Investing in real estate has always been a lucrative way to build wealth, and adding multifamily properties to your investment portfolio can take your earnings to new heights. With the potential for increased income and reduced vacancy rates, multifamily investing is an opportunity worth exploring.

What Exactly is a Multifamily Property?

A multifamily property is any residential property that contains more than one housing unit. This can include duplexes, townhomes, apartment complexes, and condominiums. Even if the owner lives in one of the units, it still qualifies as a multifamily property. For new investors, these properties offer excellent investment opportunities, providing various ways to generate wealth.

Tips for Investing in Multifamily Real Estate

Investing in multifamily real estate requires a different approach than investing in single-family properties. Here are three essential tips to keep in mind:

1. Find Your 50%

To evaluate potential deals, it's crucial to crunch the numbers and determine how much a specific multifamily property can generate in income. Calculate the difference between expected income, such as rent payments, and expenses like repairs and maintenance. If you don't have access to neighborhood comparables, you can use the 50% rule. Halve the expected income to estimate your expenses, and the difference between income and expenses will give you the net operating income (NOI).

2. Calculate Your Cash Flow

In the next step, factor in mortgage payments to calculate your estimated monthly cash flow. Subtract the monthly mortgage from the property's NOI to determine how much money you'll be earning. This calculation will help you decide if the investment is worth pursuing.

3. Figure Out Your Cap Rate

The capitalization rate, or cap rate, is another critical calculation for multifamily investors. It indicates how quickly you'll see a return on your investment. Remember that a higher cap rate doesn't always mean a better investment; it often signifies higher risk and higher returns. Aim for a cap rate in the 5%-10% range to strike a balance between yield and risk.

Image Source: Multifamily Real Estate

Image Source: Multifamily Real Estate

What to Look for When Investing in Multifamily Properties

Investing in multifamily properties requires thorough due diligence. Consider the following factors when evaluating potential properties:

The Location

Location is crucial in real estate, especially for multifamily properties. Look for high-growth areas with high demand and well-maintained neighborhoods. The location is often the most desired criterion for tenants.

The Total Number of Units

Evaluate the property as a whole and consider the number of units and rooms in each unit. Duplexes, triplexes, and four-plexes are ideal for beginner investors, offering more upside with less risk and affordability.

The Potential Income

Determine the income the property can generate by researching rental prices and income in the area. Use websites like Rentometer.com or Craigslist for rental estimates. For conservative estimates, follow the 50% rule, ensuring that 50% of the income covers expenses rather than the mortgage.

The Costs

Consider your financing options, such as owner-occupied financing or portfolio loans. Factors like credit score, debt-to-income ratio, and down payment will influence your financing choices. Also, evaluate the seller's motivation to potentially negotiate a better purchase price.

Image Source: Multifamily Investment

Image Source: Multifamily Investment

Single Family vs. Multifamily Investing

Investing in single-family properties versus multifamily properties is an ongoing debate in the real estate world. Each type of investment offers its advantages and disadvantages. Understanding these differences is crucial to your success. Here are some key points to consider:

Multifamily Investing Benefits

Multifamily properties provide additional sources of monthly income, slow but steady appreciation, and scalability. With more units, these properties offer a larger pool of tenants, making them less risky than single-family homes. Multifamily investments are ideal for property management, as they generate enough income to justify hiring professional management companies. Additionally, these properties offer various tax benefits and simplify insurance policies.

Single Family Investing Benefits

Single-family properties are more affordable, easier to finance, and tend to appreciate more than other types of properties. Managing single-family rentals is also simpler due to fewer units to handle. These investments are a great option for beginner investors, offering lower costs and less complexity.

Image Source: Investing in Multifamily Properties

Image Source: Investing in Multifamily Properties

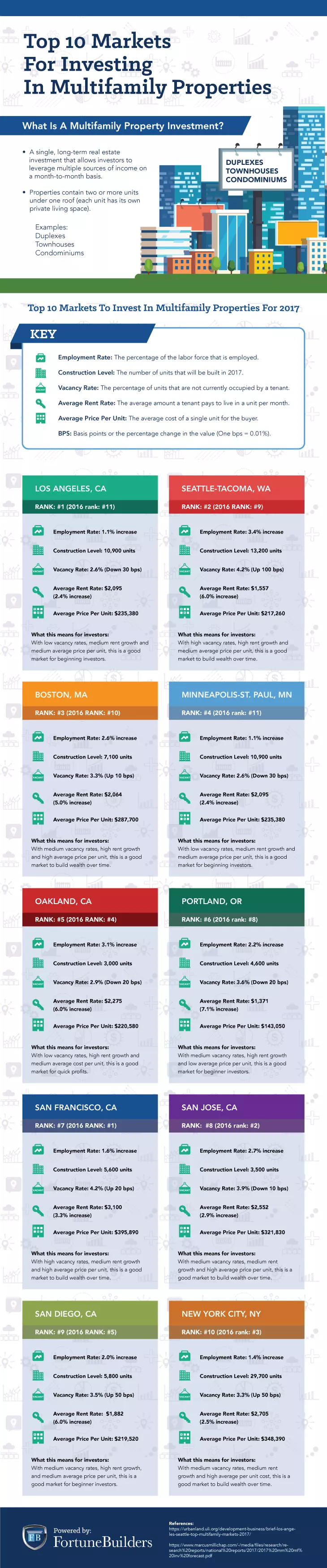

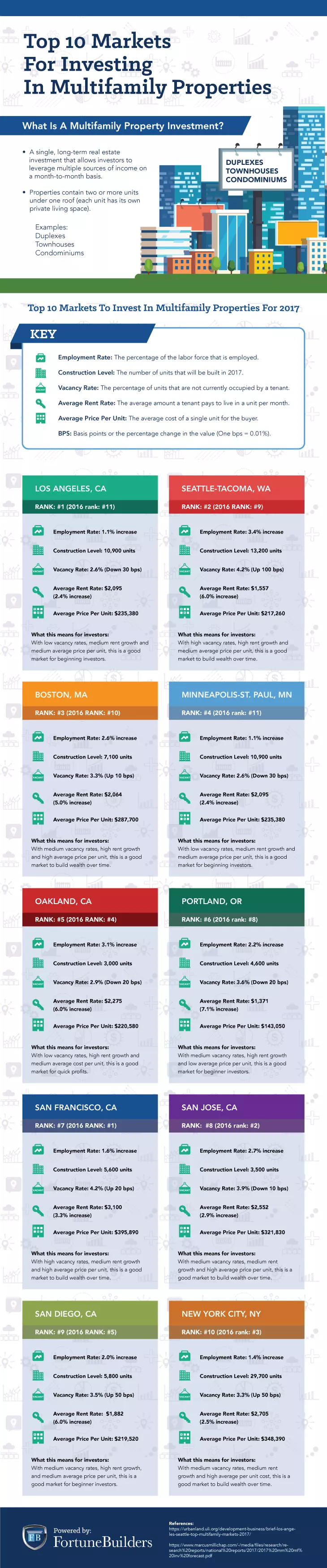

Top 10 Markets for Multifamily Real Estate Investing

Location plays a crucial role in the success of your real estate investment. If you're considering multifamily real estate investing, these top 10 markets are worth exploring:

- Los Angeles, CA

- Seattle-Tacoma, WA

- Boston, MA

- Minneapolis-St. Paul, MN

- Oakland, CA

- San Jose, CA

- Portland, OR

- San Francisco, CA

- New York City, NY

- San Diego, CA

Image Source: Investing in Multifamily Properties

Image Source: Investing in Multifamily Properties

Financing Multifamily Real Estate

There are several financing options available for buying multifamily properties. Private or hard money loans are popular, although conventional mortgages, HUD loans, and government-backed loans are also viable options. Research all available options, compare application periods and costs, and don't be afraid to get creative if you can't find a financing method you like.

Managing Multifamily Properties

Managing multifamily properties requires more attention than single-family rentals. Many property owners choose to work with property management companies to ensure smooth operations. Alternatively, if you decide to manage the property yourself, there are online tools available to streamline tenant communications, document management, and rent collection. Managing multifamily properties can be demanding, but there are ways to make it easier and more efficient.

In Conclusion

Investing in multifamily properties offers a unique opportunity for wealth-building and passive income. However, it requires time, effort, and a thorough understanding of the market. By following the tips and considering the factors mentioned in this guide, you'll be well on your way to navigating the world of multifamily real estate investing. Get ready to seize the opportunities available in today's real estate market by starting your journey as a multifamily investor.

Ready to dive into real estate investing? Our online real estate investing class provides everything you need to get started. Click here to enroll now!