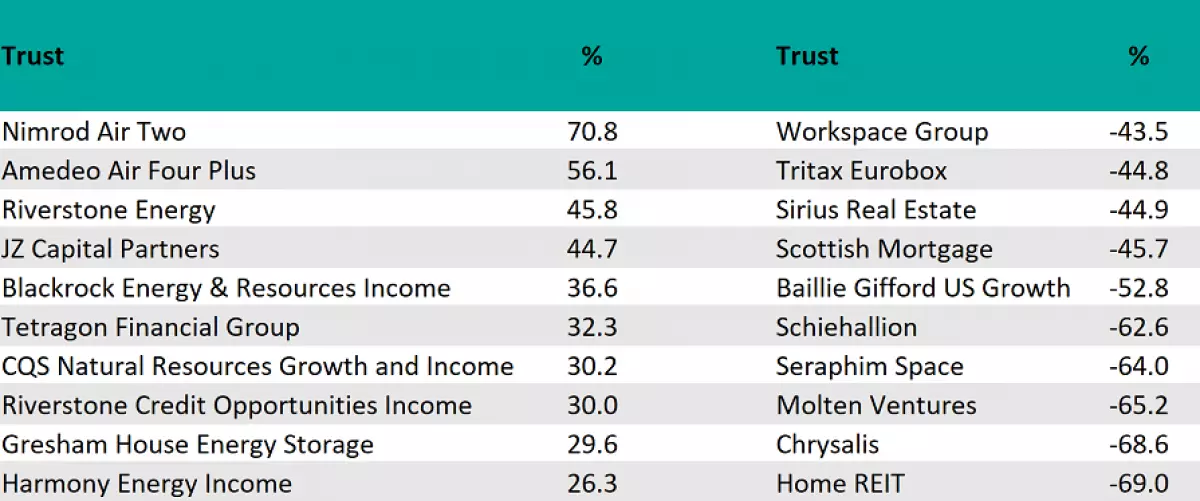

The investment landscape in 2022 was marked by some remarkable winners and losers. As alternative vehicles gained traction, energy and leasing strategies dominated the list of top-performing investment trusts. Let's dive into the details and explore the best and worst performers of the year.

Rising Above the Pandemic: Nimrod Air Two and Nimrod Air One

Topping the charts in 2022 was Nimrod Air Two, a company specializing in buying, leasing, and selling aircraft. With a portfolio of seven Airbus A380-861 aircraft, all on long-term leases with Emirates, Nimrod Air Two showcased remarkable recovery, making an impressive 70.8% gain. This stellar performance can be attributed to a rebound from a low starting point, coupled with a significant narrowing of its discount.

Had the analysis not applied a £50m filter, Nimrod Air Two would have been outshone by its sister trust, Nimrod Air One, which achieved a staggering 159.9% gain. Nimrod Air One, which owned a single Airbus A380-861 aircraft sold for £25.3m to Emirates at the end of the year, will distribute the proceeds to shareholders before its liquidation.

Flying High: Amedeo Air Four Plus and Riverstone Energy

Amedeo Air Four Plus, another aircraft leasing trust, secured the second spot on the list, boasting gains of 56.1%. Meanwhile, Riverstone Energy clinched third place, with a solid performance and gains of 45.8%. It's worth noting that trusts focused on the energy sector accounted for four of the top-10 positions, with diverse strategies within this group.

Riverstone Energy, for instance, invests across all sectors of the global energy industry. While the trust's managers are steering the portfolio towards renewable energy sources and technologies, chairman Richard Hayden highlighted that high commodity prices worked in favor of its legacy energy investments in 2022.

Exploring Further: BlackRock Energy & Resources Income and More

BlackRock Energy & Resources Income secured the fifth position, delivering gains of 36.6%. With a focus on investing in companies operating in the mining and energy sectors, the trust aims to deliver long-term capital growth and a steady income stream.

Other notable energy-related trusts on the list include Gresham House Energy Storage, which secured the ninth spot, and Harmony Energy Income, which claimed the tenth position. Both trusts specialize in battery energy storage systems, tapping into the growing demand for energy solutions.

The Tale of Struggles: REITs and Growth Trusts

On the flip side of the coin, property and growth trusts faced challenges in 2022. REITs, in particular, felt the pinch due to a variety of factors, including re-pricing of assets, increased debt-servicing costs, and competition from bonds for income-seeking capital. IT Property UK Residential and IT Property UK Logistics saw discounts reaching the 40% mark.

Home REIT, an investment trust focusing on social housing for homeless people, suffered the biggest setback, with a 69% decline. The trust faced trading suspension as it grappled with publishing its annual financial report within the set deadline. Following allegations of buying property at inflated prices and concerns over rent collection, Home REIT faced intensified scrutiny from auditors.

Baillie Gifford trusts, specifically Scottish Mortgage, Baillie Gifford US Growth, and Schiehallion, also found themselves among the worst performers. Baillie Gifford's optimistic investment approach, favoring growth companies, had propelled its trusts to the top of the performance tables during the prolonged bull run up until mid-2021. However, with rising inflation and interest rates, these trusts faced significant challenges, eroding their performance.

Merian-run Chrysalis, specializing in later-stage private companies with long-term growth potential, ranked second to last with losses of 68.6%. The trust had enjoyed substantial performance fees before the market turned against growth stocks.

Final Thoughts

2022 was a year of ups and downs for investment trusts. Alternative strategies, particularly in the energy and leasing sectors, saw remarkable success. However, property trusts and growth-focused trusts faced headwinds, highlighting the challenges posed by changing market dynamics.

As we move forward, it's crucial to assess the performance of investment trusts through the lens of their specific strategies and prevailing market conditions. Keeping a keen eye on emerging trends and adapting investment portfolios accordingly will be key to navigating the ever-changing landscape of the investment world.

Source: FE Analytics

Source: FE Analytics