The real estate investment trust (REIT) sector is diverse and offers numerous investment opportunities. One sector that has consistently shown strong demand and growth is multifamily REITs. In this article, we will delve into the multifamily sector and explore the factors that make it a lucrative investment option.

The Multifamily Sector: A Growing Demand

The demand for multifamily housing is driven by population growth, job growth, population migration, household formation, and homeownership rates. Over the years, the multifamily sector has seen a steady increase in demand due to positive trends in these metrics. Immigration plays a significant role in boosting the population, leading to a higher demand for housing. Additionally, strong job growth and population migration to markets with better employment opportunities have fueled the demand for multifamily housing.

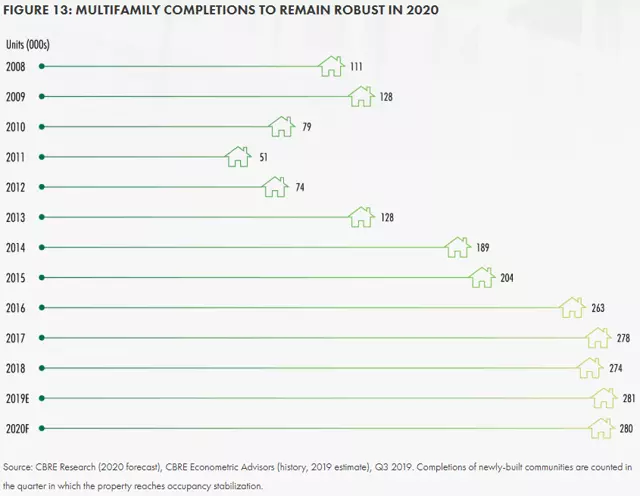

Elevated Supply Growth and Occupancy Rates

Despite robust supply growth in the multifamily sector, vacancy rates have continued to decline. This indicates a healthy demand for rental housing. In recent years, vacancy rates have fallen from their peak in 2009 to the levels seen in the first quarter of 2020. Although currently somewhat higher than the rates in the late 1970s and early 1980s, the decline in vacancy rates indicates a strong and steady demand for multifamily housing.

Portfolio Strategy: Quality and Geography

Multifamily REITs differentiate themselves based on portfolio quality and geographic focus. Most REITs invest in Class A, Class B, and Class C multifamily properties. Class A properties are newer and have higher rents, while Class B and Class C properties are older with varying amenities. Geographically, some REITs focus on top-tier coastal markets, while others have a property portfolio concentrated in the sunbelt. Strategic differences in geography impact rent growth and occupancy rates, and it is crucial to analyze economic trends and supply/demand balance in each market.

Financial Strength and Valuation

Multifamily REITs have less leverage compared to other REIT property types, making them attractive investments. With a median debt/total capitalization ratio of only 30.28%, multifamily REITs enjoy stability in cash flows, ensuring a higher degree of safety. Valuation-wise, most multifamily REITs are currently trading at a discount to net asset value (NAV), reflecting investor expectations for future growth.

Dividends and Dividend Coverage

Multifamily REITs generally offer competitive dividend yields. While some REITs have maintained dividend yields within a narrow range, others provide higher yields. Dividend coverage is also an essential aspect to consider. Most REITs have satisfactory dividend coverage, allowing for annual increases. However, a few REITs need to carefully manage their AFFO payout ratios to ensure long-term sustainability.

Consider Multifamily REITs for a Strong Investment Portfolio

Considering the positive growth trends, strong demand, financial stability, and potential for dividends, multifamily REITs present an attractive investment option. It is essential to research each REIT's portfolio quality, geographic focus, financial metrics, and dividend coverage before making investment decisions.

Investing in multifamily REITs can provide a steady income stream and long-term growth potential. With proper research and analysis, investors can maximize returns in this promising sector.

Image Source: Simon Bowler of 2nd Market Capital

Image Source: Simon Bowler of 2nd Market Capital