The housing market is always a topic of interest, and as we enter 2024, there are many questions about what lies ahead. Will there be a recession? Will prices crash? Is it a good time to buy or sell? In this article, we will delve into these questions and provide insights into what you can expect from the housing market in the coming year.

Housing Market Recession: What Is It and Are We in One?

A housing market recession is characterized by a sustained decline in home sales over a period of at least six months. Fortunately, the data shows that we are not currently in a housing market recession. In fact, home sales have been growing, with an increase from May to June 2023 and again from July to August. While there was a seasonal decline towards the end of the year, the housing market remains steady.

It's important to note that even if home sales do become unstable in 2024, a housing recession is not necessarily cause for concern. Prices tend to remain stable in such situations. A true cause for worry would be declining sales coupled with an oversupply of houses and insufficient buyer demand, which could lead to a decrease in home values and negatively impact the overall economy. Thankfully, that is not the case.

Forecast: Will the Housing Market Crash in 2024?

If you have concerns about a housing market crash in 2024, you can put them to rest. Not only are prices not expected to drop substantially, but they are actually more likely to continue rising. The National Association of Realtors predicts a 2.6% increase in existing home prices by August 2024, while Freddie Mac expects a more conservative 0.8% bump during the same period.

To gain a clearer understanding of what to expect in 2024, let's explore the three primary factors that influence housing prices: inventory, buyer demand, and interest rates.

What's the Average House Price in 2024?

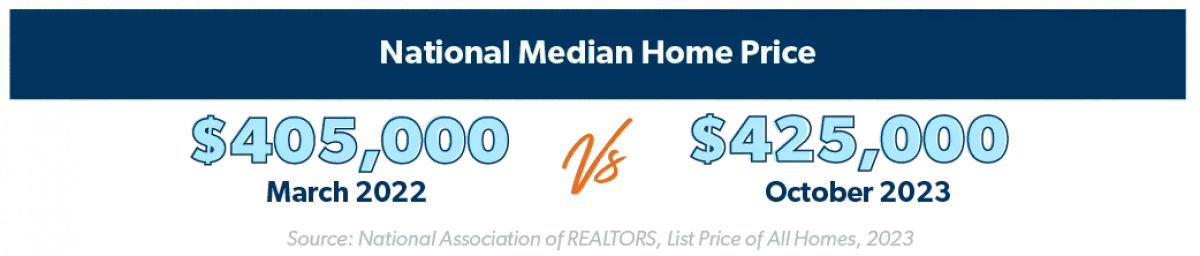

In December 2023, the average home price in the U.S. stood at $736,388, including existing homes, new builds, single-family homes, condos, and townhomes. However, it is more useful to focus on the median price, which was $410,000 during the same period. The median represents the middle point between the lowest and highest prices, providing a more accurate reflection of the market.

March 2022 median home price vs October 2023 median home price: $405k vs $425k respectively.

March 2022 median home price vs October 2023 median home price: $405k vs $425k respectively.

It's important to remember that home prices are influenced by inventory and demand. Now, let's delve into each of these areas to gain a better understanding of what to expect in 2024.

Housing Inventory

Housing inventory refers to the number of houses available for sale. When inventory is low, buyers are willing to pay more, and sellers have more negotiating power to increase their asking prices. Therefore, low inventory leads to higher home prices. Unfortunately, it appears that housing inventory will remain low in 2024. Although there was a 4.9% increase in total housing inventory in December 2023 compared to the previous year, it was 4.7% lower than November 2023 and a staggering 36% lower than pre-COVID levels. Despite new constructions, the overall impact on housing inventory is not significant. For instance, the number of permits issued for new builds was down 11.7% year-to-date in November 2023.

Buyer Demand

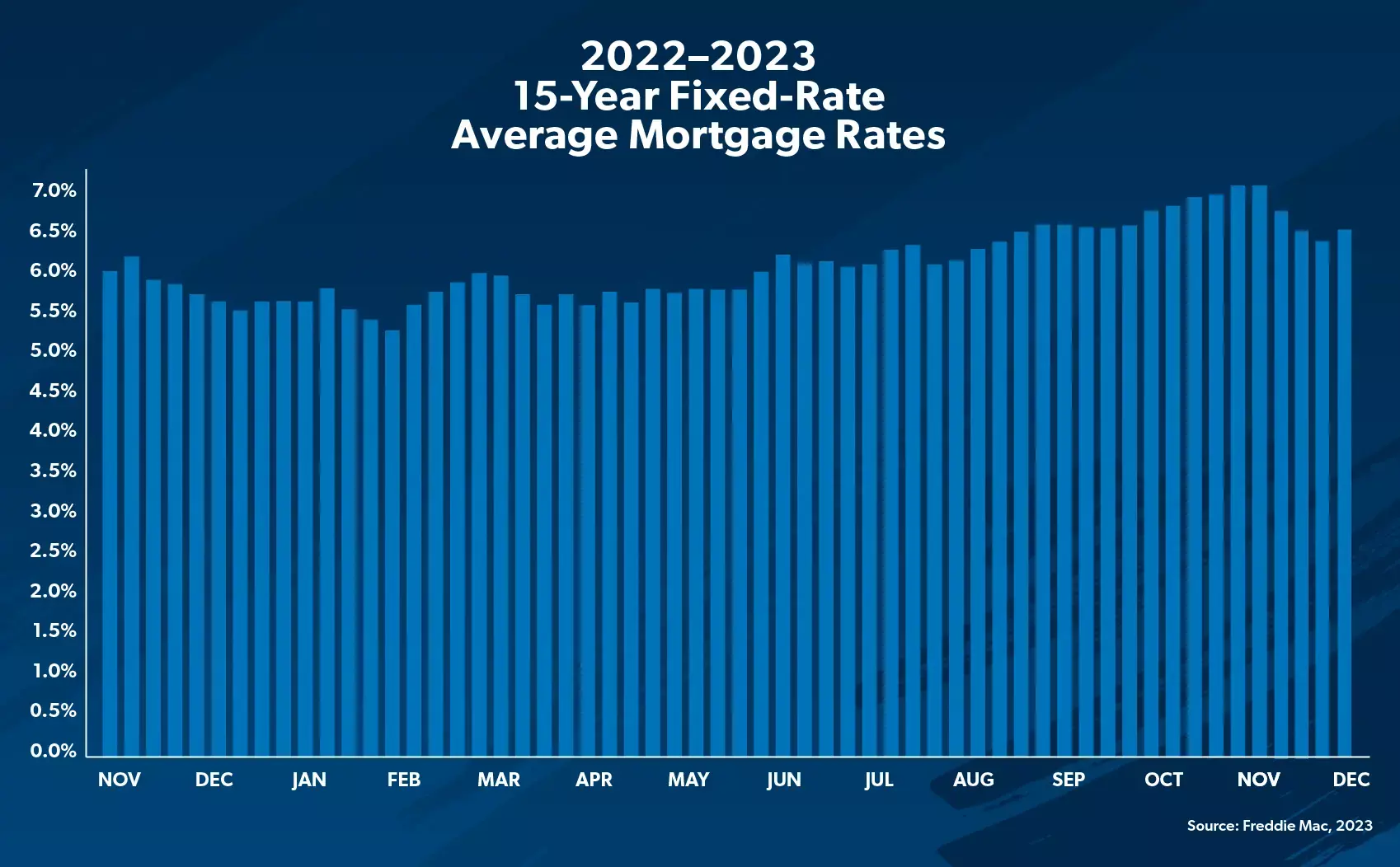

Buyer demand may decrease in 2024, particularly if the Federal Reserve continues to raise interest rates. However, current buyer demand still exceeds housing supply. Therefore, home prices are likely to remain relatively stable in 2024, with some markets experiencing minor fluctuations in dollar amounts.

Chart showing mortgage interest rates increasing.

Chart showing mortgage interest rates increasing.

Is Now a Good Time to Buy a House?

The housing market should not solely determine your decision to buy a house. If you are financially prepared, it can be a good time to buy a home even when inventory is limited and interest rates are high. Conversely, if you are not financially ready, it is not advisable to buy a home even when there is an abundance of inventory and low rates.

What the 2024 Housing Market Means for Buyers and Sellers

Is It a Buyer's Market?

A buyer's market occurs when there are more homes for sale than there are buyers. Currently, due to low inventory, a buyer's market is not expected anytime soon. However, the housing market is not as hot as it has been in recent years. Buyers now have a few more options and potentially less competition. While prices may still be high, the frenzied environment is starting to calm down.

Is It a Seller's Market?

A seller's market is characterized by a higher demand for homes than the available supply. Currently, this is still the case. If you plan to sell your home, you can expect a relatively quick sale at a price close to your asking price, provided it is realistic for the current market. Working with a knowledgeable agent will help ensure you set a fair price for your property.

Will There Be a Lot of Foreclosures in 2024?

Foreclosures are expected to increase in 2024, as they did in 2023. However, it's important to note that the number of foreclosures in recent years is significantly lower than during the Great Recession. In 2023, foreclosures were 10% higher than the previous year. Comparatively, foreclosures were down 28% compared to 2019 and a staggering 88% lower than the peak of foreclosures in 2010.

Additionally, most homes facing foreclosure today are less likely to be repossessed by lenders. Many borrowers in foreclosure currently possess positive equity, enabling them to sell their homes and avoid foreclosure. This is a positive sign for homeowners and home buyers alike.

How to Buy or Sell With Confidence in Any Housing Market

While the current housing market presents its challenges, buying or selling a home is not impossible. It is crucial to remain in control of your financial future, including your real estate decisions, regardless of market conditions.

In conclusion, the housing market predictions for 2024 suggest that there will be stability and a continued upward trend in home prices. Low inventory and strong buyer demand indicate that sellers will continue to have an advantage. While there may be an increase in foreclosures, it is unlikely to reach the levels seen during the Great Recession. By staying informed and making sound financial decisions, you can navigate the housing market with confidence.