This definitive guide will walk you through the essential elements of a comprehensive real estate due diligence checklist. Whether you're a seasoned investor or new to the game, conducting thorough due diligence is crucial to mitigate risks and make informed decisions. In addition, we'll explore how digitizing the process can increase efficiency and streamline your workflow.

What is Due Diligence in Real Estate?

Before diving into the checklist, let's understand the concept of due diligence in real estate. Due diligence is an exhaustive review of a potential investment property to identify any risks or red flags that may impact your investment decisions. It involves assessing the property's financials, legal and zoning compliance, physical condition, tenant leases, and other relevant factors. By conducting due diligence, you can ensure the property aligns with your risk profile and investment strategy.

How Long Does the Due Diligence Period Last?

The duration of the due diligence period can vary depending on various factors, such as the complexity of the deal and the buyer's processes. Typically, the period ranges from 30 to 90 days, as specified in the Purchase and Sale Agreement (PSA). During this time, buyers have the opportunity to thoroughly examine the property and its documentation before finalizing the purchase.

Preliminary Checklist

The preliminary stage of due diligence involves conducting the initial inspections and gathering relevant documents. Here are some key items to review:

- Current title policy and other related documents

- Development and construction plans

- Property condition report

- Government-issued documentation (permits, certificates, warranties, etc.)

- Property tax bills and utility bills

- Environmental and energy reports

- Capital expenditures

- Personal property documentation

- Assessment of identified issues and total expenses

By completing these steps, you will gain a comprehensive understanding of the property and its suitability for your investment strategy.

Site Underwriting Checklist

Once you've passed the preliminary stage, it's time to dive deeper into the property's financial, legal, and physical aspects. Here's a breakdown of what to review:

Financial & Insurance:

- Appraisals of the property

- Insurance policies and previous claims

- Rent roll and tenant expenses

- Service contracts and cancellation penalties

- Demographic research and competitive analysis

- Comparative analysis of selling price, lease financials, and cash flow

Title, Zoning & Surveys:

- ALTA survey and topographical surveys

- Zoning compliance certificate

- Review of liens and encroachments

- Examination of legal restrictions and easements

- Interviews with local municipality representatives

Legal:

- Assessment of impending and ongoing litigation

- Review of the property's legal description

Documents:

- Letter of intent and client authorization

- Review of the purchase contract

Property:

- Site inspection to assess location and market viability

- Common area maintenance (CAM) recommendations

Tenant/Leasing:

- Review of pro forma information

- Analysis of current tenant leases and credit ratings

- Assessment of SNDAs and tenant sales reports

- Interviews with current tenants

- CAM recommendations for tenant fees

By thoroughly examining these aspects, you will gain a comprehensive understanding of the property's financial, legal, and physical condition.

Streamlining the Due Diligence Checklist

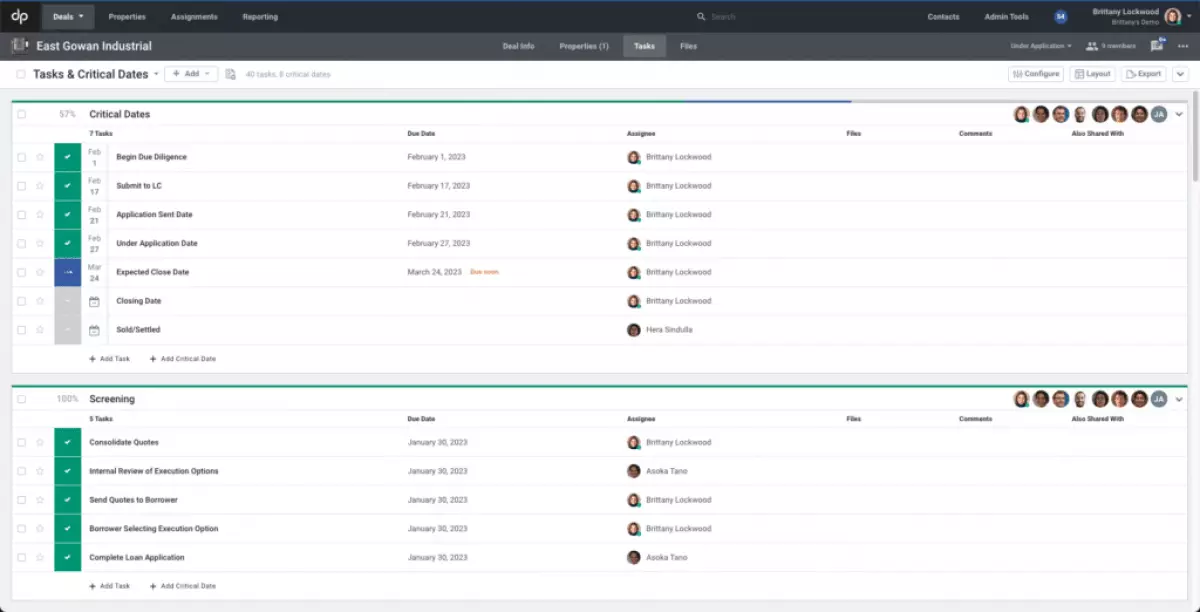

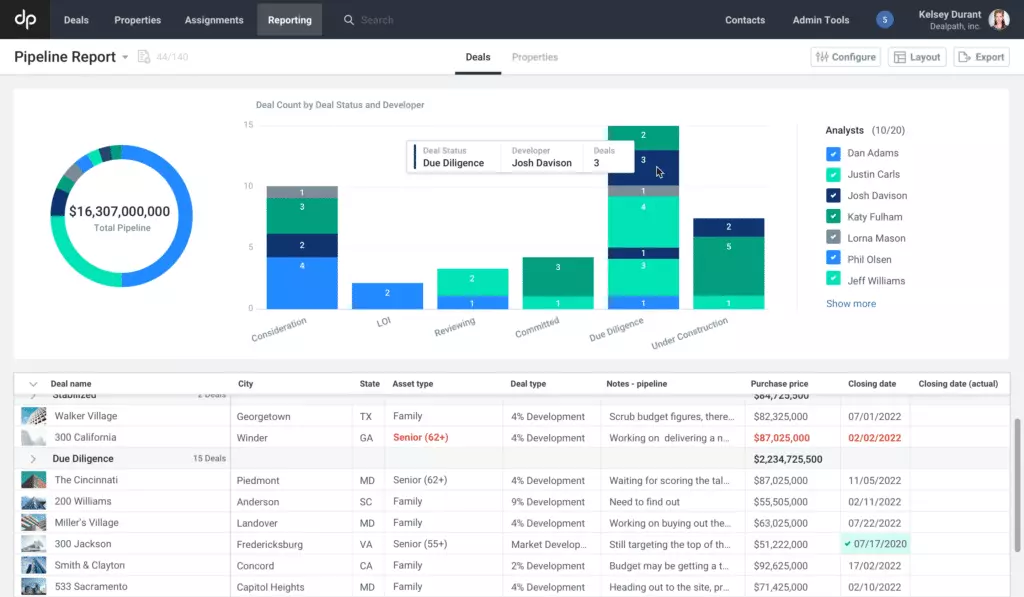

To streamline the due diligence process, many real estate professionals are turning to digitized solutions. Deal management software, such as Dealpath, can help optimize your workflow and increase efficiency. Here are five critical considerations when choosing a digital platform:

- Real-Time Visibility: Ensure your software provides real-time updates and progress tracking to keep everyone on the same page.

- Standardize Checklists: Simplify the process by using efficient templates tailored to different deal types and roles.

- Automate Communications: Automate alerts and communications to keep team members informed and on track.

- Track Approvals: Document and track task approvals to ensure nothing falls through the cracks.

- Reporting: Generate configurable reports to keep stakeholders informed about outstanding tasks and timelines.

By leveraging a cloud-based tool like Dealpath, you can enhance collaboration, centralize information, and increase overall efficiency.

Creating Visibility and Accountability

Standardizing your due diligence checklists within a digital platform empowers your team with clear visibility and accountability. Deal data is accessible to everyone involved, eliminating information silos and ensuring efficient collaboration. Additionally, new team members can easily understand their tasks, and executives can monitor progress and make informed decisions.

Take Your Real Estate Due Diligence Checklist to the Cloud

In today's collaborative environment, managing due diligence in the cloud is essential. It enables seamless integration of data, eliminates manual processes, and improves overall productivity. Download our free e-book to discover how modern deal teams are leveraging cloud-based tools to mitigate risk, streamline workflows, and drive operational efficiencies.

Commercial real estate due diligence

Commercial real estate due diligence

Due diligence in real estate

Due diligence in real estate