Image: How to Do Accounting for Your Real Estate Business

Image: How to Do Accounting for Your Real Estate Business

Handling the accounting for your real estate practice doesn’t have to be a major hassle. A strong foundation in accounting best practices paves a smooth path for your business to flourish and win new clients. In this article, we will dive deep into real estate accounting and provide you with valuable insights into mastering financial success in 2024. By following these guidelines, you'll be equipped with the tools to make informed decisions and take your real estate business to new heights.

What is Real Estate Accounting?

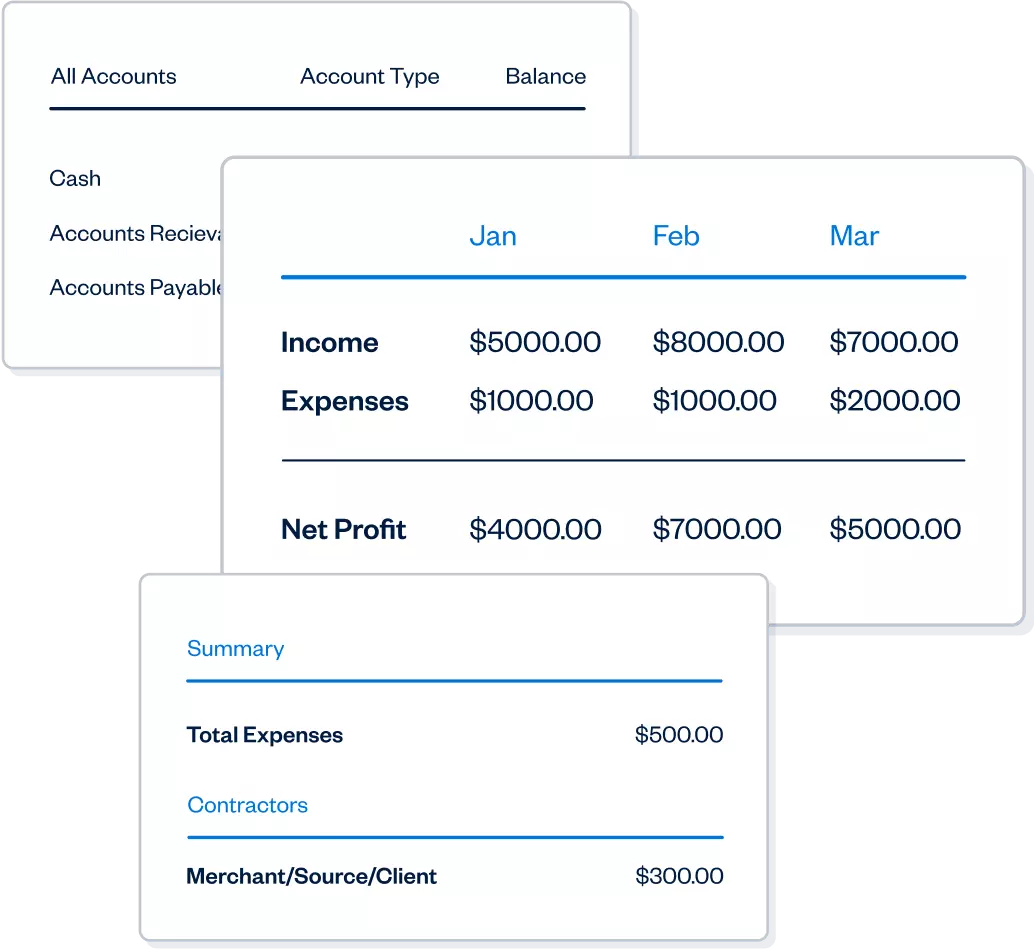

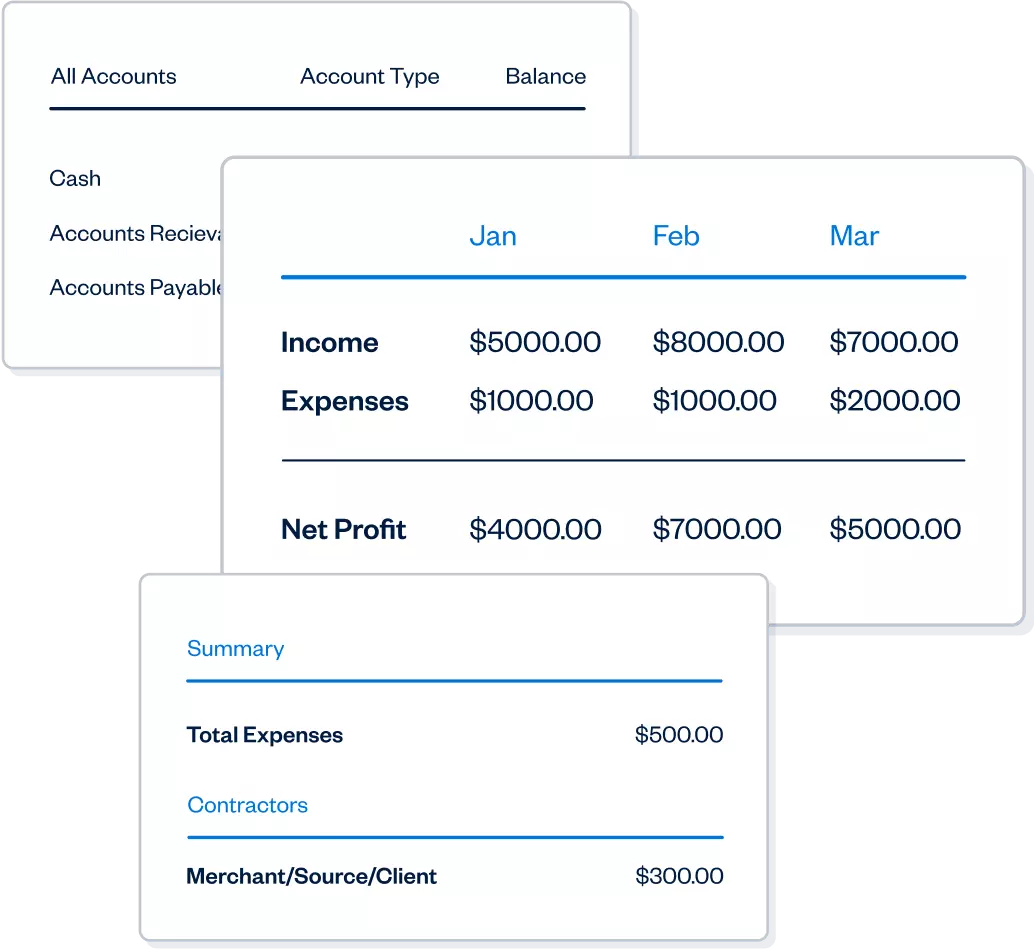

Real estate accounting refers to the monthly and yearly financial tasks that a business owner must perform to keep their operations running smoothly. It involves tracking the potential revenue generated by properties and managing matters of taxation. By tracking income and expenses, you can gain a clear overview of each property's cash flow and make informed decisions regarding tax payments and audits. To simplify your accounting needs, consider using FreshBooks accounting software. It offers features like receipt tracking, automated reconciliation, and easy-to-read metrics.

Image: FreshBooks accounting reports

Image: FreshBooks accounting reports

Real Estate Accounting Basics - What to Track

Whether you're selling small properties or managing large-scale corporate contracts, tracking the right financial information is crucial. Here are some key elements to track in your real estate accounting:

Income From Commissions

Accurately tracking and reporting all incoming cash from property sales and commissions is vital. These are the primary sources of income for real estate agents.

Association Fees and Expenses

Share any commissions with your brokerage, firm, or association as required. Additionally, consider deducting membership fees for associations and national organizations.

Continuing Education Costs

Renewals and continuing education classes are necessary expenses for maintaining a real estate license. Keep track of these costs for tax purposes.

Office-related Charges

Track expenses for office supplies, equipment, rent, event space, cleaning, or maintenance. As more real estate professionals operate in a mobile format, these costs may be minimal.

Marketing Expenses

Include expenses for website design, social media management, advertisements (print, online, or digital), business cards, and event sponsorships.

Travel, Mileage, and Transportation

Track expenses related to property visits, client meetings, and maintaining your network of properties.

Why Do Real Estate Agents Need Accounting?

Maintaining proper accounting records is crucial for the success of any real estate business. Here are some reasons why real estate agents need accounting:

- Gain a high-level perspective of your personal financial situation

- Insight into your financial performance from year-to-year

- Manage cash flow and watch for potential red flags

- Streamline yearly tax returns

- Timely payment of expenses

- Take advantage of available tax deductions

- Make financially sound decisions for business growth and profitability

The true goal of real estate accounting is to provide a clear and full understanding of the health and future of your business. It helps you make informed decisions and guides you towards financial success.

Accounting Vs. Bookkeeping for Real Estate Agents

While the terms "accounting" and "bookkeeping" are often used interchangeably, they refer to different aspects of financial management in real estate.

Bookkeeping involves tasks such as tracking debit and credit card charges, invoicing clients, reconciling bank statements, and maintaining payroll records.

Accounting, on the other hand, encompasses a broader range of financial responsibilities. It includes performing audits, maintaining compliance with regulations and legal requirements, tax preparations, understanding profits and losses, generating financial statements, and budgeting.

Understanding the division between bookkeeping and accounting helps you know when to delegate tasks to professionals and ensures comprehensive financial management.

Accounting Best Practices for Real Estate Agents

To excel in real estate accounting, follow these best practices:

Conduct a Monthly Review

Regularly monitoring your accounts is essential even if you use an automated accounting system or work with a financial manager. Schedule monthly reviews to stay updated on incoming cash and outgoing expenses, ensuring your numbers stay on track.

Use Accurate Reporting Procedures

Accurate reporting depends on accurate numbers. Once you have confidence in your financial data, generate reports such as profit and loss statements, income statements, outgoing cash flow reports, and tax documents. Automated accounting software simplifies the process and allows you to analyze and sort data efficiently.

Separate Personal and Business Funds

Create separate business accounts to track transactions accurately. This separation simplifies accounting and ensures seamless integration with accounting software. Connect your personal account or schedule regular fund transfers between accounts.

Itemize All Incoming and Outgoing Transactions

Proper itemization saves time and effort during tax season and reduces stress. Familiarize yourself with the IRS's Schedule E, which defines important business itemizations. Efficiently managing expenses and income streams enables you to maximize deductions and track financial performance.

Learn Local Requirements

Real estate regulations and requirements vary based on your jurisdiction. Familiarize yourself with local regulations concerning real estate income, state tax obligations, and business licensing requirements. Compliance with local requirements may impact how you manage your real estate accounting.

Common Real Estate Accounting Mistakes

As you venture into real estate accounting, it's normal to make a few mistakes. Here are some common mistakes and how to avoid them:

- Always back up your files: Maintain automatic backups of your financial records to avoid losing critical information.

- Don't assume you can lump all expenses together: Seek professional help to ensure accurate itemization of expenses for maximum tax benefits.

- Communicate with invested parties: Clearly communicate your documentation requirements to ensure timely submission of necessary documents.

Image: Accounting You Can Count On

Image: Accounting You Can Count On

How to Simplify Your Real Estate Accounting Needs

If the vast amount of information on real estate accounting overwhelms you, don't worry! There are options to simplify your accounting needs:

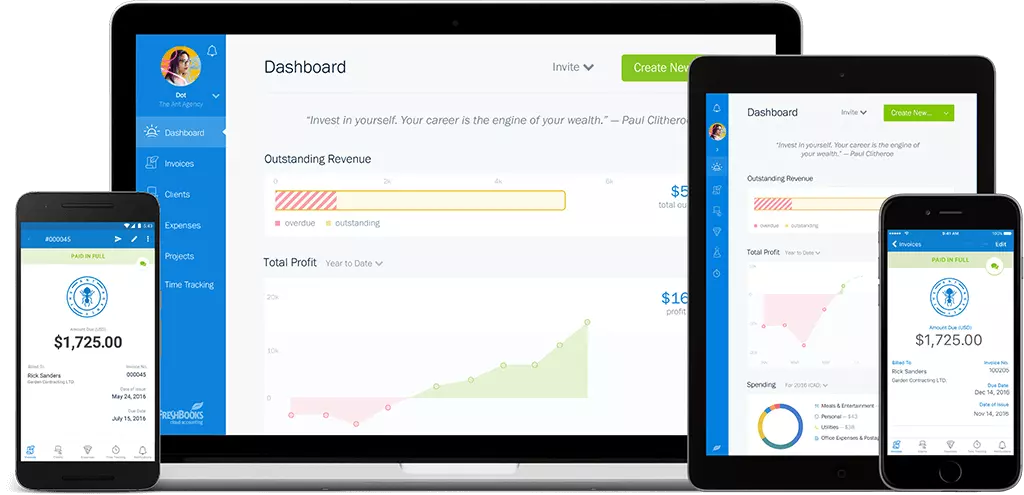

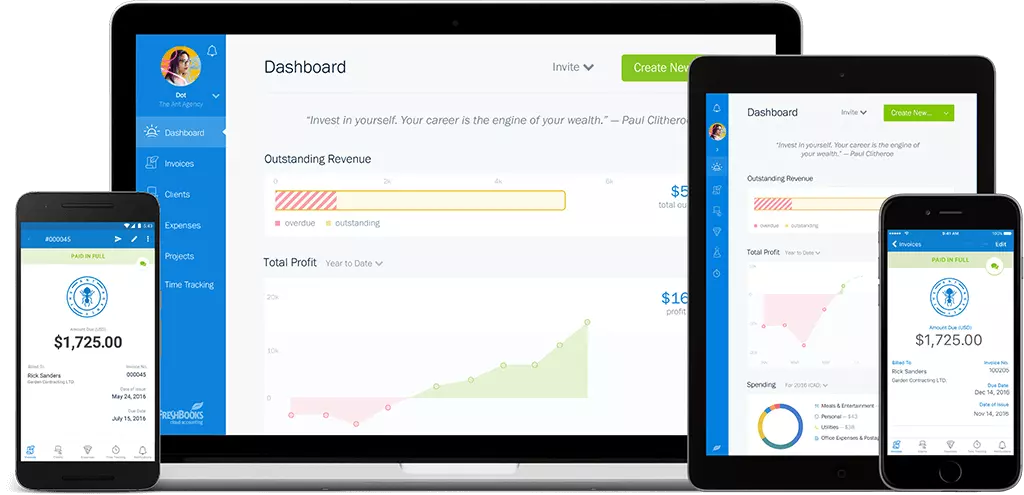

- Implement a solid accounting platform: Intuitive and user-friendly accounting platforms streamline your accounting procedures and offer various features to suit every budget.

- Outsource to a consultant or accountant: As your real estate business grows, hiring a financial manager can save you time and effort. A professional can ensure accurate accounting while leveraging accounting software and providing valuable insights.

Streamline Your Real Estate Business Accounting

Every small business is unique, and finding an adaptable accounting solution that suits your real estate business practices is essential. Simplify your accounting work with FreshBooks real estate accounting software. It offers modern invoicing, late payment reminders, interactive team collaboration, and more.

Image: FreshBooks accounting software

Image: FreshBooks accounting software

Conclusion

In this comprehensive article, we explored the key aspects of real estate accounting. We covered the fundamentals of real estate accounting, the differences between accounting and bookkeeping, and best practices for successful real estate accounting. By following these guidelines and implementing the right tools and strategies, you can bring clarity to your accounting practices and achieve financial success in the real estate industry.

FAQs on Real Estate Accounting

Q: What type of Accounting is Used in Real Estate? A: Real estate accounting focuses on financial practices related to real estate transactions. It involves tracking revenue generated by properties and fulfilling taxation requirements.

Q: How is Accounting Used in Real Estate? A: Accounting in real estate provides an accurate picture of a business's financial health. It helps with tax preparations, audits, and overall management of expenses and income streams.

Q: What is Bookkeeping in Real Estate? A: Bookkeeping in real estate involves maintaining accurate records of invoices, expenses, and payroll. It is a subset of financial activities within a business.

Q: Is Real Estate Accounting Difficult? A: Real estate accounting can be challenging if you're new to accounting practices. However, with a solid understanding of the fundamentals and good organizational skills, it becomes manageable.

Q: What are the duties of a real estate accountant? A: A real estate accountant is responsible for managing the financial aspects of real estate transactions, including buying, selling, leasing, and renting properties. They also prepare essential documents for tax season.

Q: Businesses Related to Real Estate

- How to Start a Painting Business

- How to Start a Moving Business

- How to Start a Handyman Business

- How to Start a General Contractor Business

- How to Start an HVAC Business

- How to Start a Pest Control Business

- How to Start a Plumbing Business

- How to Start a Roofing Business

- Real Estate Tax Deductions

RELATED ARTICLES