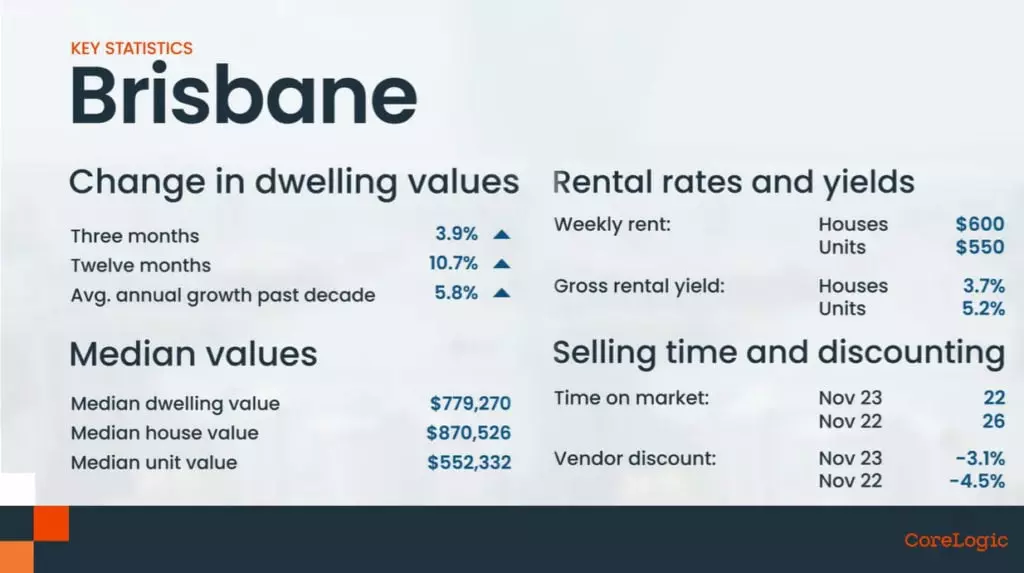

Brisbane remains one of the strongest capital city housing markets, with dwelling values rising consistently at more than 1% month on month since May. The market recovered in October from an 8.9% drop in values through the downturn, with the latest November update taking the cumulative growth trend since January’s trough to 12.2%. Advertised stock levels remained 35% below the 5-year average in late November, while from a demand-side the estimated volume of home sales is trending almost 5% above average levels. House values are showing a slightly stronger rate of appreciation through the upswing, rising 12.5% since the market bottomed out, compared with an 11.3% rise in unit values.

Image source: Saigon Intela

Image source: Saigon Intela

Here's what's happening in Brisbane property

Brisbane was the strongest property market in 2021, exhibiting astonishing growth, with many locations experiencing 30+% house price growth as the relentless demand for Queensland property fueled a record pace of growth. And even as growth slowed across Australia in 2022, Brisbane’s housing markets continued to perform strongly during the first half of the year, its downturn lagging far behind and only following suit in the second half of the year.

And this was despite suffering from devastating floods early in the year - just another sign of the resilience of the Brisbane property market. Unlike in Sydney and Melbourne, prices are still far higher across the city than just 12 months ago, reflecting the enormity of the previous upswing.

CoreLogic reports that Brisbane's dwelling values increased by 42.7% from trough to peak over the Covid period, but dwelling values have now fallen -9.4% from their peaks in June 2022, but as always the housing market in Brisbane is very fragmented. Digging deeper into the stats, some properties have far outperformed others, and freestanding Brisbane houses within 5-7 km of the CBD or in good school catchment zones have grown in value strongly. It’s really a tale of two cities - while some properties overperform, others underperform.

The worst-performing segments of the market are apartments (particularly high-rise towers and new off-the-plan apartment sales) and properties in blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and many people will be out of work for a while. It’s likely that some of the high-rise apartment towers in and around Brisbane’s CBD, which were already suffering from the adverse publicity of structural problems prior to Covid-19, will now become the slums of the future as they are shunned by homeowners and investors. Like after every downturn, moving forward there will be a flight to quality properties and an increased emphasis on livability. That explains why we’re seeing robust demand for A-grade homes and investment-grade properties, particularly in lifestyle locations, with many holding their values well.

Going forward, there is a clear consensus that Brisbane’s property prices will continue to fall, but that once the Reserve Bank finishes up its cycle of interest rate increases to get a hold on Australia's surging inflation rate, Brisbane’s property market will begin a fast recovery. Here are some of the most recent forecasts:

- ANZ Bank forecast Brisbane property values could decrease 10% in 2023

- CBA forecast Brisbane property values could decrease 6% in 2023

- NAB forecast Brisbane property values could decrease 9.4% in 2023

- Westpac forecast Brisbane property values could decrease 6% in 2023

- PropTrack forecast Brisbane property values could decrease 8-11%

Unlike elsewhere in the country, where there has been a sharp turn in buyer and seller sentiment towards caution and hesitancy, demand for Queensland property remains robust with buyers aware that you can get more bang for your buck versus Victoria or NSW.

Listings are low, clearance rates are stable

This year, sellers have erred on the side of caution before listing and the trend is moving lower again with the flow of new listings consistently below average since spring last year as sellers sit on their hands. Brisbane’s new listings are 17.8% lower than the previous five-year average and almost 20% lower than a year ago.

Seller and buyer sentiment also continues to weigh on Brisbane's clearance rates, which are stable at around 56.1% of 88 auctions over the third weekend in March. However, this is significantly lower than the national clearance rate of 63.4%, reflecting the more challenging selling season.

Queensland’s economy held up by migration and population growth

Brisbane and Queensland can thank a huge influx of internal migrants for the robustness of their property markets - between the pandemic, lockdowns, and a surging property market, many Australians, particularly from Victoria and NSW, flocked northwards to our Sunshine State in search of more affordable property in lifestyle suburbs. Similarly, popular areas of the Gold Coast and Sunshine Coast have enjoyed strong demand considering the increased flexibility of being able to work from home and commuting to the big smoke less frequently.

At the same time, property investor activity has been strong, particularly for houses, not only coming from locals but also from interstate investors who see a strong upside in Brisbane property prices as well as favorable rental returns. Of course, there is not one Queensland property market, nor one south-east Queensland property market, and different locations are performing differently and are likely to continue to do so.

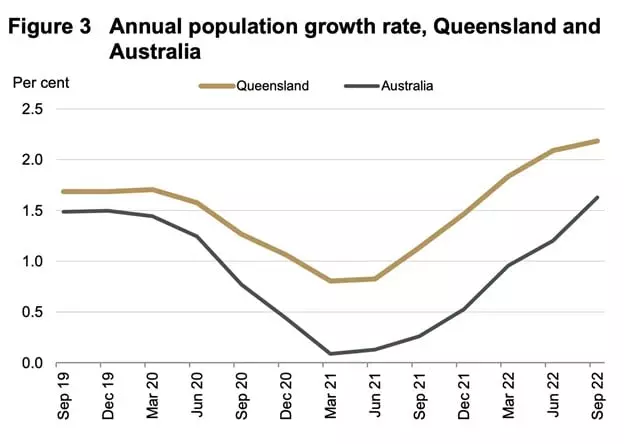

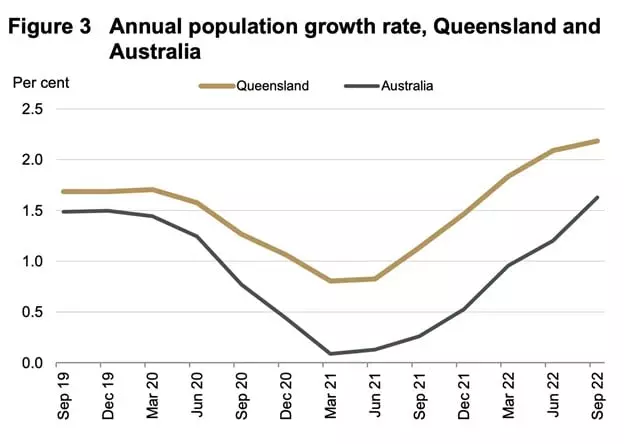

Queensland recorded a population growth rate of 2.2% in the 12 months to September 30, 2022, above the national average (1.6%) and the highest of all states and territories.

Net interstate migration made the largest contribution to population growth in Queensland in the 12 months to September 30, 2022 (40.7%), followed by net overseas migration (37.4%) and natural increase (21.9%) - each of these migration flows is holding at a remarkably strong pace.

Brisbane’s fundamentals are very strong

While Brisbane’s red-hot property market may now have gone cold, even outside of Brisbane’s population and migration growth, the remainder of the city’s underlying fundamentals are very strong. Queensland has made history by becoming the best-performing state economy for the first time in January this year.

The recent CommSec State of the States report shows that its economy has been growing at a faster pace than any other state in Australia, thanks to strong population growth, a solid job market, and overseas demand for energy resources, such as coal and natural gas. It is worth noting that Queensland has the highest underemployment rate and lowest participation rate and employment-to-population ratio across the major eastern states. And I would argue it has been this job growth that has fueled record levels of migration because most will not be willing to make a life-changing move unless they have some form of employment on the horizon. This is something that was sorely missing from the Sunshine State in the first half of the last decade.

Another appeal of Queensland’s property market is that values remain low relative to other major cities - and we know affordability is a key driver of migrants into the area. The median dwelling price for our combined capital cities now sits at $761,674, but for Brisbane, this sits much lower at $694,495 - that’s significantly below Sydney’s $1.006 million median and Melbourne’s $743,554 median price. The affordability of Brisbane’s property market is much better than its respective major cities, which is particularly valuable at a time when interest rates are rising steeply.

Moving forwards, the 2032 Olympics, which will be hosted by Brisbane, will put pressure on the need for upgraded infrastructure and transport in Brisbane, the Gold Coast, and the Sunshine Coast. This will likely put a rocket under Brisbane’s property market as infrastructure spending can be the most powerful force in residential real estate - It can transform local economies and generate real estate booms. Major infrastructure projects can elevate the appeal of locations by improving the accessibility or amenity of an area, and they can also generate economic activity and jobs during construction.

Brisbane’s rental markets

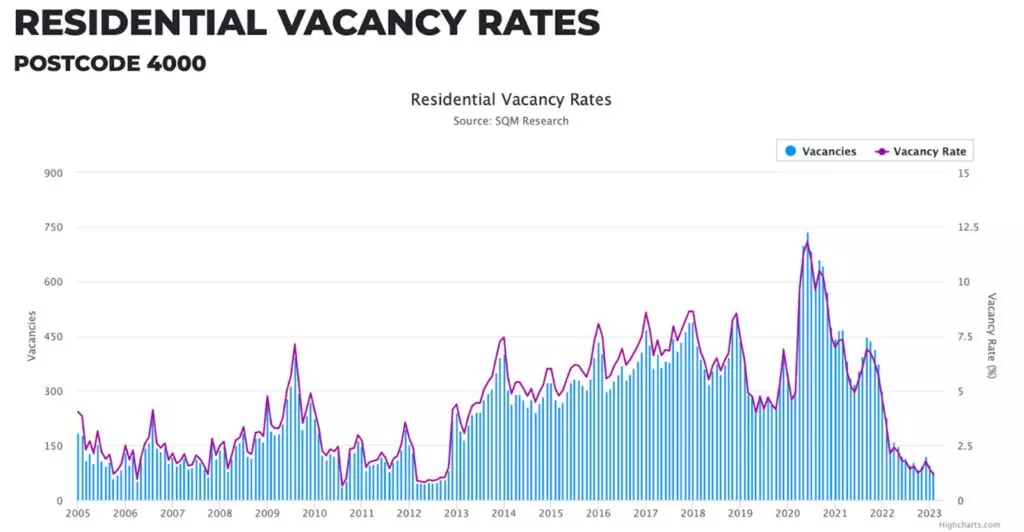

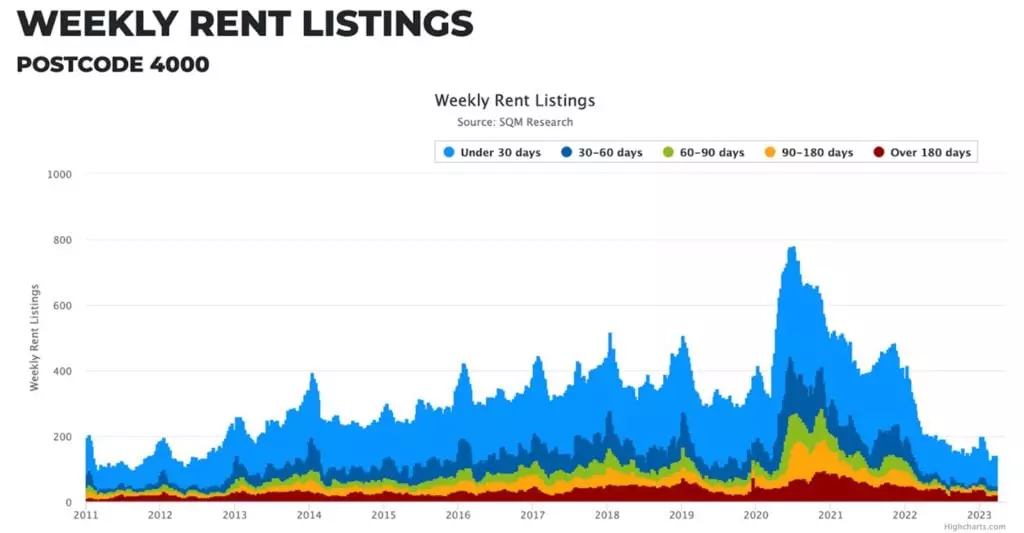

Traditionally in Brisbane, vacancy rates have been tight - hovering well below the level of 2.5% vacancies, which traditionally represents a balanced rental market. It currently sits around 1.2%, according to SQM Research, but asking rents are still rising.

That’s right, like everywhere else in the country, Brisbane’s rental market is in crisis. The city has seen significant investment in recent years, and many people have moved to Brisbane to take advantage of job opportunities and a high quality of life. But the migration surge has led to an increased demand for rental properties, which has kept the vacancy rate low. While the current vacancy rate in Brisbane may be good news for landlords, it only serves to exacerbate the city’s already pressurized rental market, with renters increasingly struggling to look for affordable housing.

With a low vacancy rate and declining listings rate, there may be fewer rental properties available and more competition for those that are on the market.

Brisbane’s top performers 2022

2022 was a challenging year for all our property markets as cash rate hikes, lower borrowing capacity, and cooling demand took a toll on prices throughout the city. However, the Brisbane real estate market remains very resilient. Of course, there is not one “Brisbane property market,” and some segments outperformed others.

Here are some of the best performers for Queensland in 2022, according to CoreLogic’s Best of the Best report 2022:

These are the Brisbane Suburbs with the top sales in 2022:

As you can see, Moreton Bay South, Ipswich, and Brisbane City dominate the strongest markets for houses and units in Greater Brisbane. And in regional Queensland, the Gold Coast and Sunshine Coast have seen an impressive volume of sales over the past 12 months. In fact, regional Queensland is home to the suburbs with the strongest price growth for both houses and units - Gin Gin (Wide Bay) and Laguna Quays (Mackay, Isaac, Whitsunday) with increases of 33.5% and 30.9% respectively. As with Sydney and Melbourne, there is a strong correlation between the prices of dwellings in markets and recent growth performance. This means the ‘higher end’ of the Brisbane market is generally making larger gains. You can read our Sydney housing market update here and the Melbourne housing market update here.