As we enter the year 2024, the commercial real estate industry is gearing up for a year of change and opportunity. With stabilizing interest rates, evolving underwriting requirements, and a focus on affordable housing, the landscape is set for gradual shifts in the coming months. Additionally, the impact of AI on the industry is becoming more apparent, with new tools and technologies emerging to enhance productivity and streamline operations.

Interest Rate Hikes Winding Down

The Federal Reserve's decision to keep interest rates steady at 5.5% represents a pause in rate hikes, signaling a potential end to the cycle in 2024. Positive economic indicators and industry feedback suggest that we may narrowly avoid a recession and that the Fed is likely finished with corrective actions. This optimistic outlook paves the way for increased transaction velocity and investment opportunities.

Loosening Underwriting Requirements

As uncertainty fades and positive return on investment becomes more likely, lenders may become more open to financing deals. While caution will still prevail, proactive communication between investors and lenders can lead to more opportunities. Building strong relationships with financial partners will be crucial for capturing the perfect deal as the market evolves.

A Push into Affordable Housing

Affordable housing is a hot topic in the commercial real estate space, with the government and local administrations prioritizing its development. Incentives for asset conversions and creative solutions, such as mixed-use developments, are gaining traction. While home prices are predicted to fall, the demand for rental units, especially among younger demographics, remains high. Savvy investors may find markets with stable rent and solid fundamentals to strike a balance between demand and affordability.

Construction Deliveries Impacting Demand

After a post-pandemic slowdown, construction picked up in 2023. However, the majority of new assets are Class A properties, which may experience reduced demand due to high rents. Industrial properties may face higher vacancy rates due to increased deliveries. On the other hand, a halt in office construction may lead to increased demand for existing spaces as the economy continues to perform strongly.

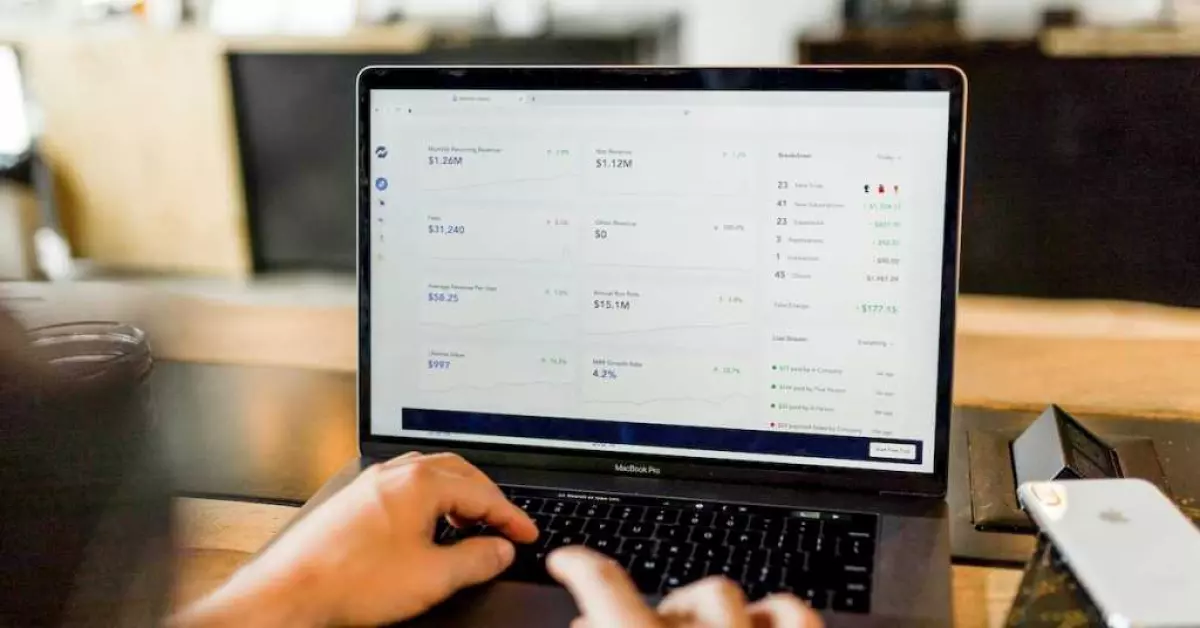

AI Revolutionizing Productivity and Workflows

AI is transforming the commercial real estate industry, offering tools to enhance productivity, reduce operational costs, and improve deal analysis and closure. While the sector has been slow to adopt new technology, those who embrace AI will gain a competitive advantage. With regulatory limitations being the only potential obstacle, AI's impact will continue to grow in 2024 and beyond.

The Rise of Retail Concepts

Contrary to expectations of a "retail apocalypse," the retail sector is evolving and becoming more meaningful. Creative concepts, experiential shopping, and flagship stores are attracting and retaining customers. Retail hubs are becoming more valuable to corporations as they aim to build lasting relationships with their customers. A multi-channel approach, where the in-store experience plays a critical role, will be essential for brands and shoppers in 2024.

Rising Insurance Costs

Increased insurance costs, especially in coastal markets, are a concern for investors and property owners. The frequency and severity of disasters are heightening insurance companies' perception of risk. Future-proofing developments with climate-resilient features can help reduce insurance costs and secure coverage. It is crucial to factor in weather-proofing and insurance premiums as operational costs when considering a property purchase.

Auctions as Effective Disposal Tools

Auctions are increasingly becoming an effective and quick method to dispose of properties. Online auctions offer transparency, broader reach, and certainty of closure, benefiting both buyers and sellers. As banks reshuffle their loan portfolios, online auctions provide liquidity and untapped potential for cash buyers to find great deals.

In conclusion, while 2023 was a year of uncertainty, 2024 offers a glimpse of stability and normalization. These trends and predictions provide valuable insights to navigate the year ahead in the commercial real estate industry. Stay informed and capitalize on the opportunities that arise.