Image source: stockstudioX/E+ via Getty Images

Image source: stockstudioX/E+ via Getty Images

Are you an income investor searching for something different to add to your portfolio? Look no further than EPR Properties (NYSE:EPR), an entertainment-focused real estate investment trust (REIT) that offers a well-supported 7% dividend yield. While many REITs typically invest in residential or commercial properties, EPR Properties stands out by owning a vast portfolio of experiential properties, such as theaters, tourist attractions, fitness and wellness facilities, and snow-sport destinations.

A Strong Post-Pandemic Recovery

Like many businesses, EPR Properties faced challenges during the COVID-19 pandemic when non-essential facilities were forced to shut down. However, the REIT has experienced a strong post-pandemic recovery in terms of its funds from operations (FFO) and revenue. As a result, the dividend was reinstated, as predicted, and the company's shares still have revaluation potential in FY 2024.

Data by YCharts

Data by YCharts

Previous Rating and Potential for Growth

I previously recommended EPR Properties as a countercyclical investment, anticipating the reinstatement of its dividend and a significant FFO recovery once its facilities reopened to the public. Although the shares have revalued lower by 8% since then, the REIT's FFO has steadily normalized, and its dividend has been reinstated. I believe EPR Properties is not only a good buy for income but also has the potential for further revaluation.

A Balanced Portfolio with Unique Experiences

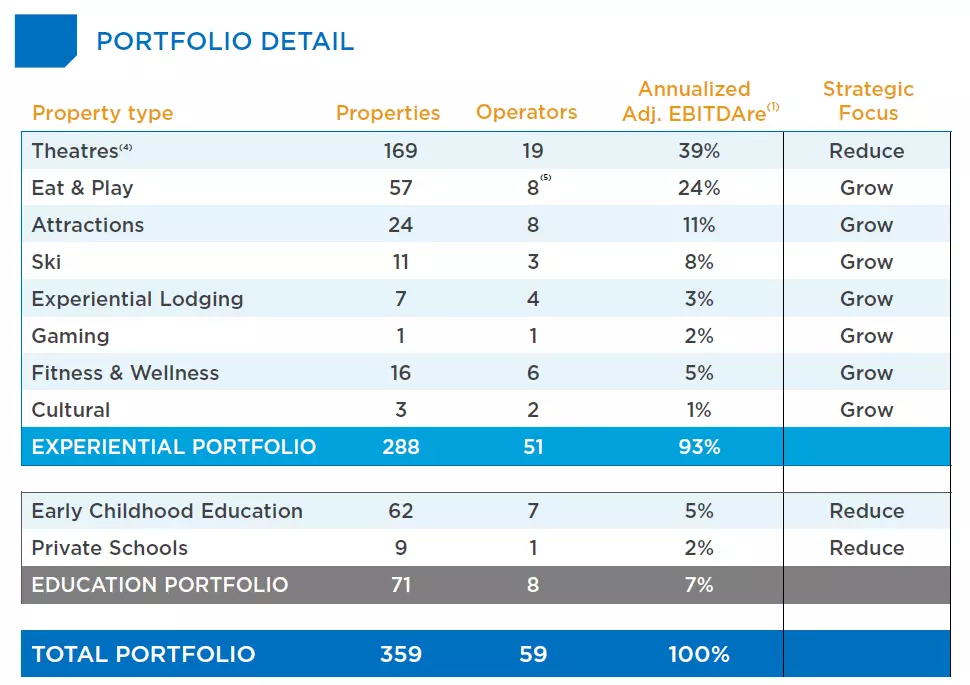

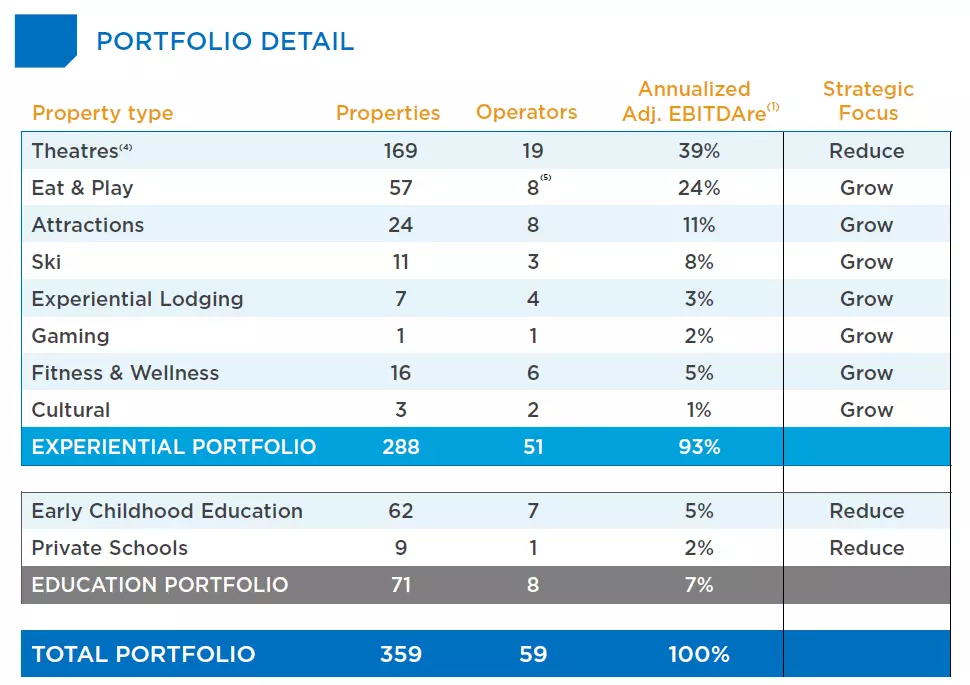

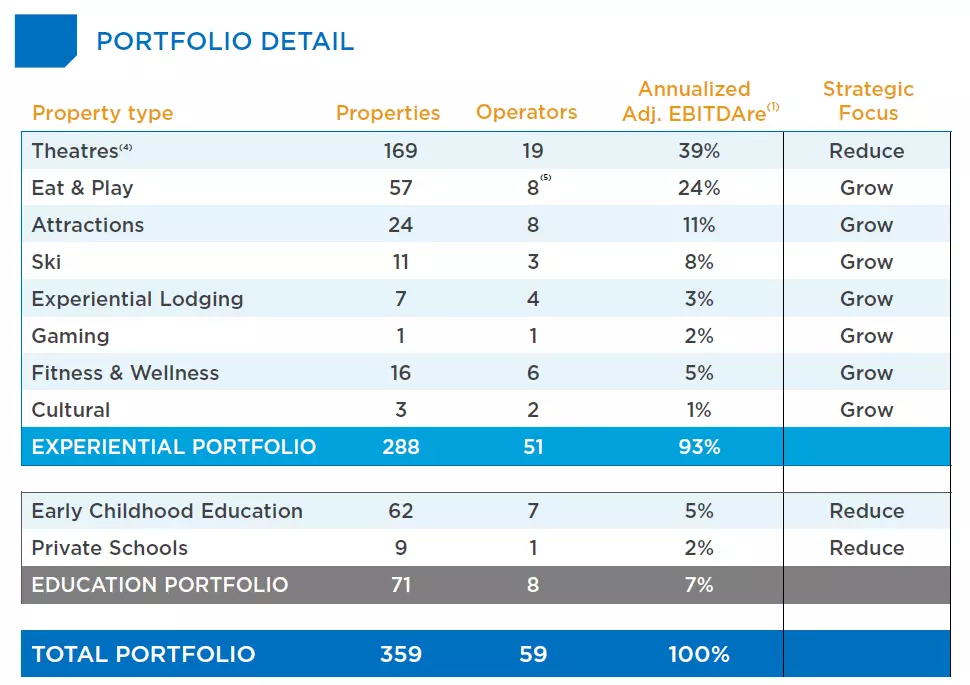

EPR Properties distinguishes itself with its unique portfolio of investment properties. With its focus on entertainment facilities, the REIT provides visitors with unforgettable experiences. While the trend towards streaming movies and TV shows has impacted theater attendance, EPR Properties has adjusted its strategy to reduce exposure to the theater segment. In total, the REIT owns 288 experiential properties and an additional 71 properties in the education sector.

During the pandemic, EPR Properties experienced a decline in visitor numbers due to travel restrictions. However, over the past three years, the REIT has made a significant recovery, fully restoring its revenue and FFO profile to pre-pandemic levels. It has also resumed its monthly dividend payments, currently set at $0.275 per share.

Strong Balance Sheet and Debt Structure

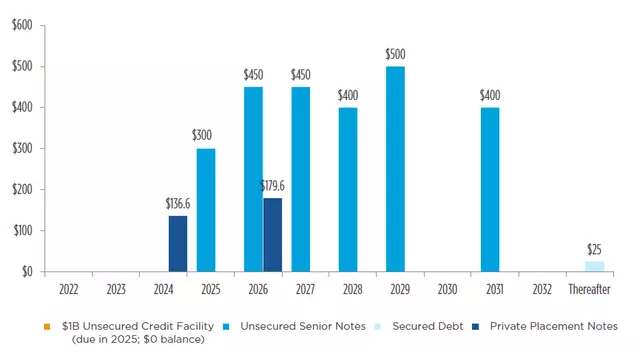

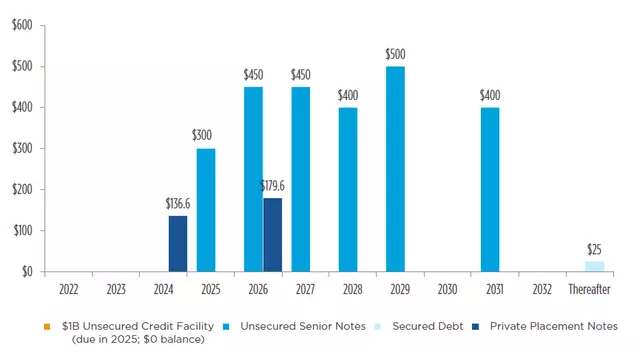

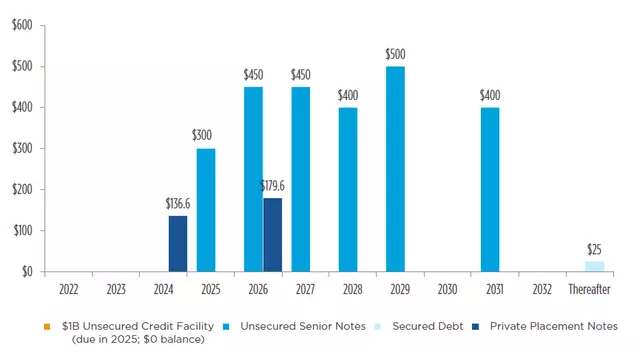

One key factor that sets EPR Properties apart is its strong balance sheet. The REIT has achieved investment-grade credit ratings from major rating agencies such as Fitch, S&P, and Moody's. Over 50% of its capitalization consists of common and preferred equity, and its net debt remains moderate compared to its total equity. With a stable balance sheet and a full FFO recovery underway, EPR Properties presents a promising yield opportunity in FY 2024.

The REIT's well-laddered debt maturity structure provides additional support. EPR Properties had no significant debt maturities in 2023 and only has a limited amount due in 2024. The majority of its debt is scheduled for repayment in FY 2026 or beyond.

Potential for Dividend Raise in 2024

Following the FFO recovery, EPR Properties now offers income investors solid dividend coverage. In Q3'23, the REIT achieved $1.47 per share in adjusted diluted FFO, a year-over-year increase of 27%. With a dividend coverage ratio of 178% for Q3'23 (162% in FY 2023, YTD), there is room for the REIT to potentially increase its dividend in FY 2024.

Fair Value Potential

EPR Properties has guided for adjusted funds from operations of $5.14 per share for the current fiscal year, indicating a 5% year-over-year growth. Considering the potential for a similar growth rate in the next fiscal year, the REIT is currently valued at a forward P/FFO ratio of 9.1X. Given its 7% dividend yield and solid coverage, it is not unreasonable to consider a fair value closer to $65 per share, representing a 32% upside revaluation potential.

Risks to Consider

Investing in EPR Properties is subject to certain risks. One key factor is the assumption that the U.S. economy will avoid a recession and maintain consumer spending on travel and leisure experiences. Any major decline in consumer spending or the occurrence of a new pandemic could negatively impact the REIT's funds from operations trajectory.

Closing Thoughts

I recommended EPR Properties over two years ago, and I continue to believe that it offers a well-supported 7% dividend yield for investors. The REIT has experienced a significant FFO recovery and has the potential for further growth, provided the U.S. economy remains stable. With its decent dividend coverage metrics, EPR Properties may even raise its monthly dividend in FY 2024. Consider investing in this unique entertainment-focused REIT and seize the opportunity for both income and potential revaluation.