Image source: onurdongel

Image source: onurdongel

REIT Rankings: Industrial

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on May 3rd.

Image source: Hoya Capital

Image source: Hoya Capital

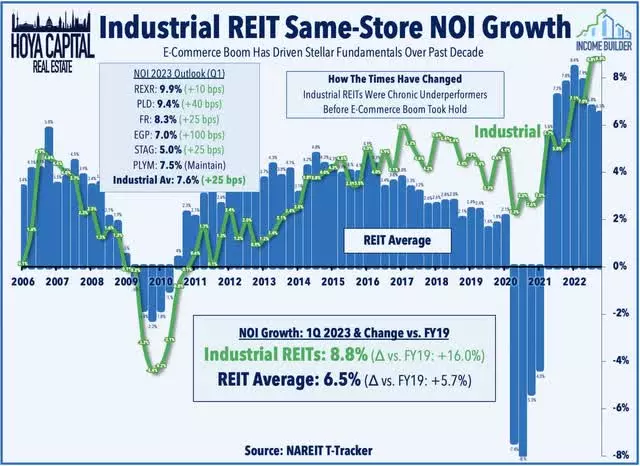

What logistics slowdown? Despite concerns of a global recession and reduced logistics spending from e-commerce giant Amazon, Industrial REITs have bounced back after a challenging year in 2022. Earnings results have revealed a surprising strengthening of property-level fundamentals, driven by the high demand for conveniently located logistics spaces that far outpaces available supply. Leading the pack is Prologis (PLD), one of the largest publicly-traded REITs in the world, in the Hoya Capital Industrial REIT Index. This comprehensive index tracks a total of eleven industrial REITs with a combined market value of around $165 billion.

Image source: Hoya Capital

Image source: Hoya Capital

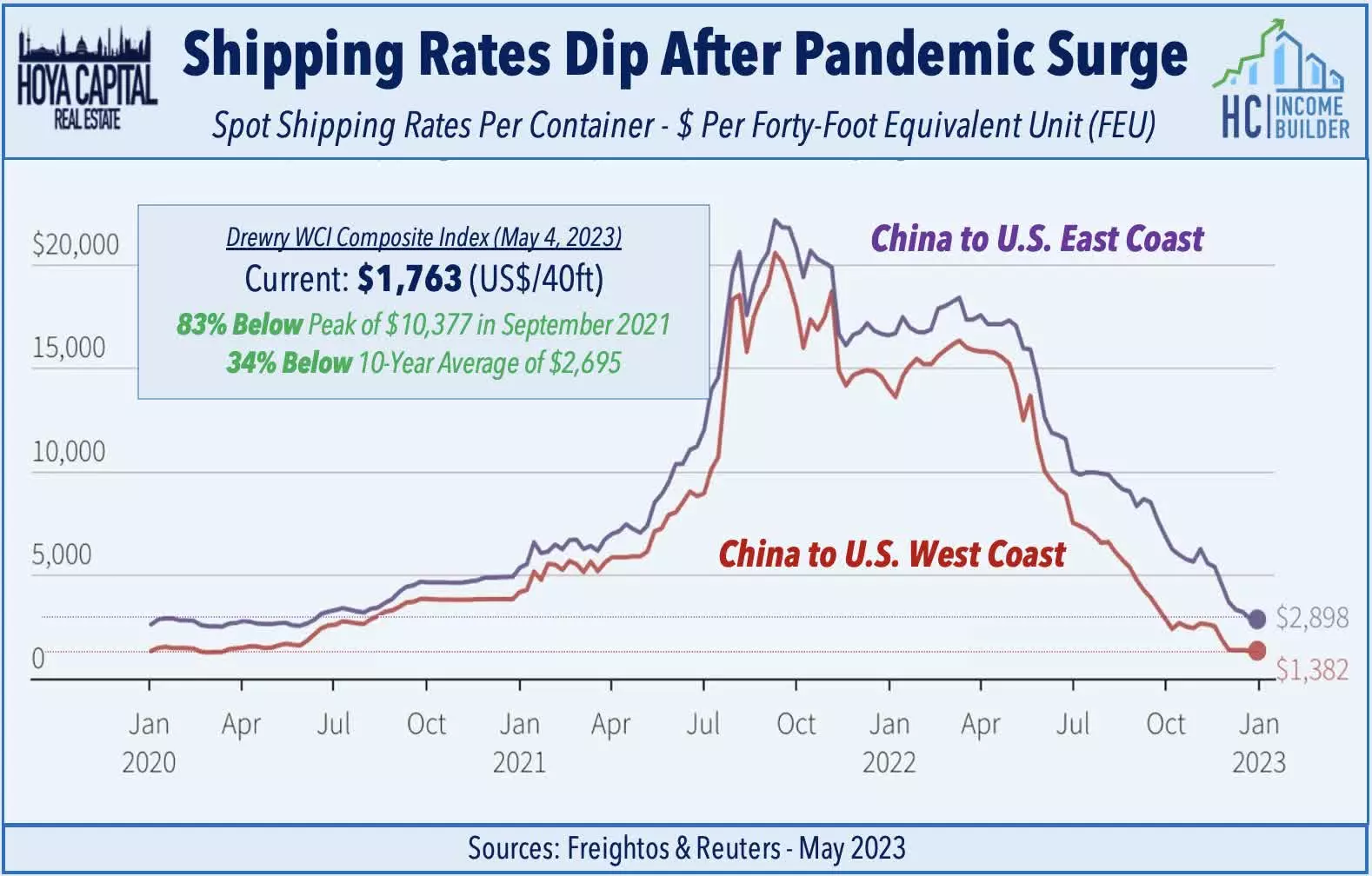

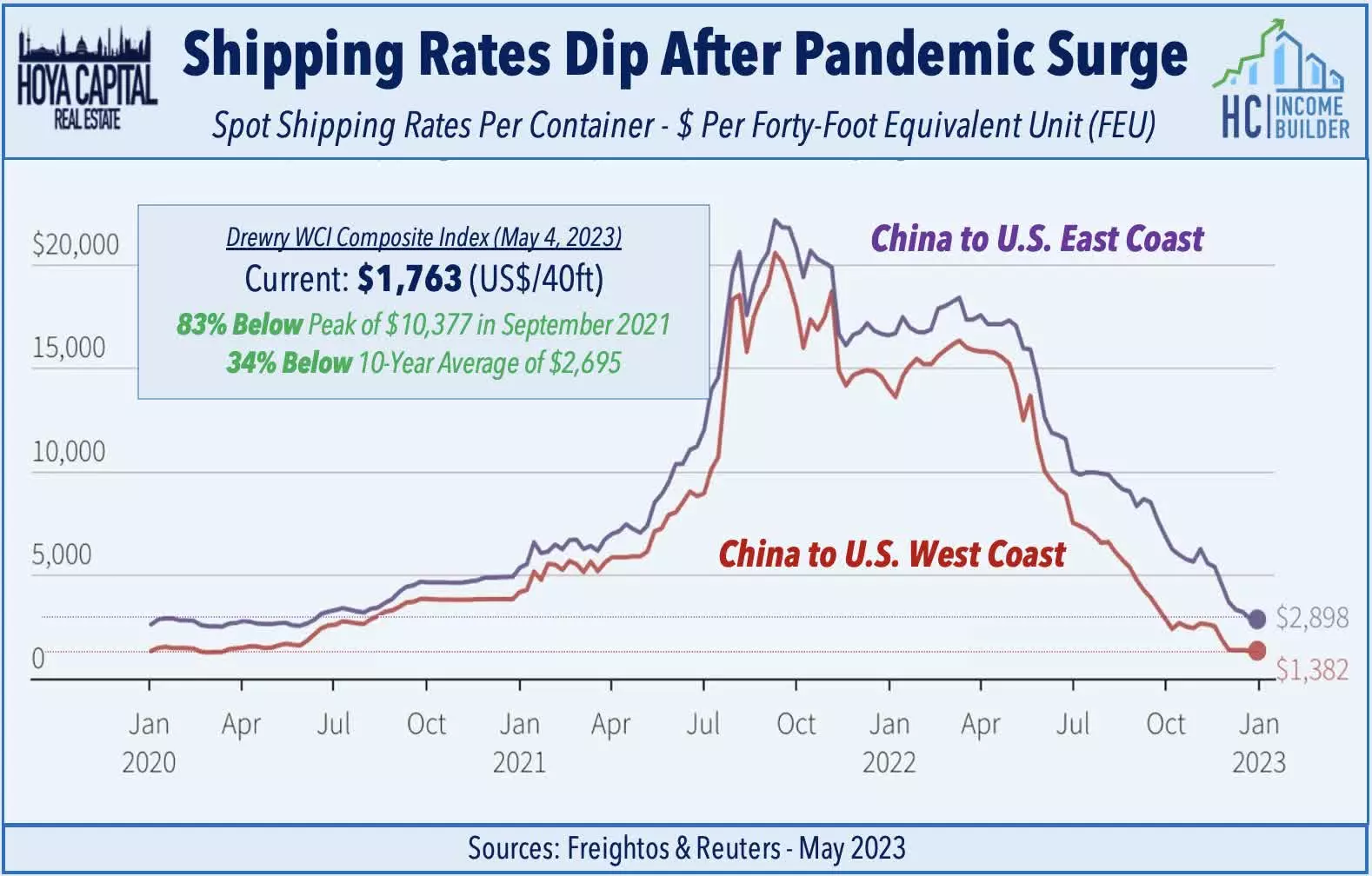

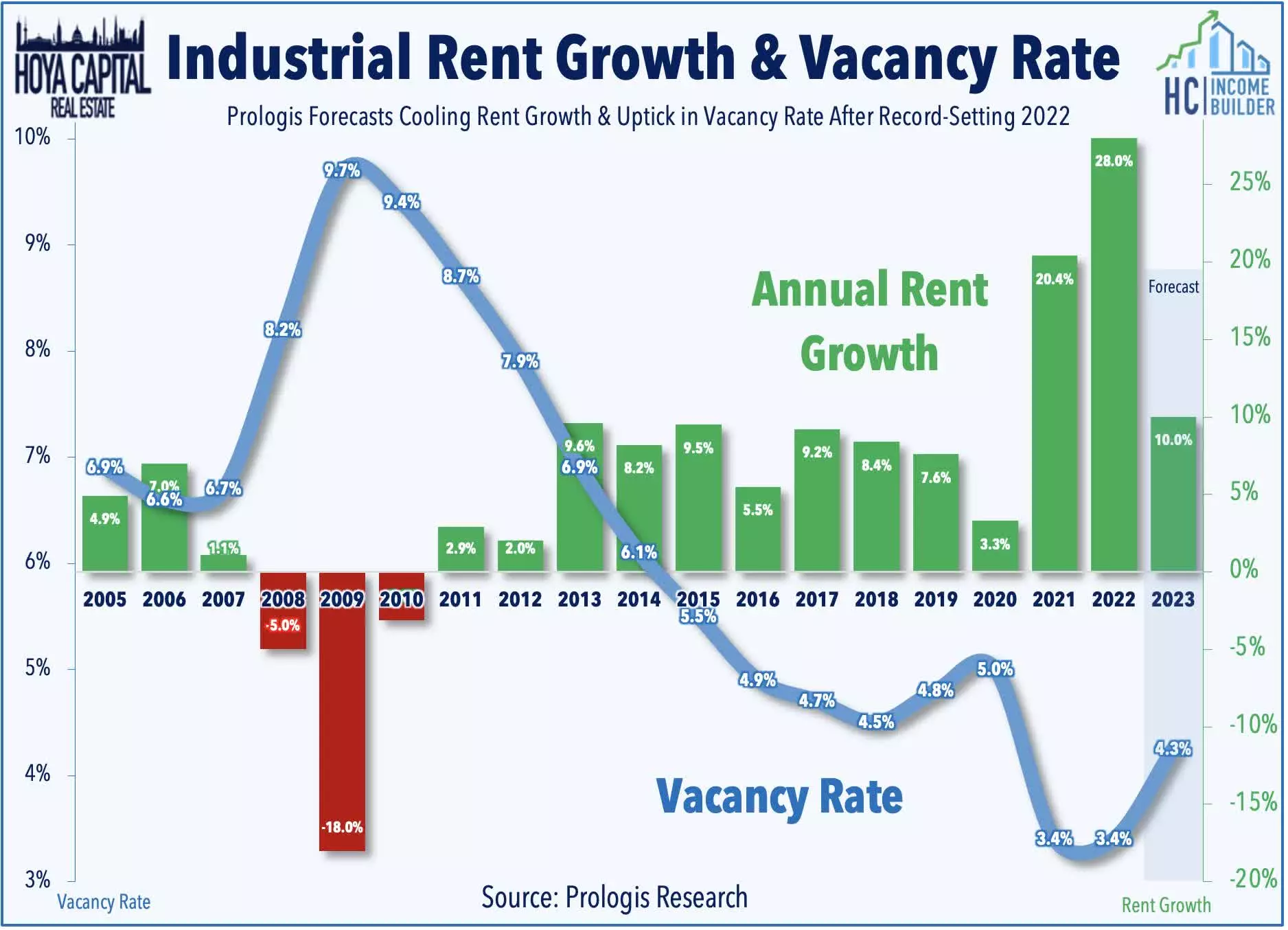

Despite storm clouds hovering over the global economy, industrial REIT valuations have been under pressure due to concerns that the challenges faced by other supply-chain-oriented sectors could spill over into the logistics property sector. Global shipping rates have plummeted by 83% from their inflation-fueling peaks in September 2021, and shipping volumes have also seen a decline. However, the limited availability of land for industrial properties ensures that property-level fundamentals remain strong. Recent earnings results indicate that the moderation in cost pressures across other supply chain areas is actually benefiting industrial REITs, as savings from reduced fuel costs are being funneled into improving physical logistics networks. Rent growth and occupancy rates have reached record highs, defying expectations of a slowdown.

Image source: Hoya Capital

Image source: Hoya Capital

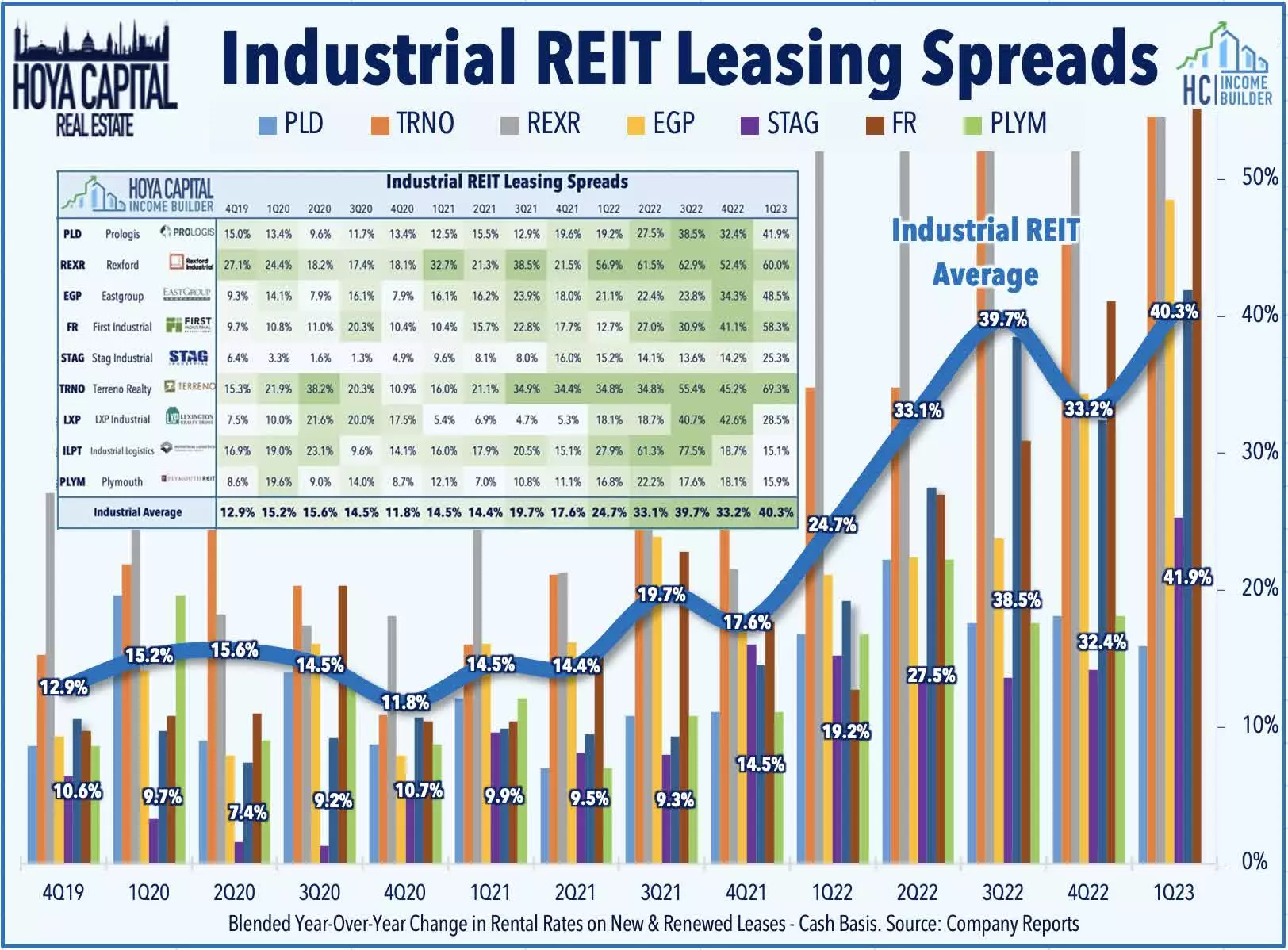

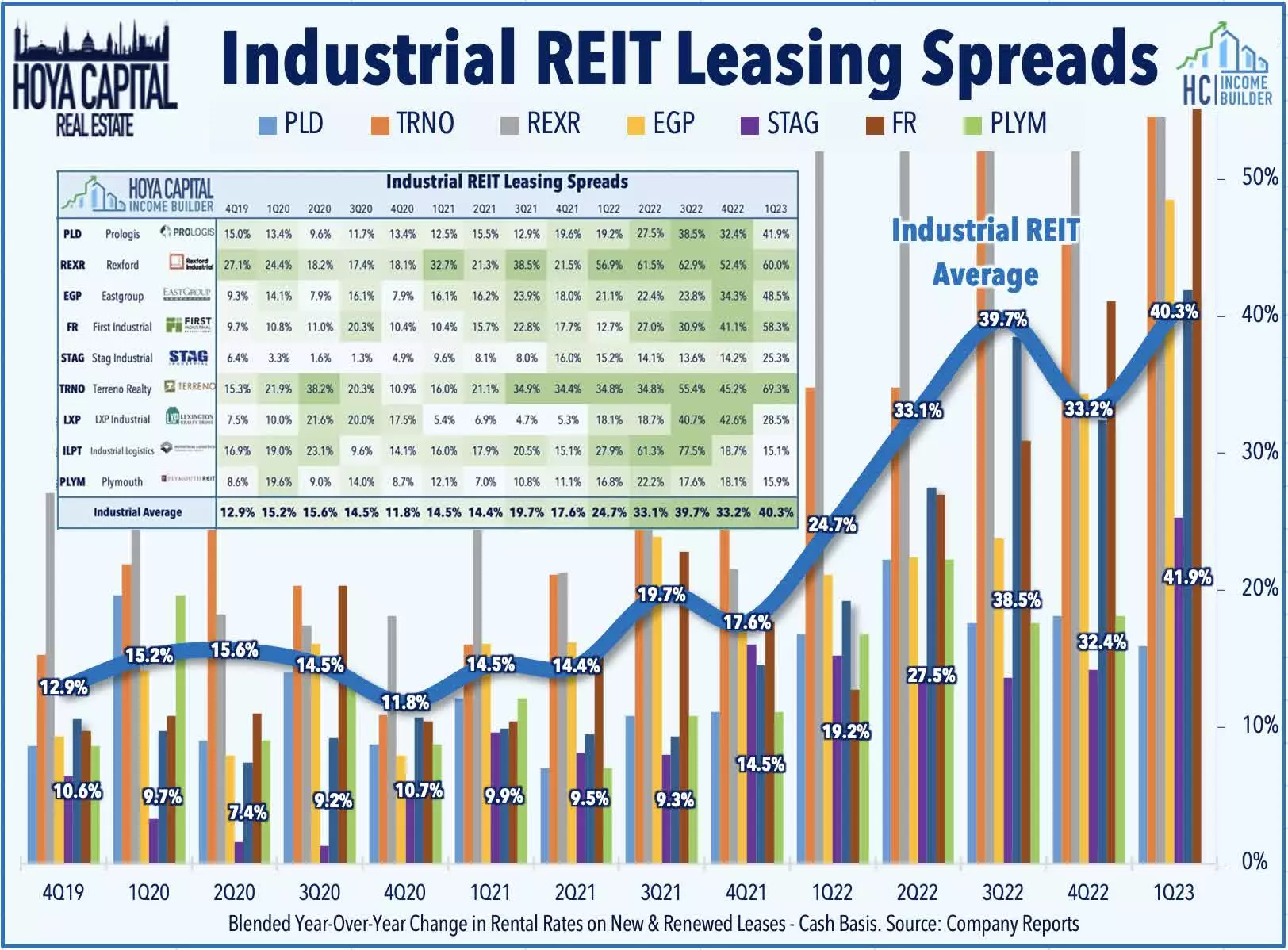

The "beat and raise" trend is evident among the top five industrial REITs, with each increasing their full-year NOI and FFO guidance. These strong fundamentals align with reports from brokerage firms CBRE and JLL, confirming that industrial vacancy rates remain near record lows. CBRE notes that companies continue to expand warehouse footprints due to strong e-commerce sales, supply chain diversification, inventory control, and population shifts. JLL adds that industrial market fundamentals remain sound, with rent growth exceeding 25% in 2022.

Image source: Hoya Capital

Image source: Hoya Capital

Prologis Research remains confident in the market rent growth forecast of 10% for 2023, following the exceptional market rent growth of 30.0% in 2022 and 20.0% in 2021. While demand is expected to moderate, supply pressures are easing, which may lead to a decline in vacancy rates. Development starts have declined significantly, indicating an easing of supply pressures in 2024. All signs point to a positive outlook for industrial REITs.

Image source: Hoya Capital

Image source: Hoya Capital

Deeper Dive: Industrial REIT Fundamentals

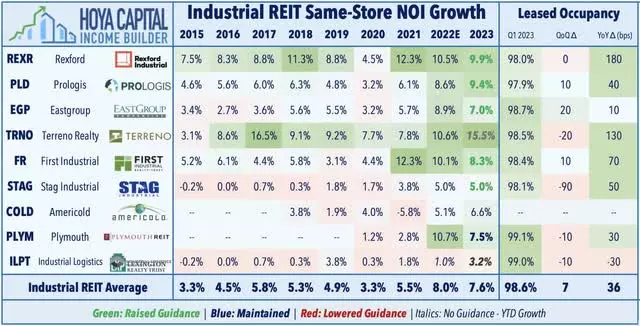

With head-spinning cash rental rate spreads and positive guidance from most industrial REITs, same-store NOI and FFO growth are expected to rise substantially in 2023. Occupancy rates have also reached record highs. Key players like EastGroup (EGP), STAG Industrial (STAG), and Prologis (PLD) have reported impressive results, further reinforcing the positive industry outlook.

Image source: Hoya Capital

Image source: Hoya Capital

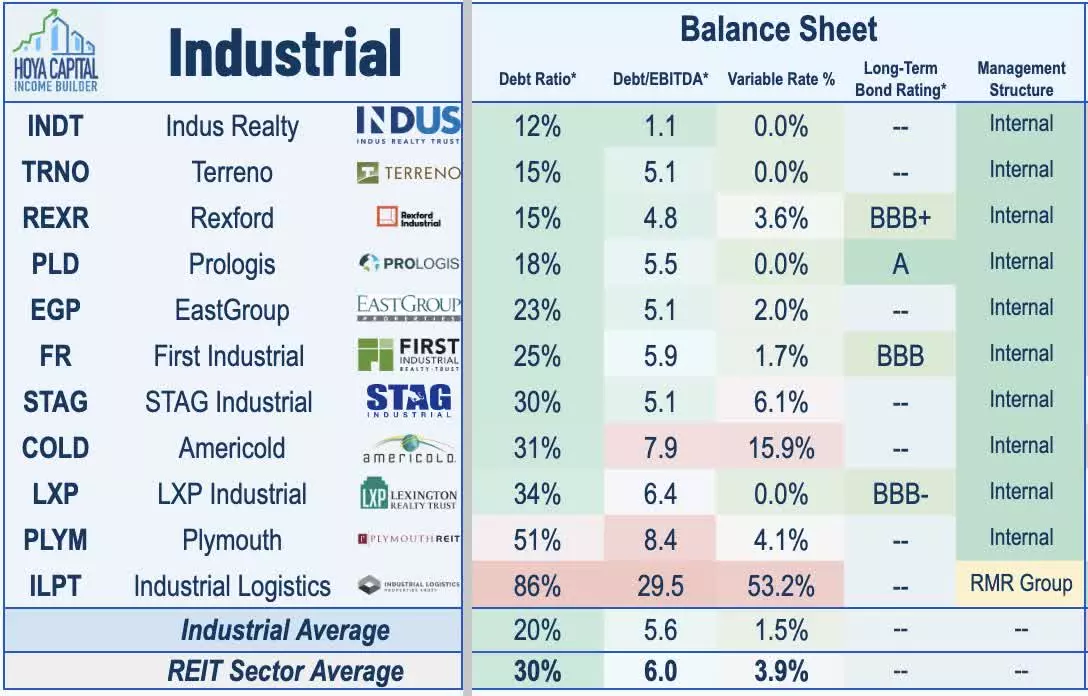

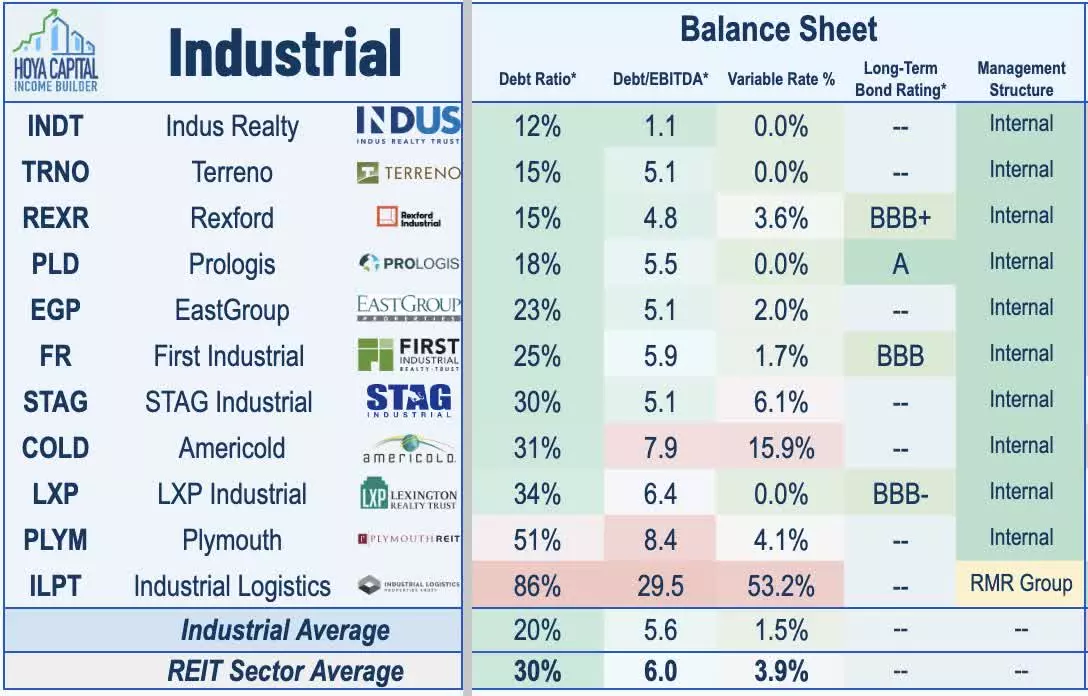

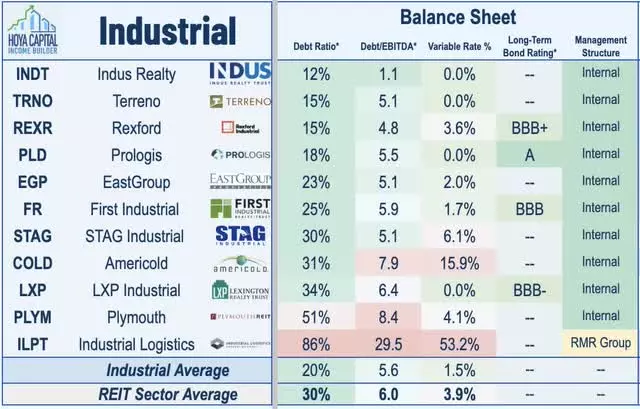

While some industrial REITs are facing challenges due to high debt levels, mid-cap REITs are benefiting from a fertile M&A environment. Recent acquisitions and consolidations indicate the industry's potential for growth and value creation.

Image source: Hoya Capital

Image source: Hoya Capital

Industrial REIT Stock Price Performance

After a challenging year in 2022, industrial REITs are off to a strong start in 2023, outperforming the broader real estate and equity indices. Despite the dip in performance last year, industrial REITs have been the best-performing property sector since 2015, with average annual total returns of 16.7%. This sector remains attractive for long-term investors.

Image source: Hoya Capital

Image source: Hoya Capital

Deeper Dive Into The Industrial Sector

Industrial REITs own a significant portion of high-value distribution-focused assets, driving rent growth and benefiting from the increasing demand for logistics spaces. The pandemic has accelerated the need for efficient supply chains, with e-commerce giants like Amazon, Walmart, Target, Home Depot, and Lowe's leading the charge. The relentless "need for speed" in the industry has fueled significant investments in logistics space, presenting ample opportunities for industrial REITs.

Image source: Hoya Capital

Image source: Hoya Capital

Industrial REIT Dividend Yields

While industrial REITs may have lower current yields compared to other sectors, they have consistently provided strong dividend growth. Industrial REITs have seen average dividend growth of nearly 8% per year since 2014, outpacing the REIT sector average. With a solid payout ratio, these REITs have room for both development-fueled growth and future dividend increases.

Image source: Hoya Capital

Image source: Hoya Capital

Takeaways: Industrial Tailwinds Still Intact

While industrial REITs are not entirely immune to post-pandemic demand normalization, the limited land availability ensures healthy property-level fundamentals. Rent growth may moderate, but the overall outlook remains positive. Investors focusing on dividend growth should consider overweighting the industrial sector and prioritizing high-quality names, while also exploring value opportunities among mid-cap and small-cap REITs.

Image source: Hoya Capital

Image source: Hoya Capital

For an in-depth analysis of all real estate sectors, check out the quarterly reports from Hoya Capital Real Estate, covering various sectors like apartments, homebuilders, manufactured housing, student housing, single-family rentals, and more.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. The company is long all components in the Hoya Capital Housing 100 Index and the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on the Hoya Capital website.

Image source: Hoya Capital

Image source: Hoya Capital

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.