Image source: Imgorthand

Image source: Imgorthand

I've been championing blue chip real estate investment trusts (REITs) on Seeking Alpha for some time now, and there's a good reason for it. Blue chips are the cream of the crop, the best quality companies you can own. They're great stocks to have in your portfolio, no matter the market cycle, because they always have access to equity and debt. Additionally, they typically generate stable earnings and dividends. The most important attributes of a blue chip are its balance sheet and conservative dividend policy. These companies usually have modest debt ratios with low-risk credit ratings.

But lately, I've become fixated on owning only the highest quality REITs. That's why I've been searching for the best balance sheets, starting with credit agency ratings to identify candidates with an A- or higher rating. In this article, I'll provide a snapshot of each of the eight A-rated REITs, showcasing their resilience and future growth prospects.

Realty Income Corporation (O)

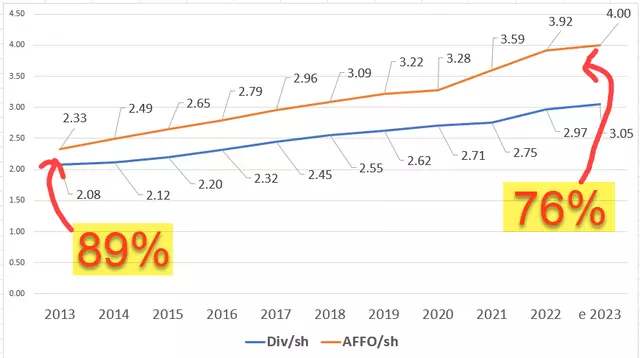

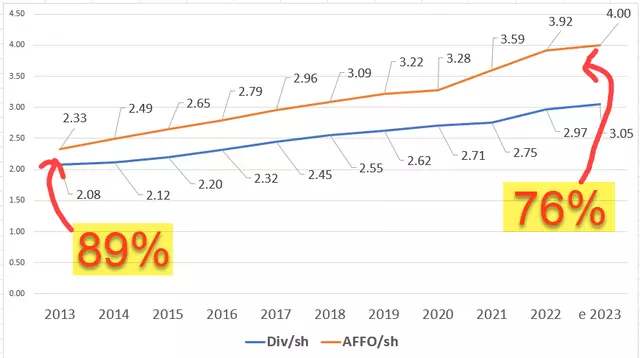

Realty Income is a net-lease REIT with a market cap of approximately $42 billion. It boasts a portfolio of 262.6 million SF consisting of single-tenant, free-standing commercial properties. These properties are net-leased to tenants operating in defensive industries like grocery and convenience retail. Realty Income has been in operation since 1969 and went public in 1994. As a member of the S&P 500 and a Dividend Aristocrat, they have raised their monthly dividend for 29 consecutive years.

Their portfolio includes over 13,000 commercial properties leased to tenants across various industries. At the end of the third quarter, Realty Income reported a physical occupancy rate of 98.8% with a weighted average lease term ("WALT") of 9.7 years. With an A- credit rating and strong credit metrics, including a net debt to pro forma EBITDAre of 5.2x, Realty Income is a solid choice.

Image source: iREIT®

Image source: iREIT®

Equity Residential (EQR)

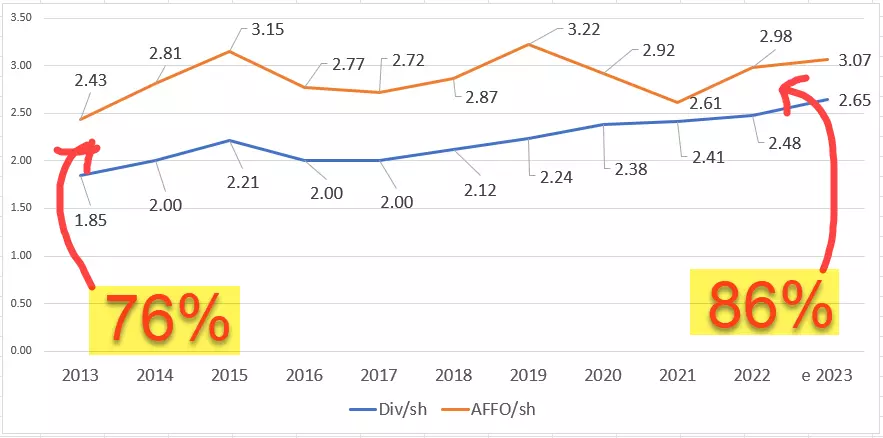

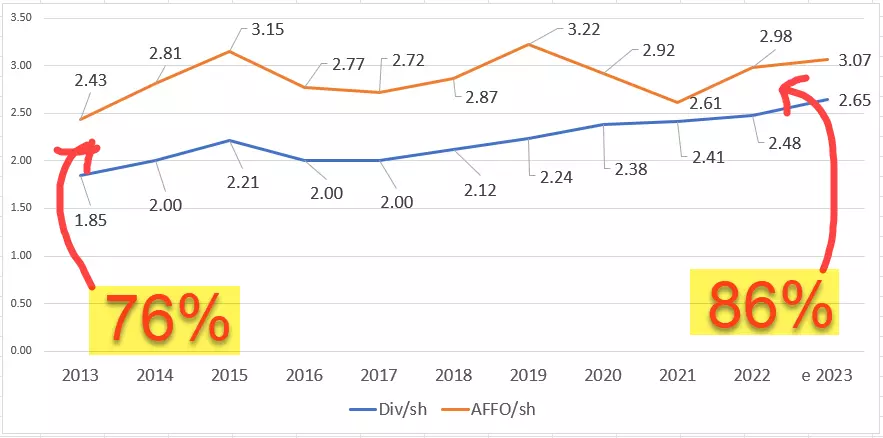

Equity Residential is a multifamily REIT with a market cap of approximately $23 billion. They specialize in the development, acquisition, and management of multifamily communities. Equity Residential's portfolio consists of 305 communities and 80,683 apartment homes located in dynamic markets such as Boston, New York, San Francisco, and more.

With a same-store physical occupancy of 96.0%, Equity Residential has established itself as a reliable player in the industry. They hold an A- credit rating and boast excellent credit metrics, including a net debt to normalized EBITDAre of 4.24x. Their debt is 78.1% unsecured and 90.2% fixed rate, with a weighted average interest rate of 3.65%. Equity Residential is a strong contender.

Image source: iREIT® (using FAST Graph data)

Image source: iREIT® (using FAST Graph data)

AvalonBay Communities, Inc. (AVB)

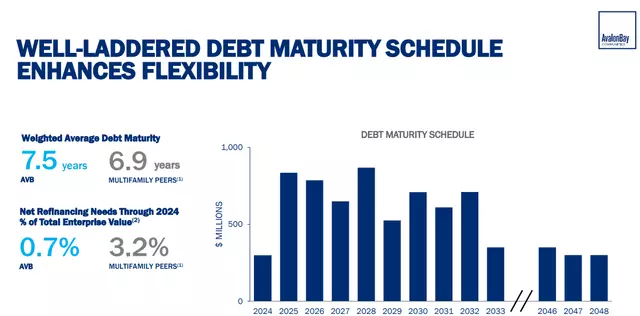

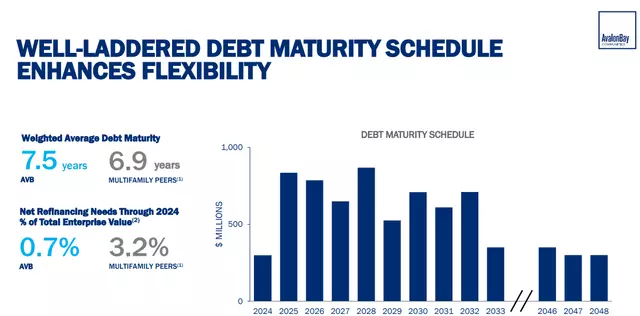

AvalonBay is another multifamily REIT, and it boasts a market cap of approximately $27 billion. Their portfolio consists of 296 communities and approximately 89,200 apartment homes located across 12 states and Washington D.C. AvalonBay focuses on leading metro areas such as New York, New England, California, and the Pacific Northwest.

At the end of the third quarter, AvalonBay reported a same-store average rental revenue per home of $2,962 and a same-store economic occupancy of 95.7%. With an A- credit rating and strong credit metrics, including a net debt to core EBITDAre of 4.1x, AvalonBay is a solid choice for investors.

Image source: AVB - IR

Image source: AVB - IR

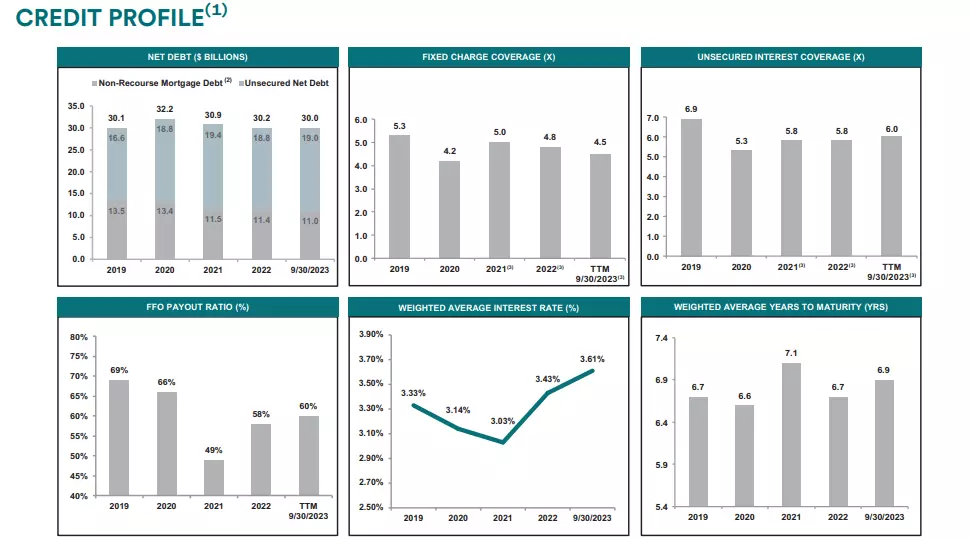

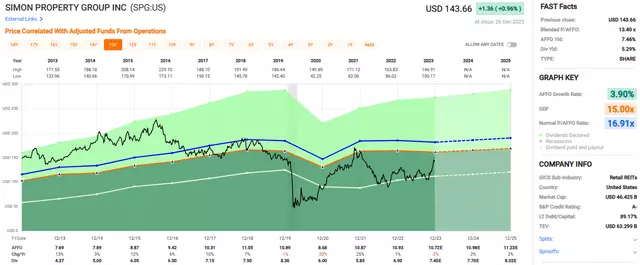

Simon Property Group, Inc. (SPG)

Simon Property is a mall REIT with a market cap of approximately $47 billion. Their portfolio comprises 230 income-producing properties located in North America, Asia, and Europe. These properties primarily consist of shopping malls, Premium Outlets, and The Mills.

Simon Property's U.S. properties are spread across 37 states, with additional international properties in Asia and 35 Premium Outlets in Canada and Europe. With an occupancy rate of 95.2% for its U.S. properties, Simon Property is a major player in the industry.

With an A- credit rating and strong credit metrics, including a total debt to total assets ratio of approximately 42%, Simon Property is considered investment grade. Their debt is 95.7% fixed rate, with a weighted average interest rate of 3.61%. Simon Property is a solid performer in the REIT space.

Image source: SPG - IR

Image source: SPG - IR

Prologis, Inc. (PLD)

Prologis is an industrial REIT with a market cap of approximately $125 billion. They boast a vast portfolio of approximately 5,500 industrial properties spanning 4 continents and 20 countries. Prologis has a diverse tenant base, including globally recognized companies like Amazon, Home Depot, Walmart, UPS, FedEx, and DHL.

With an average occupancy of 97.1% for their owned and managed properties, Prologis is an industrial juggernaut. They hold an A credit rating and boast excellent credit metrics, including a debt to EBITDA of 4.3x and a fixed charge coverage ratio of 8.1x.

Image source: PLD - IR

Image source: PLD - IR

Public Storage (PSA)

Public Storage is a self-storage REIT with a market cap of approximately $54 billion. They have a portfolio of 3,028 self-storage facilities covering roughly 217 million SF across 40 states in the U.S. In addition, Public Storage holds a 35% equity interest in Shurgard Self-Storage, which owns more than 250 self-storage properties across 7 European countries.

With a focus on developing, acquiring, and operating self-storage properties, Public Storage serves nearly 2 million customers across the U.S. and Europe. They have an A credit rating and excellent credit metrics, including a net debt + preferred equity to EBITDA of 3.9x and a debt service coverage ratio of 8.9x.

Image source: PSA - IR

Image source: PSA - IR

Mid-America Apartment Communities, Inc. (MAA)

Mid-America is a multifamily REIT with a market cap of approximately $15.72 billion. Their portfolio comprises 101,987 apartment homes located in 16 states and the District of Columbia. Mid-America focuses on high-growth Sunbelt markets, with Atlanta, Dallas, Tampa, Orlando, and Charlotte being their largest markets.

As a member of the S&P 500, Mid-America has paid consecutive quarterly dividends since 1994. They hold an A- credit rating and boast excellent credit metrics, including a net debt to adjusted EBITDAre of 3.4x and a debt service coverage ratio of 7.8x.

Image source: MAA - IR

Image source: MAA - IR

Camden Property Trust (CPT)

Camden Property is a multifamily REIT with a market cap of approximately $10.5 billion. They have a portfolio of 172 properties, which contain approximately 59,000 apartment homes across 15 major markets within the United States. Camden focuses primarily on high-growth Sunbelt markets, with Washington, D.C., Houston, Phoenix, and Dallas being their largest markets.

Camden Property boasts an average monthly rental rate per apartment of $1,999 and an average same-property occupancy rate of 95.6%. They hold an A- credit rating and excellent credit metrics, including a net debt to adjusted EBITDAre of 4.1x and a fixed charge coverage ratio of 5.9x.

Image source: CPT - IR

Image source: CPT - IR

In closing, these eight A-rated REITs offer investors solid opportunities for growth and stability. I personally own six of them: (CPT), (SPG), (MAA), (O), (PSA), and (PLD). Stay tuned for more insights on BBB+ rated REITs.

"The dynamics of capitalism guarantee that competitors will repeatedly assault any business "castle" that is earning high returns. Therefore, a formidable barrier such as a company's being the low-cost producer...or possessing a powerful worldwide brand...is essential for sustained success." - Warren Buffett.