If you're looking to understand a property, there's one document you need to focus on - the real estate pro-forma. While it's often described as a "cash flow projection," it's more than that. Think of it as a combined and simplified Income Statement and Cash Flow Statement for a property.

In this guide, we'll dive into the key components of a real estate pro-forma, providing you with valuable insights and a clear understanding of its purpose. Let's get started!

Simplification 101: Why the Real Estate Pro-Forma?

To understand the need for a real estate pro-forma, let's draw a parallel with company financial statements. In financial modeling, valuation, and investment analysis for companies, it's common to skip the full Income Statement, Balance Sheet, and Cash Flow Statement.

Instead, you can project the company's revenue, expenses, and taxes on its Income Statement. Then, create a "mini-Cash Flow Statement" that includes key recurring line items like Depreciation, the Change in Working Capital, and CapEx.

By simplifying the financial statements in this way, you can focus on the essential elements and omit non-recurring items. The same principle applies to properties, but to an even greater extent. Properties have simpler financial structures, tend to ignore income taxes, and make minimal use of "other activities" found on companies' Cash Flow Statements.

To sum it up, while properties still have full financial statements, the real estate pro-forma is the go-to document for financial modeling, valuation, and investment analysis.

The Real Estate Pro-Forma Excel and Guide

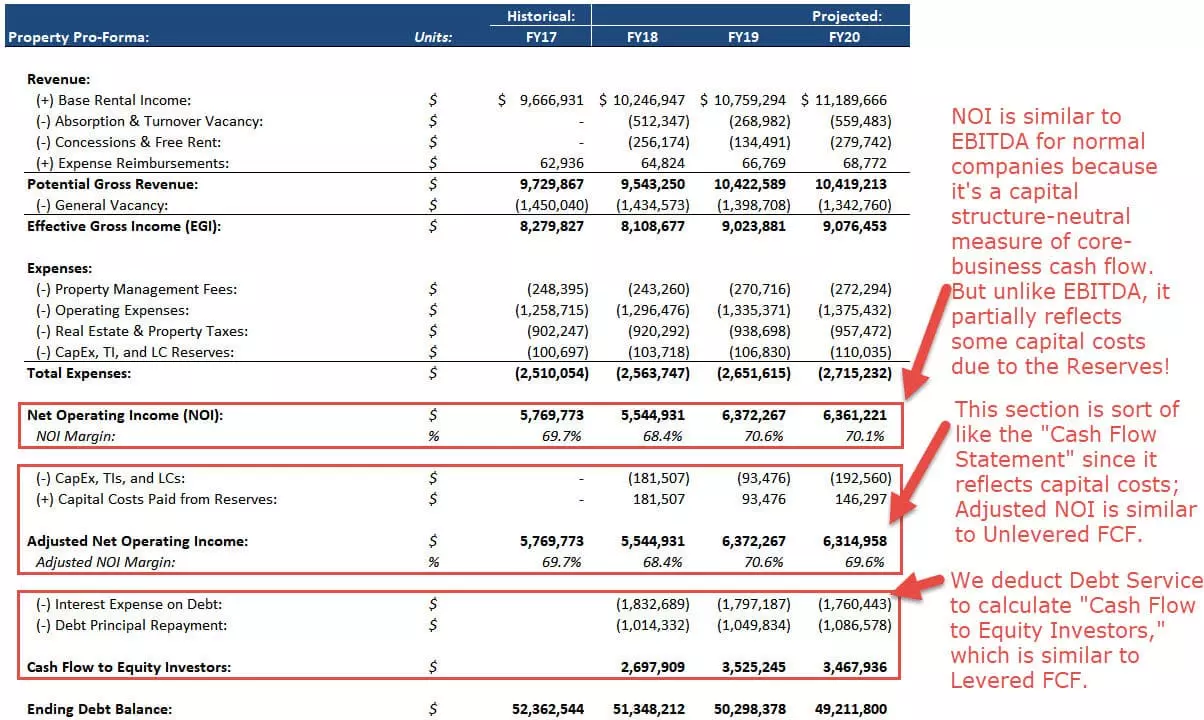

Now that we understand the importance of the real estate pro-forma, let's explore its structure and how it can be used. Below, we'll walk through a pro-forma for an office/retail property with 3 tenants on different lease types. This simplified example aims to illustrate the concepts, but more complex cases are covered in our Real Estate Financial Modeling course.

Real Estate Pro-Forma: Revenue Line Items

The revenue section of the real estate pro-forma starts with the potential rent income of a fully occupied property. However, adjustments need to be made to account for factors such as vacancy, below-market rents, and lease expiration and renewal periods.

Let's take a closer look at some key revenue line items:

Base Rental Income

This represents the potential rental income of the property if it were fully occupied and all tenants paid market rent. The calculation is straightforward: multiply the rentable square footage by the market rate.

Absorption & Turnover Vacancy

This represents the foregone rental income during the time it takes to find a new tenant after a lease expires. It's important to note that this is a loss of potential revenue, not an actual cash expense.

Concessions & Free Rent

As an incentive for tenants to sign multi-year leases, landlords may offer a period of "free rent." This line item represents the value of that incentive.

Expense Reimbursements

Tenants are often responsible for paying a portion of operating expenses such as property taxes, insurance, and maintenance/utilities. This line item reflects the amount to be reimbursed by the tenants.

Potential Gross Revenue

The sum of all the above line items represents the potential gross revenue or income for the property. This figure excludes permanently vacant spaces and non-rent sources.

General Vacancy

General vacancy refers to the potential rental income lost due to permanently unoccupied spaces. This deduction accounts for spaces without tenants and with no immediate plans for occupancy.

Effective Gross Income (EGI)

EGI represents the cash revenue generated by the property after adjustments for temporary and permanent vacancy and free months of rent. It reflects the cash flow on a cash basis.

Real Estate Pro-Forma - Property Expenses

The expense section of the real estate pro-forma includes costs related to managing and maintaining the property. Let's explore a few key property expenses:

Property Management Fees

Property owners often hire third-party management companies to handle tenant-related matters, rent collection, repairs, and maintenance. This line item represents the fees paid to these management companies, usually based on a percentage of EGI.

Operating Expenses

Operating expenses include insurance, maintenance and repairs, utilities, and other miscellaneous items. Depending on the property's size, additional expenses such as payroll, sales & marketing, janitorial, landscaping, and security services may be included.

Real Estate & Property Taxes

Local governments levy property taxes to fund various public services. The expense associated with property taxes is calculated based on a percentage of the property's assessed value. In some cases, additional taxes like "Stamp Duty" may apply.

Capital Costs on the Real Estate Pro-Forma: Capital Expenditures, Tenant Improvements, and Leasing Commissions

Capital costs refer to spending on items that provide long-term benefits for the property. Here are the key categories:

Capital Expenditures (CapEx)

These are non-tenant-specific expenses like replacing a roof, elevator, or HVAC system. CapEx varies based on the property's age and condition.

Tenant Improvements (TIs)

Tenant improvements include costs incurred to customize spaces for individual tenants. Examples include additional walls or doors in an office suite.

Leasing Commissions (LCs)

LCs are payments made to real estate brokerage and leasing companies for finding and renewing tenants. They are typically based on a percentage of the total lease value over the term.

CapEx, TI, and LC Reserves

Capital costs can fluctuate significantly from year to year, creating cash flow volatility. To mitigate this, property owners often allocate funds to reserves, smoothing out these fluctuations. The reserves cover future capital expenditures, tenant improvements, and leasing commissions.

Net Operating Income (NOI)

NOI represents the property's core-business cash flow without considering capital costs. It is a crucial figure used in property valuations and investment decisions.

Interest Expense on Debt

Debt financing is common in real estate, and interest expense reflects the cost of borrowing funds for property acquisitions and developments.

Cash Flow to Equity Investors

This final line item represents the amount available for distribution to the property's equity investors. While companies may accumulate cash, properties often distribute their annual cash flow.

Additional Items and the Real Estate Pro-Forma for Multifamily and Hotel Properties

The real estate pro-forma we explored focused on an office/retail property. However, variations exist for multifamily and hotel properties. Multifamily leases are shorter and simpler, while hotel pro-formas resemble income statements due to their unique revenue streams and expense categories.

Advanced items like Loss to Lease and Percentage Rent are used for specific tenant scenarios. Loss to Lease represents the difference between in-place rents and market rents, while Percentage Rent applies to retail tenants who pay a percentage of their gross sales in addition to fixed rent.

What's NOT on the Real Estate Pro-Forma: Taxes and Depreciation

Income taxes are typically excluded from the real estate pro-forma when properties are owned by pass-through entities. Depreciation, a non-cash expense, is also omitted since it is primarily relevant for tax purposes.

The Real Estate Pro-Forma: What's Next?

Understanding and utilizing the real estate pro-forma can help evaluate the potential risks and returns of a property investment. While it's a powerful tool, remember that real-life factors can impact the success of a deal beyond what the pro-forma predicts.

For further reading and more in-depth analysis, consider exploring our Real Estate Financial Modeling course. With practical case studies and comprehensive guidance, you'll gain a deeper understanding of the real estate pro-forma and its application to investment decisions.