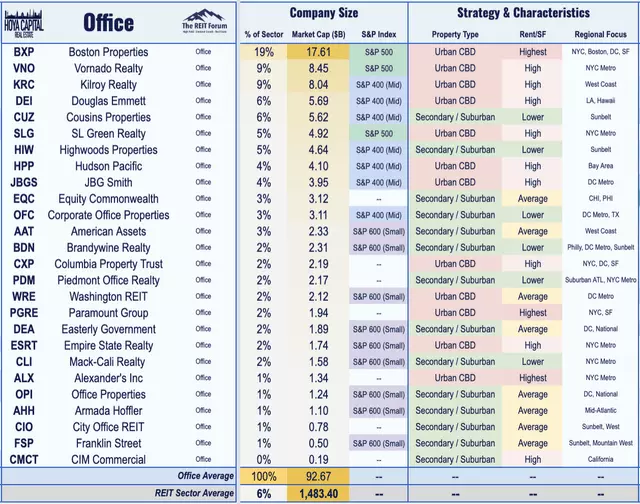

The future of work is here, and it's causing quite a stir. While office landlords are grappling with new challenges, the "new normal" of hybrid work environments also presents fresh opportunities. Office REITs, once trading at a premium, have now become "value plays" in the post-pandemic era. As expectations and valuations have been reset lower, dividend yields have swelled. In the Hoya Capital Office REIT Index, which tracks 26 office REITs, these properties account for roughly $100 billion in market value.

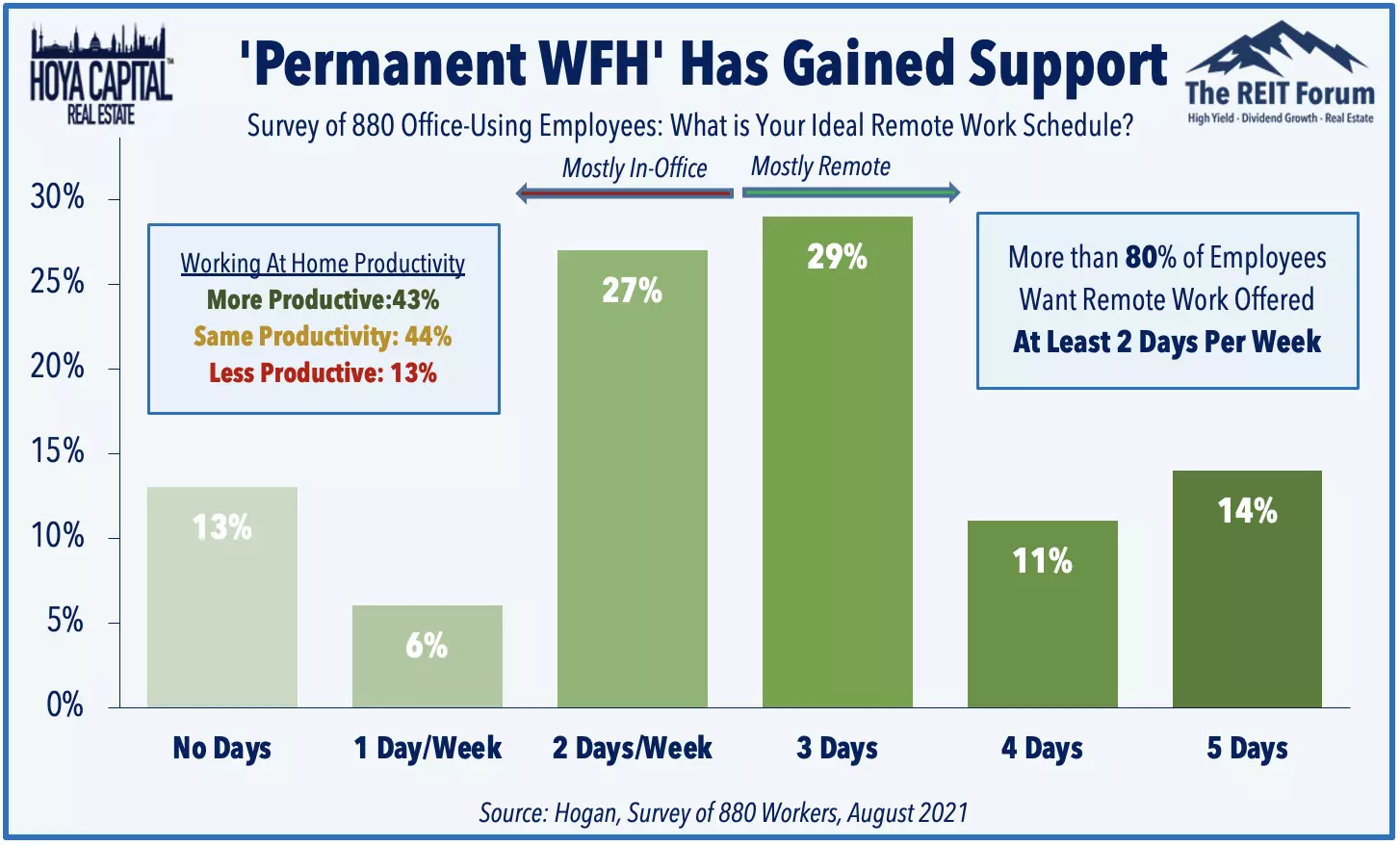

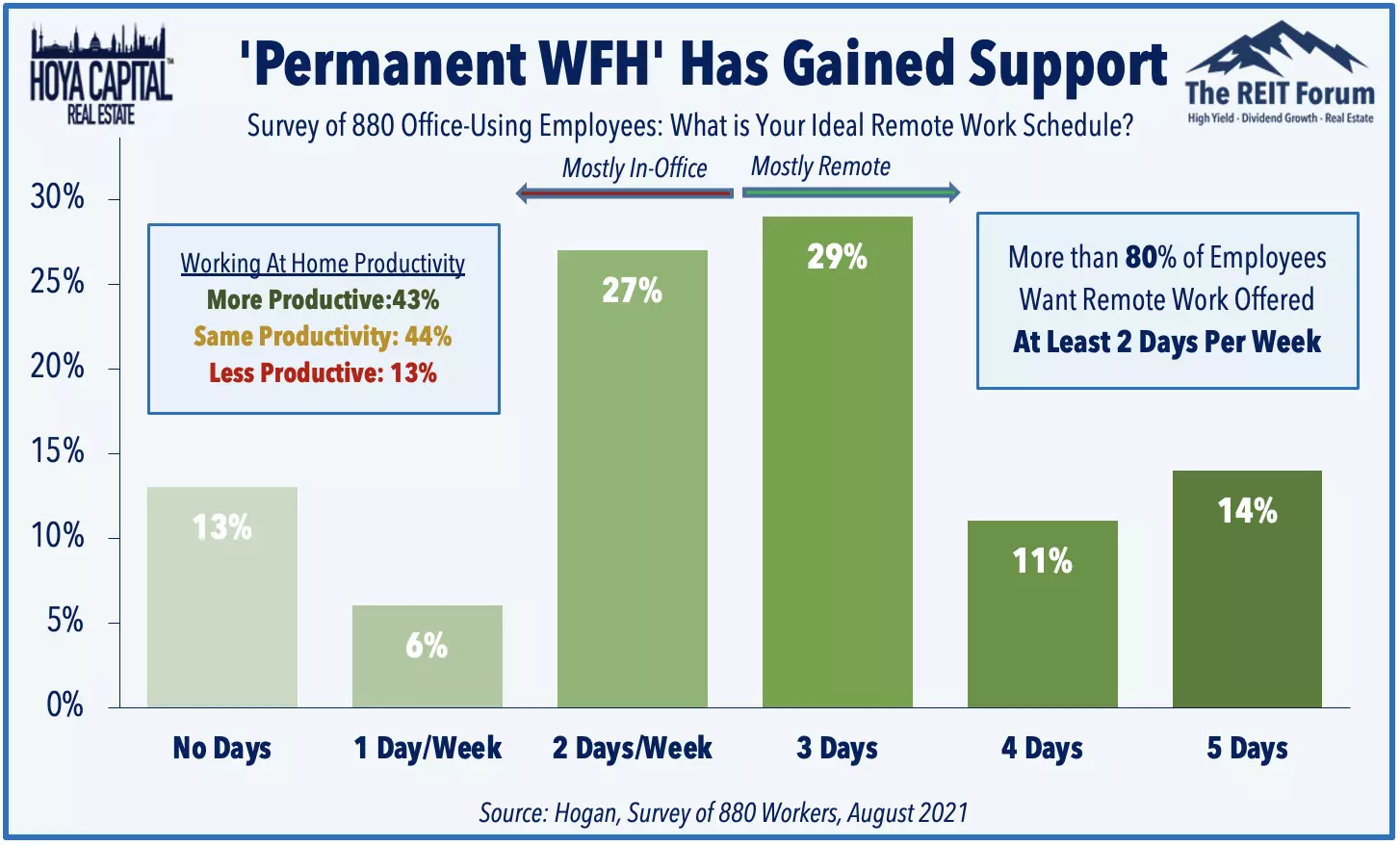

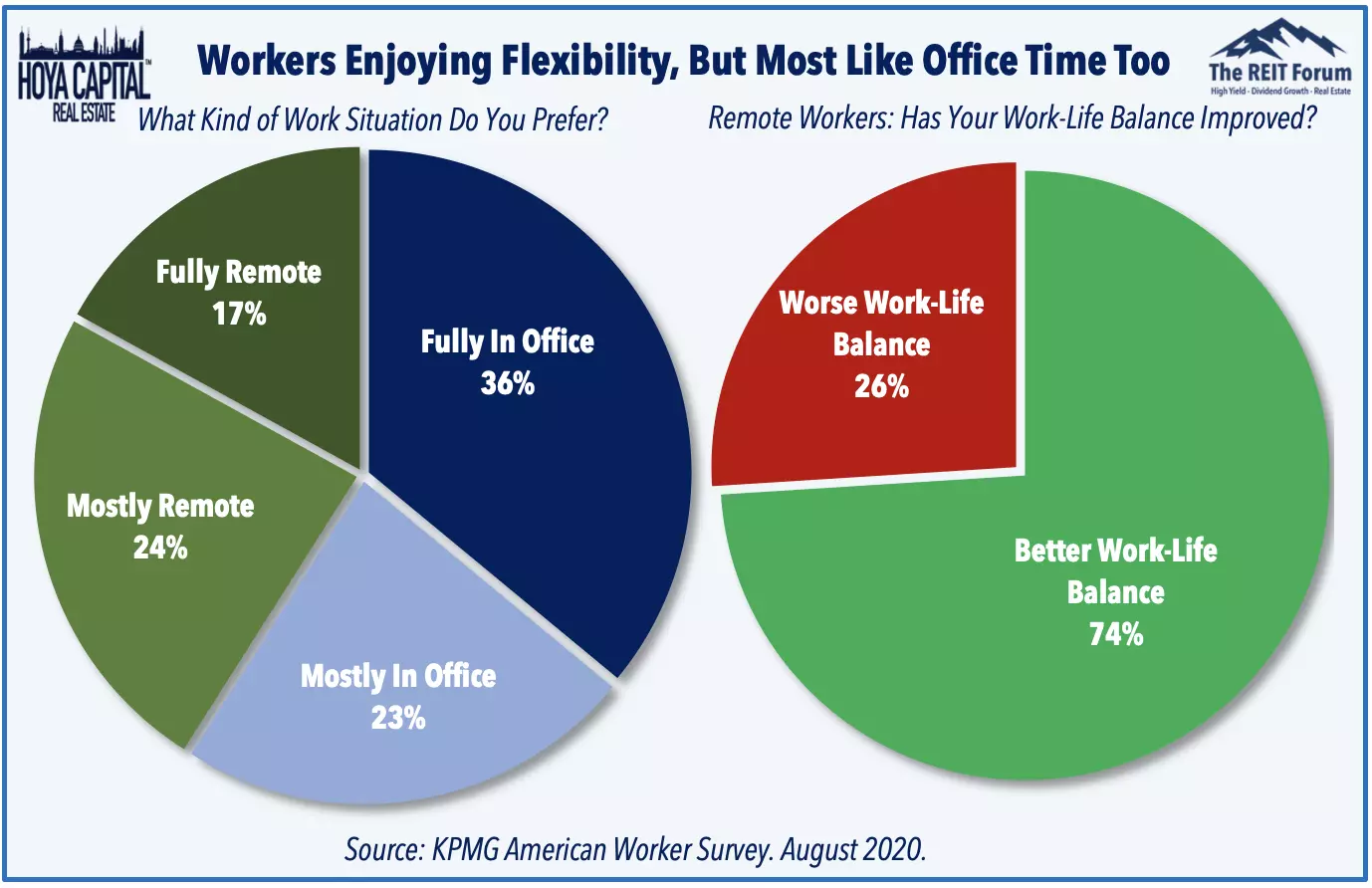

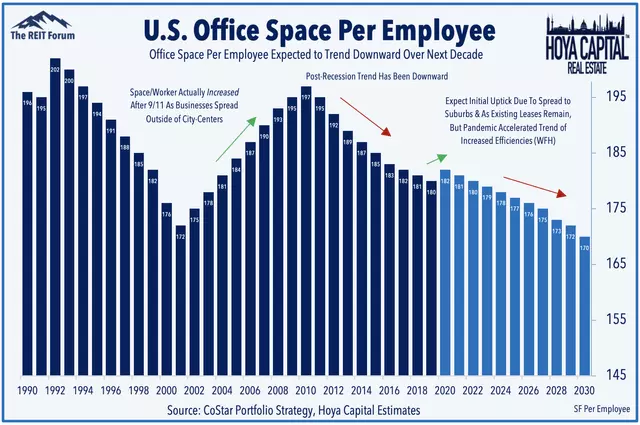

Eighteen months after the start of the pandemic, office utilization rates remain well below pre-COVID levels, particularly in densely populated coastal areas with lengthy commutes. Technology companies like Zoom, Slack, and Google have emerged as unexpected competitors to the traditional office model. The rise of remote work has prompted employees and corporations to embrace this trend, with studies showing that employees are just as productive, if not more, while working from home.

However, while the majority of employees value the flexibility of working remotely, surveys consistently show that a small percentage still prefer the office environment. Collaboration, distractions at home, and difficulty with motivation are cited as the top challenges of working remotely. This highlights the need for a balance between remote work and in-person collaboration.

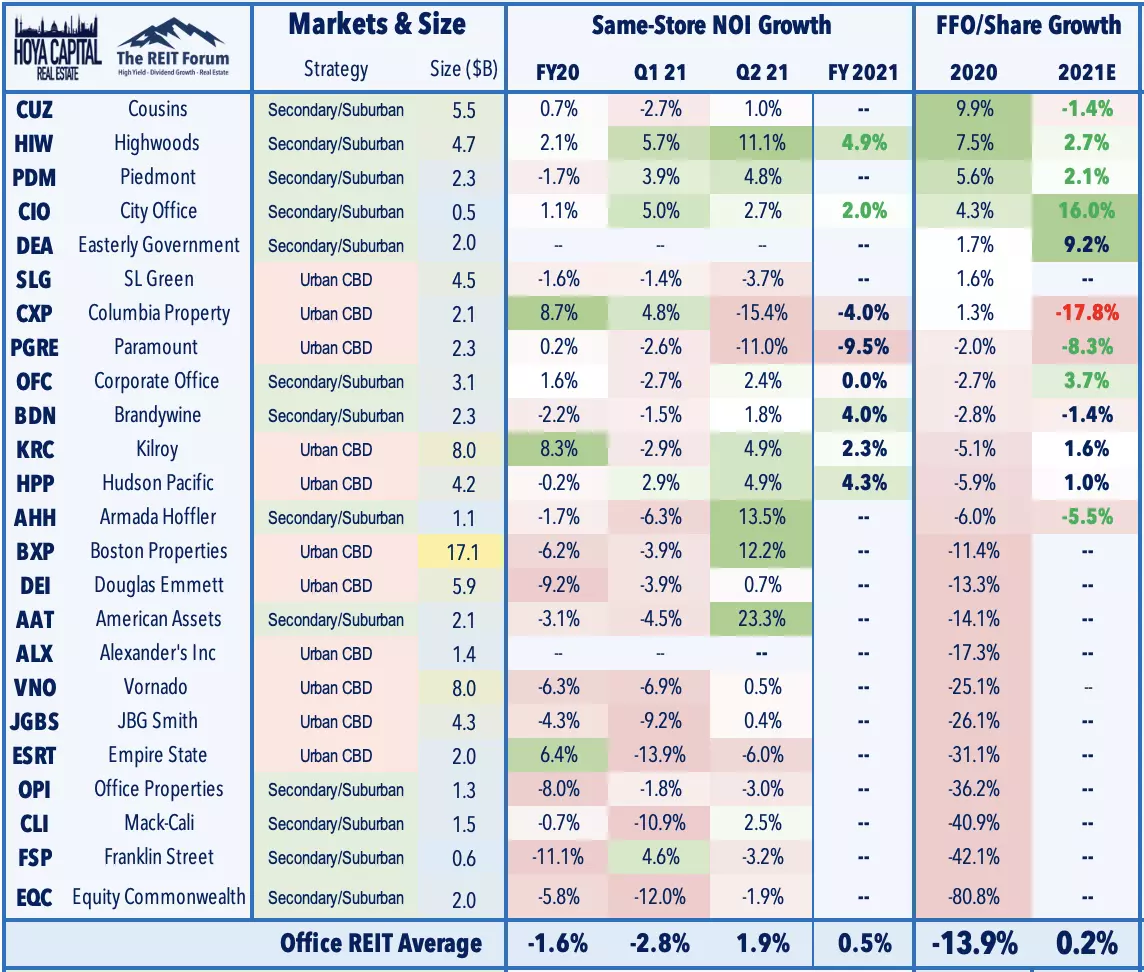

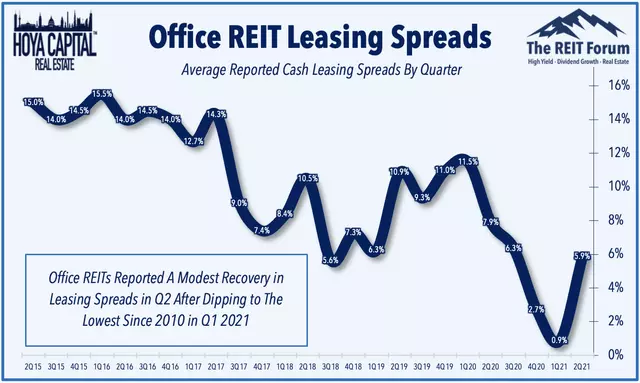

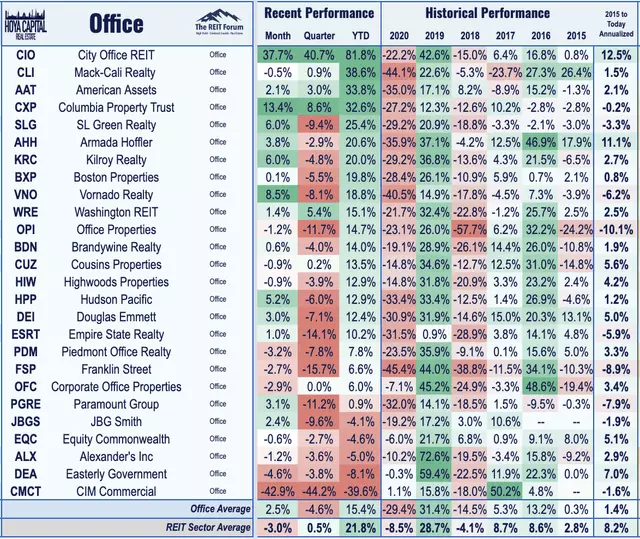

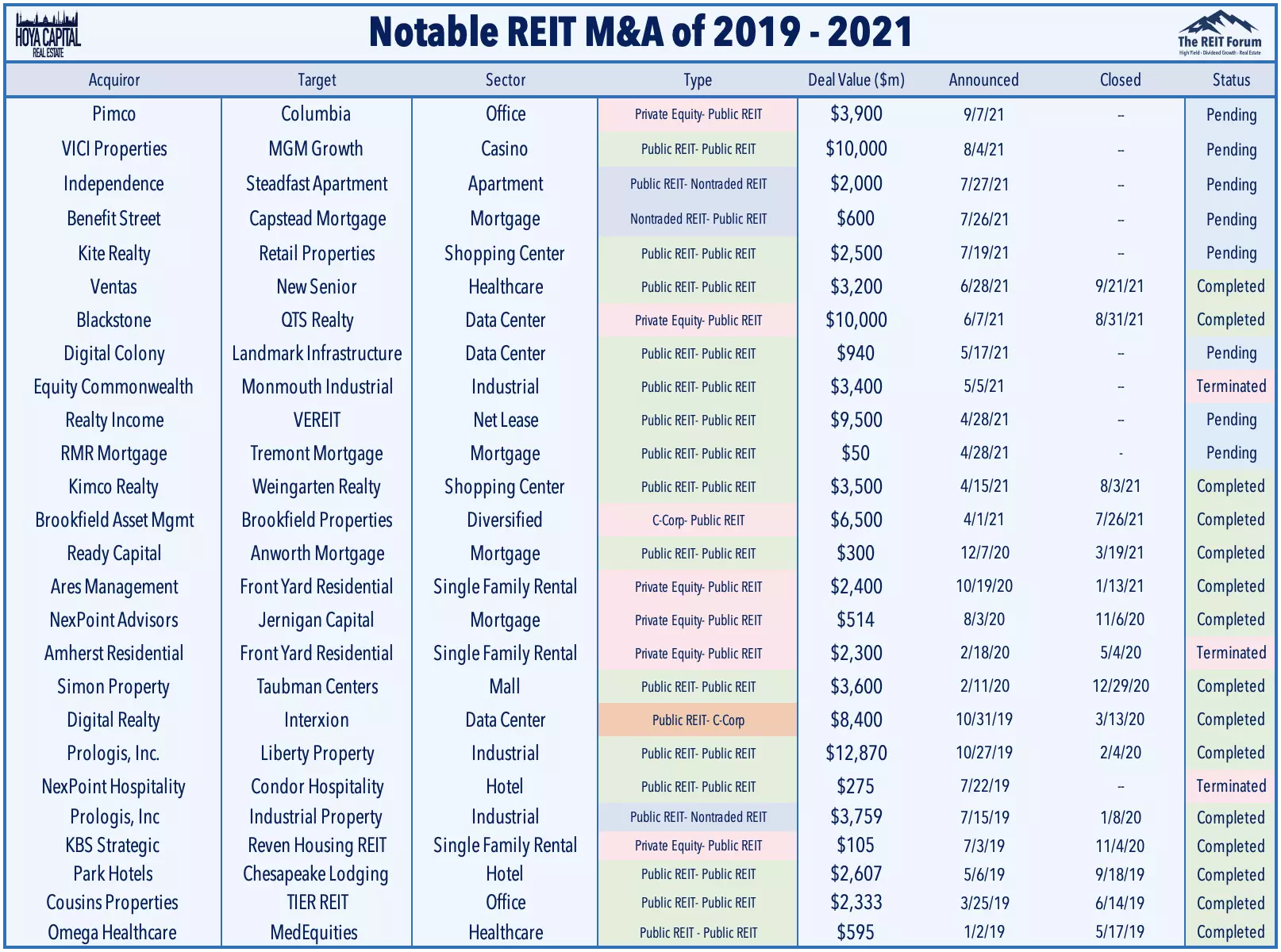

Despite the headwinds, the outlook for office REITs has improved in recent months, especially for those focused on business-friendly Sunbelt regions. Strong earnings results and favorable pricing in the private market have rejuvenated the sector. Demand for life-sciences space and from large technology companies has partly offset soft demand from financial services firms in urban centers.

Jones Lang LaSalle notes that "the U.S. office market is stabilizing and slowly capitalizing on the macroeconomic recovery." Gross leasing activity has seen a positive inflection, signaling a potential turnaround for the industry. This is a positive sign for office REITs, which tend to perform well later in the economic cycle.

While the office sector faces challenges, the housing market stands to benefit as households seek more living space in the new normal. The rise of remote work has prompted employees to consider moving to areas with better quality of life and reduced commute times. This shift has resulted in increased demand for housing outside urban centers.

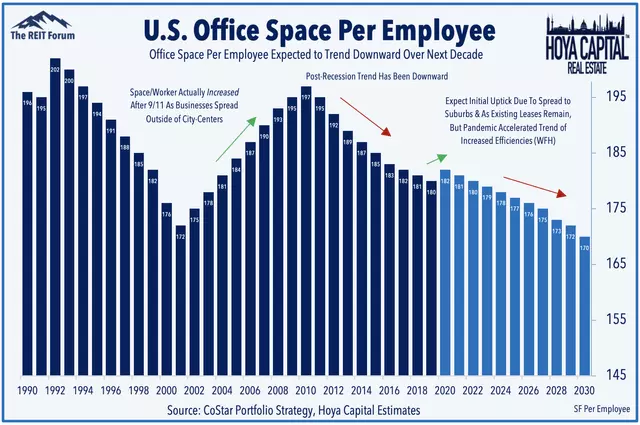

Office REITs Stock Price Performance

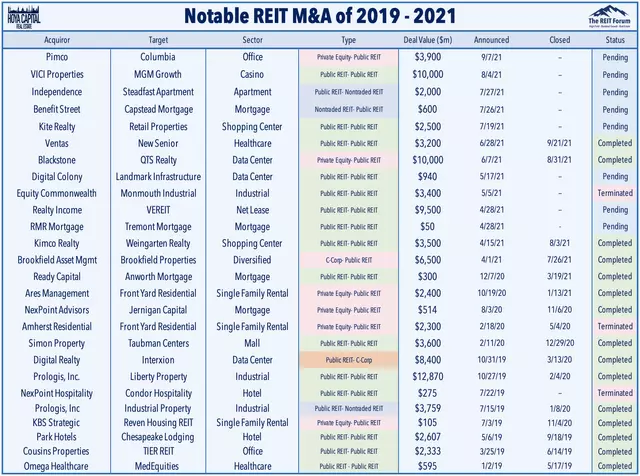

Despite better-than-expected earnings results, office REITs have faced pressure due to the ongoing impact of the pandemic. However, they have still delivered positive returns in 2021, albeit lagging behind the overall market. The sector offers potential for value creation through asset sales and consolidation. Office REITs currently trade at a discount to their private-market-implied Net Asset Value (NAV), signaling an opportunity for investors.

Deeper Dive: Office REIT Fundamentals

The office sector can be divided into two categories: Urban CBD (Central Business District) REITs, which focus on major cities, and Secondary/Suburban REITs, which concentrate on Sunbelt regions and secondary markets. Sunbelt and suburban-focused REITs, as well as those catering to non-corporate tenants, present attractive investment opportunities.

Office ownership is a tough business, requiring significant capital investment and operating margins that may be lower than other sectors. The rise of co-working spaces, exemplified by WeWork, had played a significant role in office leasing activity. However, the struggles faced by co-working companies have affected the sector. Office REITs have a relatively small pool of tenants, and with ample supply in the market, landlords may face challenges in pricing and occupancy.

The office sector relies heavily on long-term leases, making it slower to respond to economic changes. Pandemic-induced remote work arrangements have affected office demand, resulting in declining occupancy rates. The supply dynamic has also played a role, with a record-high office development pipeline before the pandemic and continued construction since. The combination of weak demand and increased supply has put pressure on office REITs.

Despite the challenges, office REITs are trading at a discount to their private-market valuations. The sector offers attractive dividend yields, which have increased due to the post-pandemic pullback. Dividend distributions are sustainable, with office REITs paying out roughly 50% of their available cash flow.

Key Takeaways: Embracing the New Normal

As the world adapts to the new normal, office REITs are facing both challenges and opportunities. The shift to remote work has impacted office utilization rates, particularly in densely populated areas. However, office REITs now offer value and attractive dividend yields. The sector has the potential for consolidation and asset sales, which could create value for investors. While remote work will continue to pose challenges, the outlook for office REITs is improving, especially in business-friendly regions.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.