Keeping an eye on the real estate market is crucial, especially during these unprecedented times. As we navigate through 2022, it's essential to stay informed about the trends and developments in the Portland real estate market. In this article, we will explore the top five news stories that have shaped the market in the first half of the year and provide insights into what it means for the remainder of 2022.

1. Fed's Rate Hikes Impact Portland Mortgage Rates

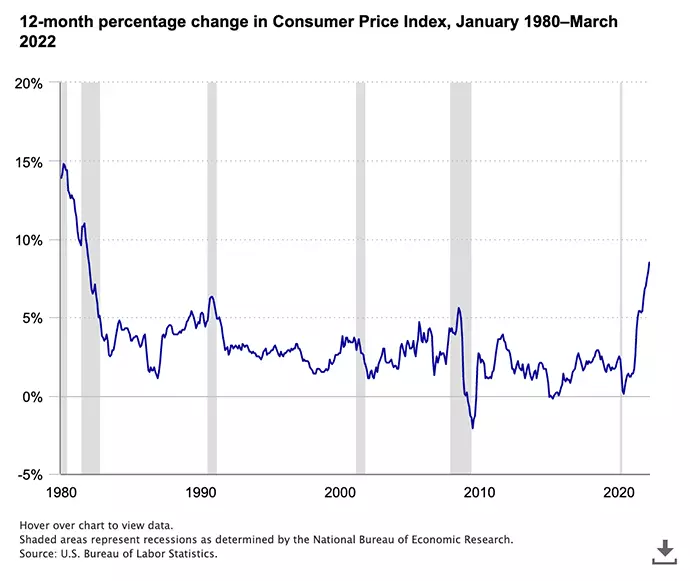

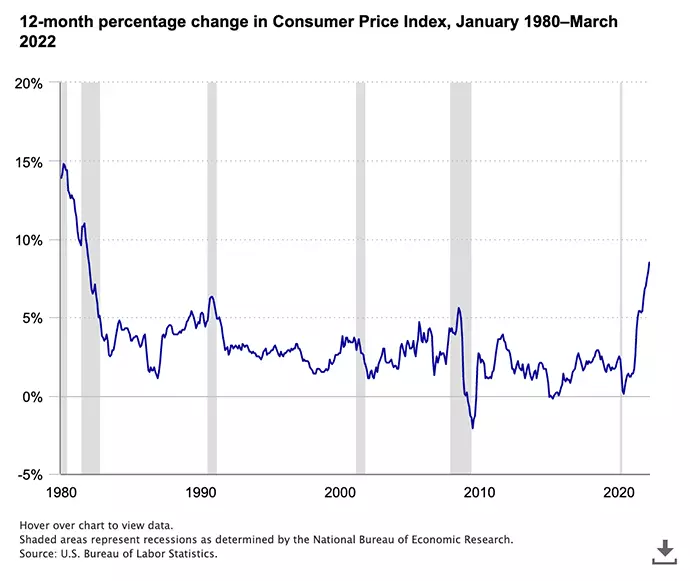

In June 2022, the Federal Reserve announced the largest rate hike since 1994, responding to the rising inflation affecting various sectors. While the Fed rate hikes don't directly impact mortgage rates, lenders increase their rates in tandem to mitigate potential losses. Experts predict mortgage rates to range from 4.8% to 5.5% by the end of 2022, with some projecting rates as high as 7%. This complex relationship between the hot seller's market, inflation, and the Fed's hikes adds complexity to the Portland real estate market.

Click the image for an interactive graph—Graph from BLS

Click the image for an interactive graph—Graph from BLS

2. Shifting Real Estate Supply and Demand in Portland

The Portland metro area witnessed a surge in home prices, with an average sales price of $615,600 in April 2022. While prices continue to rise, the buyer competition for homes is slightly relaxing due to rising interest rates. This offers buyers more breathing room when searching for properties. However, affordability remains a concern for many as home prices and interest rates increase.

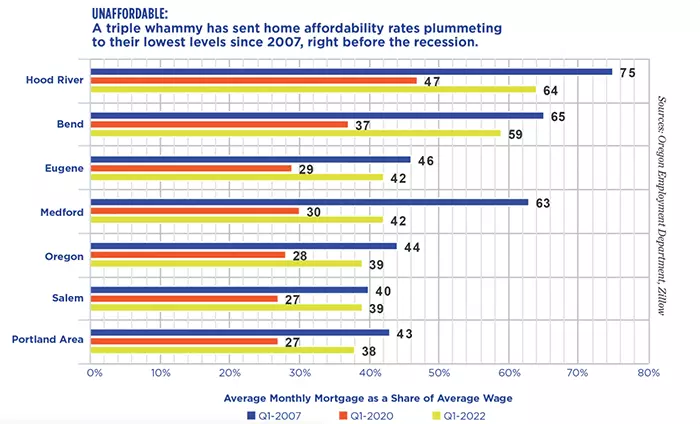

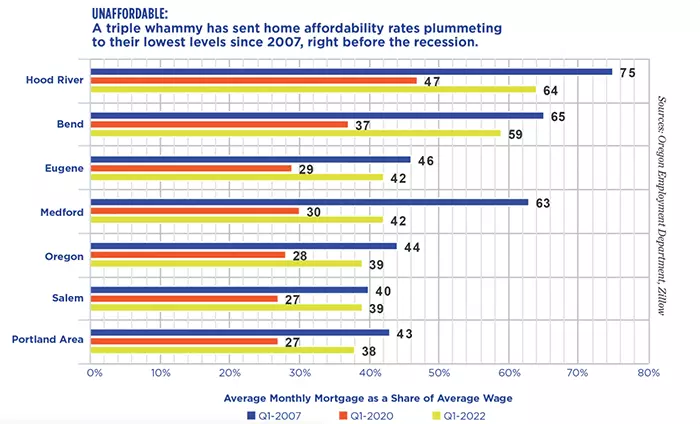

3. Addressing Portland's Housing Affordability Problem

Portland, compared to other West Coast cities, is still relatively affordable. However, the continuous increase in home prices and rising interest rates impact housing options for residents. Buying a home in Portland is becoming increasingly challenging, reminiscent of the situation before the 2008 recession. Rental prices have also seen significant increases. These affordability concerns are at the forefront for Portland residents.

4. Portland's Residential Infill Project Expands for More Affordable Housing

Portland's Residential Infill Project (RIP) aims to tackle the city's inventory and affordability issues. RIP1, which came into effect in August 2021, allowed homeowners to add more than one accessory dwelling unit (ADU) to their property with fewer restrictions. RIP2 was recently approved, allowing for more infilling options like townhomes and cottage clusters. These initiatives provide more housing options, improve affordability, and shape the city's future.

5. Slowing Home Sales and Increasing Inventory

The real estate market is gradually transitioning towards a more balanced state. Housing supplies are increasing, and home sales are starting to slow down on a national scale. Rising interest rates and buyer fatigue contribute to this shift. However, the urgency created by rising interest rates continues to drive buyer activity. As we approach fall, we can expect increased inventory and potential home price drops, making it an ideal time for homebuyers.

The Portland Fall Real Estate Market

As the market shows signs of cooling down, the upcoming fall season will bring increased inventory and potential home price drops. Historically, autumn is an excellent time to buy a home. Be sure to check out our month-by-month breakdown for more insights.

Work with an Experienced Portland Real Estate Agent

If you find the current market news overwhelming, don't worry. Our team of experienced real estate agents is here to help. With nearly 20 years of expertise in the Portland metro area, we can guide you through the buying or selling process. Whether you're a seller or a buyer, reach out to our top 1% agents, chat with our website's bot, and we'll provide you with timely advice.

Stay informed, navigate wisely, and make the most of the dynamic Portland real estate market in 2022.