The year 2023 was a phenomenal one for the S&P 500 (^GSPC 0.45%). With a remarkable 24% increase, the benchmark index experienced a surge in stock market sentiment, thanks to various contributing factors, including an unexpectedly resilient economy.

However, amidst this positive performance, it's important for investors to remember that many experts had predicted a recession to begin last year. Though that recession never materialized, the risk still looms. In fact, there is currently a forecasting tool, based on the Treasury yield curve, that has a near-perfect track record of predicting recessions for over 70 years. Alarmingly, it is now signaling its most severe reading since 1981.

The Reliability of the Treasury Yield Curve

The Treasury yield curve represents interest rates across all U.S. Treasury bonds, ranging from 1 month to 30 years. Under normal circumstances, long-term bonds yield higher returns than short-term bonds due to the expectation of increased returns over extended periods. This causes the yield curve to move up and to the right.

However, during times of economic concern, the yield curve becomes inverted, with short-term bonds yielding higher returns than long-term bonds. This inversion occurs when investors seek safety in long-term bonds, driving their yields lower, while avoiding or selling off short-term bonds, pushing their yields higher.

While inversions can happen at any point along the curve, an inversion between the 10-year Treasury and 3-month Treasury has been a particularly reliable leading indicator of recessions. According to the Federal Reserve Bank of New York, the yield curve has predicted almost every U.S. recession since 1950, with only one false signal preceding the credit crunch and production slowdown in 1967.

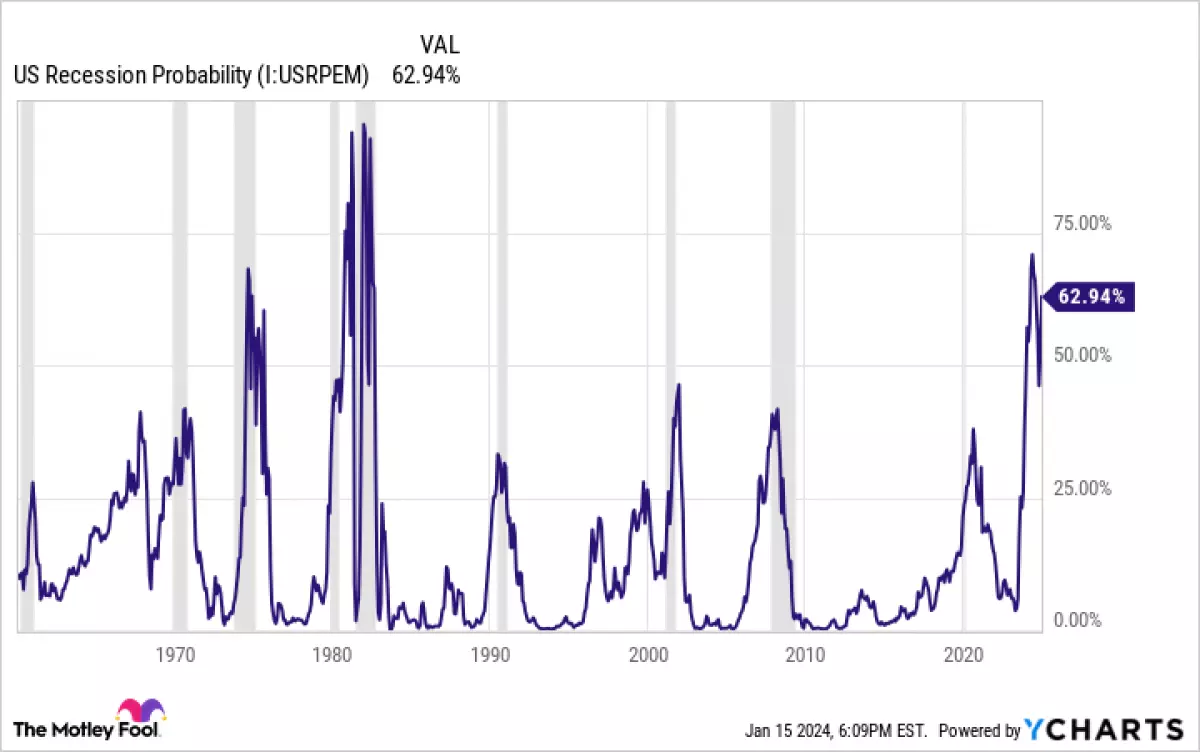

Taking this into account, the Federal Reserve uses the Treasury yield curve as a tool to estimate the probability of a recession occurring 12 months in the future. The current reading of this tool reveals the odds of a recession at nearly 63%, as shown in the chart below. Gray areas represent past recessions.

US Recession Probability Chart

US Recession Probability Chart

While a 63% probability might not sound overly alarming, it is the most severe reading since August 1981. Since 1960, the U.S. economy has always experienced a recession within 12 months of a reading surpassing 50%, with one exception being the present time period.

The S&P 500 and Recessions

Before delving into past recessions' effects on the S&P 500, it's important to acknowledge that no forecasting tool is infallible, regardless of its track record. The current yield-curve inversion could potentially be a false positive, so it is crucial for investors to view the Federal Reserve's recession forecasting tool as an estimate.

That being said, since the S&P 500's inception in 1957, the U.S. economy has experienced 10 recessions. The chart below illustrates the index's peak decline during these economic downturns.

Data source: Truist Advisory Services.

Data source: Truist Advisory Services.

As the chart demonstrates, the S&P 500 has declined by an average of 31% during the last 10 recessions. Considering that the index is currently hovering near its all-time high, a recession in 2024 could potentially result in a downturn of around 30%. Individual stocks within the index would experience varying degrees of decline and recovery.

However, history has shown that patient investors have no reason to panic. The S&P 500 has recovered from every past recession, and the rebound has often been swift. In fact, during the 12-month period following the bottom of each of the last 10 recessions, the index returned an average of 40%.

The Wisest Course of Action

Investors may be tempted to sell their holdings now and wait for the S&P 500 to hit bottom before reinvesting. However, this strategy poses two problems. Firstly, the recession forecasting tool might be incorrect, and the U.S. economy may not slide into a recession, allowing the stock market to continue its upward trajectory.

Secondly, even if a recession does occur, it is nearly impossible to accurately predict when the S&P 500 will reach its lowest point. The average decline during the last 10 recessions was 31%, but this average includes declines ranging from 14% to 57%. Attempting to time the market during a recession is akin to gambling, rather than investing, and timing-dependent strategies typically yield disappointing results.

Instead, the most prudent approach is to stay invested throughout any market downturn. Since January 1990, the S&P 500 has increased by a staggering 2,630%, compounding at an annual rate of 10.2%, despite enduring significant losses during the dot-com crash and the 2008 financial crisis.

This means that investors who had $100,000 in an S&P 500 index fund in January 1990 would now have $2.7 million, provided they remained invested throughout the entire period. Similarly, investors who consistently added $195 per week to an S&P 500 index fund since January 1990 would also have approximately $2.7 million today, regardless of the market's ups and downs along the way.

In conclusion, while the current recession indicator is illuminating its strongest signal in 40 years, it is crucial for investors to maintain a long-term perspective. By staying invested and avoiding market timing strategies, investors can weather economic downturns and potentially benefit from the eventual recovery.

*Note: The article utilizes content from the original source, including the image.