Real estate agents, especially those who are new to the industry, often find themselves on a steep learning curve during their first few transactions. While training typically focuses on acquiring clients and securing signed agreements, little attention is given to the intricacies of the closing process. However, understanding the basics of closing ahead of time can greatly reduce stress for both agents and clients.

I can still vividly recall my first closing experience. The entire process was fraught with tension, with the buyers and sellers constantly at odds every step of the way. There were moments when it seemed uncertain whether the transaction would even reach the closing stage.

Nevertheless, we made it. Although the buyers and sellers never sat down together, the settlement agent was present, necessary documents were signed, funds were exchanged, and the property's title was officially transferred. However, looking back, I realize that there was much I could have done to better comprehend the process and provide more hands-on assistance to my clients in preparing for the closing.

Getting Your Pre-Settlement Ducks in a Row

The first crucial step toward a successful closing is understanding the individuals involved. It's important to note that the parties involved may vary depending on the state in which the transaction takes place. Therefore, acquiring local expertise is essential.

At a high level, the key parties include:

- Sellers and Buyers: The individuals selling and purchasing the property.

- Real Estate Agents: Typically, you and the agent representing the other party (buyer or seller).

- Lawyers (depends on the state): In certain states or situations, lawyers for each party may be directly involved.

- Mortgage Lender: The lender who provides financing to the buyer, although they may or may not attend the closing.

- Title Company: The title company plays multiple roles. They conduct the title search, manage escrow (which involves handling all crucial documents and funds related to the closing), and assign a settlement agent responsible for managing all paperwork and personalities at the settlement table.

Working With Trusted Partners

Assisting clients in selecting a title company is typically within your discretion. As a new agent, you've likely received training on RESPA laws, which prevent you from having any financial incentive to recommend one title company over another. A good approach is to provide a number of recommendations, especially those that come from previous clients. The most highly recommended title companies often excel in communication, attention to detail, and maintain a modern, efficient workflow. Remember, you are a resource for clients who may be new to the process or have no existing relationship with a particular title company.

The Inspection Process

Once an agreement has been reached, and a settlement date has been determined, the inspection process becomes the next hurdle. Typically, the buyer will hire an inspector who will generate a detailed report. Based on this report, negotiations regarding the sale price and any necessary repairs will take place.

Securing Financing and Title

If you are representing the buyer, effectively managing the mortgage process plays a crucial role in reaching the closing stage. The contract will stipulate the deadline for the mortgage commitment, and it's important to ensure that both the lender and your clients are actively processing the necessary financial information to meet this deadline. On the other hand, if you are representing the seller, you must verify that the other party is adhering to the contract timeline and diligently securing financing.

Around the same time as the mortgage commitment, the title company will be working on the title commitment, also known as the contract to insure the title. This is when you will receive the "marked up title" to review with your clients. The closer confirms that all requirements have been met, usually referencing any endorsements provided. Additionally, the settlement date announcement is sent to all parties, and buyer/seller names, purchase price, and mortgage amount(s) are confirmed.

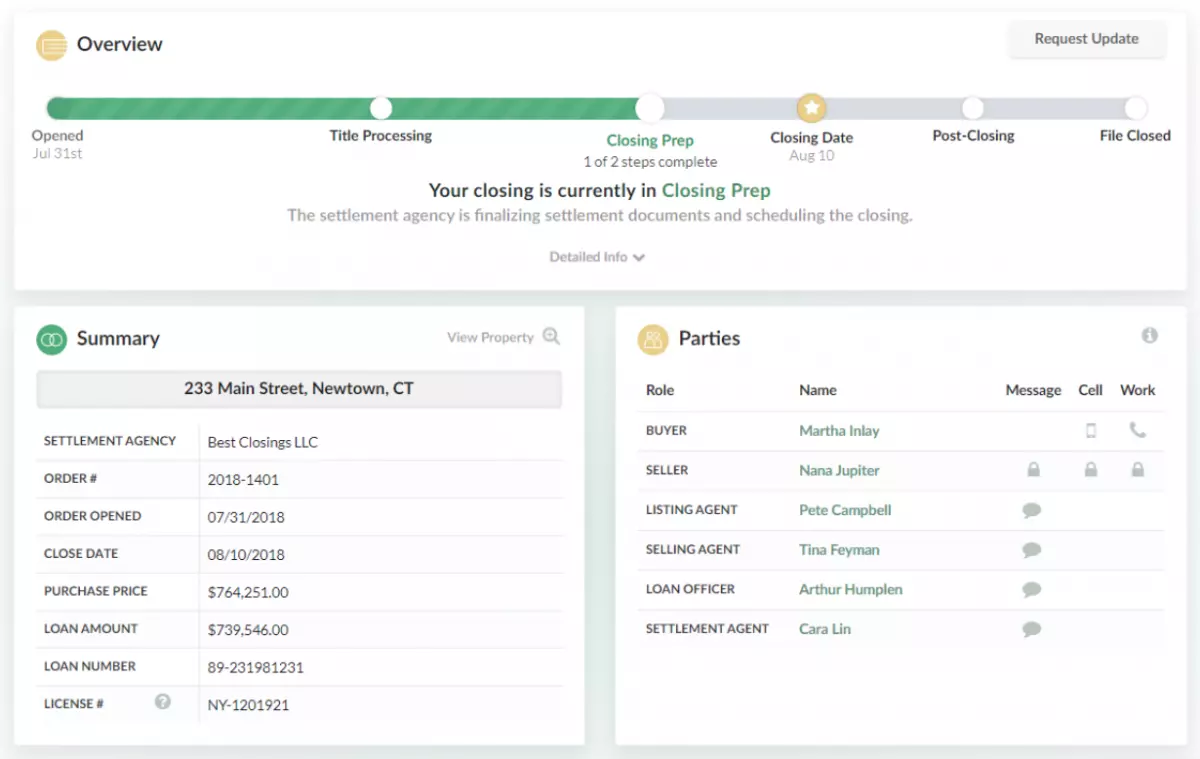

Figcaption: When your title company uses Qualia, you get live closing updates and can easily send secure messages to all parties in the transaction.

The Final Countdown

Three days prior to closing, the title company is legally obligated to send your clients the Closing Disclosure. This document provides a clear breakdown of the buyer's financial obligations in plain language. It includes the exact closing costs, ongoing tax and insurance responsibilities, and a detailed breakdown of the mortgage loan. While it follows the same format as the original loan estimate, the Closing Disclosure provides final numbers that will be disbursed at closing, barring any significant changes during the final walk-through.

At the Table and Disbursement

During the closing, a real estate agent's role is often minimal. You are present to address any questions or concerns your clients may have, although ideally, most of these would have been addressed beforehand. The settlement agent will guide everyone through the closing documents.

The final step is disbursement, where all funds outlined in the Closing Disclosure are disbursed to the buyer, seller, and brokers on both sides of the transaction.

Taking Control of the Closing Process

As a new agent, you have probably heard these words from your manager: "Nothing is certain until the keys are handed over at closing." While reaching an agreement is undoubtedly an important milestone, the journey to closing is rarely without obstacles. By understanding the process from start to finish and staying well-informed every step of the way, you can make the path to closing more achievable and, ultimately, make the closing itself as stress-free as possible.

Additional Resources

- Closing on a House - Process, Mortgage Documents & Procedures

- What Sellers Should Expect at Closing

- What Home Buyers Can Expect on the Big Day