Real estate has long been hailed as one of the best asset classes for building substantial wealth over time. In this article, we will explore the top 20 cities in America to own investment property post-pandemic. While the core message of the original article remains intact, we will bring a fresh perspective and insights to ensure the main idea shines through.

Why Real Estate Investment Matters

Real estate investment presents a powerful wealth-building opportunity, combining rising rents and increasing capital values. To make the most of this opportunity, it is crucial to focus on certain key factors when investing in real estate:

- Employment growth

- Population growth

- Demographic trends

- Interest rates/mortgage rates

- Valuations/cap rates/net rental yields

- Inventory

The Appeal of Lower-Cost Areas

In the wake of the pandemic, the shift towards lower-cost areas in the country has become more pronounced. With mortgage interest rates plummeting and remote work becoming the norm, cities like San Francisco, New York City, Seattle, Los Angeles, and Washington DC are becoming overcrowded and unaffordable. This presents an opportunity for investors to explore the heartland of America, where lower costs and growing talent pools are attracting companies and individuals alike.

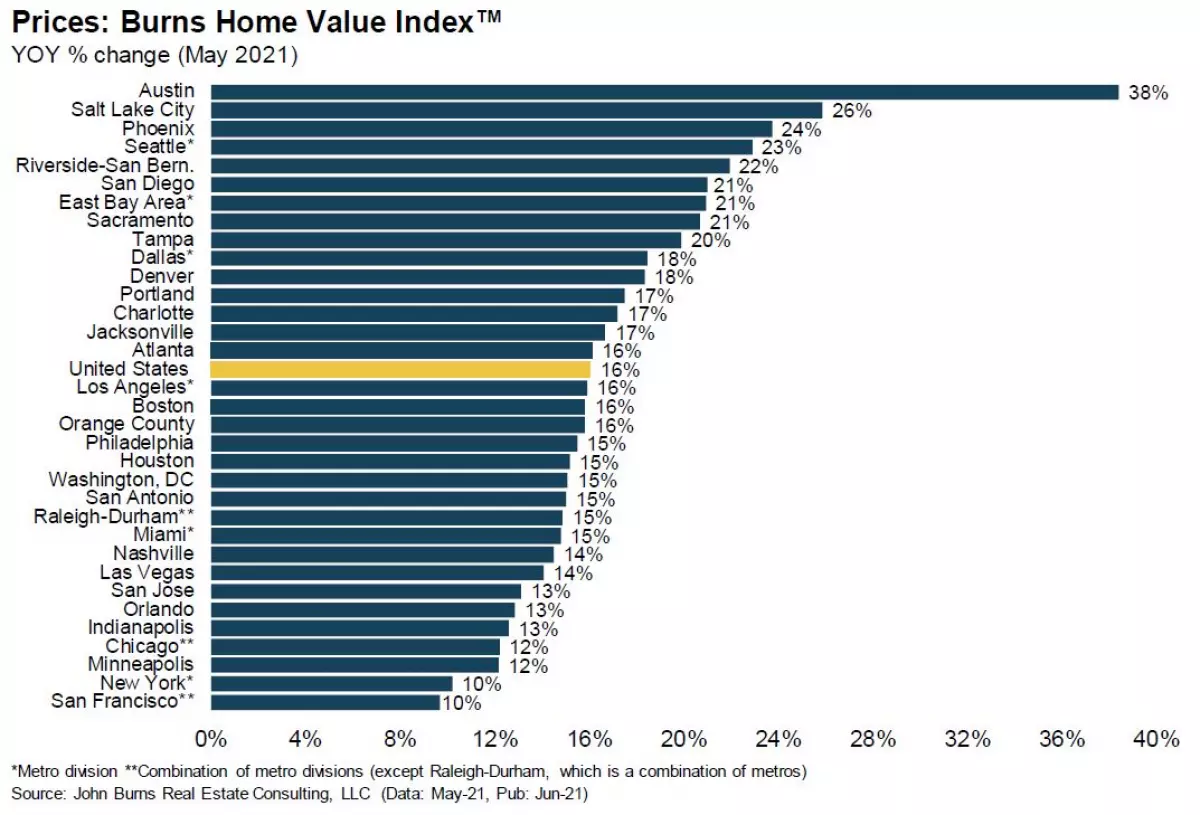

Home price appreciation by city in 2021

Home price appreciation by city in 2021

The Top 20 Cities for Investment Property

Here are the 20 best cities to own investment property, ranked in reverse order. It's important to note that an increase in home values should not be the sole determining factor, as it is a lagging indicator. Instead, focus on the rental yield, which should be higher than the risk-free rate of return. Currently, the risk-free rate of return is around 1.2%.

20. Atlanta

- Population growth: 4.0%

- Employment growth: 1.7%

- Increase in home values: 14.1%

- Rental yield: 5.1%

19. Denver

- Population growth: 3.8%

- Employment growth: 2.8%

- Increase in home values: 7.3%

- Rental yield: 5.2%

18. Kansas City, Mo.

- Population growth: 2.7%

- Employment growth: 1.5%

- Increase in home values: 11.5%

- Rental yield: 5.0%

17. Boise, Idaho

- Population growth: 2.6%

- Employment growth: 3.6%

- Increase in home values: 13.3%

- Rental yield: 5.2%

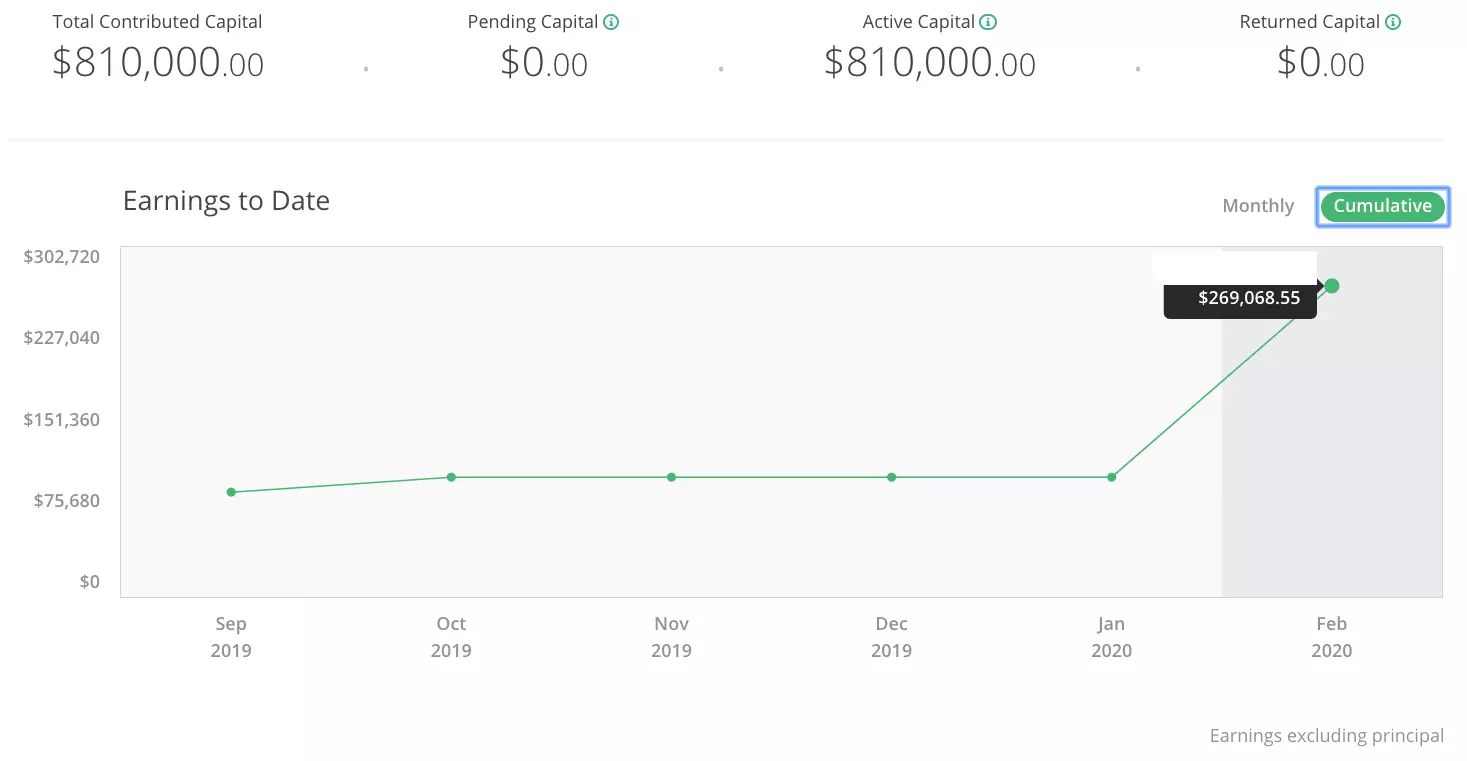

Financial Samurai Real Estate Crowdfunding Dashboard - best cities to own investment property

Financial Samurai Real Estate Crowdfunding Dashboard - best cities to own investment property

The list continues with more cities, each offering unique investment opportunities. However, if we had to choose the top five cities, they would be:

- Arlington, Texas

- Columbus, Ohio

- Charlotte, North Carolina

- Austin, Texas

- San Antonio, Texas

The Best Way to Invest: Real Estate Crowdfunding

Investing in real estate crowdfunding platforms provides a way to participate in commercial real estate without shouldering the entire financial burden. Two of the most reputable platforms are CrowdStreet and Fundrise.

-

CrowdStreet: Based in Portland, Oregon, CrowdStreet connects accredited investors with a range of debt and equity commercial real estate investments. They focus primarily on 18-hour cities, which offer lower valuations, higher rental yields, and potential growth.

-

Fundrise: Established in 2012, Fundrise is available to both accredited and non-accredited investors. They specialize in eREITs and have been at the forefront of innovation in the real estate crowdfunding space.

These platforms offer the best marketplaces and strong underwriting, ensuring a secure investment experience.

About the Author

Sam, the founder of Financial Samurai, created the platform in 2009 to navigate the complexities of the financial crisis. With extensive experience in the finance industry, including working at Goldman Sachs and Credit Suisse, Sam has built a successful real estate portfolio. He currently owns properties in San Francisco, Lake Tahoe, and Honolulu, with $810,000 invested in real estate crowdfunding. Sam's investments generate approximately $250,000 in passive income annually.

Retiring at the age of 34, Sam now spends his time playing tennis, consulting for fintech companies, and sharing insights online to help others achieve financial freedom. The best cities to own investment property are based on Sam's expertise and original research.

Investing in real estate can provide a path to financial independence. By focusing on the best cities to own investment property and leveraging real estate crowdfunding platforms, investors can capitalize on emerging opportunities. Remember, it's all about arbitraging value across the country's real estate markets.