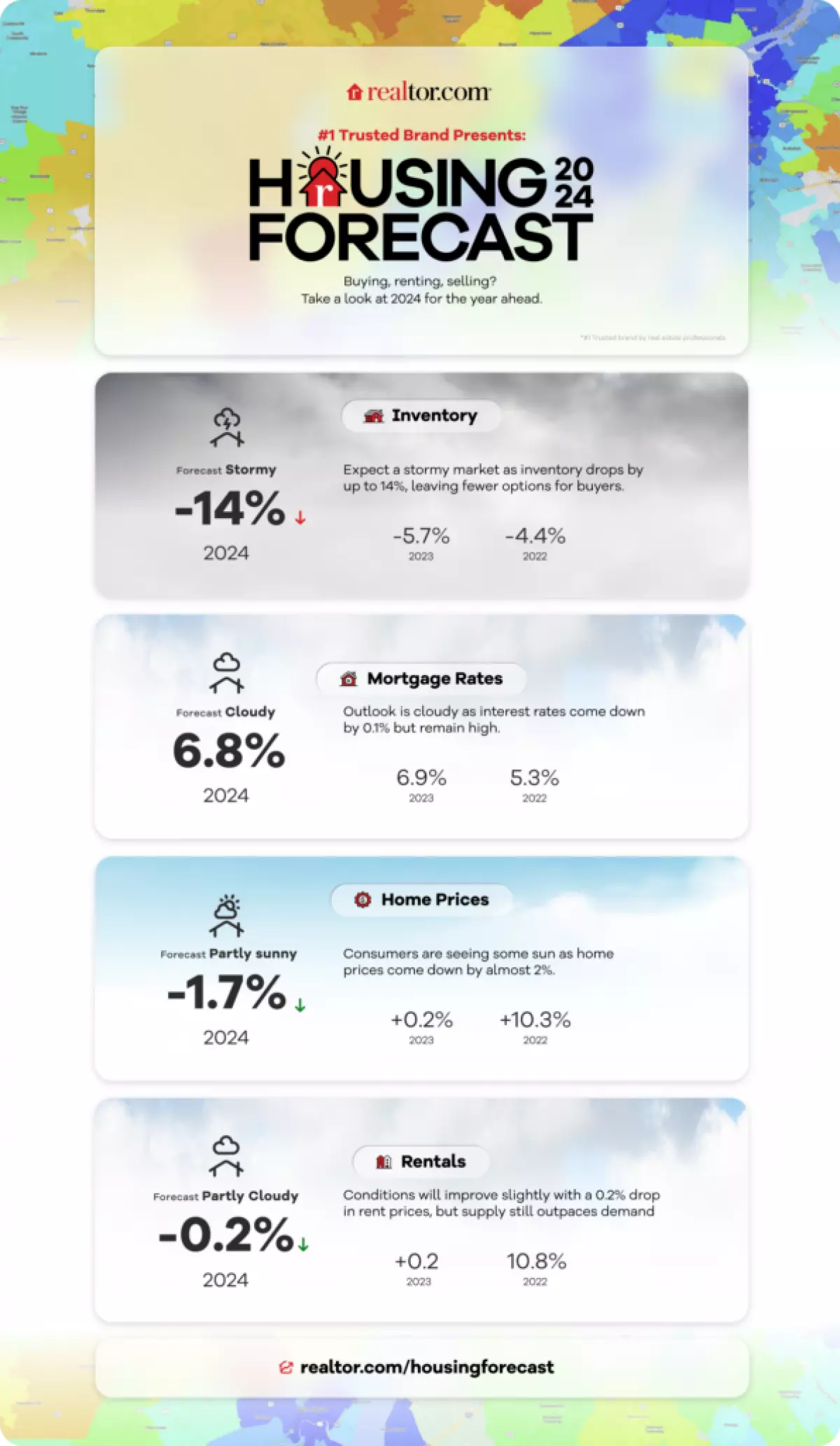

As we set our sights on 2024, the housing market and economy are poised for a mix of continuity and change. Against a backdrop of modest economic growth, slightly higher unemployment, and easing inflation, there is a glimmer of hope for homebuyers. Mortgage rates are set to make a slow retreat, improving housing affordability. This shift, however, may also dampen the sense of urgency among home shoppers. Despite the less frenzied demand, the stable supply of rental homes will keep home sales relatively steady, leading to a slight adjustment in home prices. Let's dive deeper into the key housing indicators for 2024.

Realtor.com® 2024 Forecast for Key Housing Indicators

Here's a snapshot of the Realtor.com® 2024 forecast compared to the 2023 full-year expectations and historical data from 2013-2019:

| Mortgage Rates | Existing Home Median Price Appreciation (Y/Y) | Existing Home Sales (Y/Y - Annual Total) | Existing Home For-Sale Inventory (Y/Y) | Single-Family Home Housing Starts (Y/Y - Annual) | Homeownership Rate | Rental Growth |

|---|---|---|---|---|---|---|

| 6.8% (avg); 6.5% (year-end) | -1.7% | +0.1% (4.07 million) | -14.0% | -0.4% (0.9 million) | 65.8% | -0.2% |

Image source: The original article

Image source: The original article

Home Prices Dip, Improving Affordability

After experiencing double-digit annual growth for two years, home prices are expected to take a breather in 2024. The increase in mortgage rates caused the once-red-hot market to cool down temporarily. However, even during this period, purchasing a home remained expensive. The typical household had to dedicate a significant portion of their income to mortgage payments. In 2024, as home prices ease slightly and mortgage rates dip, the cost of financing a home is projected to become more affordable. This will lead to a decrease in the percentage of income required for mortgage payments.

Image source: The original article

Image source: The original article

Home Sales Barely Budge Above Record Lows

Existing home sales faced significant challenges in 2022 due to soaring mortgage rates. While there was a brief respite in early 2023 when rates dipped, the subsequent climb in mortgage rates once again hampered home sales. Many homeowners chose not to sell their homes due to concerns about losing their low-rate mortgages. As a result, home sales in 2023 hit a record low of just over 4 million. In 2024, the housing market will continue to face headwinds, and home sales are expected to remain unchanged at just over 4 million. Moves driven by job changes, family situations, and downsizing will be the primary drivers of home sales during the year.

Image source: The original article

Image source: The original article

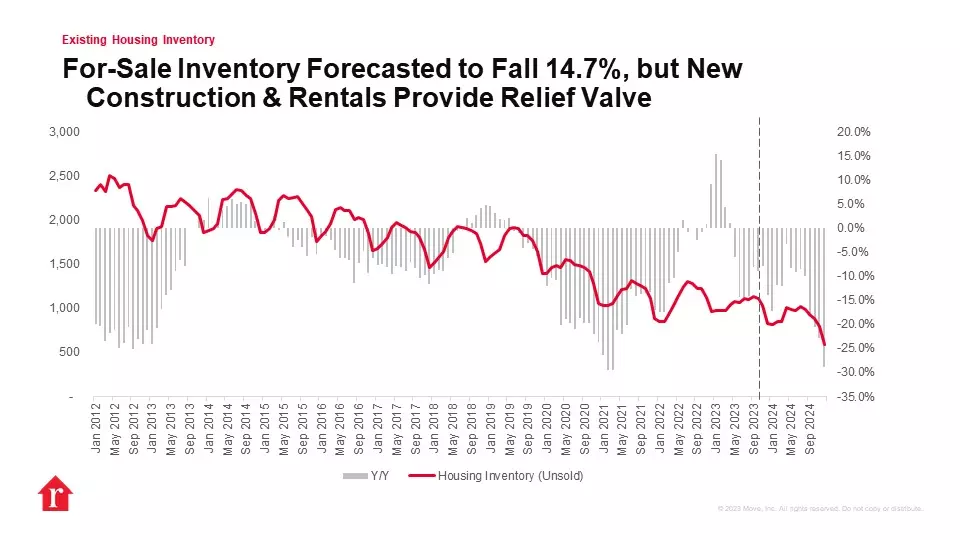

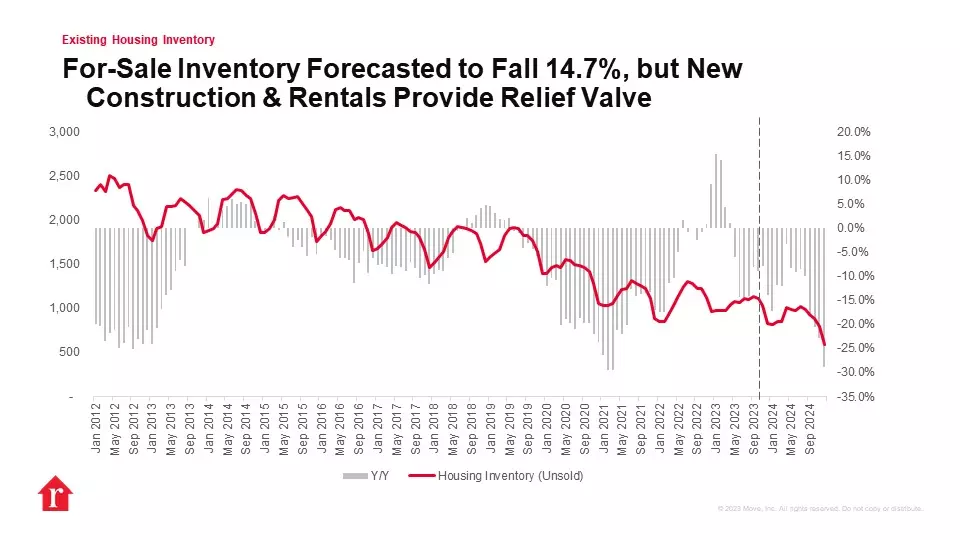

Shoppers Find Even Fewer Existing Homes For Sale

The inventory of existing homes has been dwindling even before the pandemic. Insufficient construction and high demand meant that the supply of houses couldn't keep up with household formation. While builders have been working hard to catch up, the lack of excess capacity in the for-sale home market remains evident. The number of existing homes on the market is expected to remain low in 2024. Additionally, the gap between market mortgage rates and the rates enjoyed by existing homeowners will continue to play a role in limiting the number of homes available for sale. The majority of outstanding mortgages have rates lower than market rates, making it less appealing for homeowners to sell.

Image source: The original article

Image source: The original article

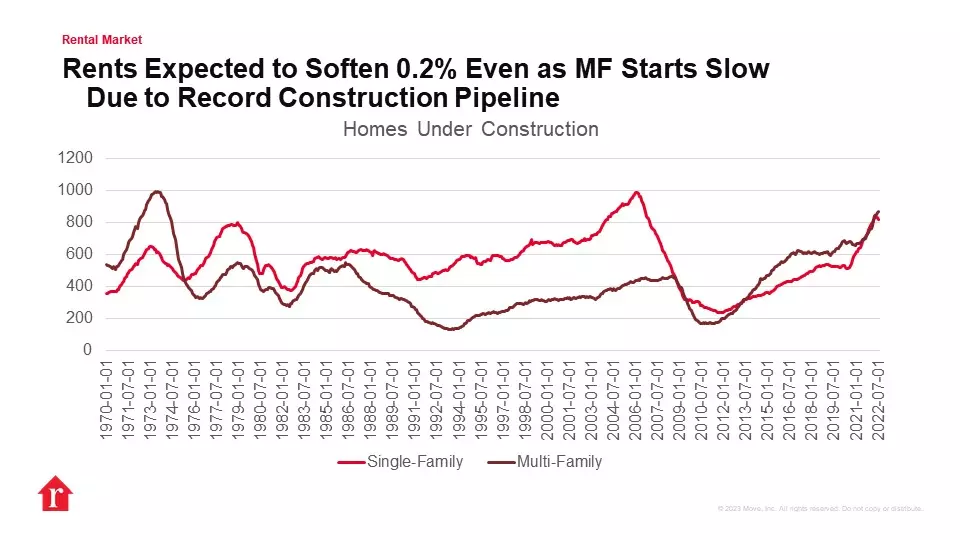

Rental Supply Outpaces Demand to Drive Mild Decline in Rents

The rental market experienced a period of rapid growth between 2021 and 2022, but it has since cooled down. In 2024, the rental market is expected to remain stable, with a slight decline of -0.2% in median asking rent. The supply of rental properties has outpaced demand, leading to an increase in rental vacancy rates. However, the sheer number of renters in the market will mitigate any significant impact on rental prices. Renting is expected to remain a more budget-friendly option than buying in most markets, despite the dip in home prices and mortgage rates.

Image source: The original article

Image source: The original article

Key Wildcards

As with any forecast, there are some wildcards that could influence the housing market in 2024. These include:

- Mortgage Rates: If inflation surges unexpectedly, it could halt the decline in mortgage rates, impacting home sales.

- Geopolitics: Ongoing conflicts and geopolitical instability, especially in trade and energy costs, could have unforeseen economic consequences.

- Domestic Politics: The 2024 elections could drive shifts in housing market trends as Americans make decisions based on political factors.

Housing Perspectives

What will the market be like for homebuyers, especially first-time homebuyers?

First-time homebuyers will continue to face challenges in the housing market in 2024. However, there are signs of improvement. Housing affordability is expected to increase as mortgage rates ease, home prices soften, and incomes grow. Although the cost of buying a home will still be higher than historical averages, it is heading in a more buyer-friendly direction.

How can homebuyers prepare?

Homebuyers can prepare by getting financially ready for the housing market. Using home affordability calculators, such as the one provided by Realtor.com, buyers can determine their price range based on income and savings. It's also essential to explore different loan products that offer lower mortgage rates or more flexible credit criteria. Down payment assistance options and loan products with low down payment requirements can help buyers overcome the obstacle of a large down payment.

What will the market be like for home sellers?

Home sellers are likely to face competition from builders rather than other sellers in 2024. Builders are focusing on lower-priced homes and are willing to make price adjustments when needed. Sellers should consider the landscape of new construction housing in their markets and its implications for pricing and marketing.

What will the market be like for renters?

Renting is expected to remain a more cost-effective option than buying in the short term. However, as home prices and mortgage rates decline, the advantage for renting will diminish. Renters should carefully consider the duration of their intended residence and evaluate the costs and benefits of renting versus buying over time.

Local Market Predictions

Remember, all real estate is local. Here are some predictions for select metro areas:

Akron, OH: 3.2% sales growth, 3.2% price growth

Albany-Schenectady-Troy, NY: 1.1% sales growth, 3.7% price growth

Albuquerque, NM: -4.1% sales growth, 5.2% price growth

(For the complete list of local market predictions, please refer to the original article.)

In conclusion, the 2024 housing market offers a glimmer of hope for homebuyers. Affordability is expected to improve, but the market will remain competitive. Sellers will face competition from builders, and renting will continue to be a viable option. Keep in mind that local market conditions can vary, so it's essential to stay informed about trends specific to your area.