Real Estate Investment Trusts, or REITs, have become increasingly popular as a way to diversify investment portfolios and generate income. In this article, we will explore the top REIT ETFs that provide exposure to the real estate market in 2025.

Introduction - The Appeal of REITs

Investing in physical real estate can be a daunting task, requiring significant capital, management, and market knowledge. That's where REITs come in. REITs are like baskets of real estate properties that are traded on exchanges, providing investors with a hassle-free way to own a diversified portfolio of real estate assets.

REITs offer exposure to various sectors such as apartments, data centers, hospitals, hotels, office buildings, retail spaces, and warehouses. By investing in REITs, investors can avoid the risks associated with owning individual properties and benefit from income generation and potential capital appreciation.

The Benefits of REITs

One key advantage of investing in REITs is their ability to provide a steady stream of income. REITs are required to distribute a significant portion (90%) of their income to shareholders in the form of dividends. This makes them especially attractive to income-oriented investors.

Moreover, REITs can act as a hedge against inflation. As landlords, REITs can pass on inflation costs to tenants in the form of higher rents, thereby preserving their income stream and protecting investors from the eroding effects of inflation.

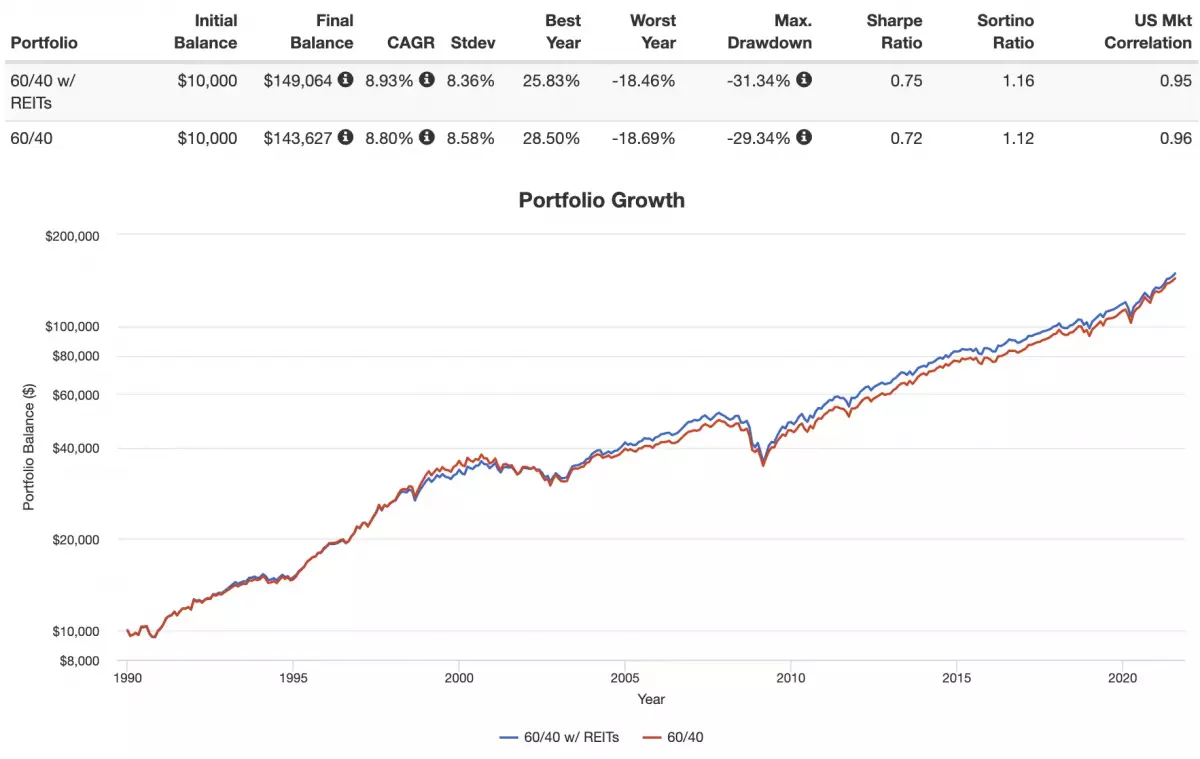

Additionally, REITs offer diversification benefits by exhibiting low correlation with stocks and bonds. This means that when stocks or bonds decline in value, REITs may rise in value, providing a cushion against market volatility.

The Top REIT ETFs for 2025

Now, let's delve into the seven best REIT ETFs that investors should consider for their real estate investment in 2025:

1. VNQ - Vanguard Real Estate ETF

The Vanguard Real Estate ETF (VNQ) is the most popular REIT ETF, with over $50 billion in assets. It provides broad exposure to the U.S. real estate market, tracking the MSCI US Investable Market Real Estate 25/50 Index. With an expense ratio of 0.12%, VNQ offers a cost-effective way to gain exposure to the domestic real estate market.

2. VNQI - Vanguard Global ex-U.S. Real Estate ETF

For international real estate exposure, the Vanguard Global ex-U.S. Real Estate ETF (VNQI) is an excellent choice. This ETF tracks the S&P Global ex-U.S. Property Index and provides access to REITs in more than 30 countries worldwide. With an expense ratio of 0.12%, VNQI offers diversification beyond U.S. borders.

3. REET - iShares Global REIT ETF

If you prefer a single fund that combines both U.S. and international REITs, the iShares Global REIT ETF (REET) is worth considering. REET seeks to track the FTSE EPRA Nareit Global REITs Index and offers exposure to a wide range of real estate assets. Despite a slightly higher expense ratio of 0.14%, REET provides convenience and simplicity.

4. SCHH - Schwab U.S. REIT ETF

The Schwab U.S. REIT ETF (SCHH) is a low-fee option for U.S. REITs, tracking the Dow Jones Equity All REIT Capped Index (excluding mortgage REITs). With over $6 billion in assets, SCHH offers investors broad exposure to the U.S. real estate market at an expense ratio of 0.07%.

5. USRT - iShares Core U.S. REIT ETF

The iShares Core U.S. REIT ETF (USRT) seeks to track the FTSE NAREIT Equity REITs Index and is comparable to VNQ. With an expense ratio of 0.08% and over $2 billion in assets, USRT offers investors a well-diversified portfolio of U.S. REITs.

6. FREL - Fidelity MSCI Real Estate Index ETF

Fidelity offers the Fidelity MSCI Real Estate Index ETF (FREL), which seeks to track the MSCI USA IMI Real Estate 25/25 Index. With an expense ratio of 0.08% and a little over $1 billion in assets, FREL provides investors with exposure to a comprehensive range of U.S. real estate assets.

7. REZ - iShares Residential Real Estate ETF

To specifically target residential, healthcare, and public storage REITs, the iShares Residential Real Estate ETF (REZ) is an ideal choice. REZ seeks to track the FTSE NAREIT All Residential Capped Index and offers investors exposure to a unique segment of the real estate market. With an expense ratio of 0.48%, REZ provides a specialized approach to real estate investing.

Where to Buy REIT ETFs

To invest in these REIT ETFs, they are widely available at major brokerage firms. One recommended option is M1 Finance, which offers zero trade commissions, zero account fees, and fractional shares. M1 Finance also provides a user-friendly interface, dynamic rebalancing, and a comprehensive range of features for investors.

For Canadian investors, Questrade or Interactive Brokers are suitable platforms to access these ETFs. Investors outside North America can consider eToro or Interactive Brokers for their investment needs.

Conclusion

Investing in REIT ETFs can be an effective strategy to gain exposure to the real estate market while enjoying diversification, income generation, and potential capital appreciation. The seven REIT ETFs mentioned above offer a range of options to suit different investment preferences.

Remember to perform your own due diligence and consult with financial advisors before making any investment decisions. Happy investing!

Source: PortfolioVisualizer.com

Source: PortfolioVisualizer.com

Disclaimer: The information provided in this article is for informational, educational, and entertainment purposes only. It is not financial advice, investing advice, or tax advice. Always conduct your own research and consult with professionals before making any investment decisions.