Introduction

Are you interested in investing in real estate but don't have the capital or expertise to do it on your own? Real Estate Investment Groups (REIGs) may be the solution you've been looking for. REIGs are organizations formed by real estate investors who pool their resources to invest in properties together. In this article, we will explore the different types of REIGs, how to join them, their benefits, potential challenges, and best practices for successful participation.

Types of Real Estate Investment Groups

Real Estate Investment Clubs

Local Clubs

Local real estate investment clubs are organized by geographical location and provide a platform for investors to meet in person. These clubs offer opportunities to discuss investment strategies, market trends, and host workshops and networking events. It's a great way to connect with like-minded individuals in your area.

Online Clubs

If attending physical meetings is not convenient for you, online real estate investment clubs offer a virtual platform to connect with other investors. You can participate in webinars, join online forums, and access valuable resources remotely. Online clubs provide flexibility and the ability to engage with a wider network of investors.

Real Estate Investment Trusts (REITs)

REITs are companies that invest in income-generating properties and offer individuals the opportunity to invest in real estate without directly owning the properties. There are three main types of REITs:

Equity REITs

Equity REITs focus on income-producing properties and generate returns for investors through rental income and property appreciation.

Mortgage REITs

Mortgage REITs invest in mortgage-backed securities and generate returns for investors through interest income.

Hybrid REITs

Hybrid REITs combine elements of both equity and mortgage REITs. They invest in a diversified portfolio of properties and mortgage-backed securities, providing investors with a balanced investment approach.

Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms allow investors to pool their resources online and collectively invest in various property types, such as residential, commercial, or industrial properties. These platforms provide access to a wide range of investment opportunities and offer flexibility in choosing the projects to invest in.

Real Estate Limited Partnerships (RELPs)

RELPs are investment structures where a general partner manages the investment properties, and limited partners provide the capital. This arrangement allows for passive investment and potential tax benefits for limited partners. RELPs are suitable for individuals who want to invest in real estate without actively managing the properties.

Real Estate Syndications

Real estate syndications involve a group of investors pooling their resources to acquire, manage, and profit from a specific real estate project. There is typically a lead investor or sponsor who manages the investment on behalf of the group. Syndications can provide access to larger and more lucrative real estate deals.

How to Join a Real Estate Investment Group

If joining a REIG sounds appealing to you, here are some steps to help you get started:

Research and Identify Suitable Groups

Start by researching and identifying real estate investment groups that align with your investment objectives, strategies, and geographical focus. Look for groups with a strong track record and a good reputation.

Attend Meetings and Events

Attending meetings and events hosted by the group will give you a sense of their dynamics, objectives, and member composition. It's an excellent opportunity to meet other investors and determine if the group is a good fit for your investment goals.

Evaluate the Group's Objectives and Strategies

Before joining a REIG, assess their investment objectives, strategies, and track record. It's important to ensure that the group's goals align with your personal investment goals and risk tolerance.

Assess the Group's Leadership and Members

Consider the experience, expertise, and reputation of the group's leadership and members. Strong leadership and knowledgeable members can contribute significantly to the group's success and provide valuable insights.

Consider Financial Requirements and Obligations

Joining a REIG may involve membership fees, investment minimums, or other financial obligations. Carefully review these requirements to ensure they are comfortable for you.

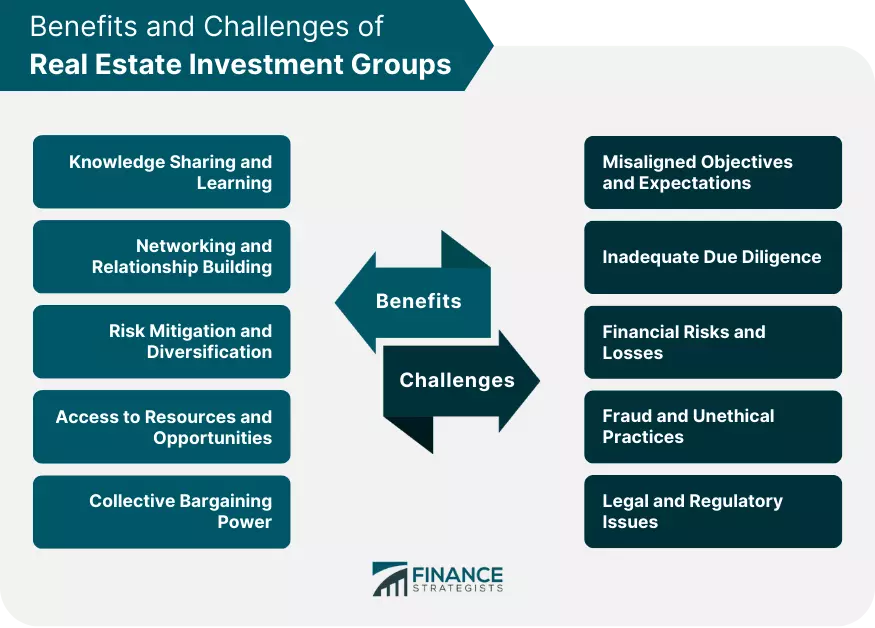

Benefits of Joining a Real Estate Investment Group

Joining a real estate investment group offers several benefits that can enhance your investment journey:

Knowledge Sharing and Learning

REIGs provide a forum for individuals to share experiences, expertise, and strategies in the real estate market. Members can learn from one another, stay informed about market trends, and gain insights into various investment opportunities.

Networking and Relationship Building

By joining a REIG, you can develop relationships with like-minded investors, industry professionals, and potential business partners. Building a strong network can lead to future investment opportunities, referrals, and support.

Risk Mitigation and Diversification

Investing in real estate through a group allows for pooling resources and investing in a variety of properties, reducing the risk associated with individual investments. Diversification strategy leads to more stable returns and minimizes the impact of market fluctuations.

Access to Resources and Opportunities

Real estate investment groups often have access to exclusive deals, off-market properties, and financing options. Members can leverage these resources to enhance their investment portfolios and potentially achieve better returns on investment.

Collective Bargaining Power

Pooling resources and negotiating as a group can lead to better deals on property prices, financing terms, and property management services. This can maximize returns on investment and minimize costs.

Potential Challenges and Risks of Real Estate Investment Groups

While there are many benefits to joining a REIG, it's essential to be aware of potential challenges and risks:

Misaligned Objectives and Expectations

Conflicting investment objectives and expectations among group members can lead to disagreements, inefficiencies, and suboptimal investment outcomes. It's crucial to align your goals with those of the group.

Inadequate Due Diligence

Insufficient due diligence on investment opportunities can result in financial losses, legal issues, and damage to the group's reputation. Always thoroughly evaluate potential investments before committing your resources.

Financial Risks and Losses

Real estate investments inherently carry risks, and members should be prepared for the possibility of financial losses or underperformance. It's important to diversify your investments and maintain a long-term perspective.

Fraud and Unethical Practices

Some real estate investment groups may engage in fraudulent or unethical practices, which can result in legal consequences and financial losses for members. Conduct thorough research and only join reputable groups.

Legal and Regulatory Issues

Real estate investment groups must comply with laws and regulations governing real estate transactions, securities, and investment activities. Non-compliance can lead to fines, penalties, and legal liabilities. Ensure that the group operates within legal boundaries.

Best Practices for Successful Real Estate Investment Group Participation

To make the most out of your participation in a real estate investment group, follow these best practices:

Active Involvement and Contribution

Maximize the benefits by actively engaging in discussions, sharing your experiences and expertise, and contributing to the group's projects and initiatives. Your involvement can create a positive impact and help drive the group's success.

Continuous Learning and Skill Development

Real estate investment is an ever-evolving field, and continuous learning is crucial for success. Stay informed about industry trends, attend workshops and seminars, and seek mentorship to enhance your knowledge and skills.

Collaboration and Teamwork

Working collaboratively with other group members allows you to leverage the collective knowledge and resources. This cooperation can lead to better decision-making, successful investments, and stronger relationships within the group.

Due Diligence and Risk Assessment

Before investing in any real estate project, conduct thorough due diligence and assess the associated risks. This will help you minimize potential losses and ensure your investments align with your risk tolerance and objectives.

Long-Term Strategy and Goal-Setting

Successful real estate investments require long-term planning and strategic goal-setting. Develop a clear vision for your investment objectives and regularly review your progress to ensure you are on track.

Conclusion

Real estate investment groups offer a powerful way for individuals to invest in real estate collectively. These groups provide opportunities for networking, knowledge sharing, and risk mitigation. By joining a REIG, you can access exclusive resources, learn from experienced investors, and build valuable relationships. However, it's important to be aware of potential challenges and risks and adhere to best practices to ensure a successful investment journey. So, why not explore the world of real estate investment groups and unlock the potential of collective investing?