Image by Space_Cat/iStock via Getty Images

Image by Space_Cat/iStock via Getty Images

REIT Rankings: Hotels

(Hoya Capital Real Estate, Co-Produced with Colorado WMF)

Hotel REIT Sector Overview

With vaccines rolling out and the economy rebounding, it seemed like it would be a memorable summer for hotel REITs and the tourism industry at large. However, the resurgence of COVID variants has changed the outlook. Despite posting impressive gains during the vaccine development stages, hotel REITs have been the weakest-performing property sector since vaccines became widely available in late April. The risks for hotel REITs remain tilted downward as valuations are not attractive enough to justify near-zero dividend yields and the risk of further pandemic setbacks.

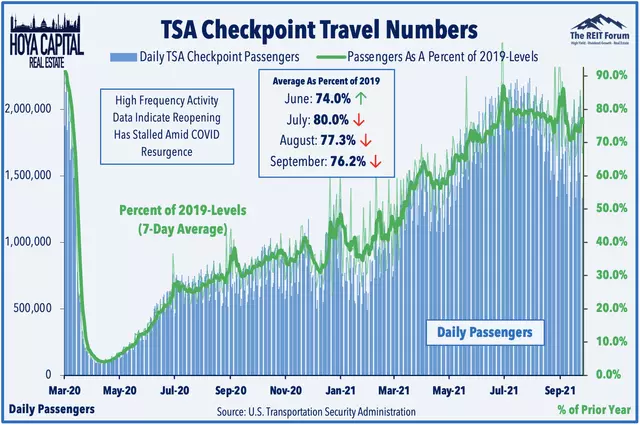

The latest wave of the pandemic, known as the "fourth wave," arrived at a crucial time for the domestic tourism industry. The industry was relying on robust demand during the late-summer season and the return of business travel in the fall. Unfortunately, domestic travel has stalled over the past two months, with declining trends in August and September. While the past two weeks have shown more promising signs, the surge in energy prices poses a new challenge.

Hotel occupancy, closely linked to domestic airline travel, has also seen a similar decline. After briefly recovering to pre-pandemic levels in the early summer, hotel occupancy rates slipped in early September. However, they have since stabilized as the "fourth wave" has subsided. Occupancy rates are still below 2019 levels, but regional differences are significant, with cities like San Francisco experiencing much lower occupancy rates compared to places like Tampa, which reported rates above 2019 levels.

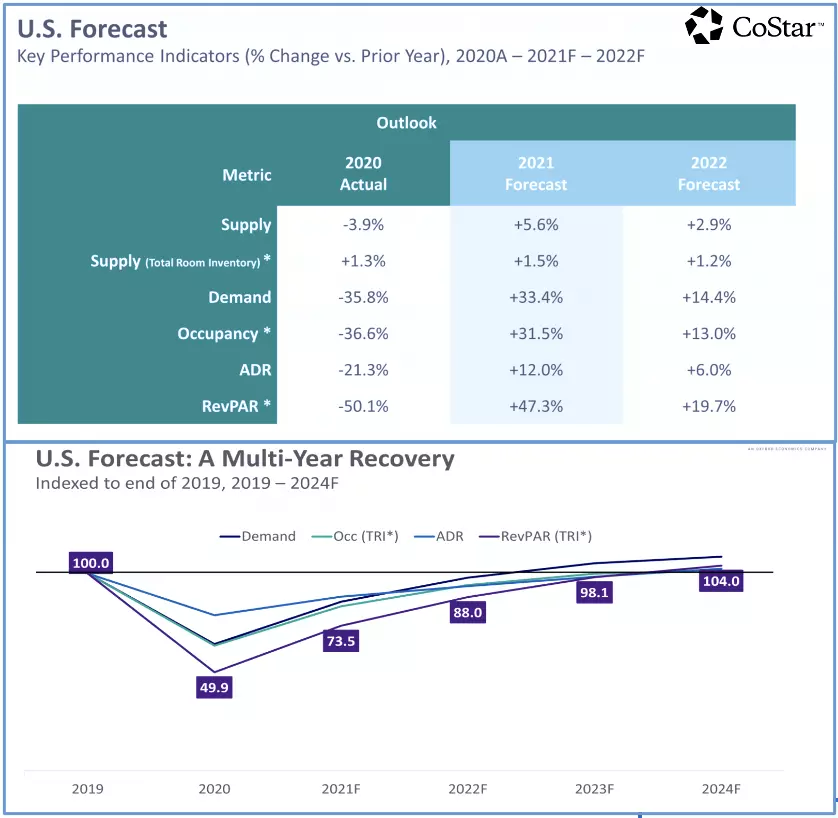

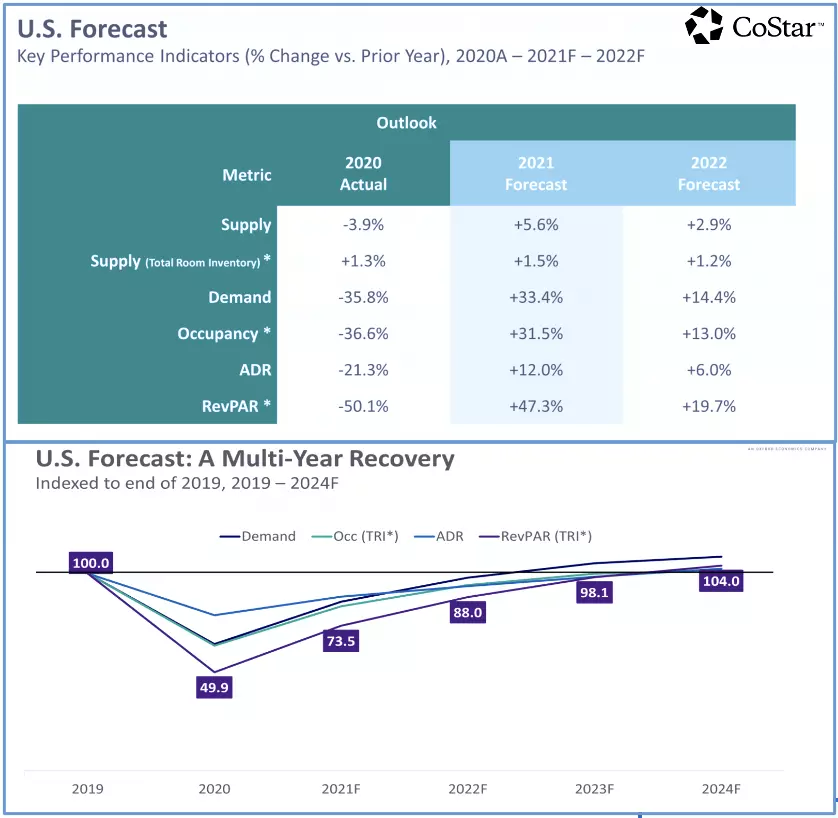

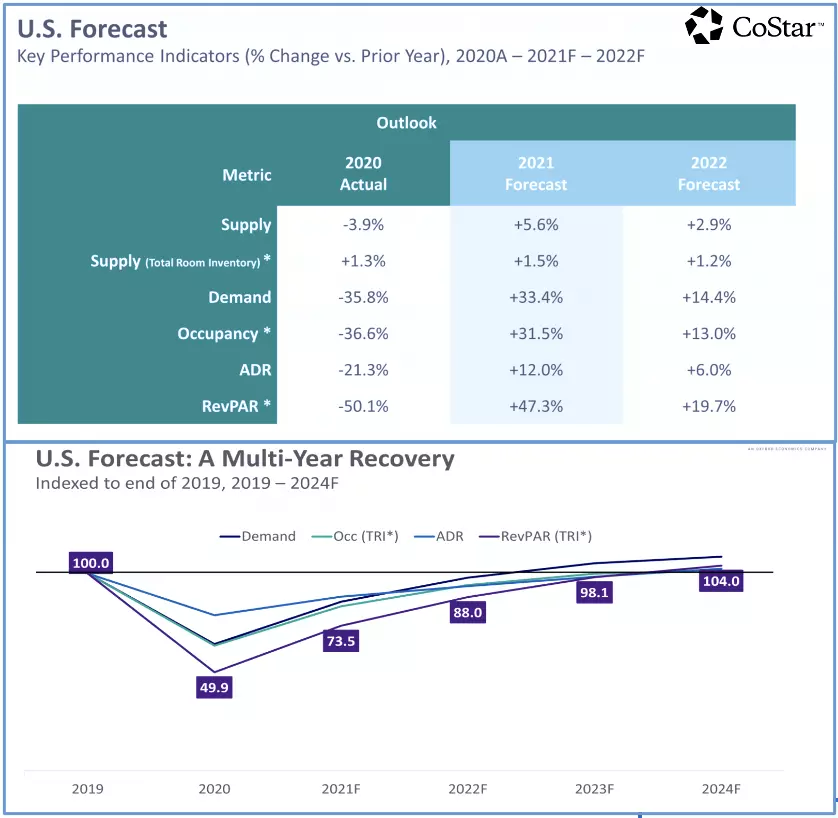

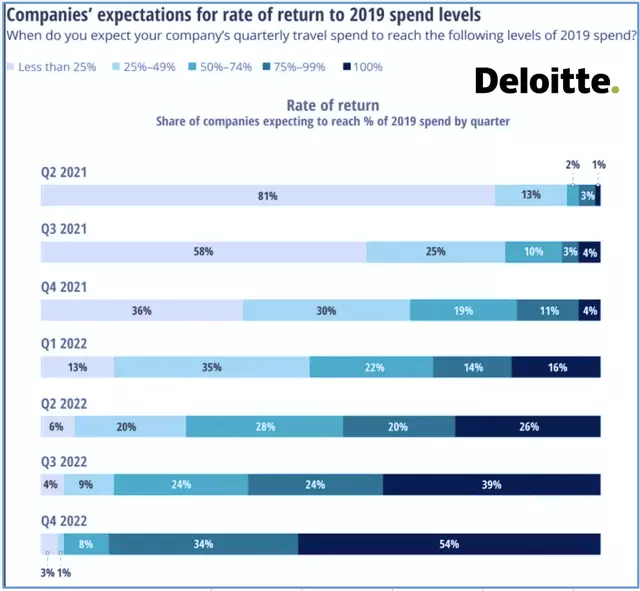

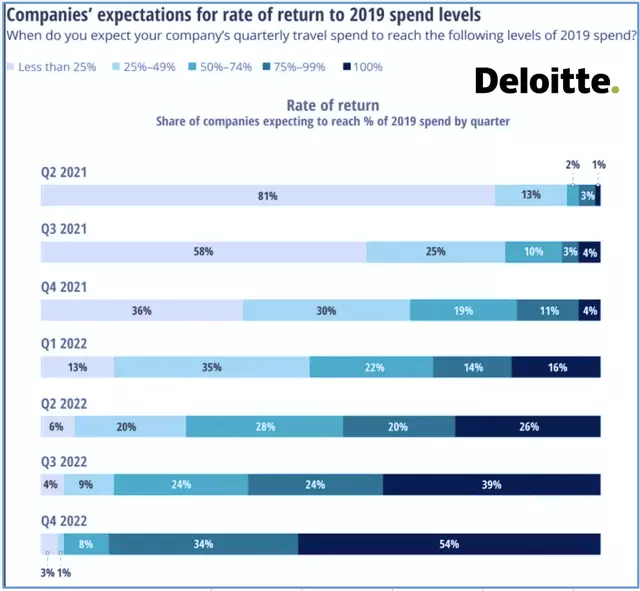

According to STR, a leading provider of hotel market data, while the industry is projected to recapture about 85% of occupancy by the end of this year, revenue per available room (RevPAR) is expected to be 30% lower in 2021 than in 2019. This means that hotel guests will pay significantly lower daily rates, on average, compared to pre-pandemic levels. A full recovery in occupancy and RevPAR is not expected until 2023 and 2024, respectively, as transient business, group, and international travel continue to face challenges.

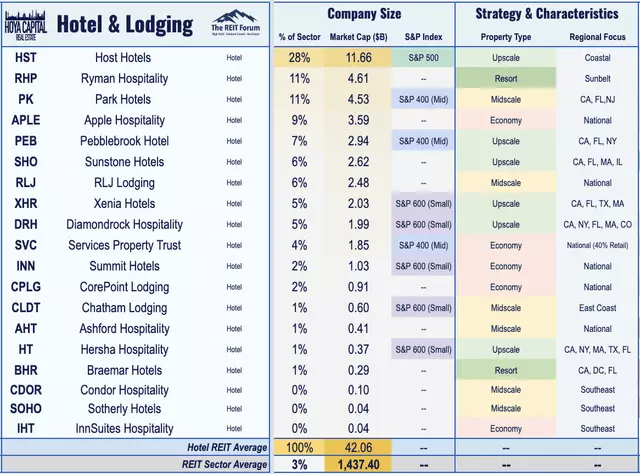

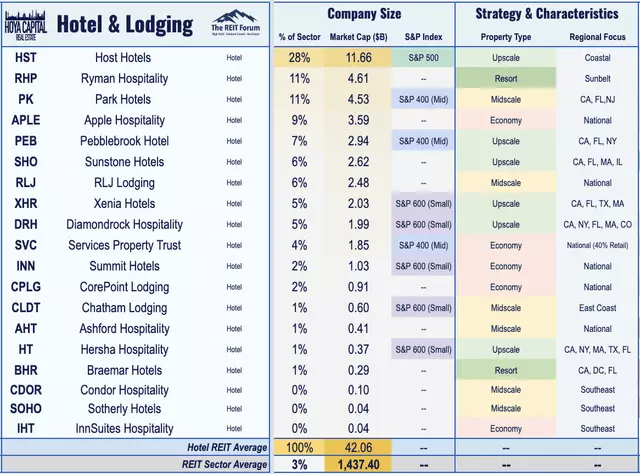

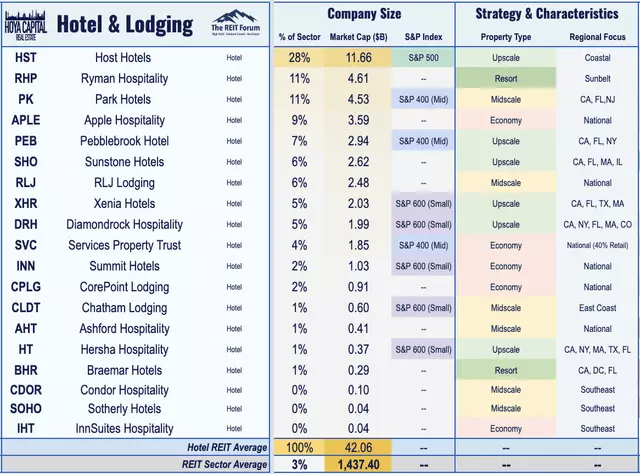

As discussed earlier in our article on office REITs, the return to the office and business travel is not happening as planned this fall. Many corporate events and conventions scheduled for this season have been canceled or postponed once again. As a result, hotel REITs heavily reliant on business travel and conventions during the "shoulder seasons" have experienced muted occupancy gains compared to hotel REITs focused on the lower end of the price spectrum, which cater more to domestic leisure travelers.

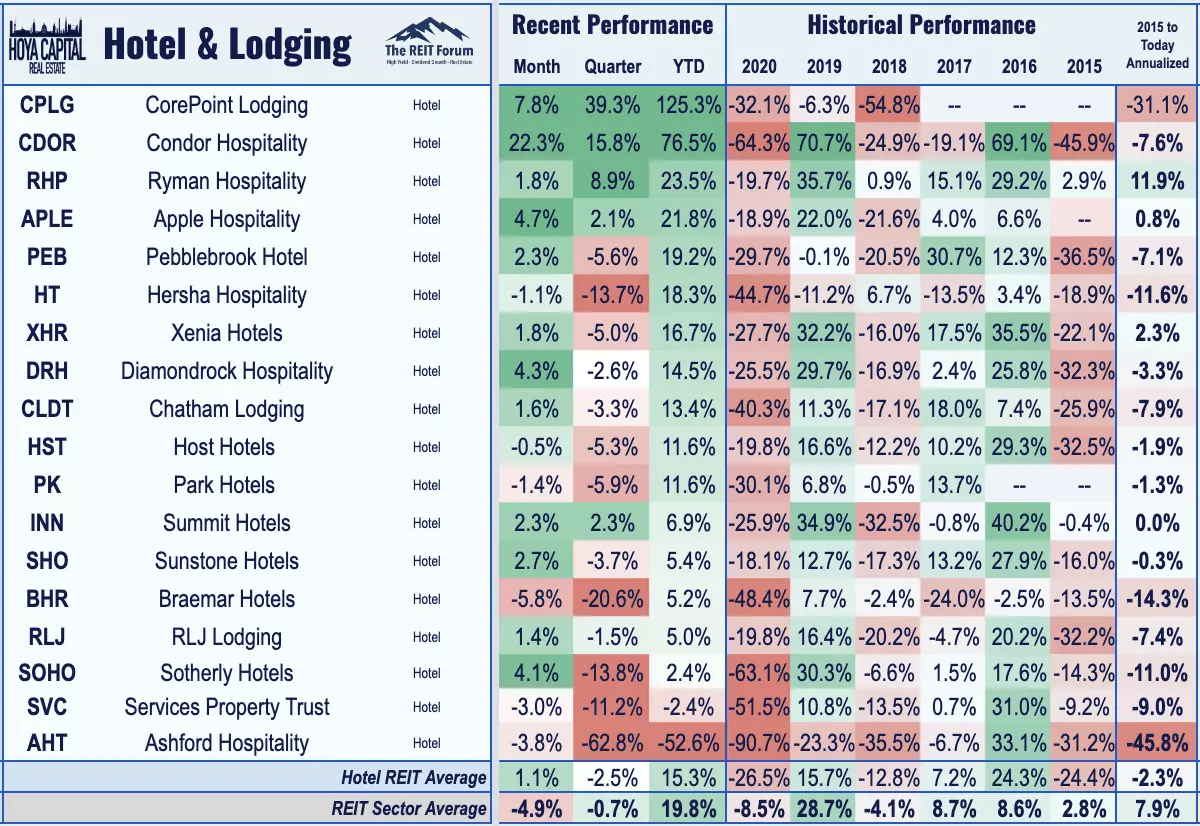

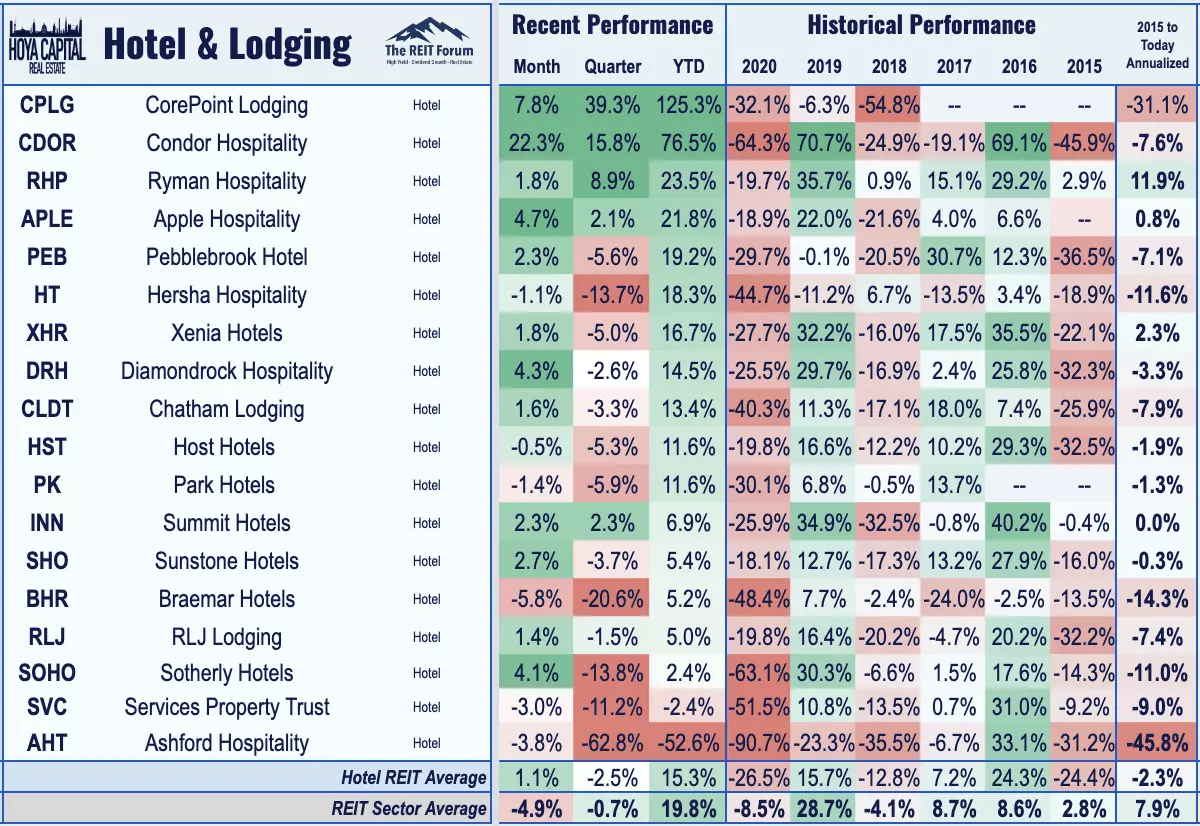

Hotel REIT Stock Performance

Hotel REITs, along with the global leisure and tourism industry, were severely impacted in the early stages of the pandemic, experiencing a decline of more than 65% between late February and early April 2020. However, with the vaccine rollout, there was a "reopening rotation" into the COVID-sensitive sectors, including hotel REITs. After a strong post-vaccine share price recovery, hotel REITs and the broader hospitality industry have stalled in recent months due to the "fourth wave" of the pandemic. While hotel REITs have outperformed the market-cap-weighted average, their gains have slightly lagged behind the performance of the Vanguard Real Estate ETF (VNQ) and the S&P 500 ETF (SPY).

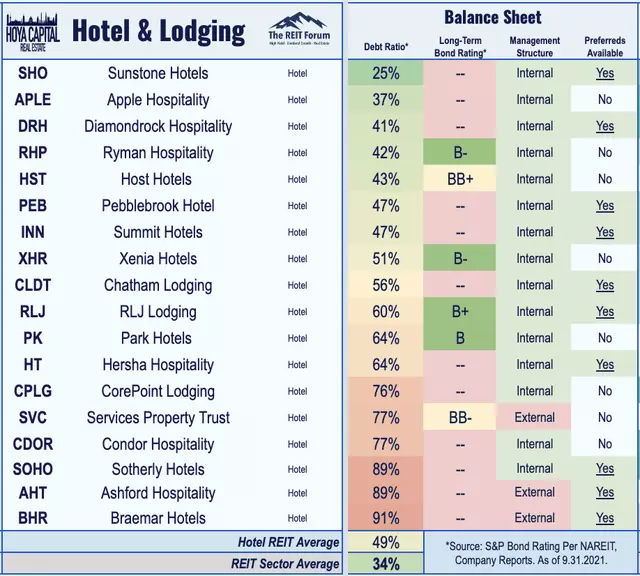

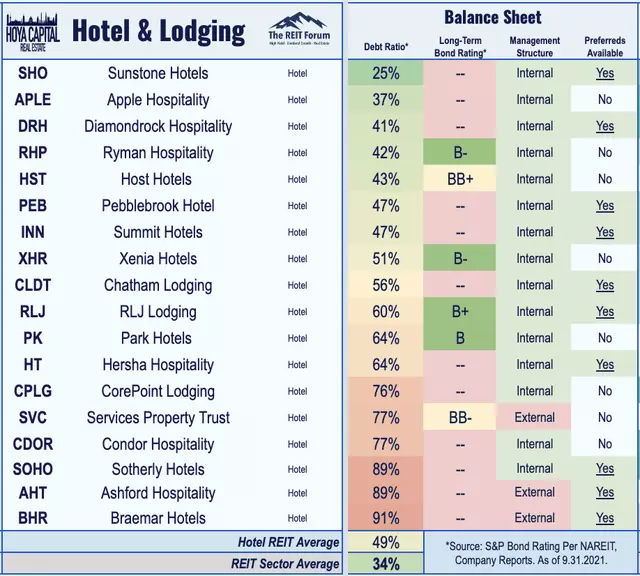

Small-cap CorePoint Lodging (CPLG) has emerged as the top performer this year, with solid earnings results and plans to explore strategic alternatives to maximize shareholder value. Condor Hospitality (CDOR) has also seen significant gains after announcing a deal to sell its entire portfolio of hotels to Blackstone (BX) in a $305 million all-cash transaction. Notably, Ashford Hospitality (AHT) and other small-cap hotel REITs have faced challenges due to balance sheet issues and a high level of leverage.

Deeper Dive: Hotel REIT Economics

Hotel ownership is a capital-intensive business, especially during challenging times. Many hotel operators, such as Marriott (MAR), Hilton (HLT), Hyatt (H), Choice Hotels (CHH), and Extended Stay (STAY), do not actually own the hotels they manage. Instead, they operate with an "asset-light" model, resulting in higher margins and lower leverage. In contrast, hotel REITs operate under an asset-heavy model and have lower margins. During normal times, hotel REITs have adjusted NOI margins of just 10-20%, the lowest among REIT sectors. This operating profile makes them highly sensitive to changes in supply and demand conditions. While hotel REITs may be less nimble and have slower growth rates compared to hotel operators, they historically offer sizeable dividend yields to investors.

In recent years, hotel operators have faced challenges from the growth of short-term home rentals offered by platforms like Airbnb. Although Airbnb's valuation may be viewed skeptically, the utilization of short-term home rentals has increased. These rentals currently represent less than 10% of available room nights on an average night but experience significant supply growth during periods of high demand. Studies have shown that short-term rentals particularly affect urban hotels, compromising their pricing power on critical compression nights.

Hotel REIT Dividend Yields

Paying dividends becomes challenging when hotels are operating at reduced occupancy levels. On average, hotel REITs require occupancy rates of 40-50% to cover their expenses. Once a sector known for high dividend yields, all 18 hotel REITs significantly reduced their dividends last year, making up a substantial portion of total dividend cuts across the market. Currently, hotel REITs offer an average dividend yield of just 0.1%, significantly lower than the market-cap-weighted average yield of 2.8% and the 6.7% yield on the Hoya Capital High Dividend Yield Index.

While emergency stimulus programs and access to capital helped hotel REITs avoid severe financial distress, they were not enough to prevent a wave of dividend cuts last year. As expected, hotel REITs have been among the last REITs to restore their dividends. Currently, only four out of the eighteen hotel REITs pay a dividend. Nine of the hotel REITs also have exchange-listed preferred securities, which saw suspended distributions during the peak of the pandemic. However, all except two have since resumed and caught up on their preferred dividends.

Key Takeaways: Preparing for Winter

With the resurgence of COVID variants, the outlook for hotel REITs remains uncertain. Despite initial optimism fueled by vaccine development, hotel REITs are now the weakest-performing property sector since the widespread availability of vaccines. The recovery of international tourism will likely take an extended period, and the return of business travel remains uncertain. Considering the risks, it is advisable to approach hotel REIT investments with caution. While midscale portfolios and those focused on the Sunbelt region may offer better prospects, valuations are currently unattractive, with near-zero dividend yields and the potential for future setbacks.

For a comprehensive analysis of all real estate sectors, be sure to check out our quarterly reports on various segments of the market. Please note that Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. Additionally, Hoya Capital holds a long position in all components of the Hoya Capital Housing 100 Index and the Hoya Capital High Dividend Yield Index. For more information, visit our website.