Investing in real estate, especially in hot markets like San Francisco and New York City, can seem like an unattainable dream for many. However, with the rise of Real Estate Investment Trusts (REITs), you can now gain exposure to these markets without the need for a large down payment. In this article, we will explore what office REITs are and how they work, as well as provide you with some top investment options in this sector.

Understanding Office REITs

Office REITs are specialized REITs that focus on office and commercial spaces in major metropolitan areas. These REITs own and manage a portfolio of properties that cater to businesses, providing them with office spaces to conduct their operations. By investing in an office REIT, you become a shareholder and can enjoy the benefits of income generated from rental payments made by tenants.

Office REITs offer several advantages for investors. They provide an opportunity to diversify your investment portfolio, as these REITs usually own properties in prime locations that would be otherwise unaffordable for individual investors. Additionally, office REITs typically pay out most of their taxable income as dividends, making them an attractive option for those seeking a reliable and consistent passive income stream.

Top Office REITs to Consider

Let's take a look at some of the most-watched office REITs that you should consider for your investment portfolio:

Orion Office REIT

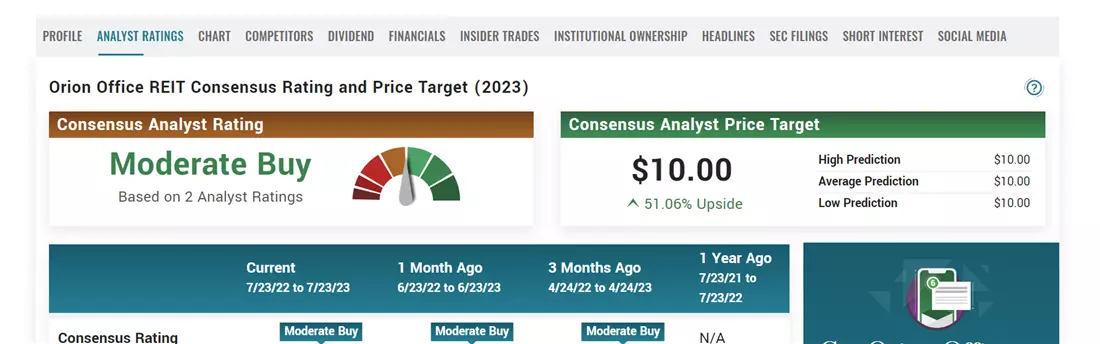

Caption: Orion Office REIT overview and step-by-step buying guide

Caption: Orion Office REIT overview and step-by-step buying guide

Orion Office REIT (NYSE: ONL) is a highly diversified office REIT that invests in mission-critical and corporate headquarters across the United States. With a commitment to holding a diverse range of properties, Orion ensures a stable portfolio of tenants. It currently has a market capitalization of $375 million and a dividend yield of 6%. This REIT is a promising entry point for REIT investors.

Vornado Realty Trust

Caption: Vornado Realty Trust overview on MarketBeat

Caption: Vornado Realty Trust overview on MarketBeat

Vornado Realty Trust (NYSE: VNO) is one of the largest office landlords in the United States. It owns a diverse portfolio of commercial real estate assets, including office buildings, retail properties, and mixed-use developments. With a market capitalization of over $3.9 billion, Vornado has a significant presence in major urban markets such as New York City and the D.C. metropolitan area.

Boston Properties

Boston Properties (NYSE: BXP) is another major player in the U.S. real estate market. This REIT focuses on high-quality office buildings in major urban markets, catering to top-tier tenants with higher corporate budgets. With a market capitalization of almost $10 billion, Boston Properties is one of the largest office REITs in the country. It also maintains an attractive yet stable dividend yield of 6.18%.

Alexandria Real Estate Equities

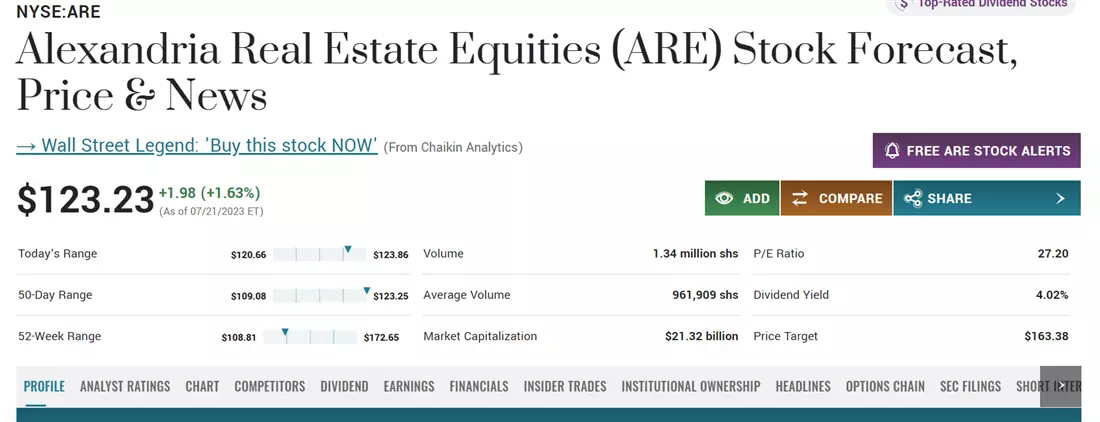

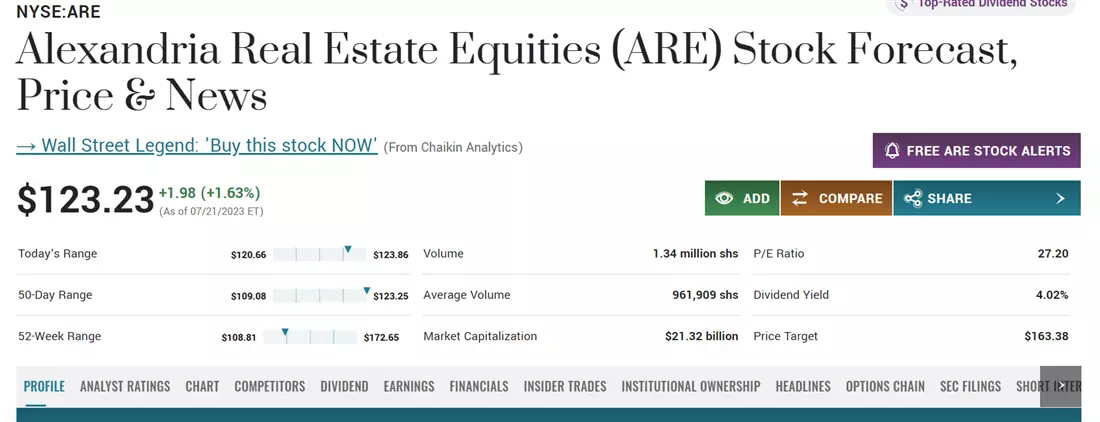

Caption: Alexandria Real Estate overview on MarketBeat

Caption: Alexandria Real Estate overview on MarketBeat

Alexandria Real Estate Equities Inc. (NYSE: ARE) focuses on properties that cater to the needs of life science and technology companies. Its strategic locations in key metropolitan areas make it a prime choice for high-value, research, and development-oriented clientele. With a market capitalization of $21 billion, Alexandria is one of the biggest office REITs in the country.

Hudson Pacific Properties

Hudson Pacific Properties Inc. (NYSE: HPP) offers exposure to the West Coast real estate market. With a series of office and studio spaces across major cities like Los Angeles, San Francisco, and Seattle, this REIT provides opportunities for investors looking for West Coast exposure. It also offers a higher dividend yield of almost 9%.

How to Invest in Office REITs

Investing in office REITs is similar to investing in other stocks. Here are some steps to help you get started:

Step 1: Open a brokerage account.

To buy and sell shares of office REITs, you'll need to open a brokerage account. This account will allow you to hold various investment assets, including REITs.

Step 2: Research available REITs.

Once you have a brokerage account, research the available office REITs. Consider factors such as the company's market capitalization, dividend yield, and performance history. Many brokerage platforms offer tools to help you compare and analyze different REITs.

Step 3: Place a buy order.

After selecting a specific office REIT, place a buy order through your brokerage account. Make sure to fund your account before making the purchase.

Step 4: Monitor your investment.

Keep track of your investment in office REITs. As a shareholder, you'll receive dividends according to the company's payment schedule. Stay updated with the REIT's performance and adjust your investment strategy accordingly.

Pros and Cons of Office REITs

Before investing in office REITs, it's essential to consider the pros and cons:

Pros:

- Dividend income: Office REITs provide a reliable and consistent passive income stream through dividends.

- Enhanced liquidity: These REITs trade on major exchanges, making it easy to sell your shares if needed.

- Access to prime locations: Investing in office REITs gives you exposure to properties in prime locations that may be otherwise inaccessible.

Cons:

- Tenant risk: Office REITs heavily rely on their tenant base and lease agreements. Vacancies or financial challenges faced by major tenants can lead to lower rental income.

- Concentrated risk: Office REITs are specialized investments focused solely on office properties. A downturn in the office market can adversely affect their performance.

FAQs

Here are some frequently asked questions about office REITs:

Q: What is a REIT? A: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate properties.

Q: Are office REITs a good investment? A: Office REITs can be profitable investments, especially considering their dividend income potential and enhanced liquidity. However, it's important to carefully analyze each opportunity and consider the associated risks.

Q: Can I lose money by investing in office REITs? A: Like any investment, office REITs carry inherent risks. The value of your investment can fluctuate, and you may experience losses if the market performs poorly or the tenant base faces challenges.

In conclusion, office REITs offer a unique opportunity to invest in prime office properties in major metropolitan areas. By following the steps outlined in this article, you can begin your journey into the world of office REIT investing. Remember to research and carefully analyze each investment option to make informed decisions. Happy investing!