Investing in real estate has never been easier, thanks to platforms like Fundrise. But did you know there's a whole world of alternative options out there? In this article, we'll explore 11 amazing Fundrise alternatives that offer unique investment opportunities for both accredited and non-accredited investors. So whether you're a seasoned investor or just starting out, there's something for everyone on this list.

What Makes Fundrise Special?

Fundrise has revolutionized real estate investing by offering diversified portfolios and low investment thresholds. With options like the Starter Portfolio and Core Portfolios, investors of all levels can gain access to real estate assets. But let's dive deeper into the alternatives that offer even more exciting opportunities.

1. First National Realty Partners (Grocery-Anchored Commercial Real Estate)

First National Realty Partners (FNRP) is a rapidly growing commercial real estate investment firm that aims to provide everyday investors with access to assets traditionally limited to institutional investors. With a focus on grocery-anchored commercial real estate, FNRP offers exclusive access to investment opportunities that yield cash flow and potential capital appreciation.

2. EquityMultiple

EquityMultiple allows accredited investors to invest in individual commercial real estate projects. With a minimum investment of $5,000, investors can participate in opportunities that offer potential higher returns. This platform is ideal for those who want more control and direct involvement in their real estate investments.

3. YieldStreet

YieldStreet is an alternative investment platform that offers income-generating opportunities across various asset classes, including real estate. With a minimum investment of $2,500, investors can diversify their portfolios and earn passive income. YieldStreet's transparent and collateral-backed investments provide stability and attractive returns.

4. CrowdStreet

CrowdStreet focuses on long-term commercial real estate investments for accredited investors. With a minimum investment of $25,000, investors can participate in high-quality, institutional-grade projects. While this platform requires a higher entry fee, it offers the potential for significant returns in the commercial real estate market.

5. FarmTogether

FarmTogether is a unique platform that allows investors to invest in farmland. With a minimum investment of $10,000, accredited investors can enjoy stable cash flows and potential land appreciation. Investing in farmland provides diversification and opportunities for passive income.

6. AcreTrader

AcreTrader offers a crowdfunding real estate investing platform focused on farmland. With a minimum investment of $10,000, accredited investors can invest in high-quality farmland opportunities. AcreTrader's rigorous underwriting process ensures that investors have access to top-tier farmland investments.

7. Streitwise: Real Estate Investment Trusts (REITs)

Streitwise allows investors to participate in real estate investment trusts (REITs) with a minimum investment of $5,000. With a focus on income-generating assets, Streitwise provides stable cash flow and potential capital appreciation. This platform is ideal for those seeking passive income and long-term investment growth.

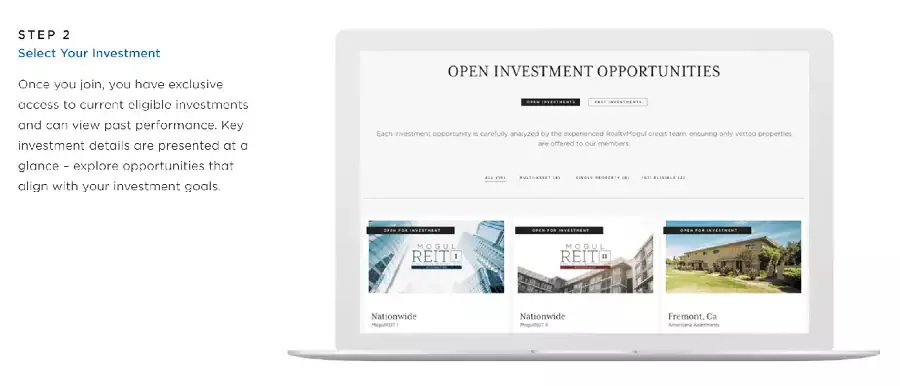

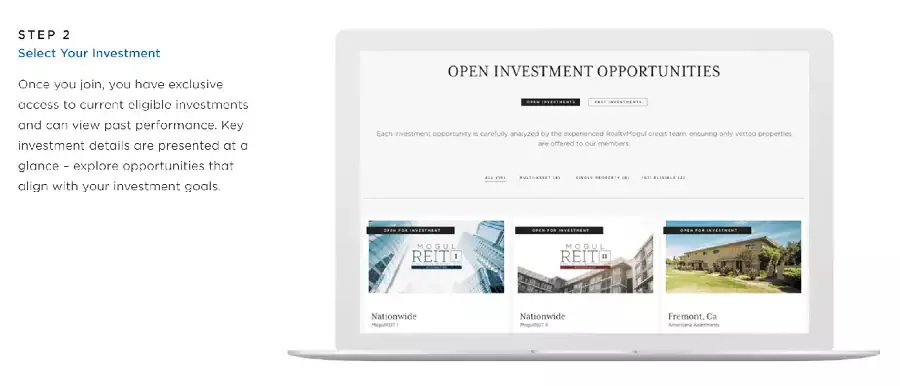

8. RealtyMogul

RealtyMogul offers opportunities for both accredited and non-accredited investors to invest in commercial and residential real estate. With a minimum investment of $5,000, investors can diversify their portfolios and enjoy potential cash flow and appreciation. RealtyMogul's transparent and professionally managed investments provide peace of mind.

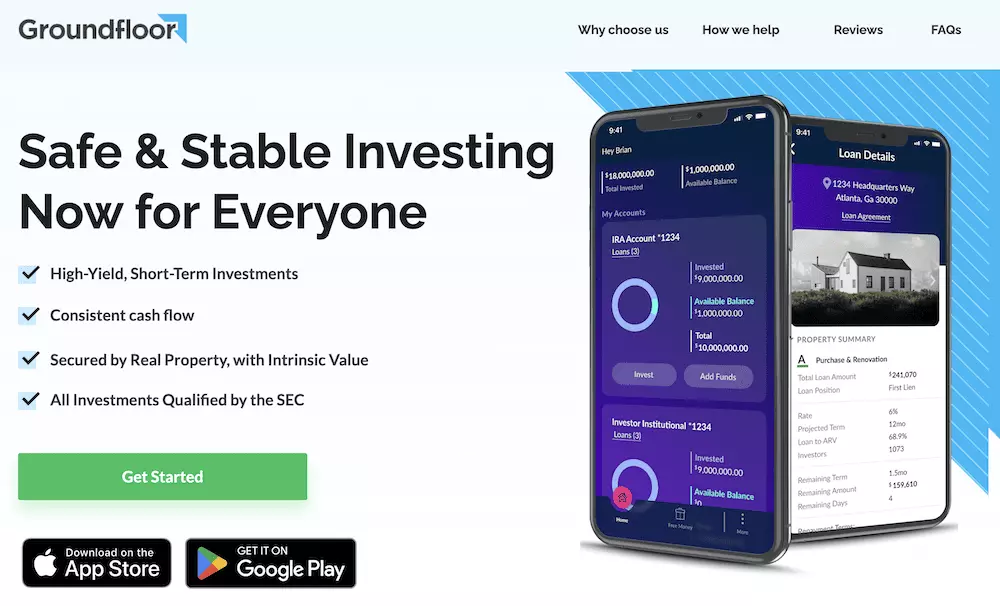

9. Groundfloor: Investing in Fix and Flips

Groundfloor specializes in short-term, high-yield real estate debt investments. With a minimum investment of $1,000, investors can participate in fix-and-flip projects and earn attractive returns. This platform is ideal for those who want to invest in real estate without the hassle of property selection and management.

10. DiversyFund: Investing in Multi-Family Units

DiversyFund focuses on multifamily residential and commercial real estate investments. With a minimum investment of $500, investors can participate in projects that offer cash flow and potential capital gains. DiversyFund's expertise in the multifamily market ensures quality investment opportunities.

11. Roofstock

Roofstock provides opportunities for investors to purchase residential real estate properties. With a minimum investment equal to the full price of the property or $5,000 for accredited investors, investors can own turnkey rental properties. This platform is perfect for those interested in long-distance real estate investing.

Wrap Up

These 11 Fundrise alternatives offer a diverse range of investment opportunities that cater to both accredited and non-accredited investors. Whether you're looking for commercial real estate, farmland, or residential properties, there's an option for you. Remember to do your due diligence and choose the platform that aligns with your investment goals. Happy investing!