Image source: Mohammed Haneefa Nizamudeen

Image source: Mohammed Haneefa Nizamudeen

Introduction

The residential real estate market has always been a hot topic, with house prices experiencing significant growth over the past 60 years. While asset price inflation plays a role, there are other factors at play as well. Real estate is a rate-sensitive asset class, heavily reliant on mortgage debt. Additionally, supply-demand dynamics and general economic conditions impact property values. In this article, we will explore the analytics behind the residential real estate cycle and shed light on a potential rebound in prices.

House Prices and Mortgage Rates

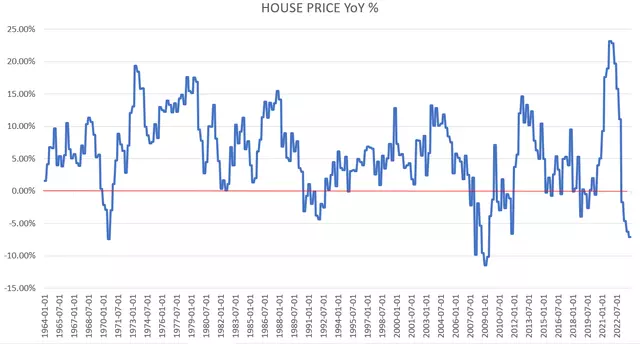

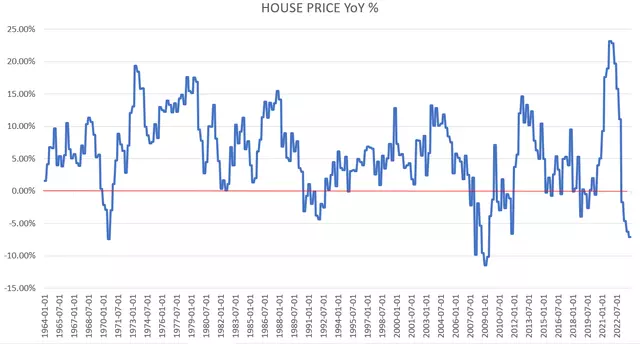

Image source: FRED

Image source: FRED

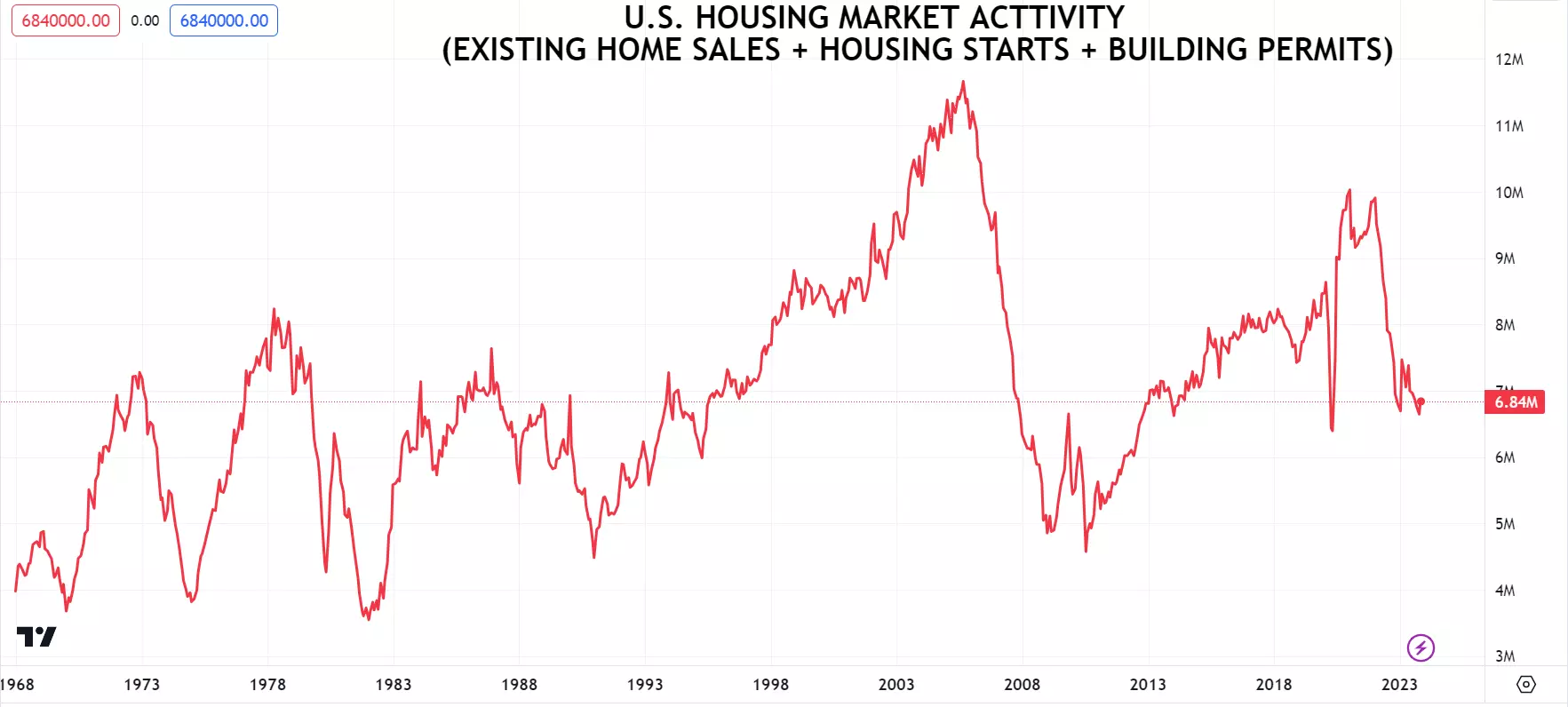

Home prices typically experience positive year-over-year growth, with only six instances of negative growth in the past 60 years. Following a staggering 23% YoY increase in 2021, there was still significant growth in 2022. However, the 40-year high inflation in 2022 led to skyrocketing mortgage rates, matching levels last seen in 2000. This sudden increase in rates caused a decline in mortgage demand and a subsequent collapse in housing market activity.

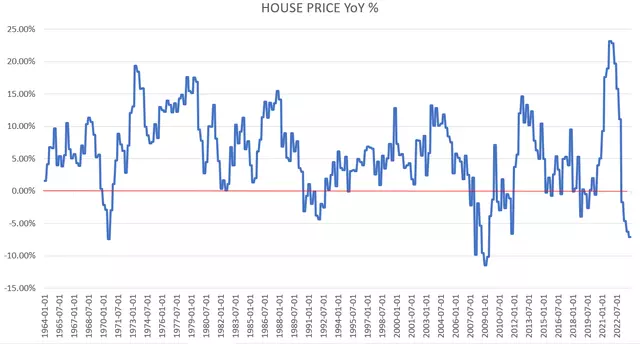

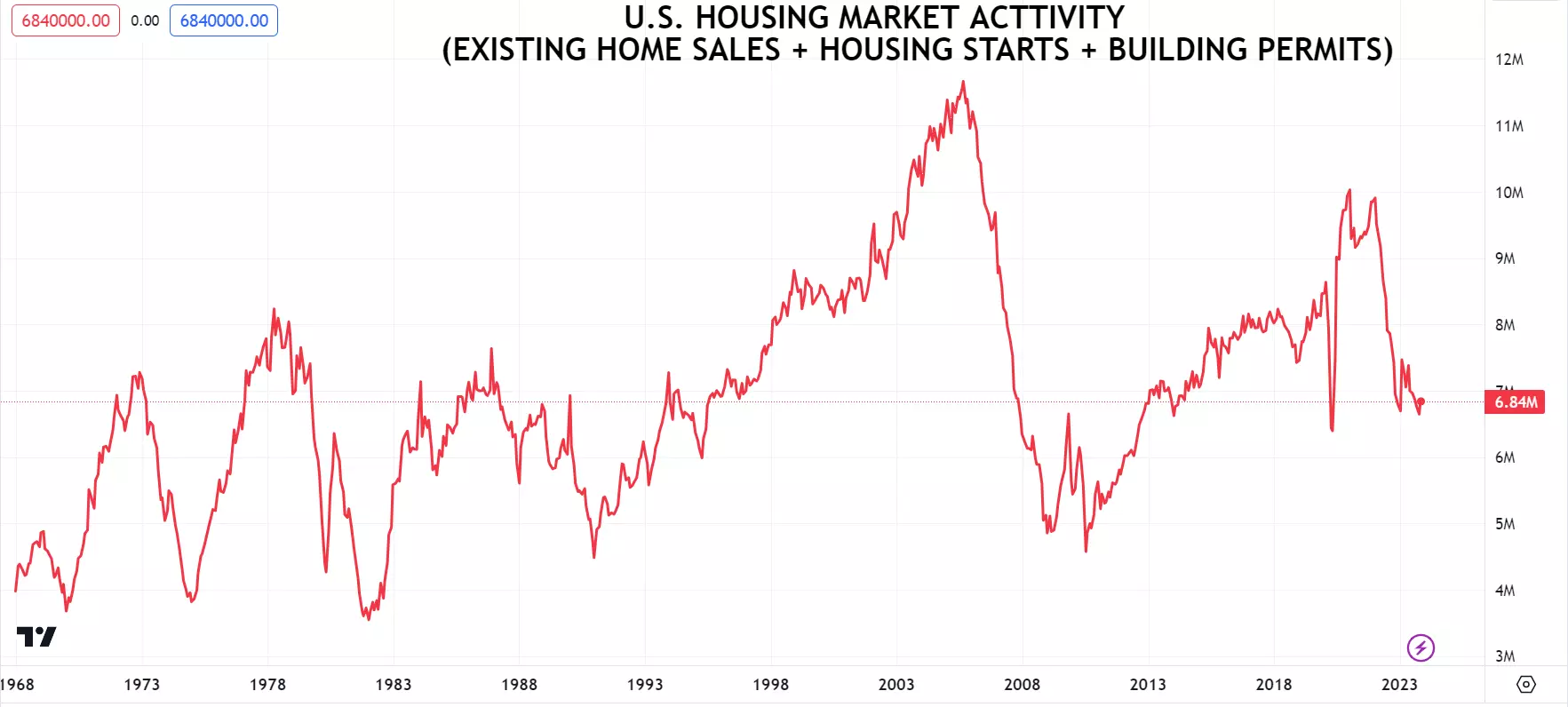

Image source: TRADINGVIEW

Image source: TRADINGVIEW

Supply and Demand Imbalance

The aftermath of the great financial crisis saw a shift towards fixed-rate mortgages, while shorter-term or variable-rate loans declined significantly. This allowed debtors to refinance their loans at lower rates. However, with the surge in mortgage rates in 2022, the demand for new mortgages plummeted. Homeowners became unwilling to sell their properties, opting to keep their long-term fixed low-rate mortgages instead of taking out higher-rate loans. This resulted in a lack of available existing home sales and a significant housing shortage.

Image source: TRADINGVIEW

Image source: TRADINGVIEW

However, since September 2023, the situation has improved, and the supply of homes has reached levels similar to late 2021.

Image source: TRADINGVIEW

Image source: TRADINGVIEW

Analyzing the Residential Real Estate Cycle

To understand the future trajectory of residential real estate prices, it's crucial to analyze key statistics and historical data. Several factors influence this cycle: the supply peak, 10-year treasury yield peak, cyclical growth peak, 10-year/3-month yield curve inversion, and the U.S. dollar peak.

Supply Peak

The months' supply ratio indicates the size of new for-sale inventory relative to the number of new houses sold. Historical data suggests that house prices start decelerating three months before the supply peak, reaching their lowest point 10 months after. On the other hand, real house prices bottom out one month after the supply peak but significantly rebound 10 months later.

Image source: TRADINGVIEW

Image source: TRADINGVIEW

10-Year Treasury Yield Peak

As real estate is rate-sensitive, analyzing the peak in the 10-year note yield provides insights into house price changes. Historically, house prices continue to grow both before and after the yield peak, but the annual growth rate peaks before and bottoms out after the yield peak. Adjusting for inflation, home prices turn negative one month after the yield peak, with a rebound typically occurring 10 months after.

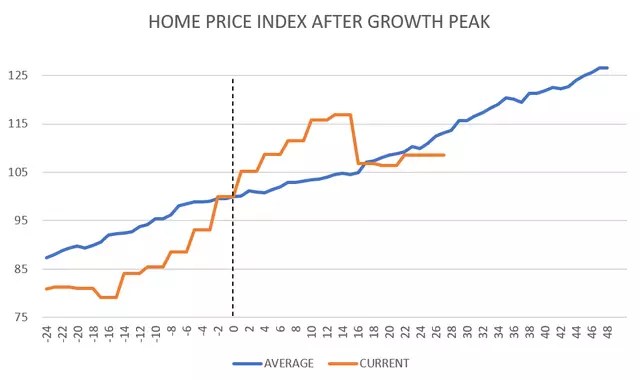

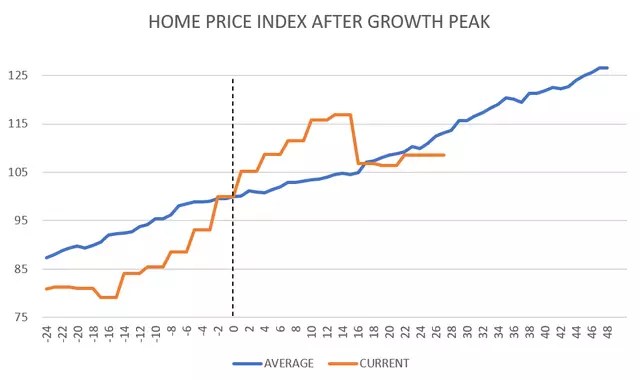

Cyclical Growth Peak

Cyclical growth, including employment, consumer spending, and production, heavily influences real estate demand. House price growth starts falling seven months before the peak of cyclical growth, bottoms out five months after, and starts rebounding 14 months later. Real house prices enter a slight negative growth rate four months after the peak but rebound after 10 months.

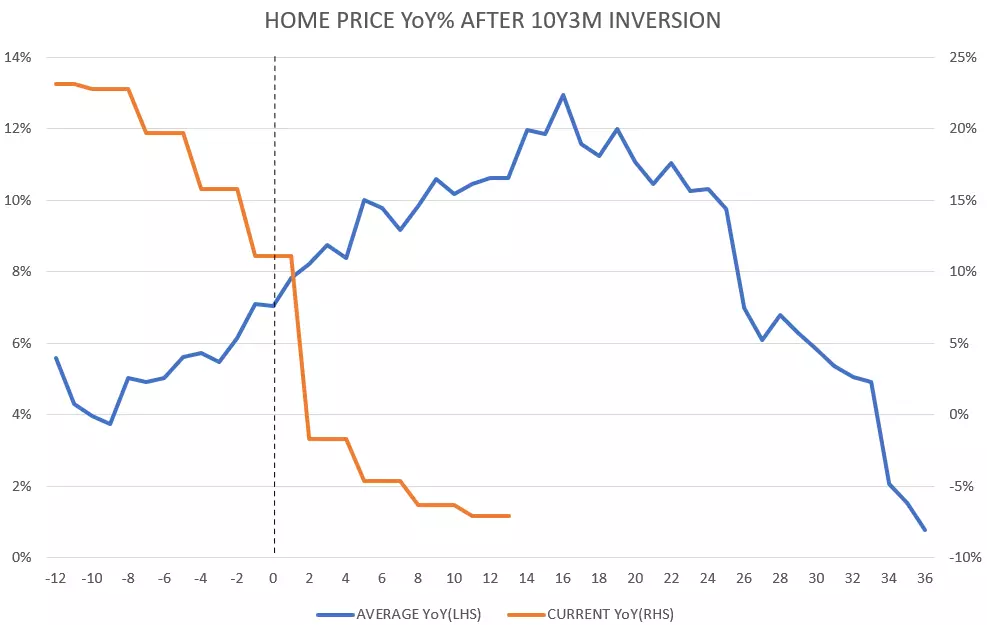

10-Year/3-Month Yield Curve Inversion

The inversion of the 10-year and 3-month yield curve has often served as a reliable indicator of recession and financial turmoil. Typically, house price growth accelerates until 18 months after the inversion, before decelerating to around 0% growth by 36 months after. Adjusting for inflation, home prices turn negative after 27 months and contract for 10 months before rebounding.

U.S. Dollar Peak

The strength of the U.S. Dollar plays a significant role in the global economic cycle. A stronger dollar indicates tightening financial conditions globally and can impact asset price growth. Nominal growth in house prices remains positive before and after the peak, but growth rates start falling eight months before and bottom out one month before. Real house prices enter contraction three months prior to the peak and rebound after two to three months.

Combined Model

To model the current environment, historical average data after each peak was combined into a single model. The model suggests that house price growth should accelerate and peak in the summer of 2024. A deceleration is likely to begin in Q3 2024 and last until Q1 2025. It is worth noting that the current growth rate in the residential real estate market has deviated somewhat from historical averages, likely due to rising rates and a correction following the parabolic growth rate in 2021.

Image source: TRADINGVIEW

Image source: TRADINGVIEW

REIT Investment Strategy

Investors looking to capitalize on the favorable conditions in the residential real estate market may consider investing in residential real estate equity trusts (REITs). REITs provide an opportunity to earn dividends from real estate investments without directly owning or managing properties. Residential equity REIT prices are highly correlated with the market value of houses. Therefore, a rise or acceleration in residential property price growth should support residential equity REIT prices.

Image source: TRADINGVIEW

Image source: TRADINGVIEW

When evaluating REITs, it is important to consider both property prices and their cash flow-generating ability. Currently, REITs are undervalued based on their price-to-funds-from-operations (P/FFO) multiples. A good option for investors looking for diversification is the iShares Residential and Multisector Real Estate ETF (REZ), which tracks the FTSE NAREIT Residential Index. This ETF includes the top holdings in the residential real estate sector, offering exposure to potential market gains.

Camden Property Trust (CPT)

Camden Property Trust owns and operates numerous multifamily properties across the United States, offering opportunities for investors. CPT is currently trading at a discount compared to both its peers and its historical self. Analyst consensus suggests stable growth in funds from operations (FFO) until 2027, with FFO expected to increase by 27% during that period.

Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities operates a portfolio of apartment communities across the United States. MAA is currently trading at a discount compared to its peers and its historical valuations. Analyst consensus projects stable growth in FFO, with an expected increase of 22.8% by 2027.

Image source: IBKR

Image source: IBKR

Conclusion

Based on macro and market developments, residential house prices are expected to rebound significantly. This creates an attractive opportunity for investors to capitalize on this trend by investing in residential real estate equity trusts. The residential real estate sphere is currently undervalued, making it an enticing space for potential returns. Consider the iShares Residential and Multisector Real Estate ETF (REZ) for diversified exposure to potential REIT rebound. Additionally, Camden Property Trust and Mid-America Apartment Communities offer attractive value propositions among their peers. Remember, thorough research is essential before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.