Ever wondered how much that charming bungalow down the street sold for back in the day? We've all been there! Understanding the ebb and flow of property values can be fascinating. In this article, we'll journey through the historical data of US housing prices from 1953 to 2023. We'll unpack the difference between average and median prices, explore the trends and pinpoint the factors that have shaped the market we know today.

We'll also delve into the intriguing world of inflation-adjusted prices, giving you a clearer picture of how real estate values have shifted over the decades. So, buckle up and get ready for a trip down memory lane – it's going to be an insightful ride!

Decoding the Numbers: Average vs. Median Home Prices

Before we dive into the historical data, let's clarify the key players: average and median prices.

- Average Price: Imagine adding up the prices of all homes sold in a certain period and then dividing by the total number of homes. That's your average price. It can be swayed by outliers (those super-luxurious mansions or surprisingly affordable fixer-uppers).

- Median Price: Now, picture lining up all the homes sold from least to most expensive. The price smack-dab in the middle is your median. It's like the "Goldilocks" price – not too high, not too low, but just right for representing the typical market value.

The Upward Climb: Average and Median Home Prices Over Time

Data from FRED, a reliable source managed by the Federal Reserve Bank of St. Louis, reveals some eye-opening trends:

- Average price in Q2 2023: $495,100

- Peak: $552,600 (Q4 2022)

- Lowest: $17,200 (Q1 1963)

- Median price in Q2 2023: $390,500

- Peak: $417,800 (Q4 2022)

- Lowest: $17,500 (Q1 1963)

The takeaway? Both average and median prices have been on a steady climb over the decades, albeit with some dips and surges along the way.

A Visual Journey: Charting the Trends

A picture is worth a thousand numbers, right? Let's see what the historical trends look like:

Notice those distinct periods of growth? The late 70s, the late 90s, and the 2010s were boom times for the housing market. Conversely, the early 80s, the late 2000s (remember the housing crisis?), and recent times have seen slight downturns.

What Drives the Housing Rollercoaster?

Fluctuations in the housing market aren't random. Several key factors play a role:

The Balancing Act: Supply and Demand

It's Economics 101: When the number of eager buyers outweighs available homes, prices shoot up. Conversely, a surplus of homes for sale can lead to price drops.

The Money Factor: Income, Inflation, and Interest Rates

Rising incomes often fuel demand for housing, pushing prices upward. However, high inflation and interest rates can make mortgages less affordable, potentially cooling down the market.

Feeling Confident? Consumer Sentiment Matters

When the economy is humming and people feel optimistic about the future, they're more likely to invest in homes. Conversely, economic uncertainty can make buyers hesitant.

Government: A Helping Hand or a Steady Hand?

Government policies, like tax incentives for homebuyers or regulations for builders, can influence the housing market.

Location, Location, Location: Regional Variations

The US is a diverse country, and housing markets reflect that. Factors like climate, job opportunities, and local amenities all contribute to regional price differences.

A Blast from the Past: Median Prices of Existing Homes

Now, let's rewind even further, all the way back to 1953, using data from DQYDJ:

- Median price in September 2021: $363,300 (both nominal and inflation-adjusted)

- Median price in January 1953:

- Nominal: $18,080

- Inflation-adjusted: $207,781

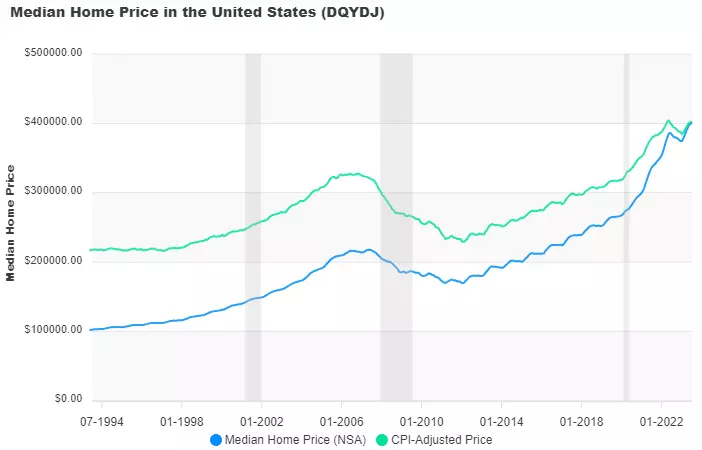

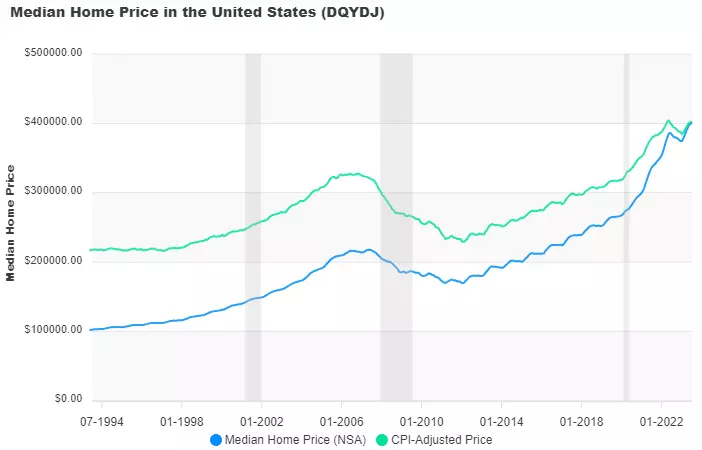

Here's a visual representation:

As you can see, while nominal prices (the sticker price at the time) have skyrocketed, inflation-adjusted prices tell a different story. They highlight that real home values, while still increasing, haven't risen as dramatically.

Wrapping It Up: A Historical Perspective

Understanding historical property values allows us to appreciate the dynamic nature of the housing market. It's a story of booms and busts, influenced by a complex interplay of economic factors, government policies, and even our own feelings about the future. So, the next time you're chatting about real estate, remember, there's a rich history behind those numbers!