Image: Variety of lien documents on an image of a construction site

Image: Variety of lien documents on an image of a construction site

If you've ever had a lien filed on your property or are just curious about liens in general, you've come to the right place. In this article, we will delve into the topic of liens, exploring what they are, the different types, and how they can impact you. So let's get started!

Understanding the Definition of a Lien

A lien, derived from the Latin word "ligāre," meaning "to bind," is a legal concept that binds or encumbers the title of a property. In simple terms, it is a charge against or interest in a property to secure payment of a debt or the performance of an obligation. Liens are commonly associated with real property, such as homes and land.

When a lien is filed on a property, it clouds the property title. This means that if the owner wants to sell, refinance, or transfer the property, the lien will show up during a title search. Liens are attached to the property itself and follow it, rather than the individual owner.

It's important to note that while this article focuses on property liens, there are various types of liens, including artisan liens, aircraft liens, attorney's liens, mineral liens, and even livestock liens!

Exploring the Different Categories of Liens

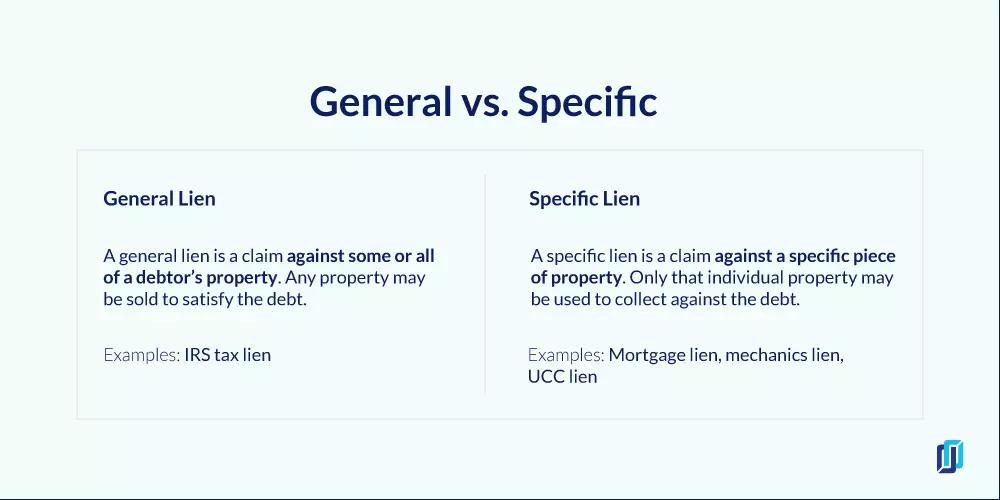

Liens can be classified into general vs. specific and voluntary vs. involuntary categories.

General vs. Specific Liens

A general lien doesn't attach to a specific piece of collateral but rather to all the assets of the borrower. This includes their house, bank accounts, vehicles, and any other personal property they own. An example of a general lien is an IRS tax lien, as the IRS has the authority to sell different types of the owner's property to recover the debt.

On the other hand, a specific lien attaches to a specific asset. For instance, a mortgage bank holds a lien on the real estate they financed. In this case, the property itself serves as collateral for the loan or credit.

When a borrower fails to make payments, a creditor's specific lien is limited to the value of that particular asset. They cannot go after unrelated assets, as they can with a general lien.

Voluntary vs. Involuntary Liens

Liens can also be voluntary or involuntary, depending on whether the property owner consents to the lien.

A voluntary lien arises when the owner willingly agrees to have the lien placed on their property. This commonly occurs when financing the purchase of property with a loan. For example, a mortgage is a well-known type of voluntary lien, as the owner agrees to borrow money and grants the lender a legal right, or security interest, on their property.

In contrast, involuntary liens are placed on the property without the owner's consent. Judgment liens and mechanics liens are examples of involuntary liens.

Different Types of Property Liens

Liens can be filed on two types of property: real property and personal property. Real property includes land and assets permanently attached to it, such as houses. Personal property refers to movable assets like cars, animals, boats, and equipment.

Let's take a closer look at some of the types of liens used on real property.

Tax Liens

Tax liens are involuntary general liens created by state or federal statutes. If an individual or company fails to pay their taxes, whether income taxes, business taxes, or property taxes, the IRS or another government entity can place a lien on the property for the amount owed. Tax liens usually remain on the property to ensure payment priority.

Mortgage Liens

A mortgage lien is a voluntary specific lien often used when a bank lends money to purchase or refinance a home. Mortgages are "secured loans," meaning that the property serves as collateral. If the borrower stops making payments, the lender can foreclose on the property to recuperate the outstanding balance.

Mechanics Liens

Mechanics liens are crucial for those in the construction industry. These involuntary specific liens are created through statutory rights. Construction businesses and laborers have the right, under state laws, to claim a mechanics lien if they provide services for the construction or repair of real property and are left unpaid. Mechanics liens have specific notice requirements, deadlines, and expiration dates that must be met to secure rights.

UCC Liens

The UCC (Uniform Commercial Code) consists of uniform laws governing commercial transactions across states. A UCC lien can be filed by anyone lending money to another party, putting a claim on specific real or personal property until the debt is repaid. This voluntary specific lien is often used when lending money that won't be used to purchase a specific asset or when the borrower's credit history is less favorable.

Judgment Liens

A judgment lien arises from a lawsuit where the court awards damages as a money judgment to the plaintiff. If the judgment isn't paid, the judgment creditor can place a lien on the debtor's property. In the case of mechanics liens, they can become judgment liens if the unpaid contractor enforces their claim and wins a foreclosure lawsuit.

Collecting Payment through a Lien

To enforce their right to payment, lienholders initiate a foreclosure action. This involves seizing and selling the collateral that secures the debt. The proceeds from the sale go toward paying off the liens on the property.

Lien priority becomes crucial in foreclosure scenarios. If the sale price doesn't cover all the liens, the priority determines who gets paid first. Tax liens typically have first priority, followed by mortgage liens. Other liens or encumbrances will then be paid off accordingly. Mechanics liens may follow either the first-to-file or equal priority rule, depending on the state.

In bankruptcy cases, liens are considered secured debts and can survive bankruptcy. The debtor may have to sell off certain non-exempt assets to pay off these secured debts.

Removing a Lien from the Property

If a lien has been filed on your property, you still have options to remove it. Here are a few steps you can take:

Pay off the Debt

The most straightforward way to remove a lien is to pay what you owe. Once the debt is settled, the lienholder is generally required to remove the lien. For mechanics liens, the claimant must file a lien release or cancellation with the appropriate office, following state-specific requirements.

Dispute the Lien

Not all liens are valid. If you believe a lien claim is invalid, you have options. Waiting for the enforcement period to expire may render the claim ineffective. You can also file a Notice of Contest in certain states, forcing the lienholder to enforce their claim within a specific timeframe or risk it being disregarded. Alternatively, you can dispute the lien during a trial and provide evidence against its enforcement.

Bonding off a Lien

For mechanics liens, bonding off the lien can be an effective way to remove it from the property title. By substituting a surety bond for the property, the lien is discharged but remains intact and enforceable against the bond rather than the property itself. This option is often chosen by property owners looking to sell or refinance their property before addressing the lien claim.

Avoiding Liens

Prevention is always better than dealing with liens after they are filed. Making timely payments and understanding the complexities of the construction industry can help you avoid mechanics lien claims. Implementing lien waivers, which release lien rights upon payment, can provide assurance and protect your property title.

Remember, staying informed and taking the necessary precautions can help keep your property title clear of liens and unnecessary complications.

For more informative articles, visit our blog.