Real estate syndication has revolutionized the investment landscape, allowing individuals to pool their resources and participate in lucrative property ventures that were once exclusive to the wealthiest few. With the advent of real estate crowdfunding, the barriers to entry have significantly lowered, granting more people the opportunity to diversify their portfolios and generate substantial returns.

Real Estate Syndication Basics: How It Works And How To Participate

Real Estate Syndication Basics: How It Works And How To Participate

The Basics of Real Estate Syndication

Real estate syndication involves a mutually beneficial transaction between a Sponsor and a group of Investors. The Sponsor, as the manager and operator of the deal, invests sweat equity by scouting for properties, raising funds, and overseeing day-to-day operations. On the other hand, Investors provide the majority of the financial equity.

To ensure a successful partnership, it's crucial for the Sponsor to have a significant stake in the deal. This demonstrates their commitment and alignment of interest with the Investors. It's also essential to evaluate the Sponsor's track record and management team to gauge their reliability and expertise.

Due diligence is paramount when investing in real estate syndication. Take the time to thoroughly research the Sponsor and build a diversified portfolio of individual deals. Platforms like CrowdStreet and RealtyMogul offer valuable opportunities in this space.

The Legal Structure of Real Estate Syndication

Real estate syndications are typically organized as Limited Liability Companies (LLCs) or Limited Partnerships (LPs). The Sponsor acts as the General Partner or Manager, while the Investors become limited partners or passive members.

The LLC Operating Agreement or LP Partnership Agreement outlines the rights and responsibilities of both the Sponsor and Investors. These include distributions, voting rights, and the Sponsor's entitlement to management fees.

Such legal structures protect the interests of both parties and ensure transparency and accountability throughout the investment process.

Profiting from Real Estate Syndication

Real estate syndication offers two primary avenues for generating profits: property appreciation and rental income. Rental income is distributed to Investors by the Sponsor according to agreed-upon terms. As the property's value appreciates over time, Investors can reap higher rents and greater profits upon sale.

Before the Sponsor shares in the profits, all Investors receive a 'preferred return,' which is a benchmark payment typically ranging from 5-10% annually on their initial investment. Once the preferred return is distributed, the remaining profits are divided between the Sponsor and the Investors based on a predetermined profit split structure.

For example, in a 70/30 split, Investors would receive 70% of the profits, while the Sponsor would receive 30%. This equitable structure fosters an environment where the Sponsor is truly aligned with the Investors' interests.

Real Estate Syndication Statistics

Real estate syndication has gained significant traction in recent years, with over 500,000 investors participating in syndications in 2022. The average real estate offering size was $3 million, with passive investors contributing 80-95% of the initial capital.

Sponsors typically receive an acquisition fee ranging from 0.5% to 2%, while the average preferred return hovers around 8%. Additionally, Sponsors may earn a property management fee ranging from 2% to 9%.

As the industry evolves, investors should anticipate a rise in the number of available deals. However, increased capital chasing these opportunities may put pressure on returns. Therefore, it's crucial to invest with reputable real estate syndication platforms that prioritize due diligence and investor protection.

Real Estate Syndication Performance versus Stocks

Real Estate Syndication Performance versus Stocks

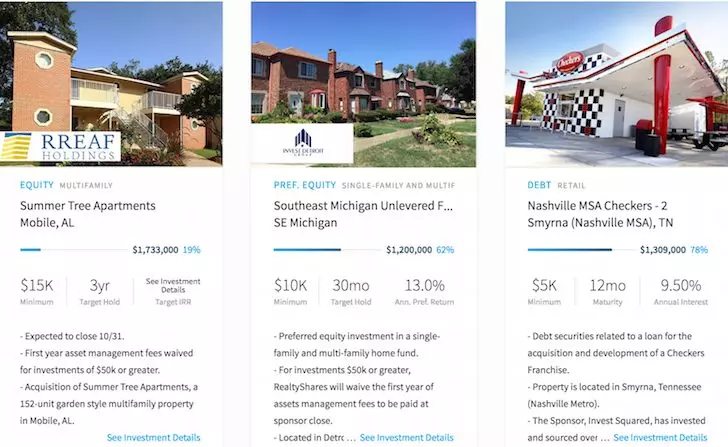

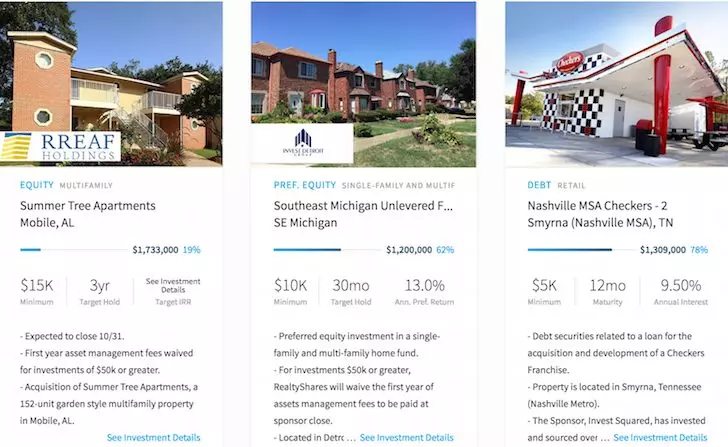

Investing with the Best Real Estate Syndication Platforms

The advent of real estate crowdfunding has transformed the investment landscape, allowing individuals to gain exposure to commercial properties across the country without the need for substantial capital. With platforms like Fundrise and CrowdStreet, investors can start with as little as $1,000 and achieve better diversification.

Fundrise, founded in 2012, offers both accredited and non-accredited investors the opportunity to invest in diversified real estate portfolios. Their innovative eREIT product provides exposure to various regions and types of real estate, making it an attractive option for many.

CrowdStreet, founded in 2014, primarily caters to accredited investors. This platform focuses on secondary cities with lower valuations, higher job growth, and higher cap rates. Investors can directly invest with screened sponsors, but thorough due diligence is crucial.

Diversifying investments through these platforms allows individuals to capitalize on the potential of various real estate markets, particularly in the heartland of America. With low mortgage rates, rebounding corporate earnings, and the work-from-home trend, real estate syndication presents a compelling investment opportunity.

Conclusion

Real estate syndication has democratized access to lucrative property investments, empowering individual investors to participate in deals previously reserved for the wealthy elite. By leveraging the power of crowdfunding platforms like Fundrise and CrowdStreet, individuals can diversify their portfolios, generate passive income, and benefit from the appreciation of real estate assets.

Remember, conducting thorough due diligence and investing with reputable platforms is essential for success in the real estate syndication space. With the right knowledge and strategic investments, you can unlock the potential of this exciting investment opportunity.

This article was written by Sam, the founder of Financial Samurai. With over $810,000 invested in real estate syndication, Sam has a wealth of experience in this field. His expertise stems from years of working at prestigious financial institutions and owning properties in San Francisco, Lake Tahoe, and Honolulu.