As an investor, you're always on the lookout for ways to optimize your capital and minimize your tax liabilities. One strategy that savvy investors employ is the 1031 exchange, which allows for tax deferment on the gains from the sale of real estate. In this second part of our investor's guide series, we will explore the benefits of executing a 1031 exchange through a Delaware Statutory Trust (DST) and delve into the crucial steps involved.

Understanding the 1031 Exchange and DSTs

A DST is a unique investment vehicle that enables passive, fractional ownership in real estate while qualifying as a "like-kind" replacement property under Section 1031 of the Internal Revenue Code. This provision allows you to defer paying taxes on the gains from the sale of business or investment real estate by reinvesting the proceeds into similar real estate properties.

How to Execute a Section 1031 Exchange

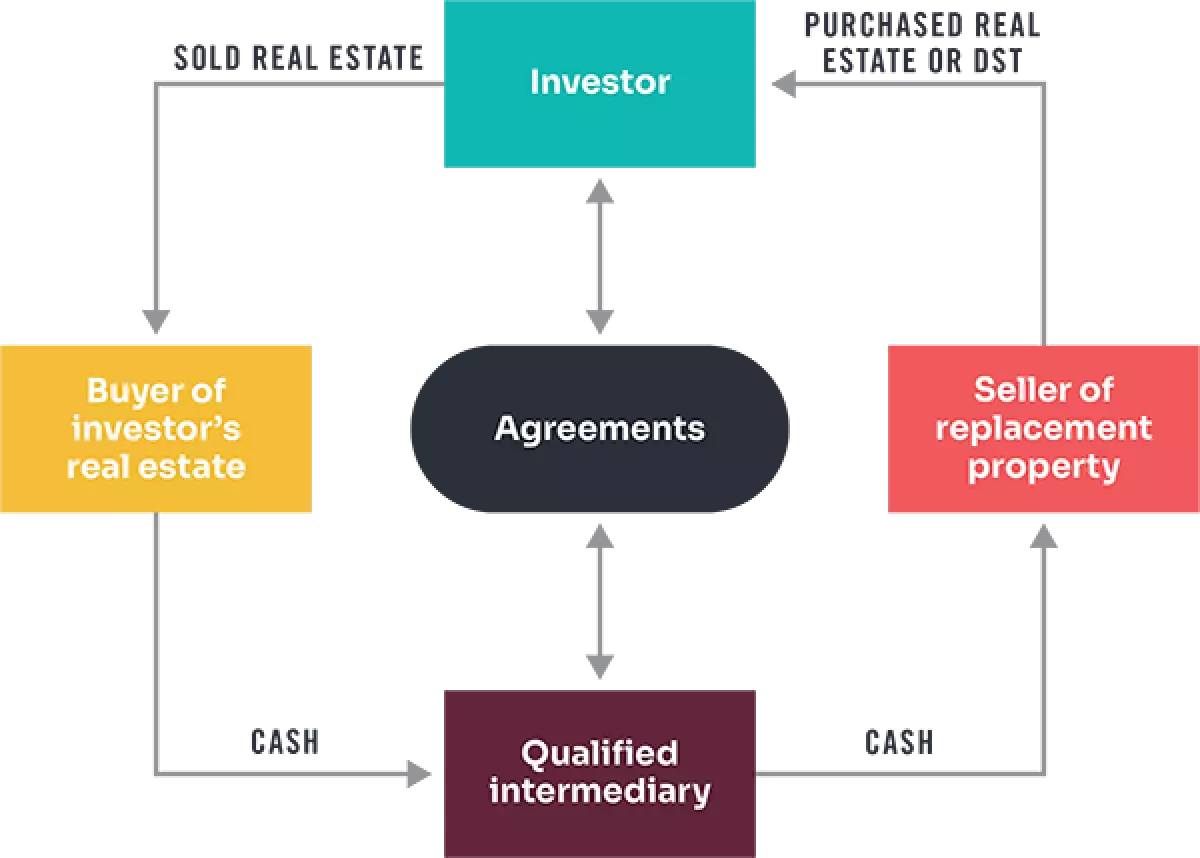

Executing a Section 1031 exchange requires careful planning and the involvement of a Qualified Intermediary (QI). Unlike simultaneous exchanges, most 1031 exchanges are deferred, meaning the sale and purchase of replacement properties occur at different times. By engaging a QI before closing the sale, you can ensure compliance with the exchange regulations. The QI acts as a mediator, holding the sale proceeds until the replacement property is ready for closing. The diagram below illustrates this process.

Diagram: The process of a Section 1031 exchange with a Qualified Intermediary

Diagram: The process of a Section 1031 exchange with a Qualified Intermediary

Understanding Boot and Minimizing Taxable Boot

Boot refers to any portion of the exchange transaction that is not "like-kind" and is taxable. Typical examples of boot include receiving cash, personal property, or reinvesting less than the net equity from the sale. While boot does not invalidate the 1031 exchange deferral, it is essential to minimize taxable boot. Two critical steps can help achieve this:

- Purchase replacement property equal to or greater in value than the sold property.

- Reinvest all the net equity received from the original property sale.

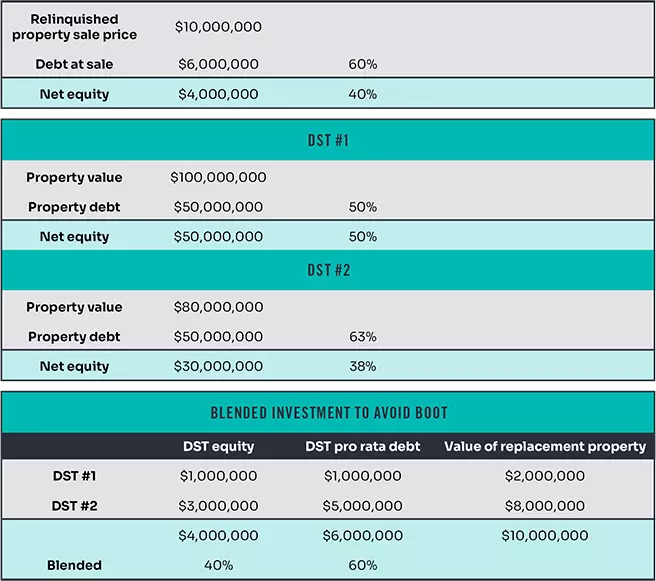

Remember that when utilizing DSTs as replacement properties, it is crucial to reinvest the net equity in properties with values equal to or greater than the sold property. Additionally, selecting DSTs that replicate the debt-to-equity ratio of the original property can be advantageous. Take a look at the illustration below for a better understanding.

Illustration: DST 1031 calculation example

Illustration: DST 1031 calculation example

Identifying Properties and Meeting the Safe Harbors

The identification rules for 1031 exchanges provide flexibility for investors. You have the option to identify three properties without considering their fair market value or an unlimited number of properties as long as their aggregate fair market value does not exceed 200% of the relinquished property's value. However, failing to meet these safe harbors doesn't necessarily disqualify you from enjoying the benefits of a 1031 exchange. You can still proceed if the replacement property is acquired before the identification period ends or if at least 95% of the fair market value of all identified properties is acquired within the exchange period.

Properly Documenting Identified Properties

If you want to achieve a successful 1031 deferred exchange, it is crucial to report your identified replacement properties to your Qualified Intermediary within 45 days of the sale. The notice should include specific descriptions, such as legal descriptions, street addresses, or distinguishable names for DSTs.

For more information on executing a 1031 exchange via a DST or to seek guidance from our experienced team, contact us at Baker Tilly. We're here to help you make informed investment decisions and maximize your financial benefits.

Image Source: saigonintela.vn