Real estate transactions can be complex, and it's crucial for homebuyers to have a thorough understanding of every aspect involved. One area that often gets overlooked is title insurance and its significance in protecting property rights. In this article, we'll explore the anatomy of a title commitment, shedding light on its purpose and what homebuyers should know.

What is a title commitment?

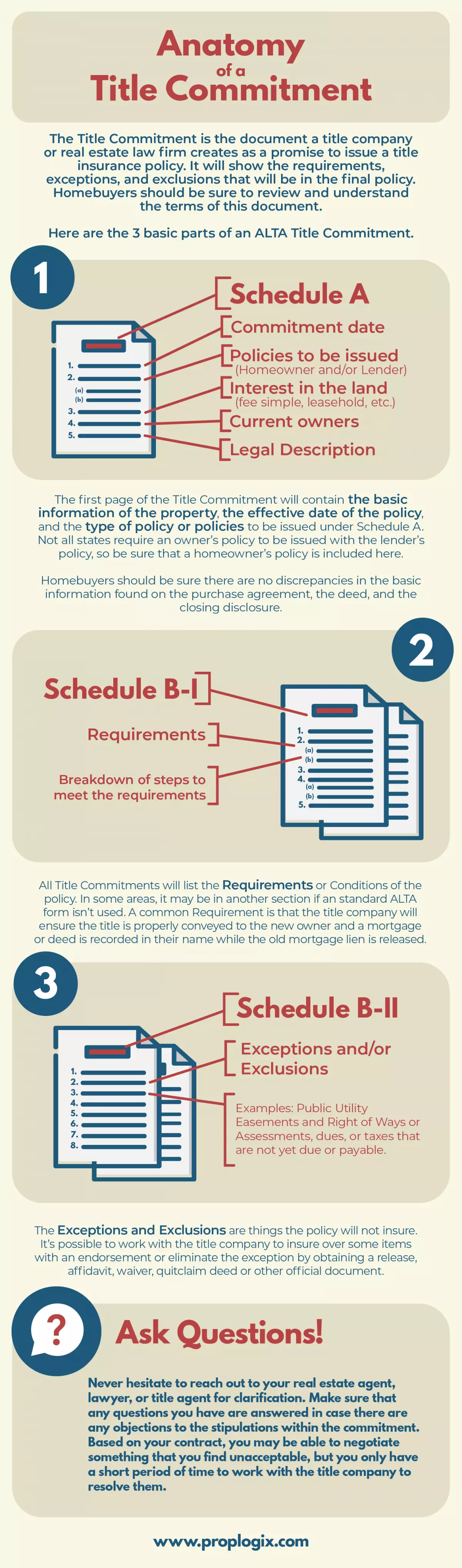

A title commitment serves as a promise from a title company or real estate law firm to issue a title insurance policy. It acts as a road map for the title agent, guiding them in resolving any defects and ensuring a clear title transfer to the homeowner. Depending on your location, a title commitment might also be referred to as a preliminary title report or a binder.

Unlike other types of insurance that safeguard against unforeseen future events, title insurance focuses on eliminating risk before issuing the policy. It is a one-time premium payment rather than monthly installments. To issue the title commitment, the title agent, underwriter, or third-party vendor conducts a comprehensive title search, based on which they create the commitment.

Reviewing the Title Commitment

Before closing, homebuyers will receive the title commitment. It's essential to review this document, along with other paperwork received from the lender and seller, such as disclosures and loan estimates. Take the time to understand the terms outlined in the commitment and seek clarification from your real estate agent, lawyer, or title agent if needed. It's crucial to address any objections or concerns within a limited timeframe.

Similar to a Loan Estimate reflecting the final Closing Disclosure, the title commitment will contain the same terms, requirements, exceptions, and exclusions found in the insurance policy.

The Basic Parts of an ALTA Title Commitment

The structure of a title commitment may vary depending on the state, and some states may not use ALTA (American Land Title Association) forms. However, the following sections are commonly included:

Schedule A

This section contains essential information, including the commitment date (also known as the effective date), details about the policies to be issued (lender and/or homeowner), loan policy information, interest in the land (fee simple, leasehold, joint tenancy, etc.), current owner(s), and the legal description of the property.

Schedule B

Schedule B is further divided into two sections: Schedule B-I (Requirements) and Schedule B-II (Exceptions and Exclusions).

In Schedule B-I, you'll find the requirements that need to be fulfilled before the title can be insured. These requirements may include recording releases, payment of taxes, terminations of notices, recording new loan documents, and more. It's crucial to review this section carefully.

Schedule B-II lists the exceptions and exclusions that the underwriter will not cover. These exceptions highlight specific matters that may affect the property's title, such as utility easements, mineral and water rights, encroachments, and pending assessments. It's important to pay attention to these exceptions as they can impact your property rights.

Understanding Endorsements, Exceptions, and Exclusions

While most title companies adhere to ALTA forms for issuing title policies, variations can exist among title commitments. Some underwriters may include additional due diligence requirements or exceptions specific to the property being purchased.

Title Endorsements

In certain situations, buyers may request additional coverage for certain exceptions if specific conditions are met. These additional coverages, called endorsements, can help tailor the policy to better meet the policyholder's needs. They may address boundary issues, survey discrepancies, or other matters that could affect the property.

How Exceptions Impact Your Property Rights

Every title commitment will contain exceptions directly related to the property being purchased. For example, covenants, conditions, and restrictions of HOAs or community associations are typically not covered by insurance. It is crucial to understand these rules as they can significantly impact how you use your property. If you find any issues with the association's rules during the inspection period, ensure your Realtor or attorney includes an option to withdraw your offer in the contract.

Other exceptions may include public access requirements, boundary issues, and pending lawsuits against an association. These exceptions inform you of any limitations or potential risks associated with the property.

What are Exclusions?

Exclusions are exceptions that cannot be removed with an endorsement. These are matters that fall outside the scope of title insurance underwriters, typically due to higher authorities or laws. Examples of exclusions include rights of eminent domain, governmental police power, and laws or regulations affecting property use.

It's worth noting that title insurance companies are consistently updating their services to meet the needs of title agents and underwriters. By providing comprehensive title searches and preliminary title commitments, companies like PropLogix aim to equip agents and underwriters with detailed information on mortgages, liens, taxes, and other defects affecting properties.

Understanding the intricacies of a title commitment is crucial for homebuyers. By familiarizing yourself with the basics, reviewing the commitment carefully, and seeking clarification when needed, you can ensure a smoother and more informed real estate transaction.

Image source: Saigonintela.vn

Image source: Saigonintela.vn