Image: bjdlzx/E+ via Getty Images

Image: bjdlzx/E+ via Getty Images

REIT Rankings: Cell Towers

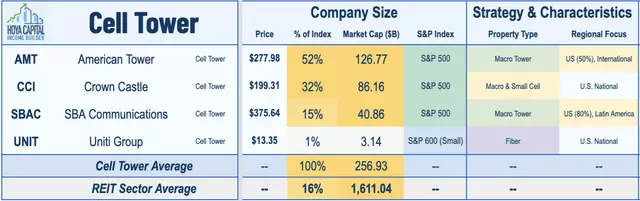

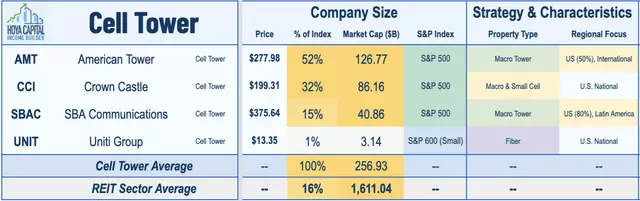

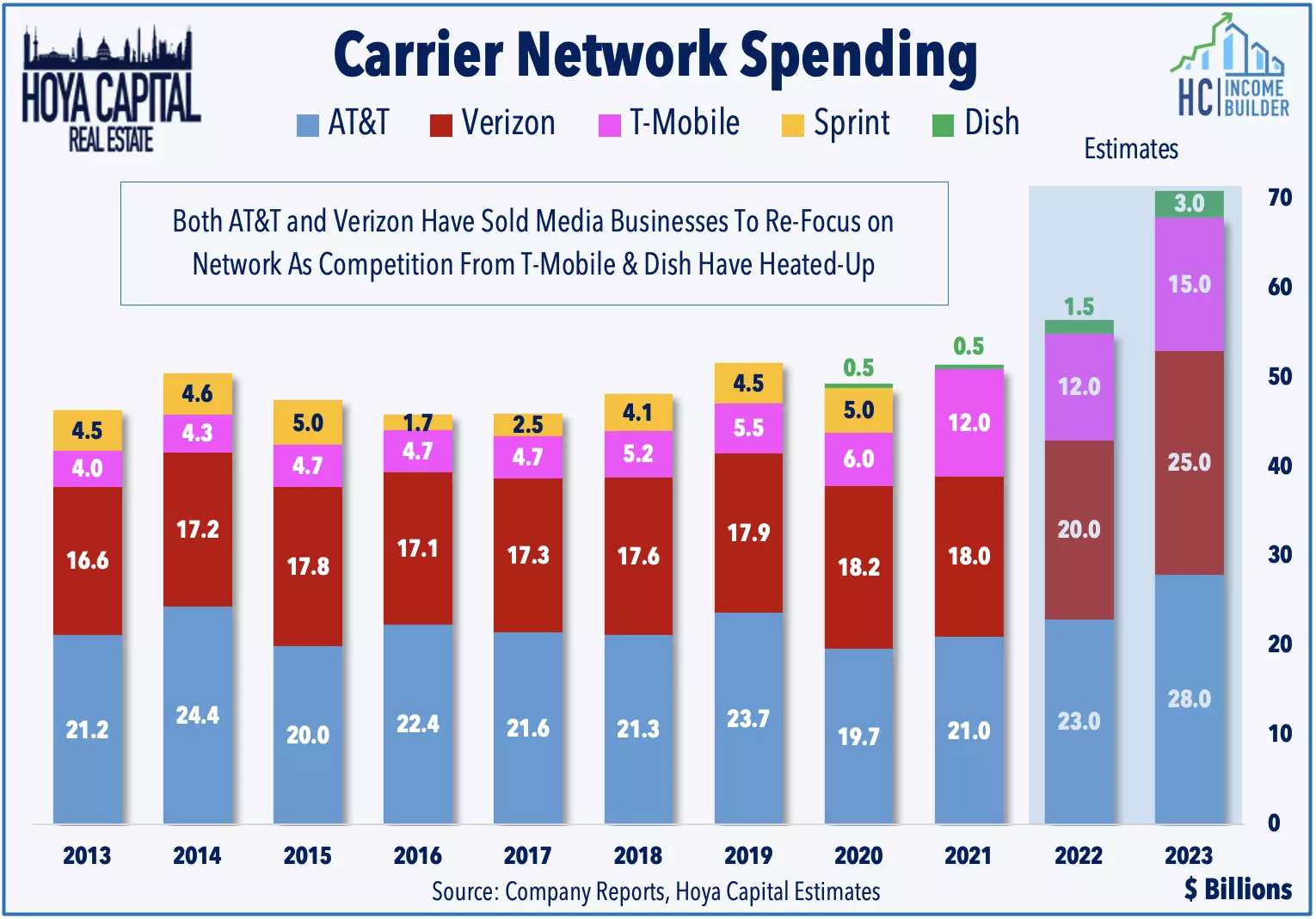

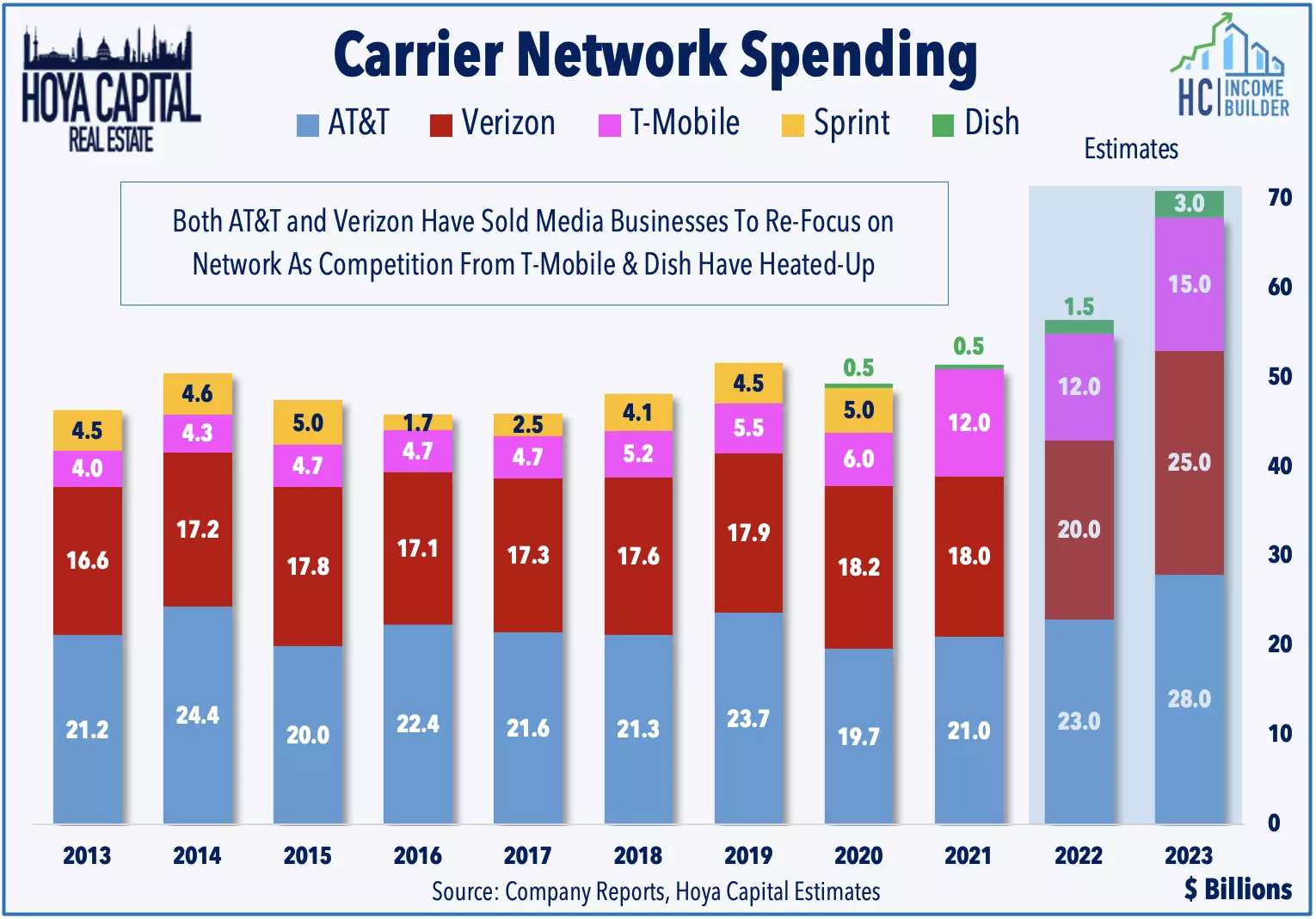

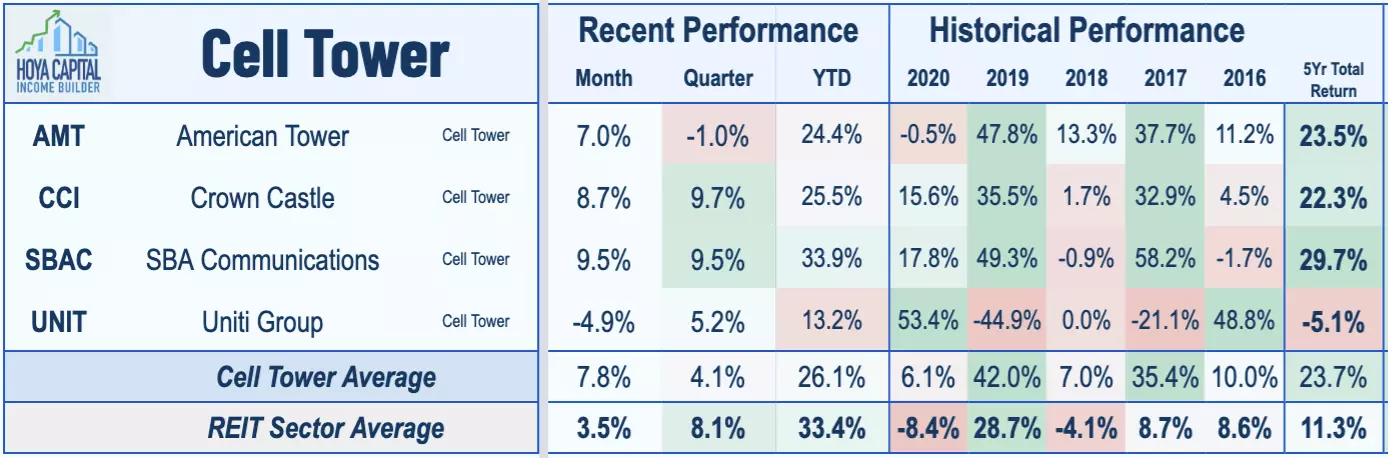

Within the Hoya Capital Cell Tower REIT Index, we track the three Cell Tower REITs that account for over $250 billion in market value: American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC). These REITs are the landlords to the four nationwide cellular network operators in the U.S.: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH). They own a significant percentage of the investment-grade macro cell towers in the United States.

The Dominance of Cell Tower REITs

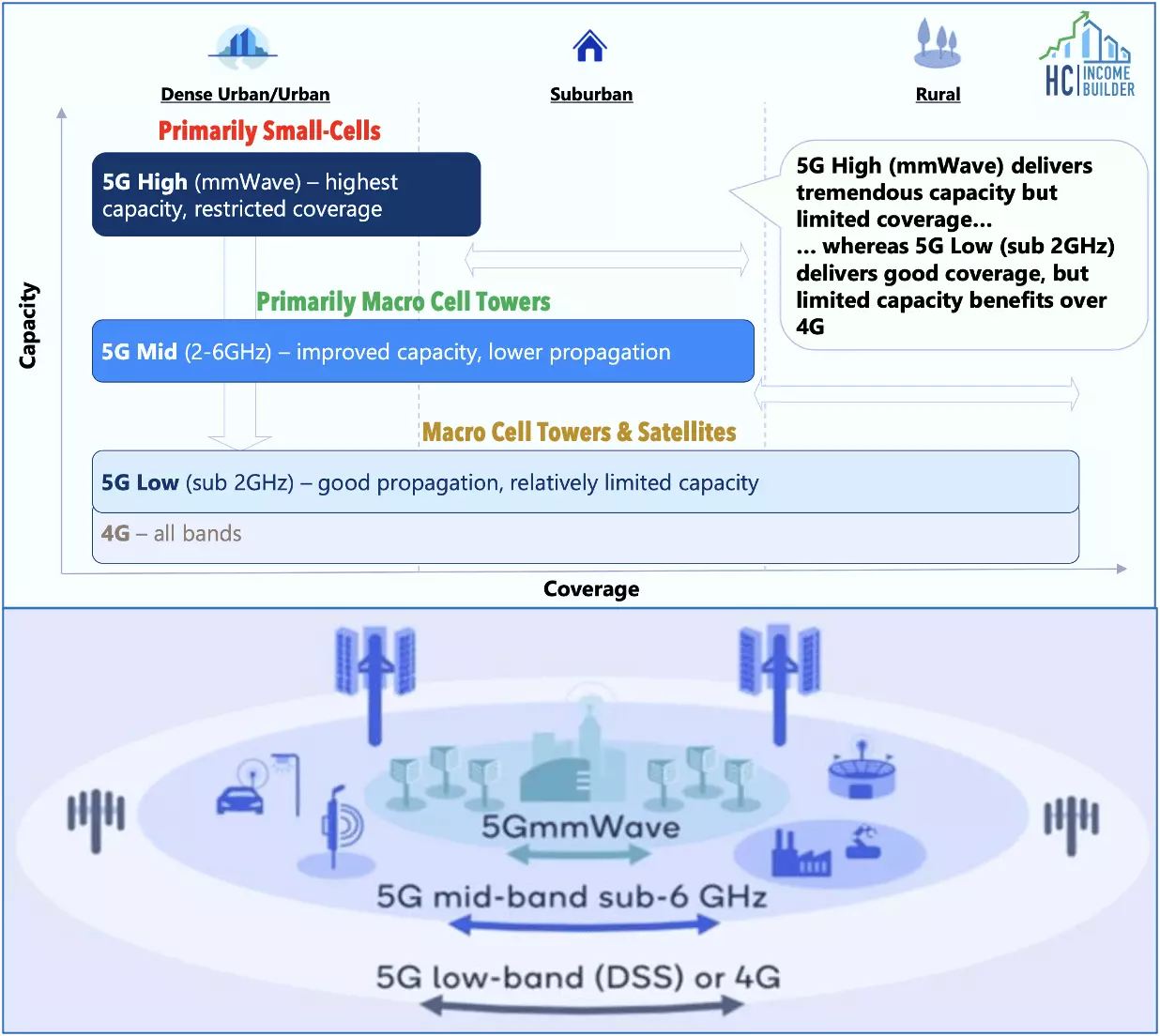

Cell Tower REITs have become the largest real estate property sector and a critical growth engine of the REIT industry in recent years. These REITs control nearly 75% of wireless communication infrastructure in the U.S. and over 50% in several major international markets. With their dominant position, they play a vital role in providing the infrastructure for cellular networks. They have also been crucial in supporting the deployment of nationwide 5G networks by upgrading equipment on existing macro towers.

The Challenges of 5G Rollout and Technological Advancements

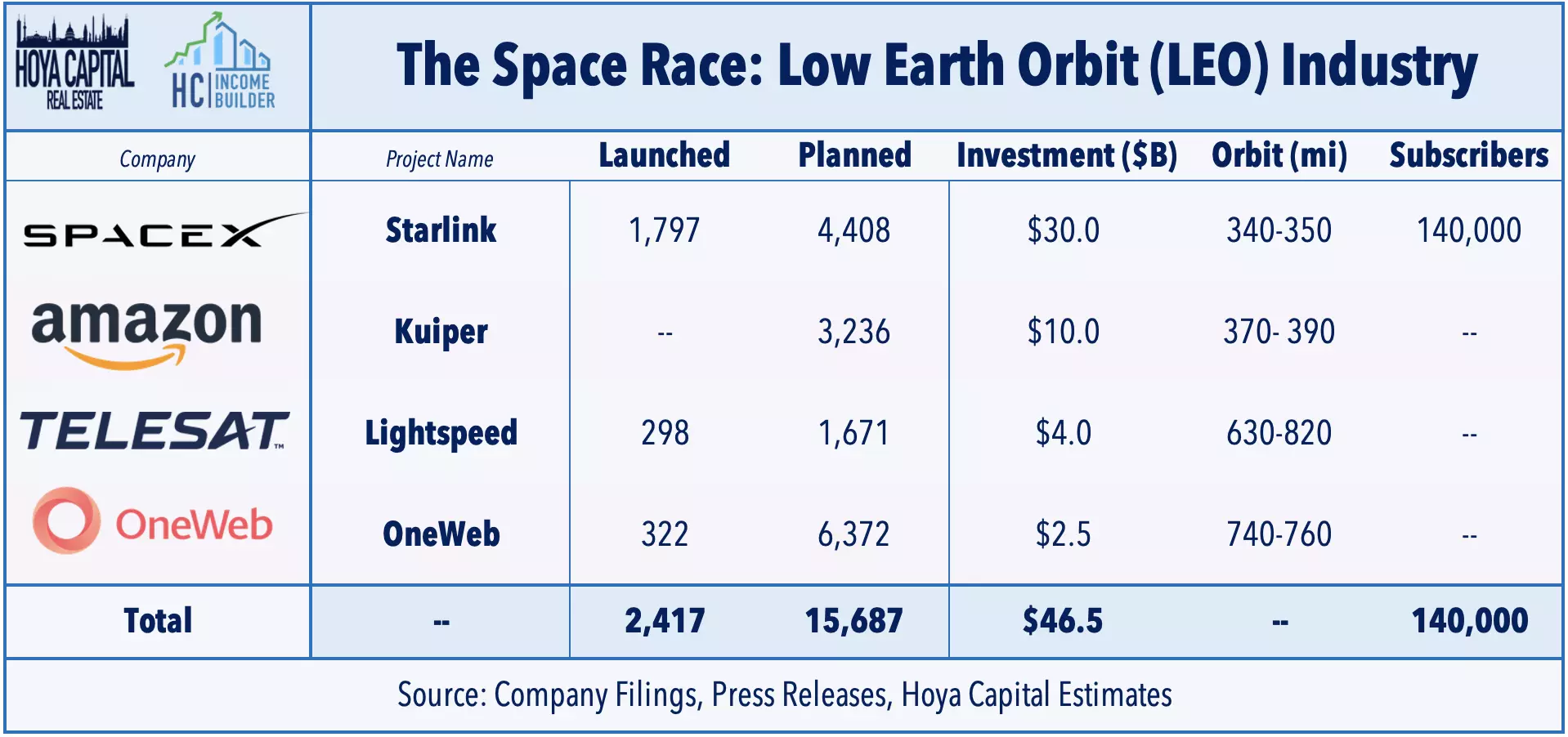

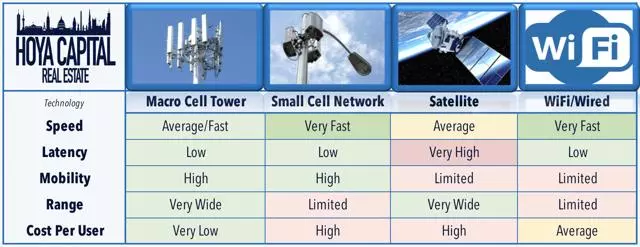

While the three major U.S. carriers have successfully rolled out their "nationwide" 5G networks, there have been delays and challenges along the way. Concerns over potential interference within the C-band spectrum have raised questions about the smooth deployment of 5G from macro cell towers. Additionally, the emergence of Low-Earth-Orbit (LEO) satellite networks poses a potential long-term threat to macro tower networks. Despite these challenges, cell tower REITs remain resilient, adapting to the evolving landscape.

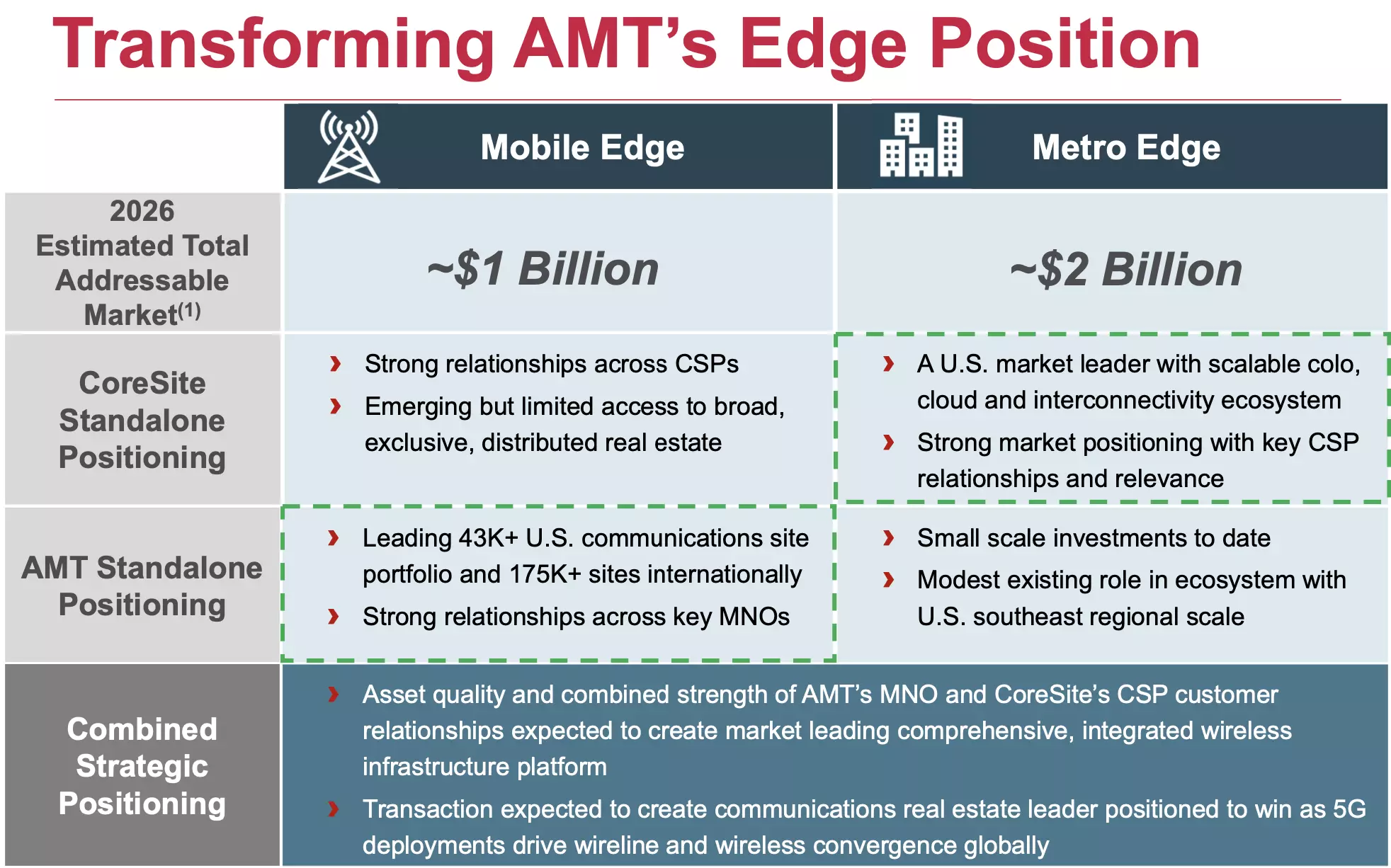

Embracing the Edge Networks

To stay ahead in the industry, American Tower made a strategic move by acquiring data center REIT CoreSite. This acquisition positions American Tower to establish dominant positioning in "Edge" networks, where cell tower sites will host "mini data centers" to reduce latency for time-sensitive applications like self-driving vehicles. While the full potential of the "edge" is still unfolding, this move shows AMT's commitment to staying at the forefront of technological advancements.

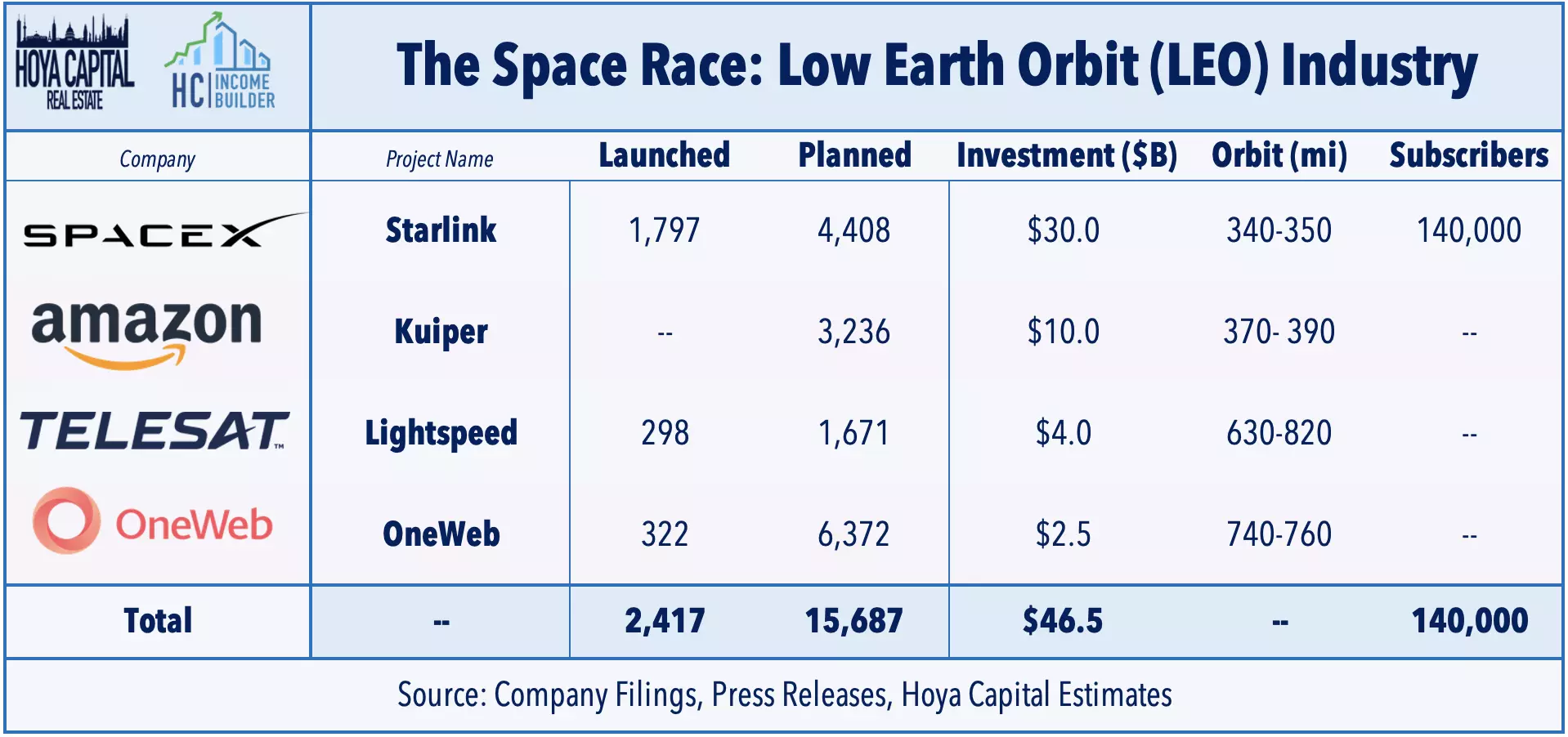

The Rise of LEO Satellite Networks

The emergence of Low Earth Orbit (LEO) satellite networks, led by companies like Starlink, Amazon's Kuiper Project, Telesat's LightSpeed, and OneWeb, has captured the attention of the industry. These networks aim to provide broadband coverage through satellite constellations. While LEO satellite networks pose some potential disruption to ground-based towers, the existing infrastructure and the superior technology of macro towers make them the preferred choice for mobile networks. Cell tower REITs continue to monitor the LEO industry closely, ensuring their strategies adapt to potential future challenges.

Cell Tower REIT Stock Performance

Despite recent challenges, Cell Tower REITs have delivered solid earnings results. However, they have lagged in terms of stock performance compared to the broader real estate sector. Concerns over inflation and rising interest rates have affected the sector, but their strong competitive positioning and growth initiatives continue to drive long-term optimism.

Cell Tower REITs and Earnings Outlook

Cell Tower REITs have been steadily raising their full-year outlooks, driven by growth in their international markets. American Tower, SBA Communications, and Uniti Group have reported solid results and raised their guidance for the year. These REITs are actively expanding their asset base through acquisitions and new tower builds, further solidifying their position in the industry.

Cell Tower Industry Dynamics and Pricing Power

Cell Tower REITs have a unique advantage in the real estate sector as true price makers. Due to the high concentration of ownership and barriers to entry related to restrictive zoning, these REITs have substantial pricing power. With their significant control over the wireless communication infrastructure, they have become indispensable partners for cell carriers. Cell tower leases typically have long-term agreements and provide steady cash flows for these REITs.

The Future of Cell Towers in Wireless Networking

While wireless broadband is gaining traction as 5G's "killer app," macro towers will remain the primary technology for high-speed wireless networks. The presence of cell tower REITs and their infrastructure is vital to the expansion of wireless connectivity. As the demand for data continues to grow, these REITs will play a pivotal role in supporting the evolving needs of the telecommunications industry.

Cell Tower REIT Dividend Yields

Cell Tower REITs offer relatively lower dividend yields compared to other sectors. However, they have demonstrated robust annual dividend growth over the past five years. With their favorable cash flow positions, these REITs have room for additional dividend growth and external expansion.

Key Takeaways: Navigating the Future with Confidence

Cell Tower REITs have emerged as dominant players in both the telecommunications and real estate sectors. Their relentless growth, strategic acquisitions, and investments in next-generation technologies position them to thrive in the evolving landscape of wireless networking. While challenges exist, these REITs continue to demonstrate their adaptability and resilience, making them a compelling option for investors seeking exposure to the future of telecommunications.

For an in-depth analysis of all real estate sectors, be sure to check out our quarterly reports covering various sectors, including cell towers. Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE.