Image source: MarsBars

Image source: MarsBars

Long-term value investors understand the power of market fluctuations. By purchasing exceptional companies at discounted prices, they position themselves for significant long-term returns. While the market may be currently fixated on overvalued tech growth stocks, savvy investors know to explore sectors that are out of favor. One such opportunity lies in Alexandria Real Estate Equities, Inc. (NYSE:ARE). Despite its strengths, this stock is currently trading 19% lower than it was a year ago, making it an attractive investment option even at a more affordable price.

Why Alexandria Real Estate?

Alexandria Real Estate is one of the oldest real estate investment trusts (REITs) on the market, with a history dating back to 1984. What sets it apart from its peers is its unique focus on the life science and AgTech sectors within the office real estate market. The company owns buildings that are leased to a diverse range of 1800 tenants in these industries.

One of Alexandria Real Estate's key advantages is its strategic property locations. Referred to as "AAA" innovation cluster locations, these properties are situated in prime areas such as the SF Bay Area, Greater Boston, New York City, San Diego, Seattle, Maryland, and the Research Triangle in North Carolina. These locations are in close proximity to major research institutions, ensuring a steady flow of well-trained talent to the tenants in Alexandria Real Estate's properties. This symbiotic relationship between access to talent and the attractiveness of the properties makes it an appealing choice for biotech and pharmaceutical tenants.

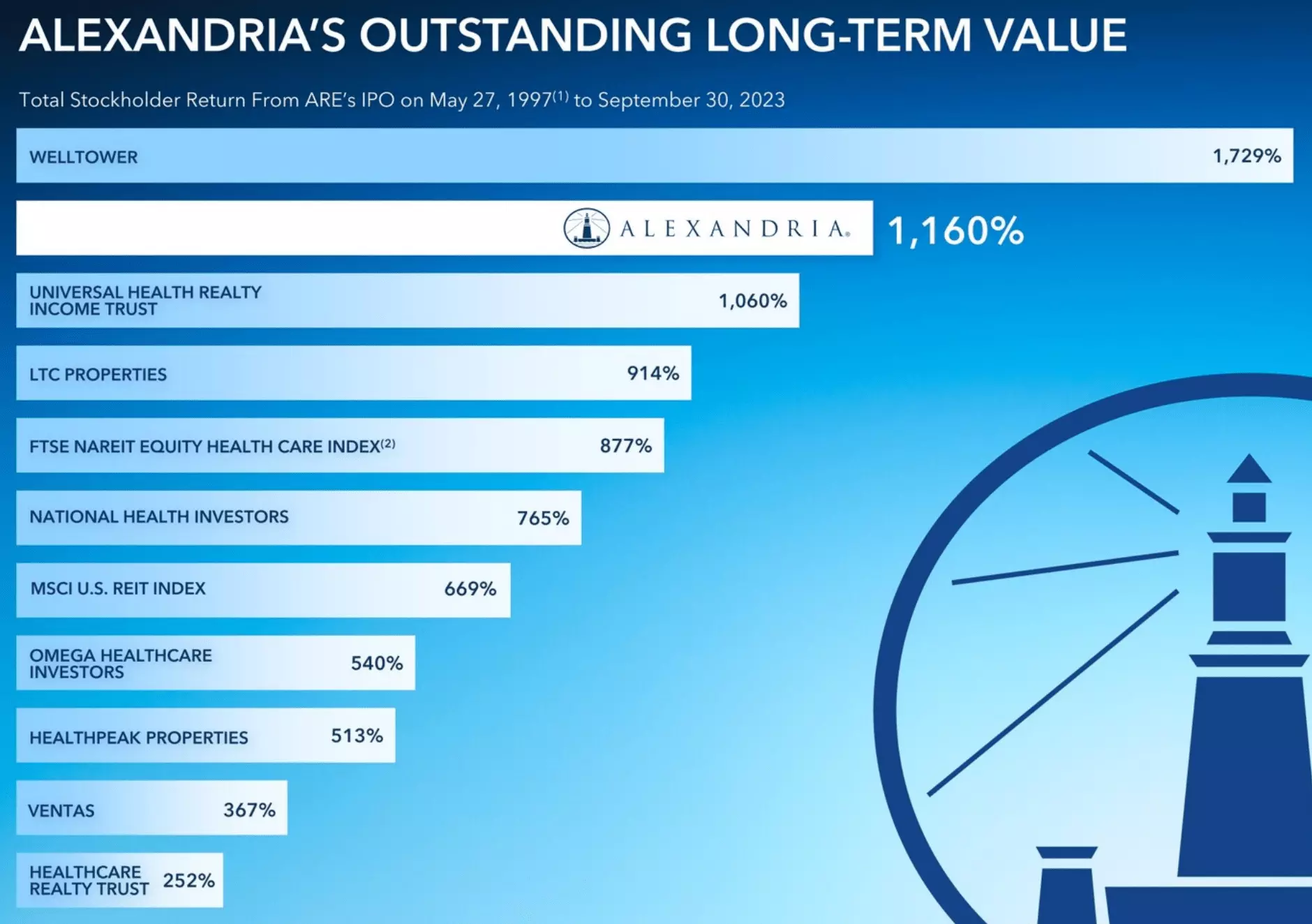

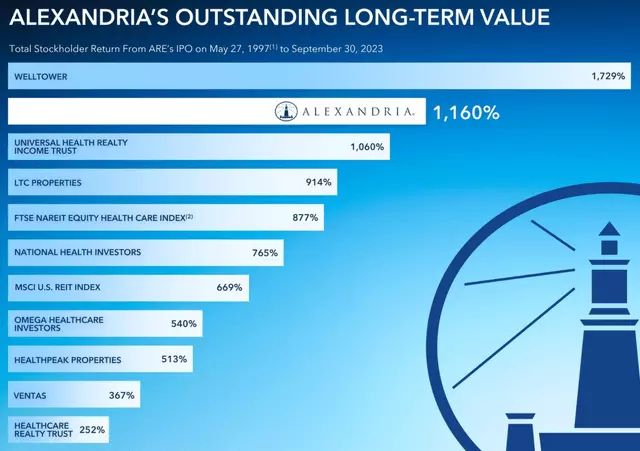

Furthermore, the life science sector is experiencing substantial growth within healthcare REITs, with companies like Healthpeak Properties, Inc. (PEAK) and Ventas, Inc. (VTR) expanding their portfolios. In terms of total returns, Alexandria Real Estate has delivered the second-best performance since 1997, trailing only Welltower Inc. (WELL) in the healthcare REIT sector.

Image Source: Investor Presentation

Image Source: Investor Presentation

Contrary to its share price performance, Alexandria Real Estate has consistently demonstrated strong operating fundamentals. During the first nine months of last year, its same-store cash net operating income (NOI) grew by an impressive 5.6%. Occupancy is expected to reach 95% for the full year 2023. The company's internal growth is fueled by robust leasing activity and high tenant demand, resulting in a remarkable 20% lease spread on a cash basis and a 29% spread on a GAAP straight-line basis. These figures reflect the strong value proposition that Alexandria Real Estate offers to its tenants.

Image Source: Investor Presentation

Image Source: Investor Presentation

Alexandria Real Estate's positive trajectory is supported by its favorable leasing activity, which aligns with historical norms. The company's strong leasing performance in recent years is a testament to its ability to attract and retain high-quality tenants.

The company's strong fundamentals underpin management's guidance for 7% growth in Funds From Operations (FFO) per share in 2023. Unlike the concerns surrounding office space, the life sciences sector remains resilient. Alexandria Real Estate's new leasing activity in its most recent quarter showcased a long weighted average lease term of 13 years, contributing to a solid portfolio-wide weighted average lease term of 11 years. These figures compare favorably to other net lease REITs, such as Realty Income Corporation (O), which has a weighted average lease term of 10 years.

Looking ahead, Alexandria Real Estate's growth prospects are further enhanced by an increasing number of FDA drug approvals. This positive trend benefitting the company's tenants is evident from the approval of 55 novel drugs in 2023 alone, spanning various disease areas. These approvals provide financial benefits to Alexandria Real Estate's tenants and effectively contribute to the company's growth.

The company's development projects also offer potential for near-term growth. Most of these projects are expected to yield initial returns ranging from 7% to 9.5%. One noteworthy development is located in Cambridge, Massachusetts, where the site is 100% leased. Situated in close proximity to the Massachusetts Institute of Technology, this site holds a strategic advantage over competing supply under construction, with a 72% leasing rate.

Image Source: Investor Presentation

Image Source: Investor Presentation

Alexandria Real Estate's development projects are supported by its self-funding model and a strong balance sheet. The company maintains a net debt and preferred stock-to-adjusted EBITDA ratio of 5.1x. It also boasts investment-grade BBB+/Baa1 credit ratings from S&P and Moody's, along with one of the longest remaining debt terms in the REIT industry at 13.1 years. Notably, Alexandria Real Estate carries a weighted average interest rate of just 3.7% and has no debt maturities until 2025.

While the investment thesis remains compelling, it's important to consider potential risks. One such risk is the ongoing possibility of drug price reform, which could impact the finances of Alexandria Real Estate's tenants and hinder their ability to invest in research and development. Additionally, a high-interest rate environment in 2025 could increase the company's cost of debt. Increased competition from new supply could also exert pressure on rent growth, although most of Alexandria Real Estate's locations are well-insulated from competition due to their desirable positions.

Importantly for income investors, Alexandria Real Estate currently offers a 4.0% yield, with the dividend well-covered by a 70% payout ratio. Management's guidance for FFO per share of $7.30 in 2023 supports this attractive dividend yield. The company has consistently raised its dividend for 13 consecutive years and boasts a 5-year dividend compound annual growth rate (CAGR) of 6%. With this in mind, Alexandria Real Estate presents an opportunity for investors to achieve 10% annual total returns. This matches the long-term performance of the S&P 500 (SPY), but with the added benefit of a higher dividend yield and the stability of a strong asset base.

Finally, despite trading at $126.25, which may not be considered cheap, Alexandria Real Estate remains an appealing investment option. With a forward Price-to-FFO ratio of 17.3, it is currently below its average over the past 10 years, which stands at 20.2. Given its robust balance sheet, high tenant demand, and internal growth drivers, the stock still holds value. While analysts project a modest 4% to 5% annual FFO per share growth over the next two years, growth is expected to accelerate to 9% in 2026.

Image Source: FAST Graphs

Image Source: FAST Graphs

Investor Takeaway

For those seeking stability and long-term growth in the healthcare/office REIT sector, Alexandria Real Estate represents a solid investment choice. Despite concerns surrounding office space, the company's life sciences tenants remain resilient and present opportunities for further growth, particularly with the rise in FDA drug approvals. With a self-funding model, strong balance sheet, and attractive dividend yield, Alexandria Real Estate is well-positioned to generate steady returns for income investors. Considering all the factors outlined above and its appealing valuation, I reiterate my 'Strong Buy' rating on the stock.